The market is doing what it does best: testing your conviction.

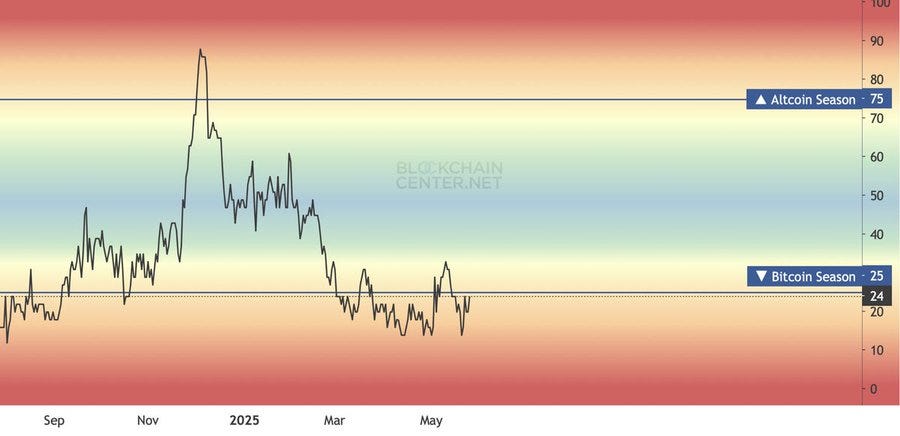

Altcoins are bleeding against BTC. BTC dominance is hovering near cycle highs. Sentiment is fractured between sidelined boredom and aggressive longing on low-caps.

This isn’t a call for altseason tomorrow, don’t FOMO.

1. Yes, We’re Still in a Bull Market. But No, You’re Not Late.

Bitcoin is still the main character. From ETF inflows to corporate treasury allocations (GameStop, Trump Media, Strive), institutional conviction is keeping the BTC engine hot.

That’s part of why altcoins look weak BTC is hogging the liquidity. Until that narrative cools down, ETH and large caps won’t run, and low caps definitely won’t.

Altseason starts after BTC dominance decisively rolls over—not while it’s still consolidating at cycle highs.

2. Cycles Matter but So Does Market Structure

It’s true: crypto follows a rough 4-year rhythm, driven by BTC halvings, liquidity conditions, and tech adoption cycles. And if you’re zooming out, 2025 looks like the second half of the game, exactly where parabolic moves start to emerge.

But it’s also where fakeouts multiply. In 2021, alts ripped after ETH outperformed BTC. Right now? ETH/BTC still looks soft. If you’re aping into low-caps before ETH flips, you’re early and exposed.

The smarter move would be to stack strength. Track which large-caps are showing real accumulation ($AAVE, $UNI, $LINK).

3. Short-Term Setups Look Better—but They’re Not Confirmed

Traders are right to eye key zones. A breakout above the range high could ignite higher-beta altcoin moves. But positioning needs discipline.

→ Use BTC as a trigger, not the trade.

→ Use spot accumulation in trending alts like $HYPE, $AAVE, $CRV as low-risk bets.

→ Watch ETH/BTC. No ETH strength, no real altseason. Period.

4. No, You’re Not Going to 200x Overnight

True asymmetry comes from being early and positioned with size in narratives that are actually accruing interest:

On-chain perps (Hyperliquid, Virtual)

ETH LRT protocols with real cashflow

DeFi names doing actual buybacks (AAVE)

Chain-native winners (Base, Solana, BNB—not micro caps yet)

Altcoin season starts with BTC printing ATHs (check).

Then ETH breaks out (pending).

Then large caps rally (some signs).

Then mid-caps follow.

Then low-caps go vertical.

We’re somewhere between Phase 1 and 2.

Stay patient and size up during the dips.👇🧵

Weekly Updates

1. Capital Efficiency Is the New Arms Race

AMMs and money-markets are fusing: EulerSwap’s LP-as-collateral model and Hyperdrive’s borrow-against-portfolio concept point to a future where idle liquidity is unacceptable. For strategy: highlight this convergence in your content—“Every asset should earn twice.”

