The Crypto Landscape in 2024: Narratives to Watch

We appear to be entering a new cycle of growth and mainstream adoption after the crash of 2022.

Here are 6 key themes that I believe will shape the crypto landscape over the next couple years 🧵 👇

First things first, make sure to BOOKMARK this thread for future reference and REPOST for love.

I like to see how these narratives play out in the coming years.

There's a lot of information here, so let's get right into it!

1. Crypto-Native Betting and Gambling

Defi has clear advantages for betting and gambling dApps.

Instead of a centralized bookmaker taking a cut, dApps can distribute funds transparently, and everything is proven on-chain.

Coupled with the inherent need for the token to have the best revenue-sharing utility, I believe this is a sector that will bloom

Projects like @rollbitcom will be the revenue printer for its $RLB token holders.

$RLB being the leader in this narrative, has seen some mad inflows of $140k in the last 7 days by smart money. (source from: @ChainEDGE_io developed by @OnChainWizard)

Check out this is a deep dive research by Jake

Also, as these apps integrate with newer EIP enhancements such as account abstraction, it makes on-chain gambling a smoother on-boarding process for plebs like myself.

Leading me to my other sub-narrative, perp DEX. I see is a variation of “gambling”; trading with leverage in expectation for life changing gains. (Don’t hammer me if you have differing views, leave your comments below and like to hear your thoughts)

It reminds of a powerhouse DEX @Chainflip, which I am particularly attracted to. They aim to dethrone @binance by having a CEX-like experience on-chain across all chains with account abstraction and they even mentioned you can start trading without connecting wallets.

@TheDeFISaint is a pure genius on the topic of account abstraction, if you have listened to his latest AMA. If not, check out his big brain research here:

2. Fintech Frontends with Crypto Backends

This is what we call, digital banking, which has brought considerable convenience for both financial institutions and their customers.

Ask yourself, would you have realized that the app you are using operates with a crypto backend? Your answer is likely no, because users are oblivious to it when mass adoption kicks in. On the other hand, the counterargument is that not much crypto backend is being implemented yet.

Hence, this reiterates my previous point regarding account abstraction. So likely, users would not even know or care about what account abstraction is.

Such digital banks already existed a dozen years ago and only came to light recently due to the increased attention given the hype in the cryptotech space.

Many mainstream fintech apps like @PayPal and @RevolutApp are already experimenting with crypto features”

PayPal has its own stablecoin $PYUSD

Revolut allows users to stake $ETH.

Over time, I believe we would see crypto completely replace the financial backends of many fintech apps. And this narrative be strengthened as CBDCs kicks in.

Leaders are in payment space have also actively pushed technology. @Visa partners with @solana blockchain for blockchain payment. Maybe something that we will see more apparent in these digital banking solution?

Blockchain payment processors would also see an increase in demand for such services.

The frontend remains smooth and user-friendly, while all the financial plumbing runs on decentralized crypto rails.

This would dramatically increase crypto adoption towards the end goal of CBDC.

