The RWA market cap just crossed $60B - and it’s growing rapidly.

Ondo is currently the only RWA protocol trusted by BlackRock, Wellington, PayPal and other giant institutions.

Here’s why $ONDO will be best RWA play for 2025👇🧵

Key Takeaways:

RWA Market Growth: The $60B+ RWA market is rapidly expanding, with tokenization unlocking accessibility, liquidity, and efficiency.

Ondo’s Institutional Edge: Ondo is the only RWA protocol trusted by institutions like BlackRock, Wellington, and PayPal, leading in tokenized treasuries.

Tokenized Treasuries: Ondo has one of the highest TVL in tokenized treasuries and operates across 8+ blockchains, showcasing tangible adoption.

Ondo Global Markets (GM): Set to launch soon, this platform will enable trading of tokenized assets like treasuries and securities, tailored for institutional players.

Future Potential: Ondo’s focus on institutional-grade solutions positions it as a frontrunner in the $1T+ tokenization revolution.

Why Tokenization Matters

To put it simply, tokenization transforms traditional assets like treasuries, bonds, and real estate into blockchain-based tokens It’s gained plenty of attention in the recent years, because of it’s significant advantages:

Accessibility: Fractional ownership lets smaller investors participate in previously out-of-reach asset classes.

Liquidity: 24/7 trading means assets can move quickly, bypassing traditional bottlenecks.

Efficiency: Reduced reliance on intermediaries lowers costs and increases transparency.

Many institutions are starting to realize the potential of this shift and that’s why they’re investing big in RWA projects.

Recently, The Depository Trust & Clearing Corporation (DTCC), the world’s largest securities depository, declared tokenization a top priority for 2025, aiming to revolutionize how securities are managed.

Institutions like DTCC are doubling down on tokenization because it aligns perfectly with these transformative benefits.

Their focus on real-world applications is a testament to how seriously the financial sector views this shift

What is Ondo?

Ondo Finance is a protocol that specializes in bringing institutional-grade financial products to the blockchain, transforming traditional financial assets into accessible, on-chain investments.

Its mission is to enhance the rails connecting DeFi and TradFi, focusing on tokenized RWAs like US Treasuries.

The protocol operates through two key divisions: asset management and technology.

The asset management team designs and oversees tokenized financial products that combine traditional finance traits with blockchain benefits. The technology team focuses on building DeFi protocols that power and scale these offerings.

Ondo's products, detailed with information on assets, yields, risks, and eligibility, are easily accessible on their website - ondo.finance

Ondo’s Unique Edge with RWA

While many projects claim to bring TradFi on-chain, few have gone beyond the conceptual phase.

Ondo, however, is operating at a different level. Here’s how:

Institutional Trust - Ondo isn’t chasing speculative user but it’s built partnerships with names like BlackRock, Wellington, and PayPal. These aren’t casual endorsements; they’re validations from institutions that demand reliability and regulatory compliance.

Dominance in Tokenized Treasuries - Ondo currently has one of the highest TVL in tokenized treasuries and is already live across 8+ blockchains—a tangible indicator of adoption. This shows that investors are actively using Ondo to gain exposure to TradFi instruments on-chain.

Yieldcoins - While stablecoins like USDC and Tether dominate the crypto landscape, Ondo is taking a step further with Yieldcoins. They’re better than stables in every way, and Ondo capitalizes on this.

Ondo Global Markets (GM) - Ondo GM serves as a trading platform for tokenized assets, including treasuries and other securities. It creates an on-chain solution that appeals to institutional players without sacrificing the benefits of DeFi. Ondo GM is set to go live next month.

https://x.com/OndoFinance/status/1763249939294163085

Broad Revenue Model - Unlike many crypto projects tied to a single use case, Ondo has diversified its offerings. Tokenized treasuries, Yieldcoins, and Ondo GM provide revenue streams across different market environments—bull or bear.

Partnerships

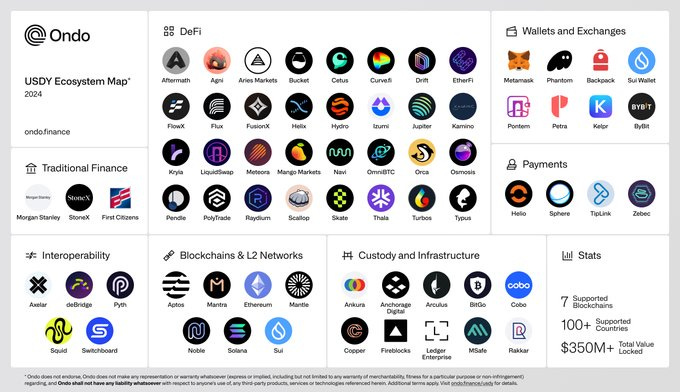

Ondo has built a robust network of partnerships with leading players in both TradFi and the blockchain space which make it really standout from other protocols.

Here’s a closer look at some of its key collaborators:

TradFi Leaders: Ondo works with global institutions like BlackRock and Morgan Stanley, leveraging their expertise to tokenize traditional assets and bring trillions of dollars in value on-chain.

Blockchain Innovators: Partnerships with major blockchain platforms, including Ethereum, Polygon, Solana, and Arbitrum, provide a robust infrastructure for Ondo's tokenized financial products. These collaborations ensure scalability, efficiency, and interoperability across networks.

DeFi Protocols and Custody Solutions: DeFi players like Chainlink, Curve, and Pendle help integrate Ondo’s offerings into decentralized ecosystems. Custody solutions from Fireblocks, BitGo, and MetaMask Institutional secure assets and streamline institutional onboarding.

Cross-Chain Bridges: Collaborators such as Axelar and LayerZero power seamless cross-chain asset transfers, further enhancing accessibility and liquidity for Ondo’s users.

They’ve also recently went ahead and announced a partnership with Wellington Management, a leading asset management firm, marking a significant move into the tokenized securities space. The collaboration will introduce the Delta Wellington Ultra Short Treasury On-Chain Fund, expanding the market for tokenized real-world assets.

This effort is supported by Libeara, a fintech company backed by Standard Chartered's venture division.

Ondo's 24/7 redemption feature allows investors to manage or exit positions at any time, a key advantage for integration with DeFi protocols.

Read more about it here - https://blog.ondo.finance/ondo-finance-works-with-libeara-to-provide-intraday-liquidity-for-tokenized-us-treasury-fund/

Ondo’s Future

The RWA narrative is gaining momentum, but not all projects are equally positioned to capitalize on it. TradFi is merging with DeFi, unlocking trillions in potential value. Public securities and funds are being tokenized, bringing everything on-chain. By bridging TradFi to DeFi, we can unlock unprecedented opportunities.

But who’s building all of this?

Well, most likely the company with partnerships alongside the biggest names in TradFi: Ondo.

Ondo’s advantage lies in its early execution and focus on institutional-grade solutions. They’re clearly the frontrunner in this revolution.

This article is written in partnership with Ondo.