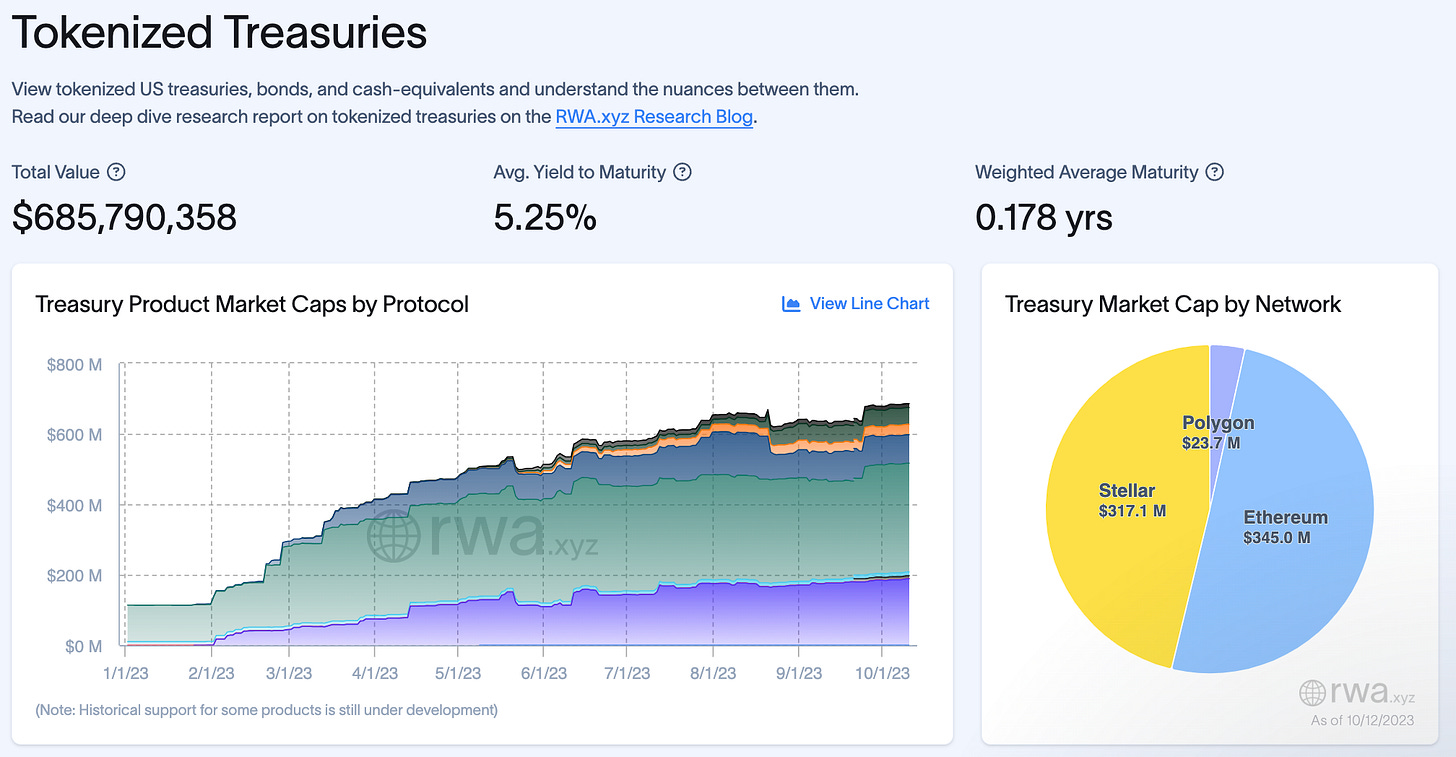

3. Tokenized Treasuries

Tokenization of real-world assets (RWAs) –refer to wrapping traditional financial instruments such as government bonds, private equity or credit in token form and placing them on blockchains

Stablecoins backed by USD Treasuries (RWAs) are likely to grow, continuing the evolution of stablecoins like USDC and USDT.

U.S. Treasuries are considered a gateway for tokenization efforts, as many digital asset investors, fund managers, crypto firms and DAOs wants high yields that comes with low-risk.

The tokenized treasuries market has grown sixfold this year to $685 million, with asset management firm Franklin Templeton being the biggest player.

@openeden_hq @OndoFinance @maplefinance released blockchain-based Treasury products. And particularly @BackedFi issuing RWAs on @coinbase, which is the first to be seen.

I have also did a RWA research sharing the market potential of RWA, where @0xGoldenDegen is bullish on it too!

As Coinbase expands its RWA offerings and global footprint, this leads to my multi-level bullish thesis I have for $COIN. Furthermore, my friend @rektdiomedes has some big brain bull thoughts on $COIN.

Overall, RWAs may even displace some existing stablecoins, as they provide safety with regulatory clarity. Circle and Tether will likely have to follow suit and add Treasury reserves.

4. Blockchain Gaming

If giants like @Ubisoft are already making their moves into the blockchain gaming space, it would be unwise to dispel this heating narrative.

This is in fact one of my favorite sector that I am bullish on: fun and social.

Though there have been critics on blockchain gaming by traditional gamers, I believe that gaming would be a perfect use case for blockchain assets and virtual economies.

I am particularly interested in the following: (Drop me some interesting game stuff to check out in the comments please!)

@illuviumio $ILV

@Immutable $IMX

@MoonfrostGame - been waiting for this for the longest time, reminding me of classical harvest moon gameplay vibes

Crypto-based video games have been building for years, and we'll soon see revivals with new releases for many OG blockchain games.

Most games will fail, but breakout hits could emerge with huge user bases and revenues. Gaming will be a key gateway to mass crypto adoption.

@0xAhri is my go to expert for anything gaming and he has spent 11 whopping years in the gaming space. I am sure he has more valuable insights to share! Like to hear what you think too my friend.

5. Social Tokens

I am somewhat bullish on this, though, on a higher level, the social aspect would tie in neater with the gaming or metaverse narrative. Naturally, the interaction for a game and metaverse pushes the social element further.

Though we have seen historically, socialfi protocols like @StrataProtocol, with its sister project called Wumbo, did not kick off well as strongly as @friendtech. My analysis here would be the lack of a strong airdrop tease to get the masses excited about using the protocol.

Adoption to a new social platform is always the toughest without any anticipation of a reward. This time, I think that @friendtech did well with its strong backing by @paradigm and the Blur-like airdrop anticipation, which are the key success factors to get new users acquainted with new platforms.

And despite the crypto winter, other social token platforms like @starsarenacom @joinfantech @PostTechSoFi are seeing organic usage.

As blockchain interoperability improves, we may see a consolidation around a few key platforms for social tokens. Differentiating factors become prominently demanded for users to make a switch or even try out a new platform.

Going forward, mainstream users will get exposed to crypto through engaging with creator coins/shares and DAO governance.

6. Physical NFTs

I believe the next evolution for NFTs would move beyond just digital art or profile picture.

It can even mean attaching a varied combination of value to the NFT for instance, revenue sharing, ownership of a RWA, entrance ticket and IP rights to something that is related to the real world.

@pudgypenguins have taken a bold step to brand creation is selling retailing penguin plushies in Walmart. As virtual worlds grow, physical NFTS will ground users in real ownership.

While crypto feels ice cold now, these trends point to how it could return to huge growth over the next couple years.

The foundations laid in 2022 around scaling, regulation, and mainstream adoption will blossom into tangible use cases across DeFi, gaming, social platforms, physical goods, and more.

Crypto winter won't last forever.

Twitter: https://twitter.com/arndxt_xo/status/1712424885505663356