2. Bitcoin DeFi Graduates From Narratives

Mezo’s BTC-backed MUSD and cbBTC acceptance in Liquity’s fork show that builders are finally treating Bitcoin as useful collateral, not just digital gold. If your audience trades yield, frame BTC as “the new US Treasuries” of crypto—safe collateral that now earns.

3. Hooks & Modular Primitives

Uniswap v4 hooks (Gamma) and Bittensor EVM Uniswap ports demonstrate that permissionless extensions are spawning CEX-like features. Content angle: expect an explosion of bespoke trading UIs—position your threads as “Why hooks make every DEX a platform.”

4. Cross-Chain Liquidity Layers Are Flattening

Malda’s borrow-to-any-chain, Katana’s VaultBridge, and Starknet’s USDC-to-Bitcoin bridge all replace bridge UX with native abstractions. Trend to watch: liquidity no longer cares where it lives. Advisable spin: “The chain wars end when the user doesn’t see a chain at all.”

5. Stablecoin Yield Wars Heat Up

From TermMax’s 19 % to Ripple’s RLUSD incentives and Pendle’s 20× multipliers, fixed-income-styled DeFi is maturing fast. For UHNW narratives (think Libertas), emphasize “institutional-grade yield without custodial compromise.”

6. Points, Quests, & Airdrops Remain Growth’s Kingmakers

Lagrange’s verifiable-AI mission and Humanity’s palm-scan gating hint at Sybil-resistant reward systems. In marketing: champion the shift toward “proof-of-personhood airdrops” to stand out from spray-and-pray campaigns.

7. RWA & Institutional Bridges Keep Expanding

Curve on Plume, Origin’s revenue buybacks, and Ripple’s RLUSD integrate traditional finance mechanics into DeFi plumbing. Asset-backed narratives continue to resonate—tie them to your RWA threads, stressing transparency and real-world yield.

Narrative Overview

Bitcoin is making fresh all-time highs, yet most of CT still feels oddly fatigued. The emotional split makes sense once you zoom out: almost every chart that matters to retail is an alt-coin chart, and nearly all of those have been range-bound for months. Add that summer is approaching, a season that has conditioned traders to expect thin order books and sudden rug-pulls, and you get the jittery mood we’re seeing on timeline.

The Treasury Gold-Rush

We are behaving as if it’s 2020 all over again. In just the past week GameStop, SharpLink, Strive, Blockchain Group and even Trump Media collectively earmarked well over US $3B for direct Bitcoin purchases. Their logic is simple: in a world where cash bleeds 5 % in real terms and long-duration bonds barely keep up, Bitcoin has been the only mainstream liquid asset to trounce inflation over a five-year horizon.

That migration of balance-sheet capital matters for two reasons.

First, it soaks up spot supply, exactly what ETF flows had started earlier in the year, making each incremental sat harder to source.

Second, it gives fund managers a benchmark for risk: “If a retailer famous for meme-stock mania puts 5 % in BTC, why can’t we?”

Expect this bid to turn what used to be cyclical rallies into a more structural grind higher. Ironically, the better Bitcoin behaves, the longer alt-season may stay deferred; dominance is showing early signs of topping, but the buyers holding the bag are CFOs, not degen rotation traders.

Capital Efficiency Wars: AMMs Eat Money-Markets

While treasurers stack sats, DeFi architects spent May erasing the boundaries between swaps, collateral and fixed income. Euler stitched Uniswap-v4 hooks into its lending engine so that LP tokens auto-qualify as borrowing collateral—just-in-time liquidity without idle TVL. Hyperdrive let Hyperliquid traders leverage USDe or USDT0 against dormant perp collateral, while Malda’s ZK-powered “lend anywhere, borrow anywhere” layer turned bridges into a UX detail.

The unspoken thesis is that any asset inside a smart contract should work twice: once for exposure and once for yield. For protocols, that keeps users sticky; for professionals chasing basis trades, it compresses spreads and reduces risk down the curve toward real-world assets.

Liquidity Migration: The Quiet Layer-2s Surge

Hyperliquid’s TVL has ripped higher each week, Base volume is quietly piggy-backing on the Virtual ecosystem, and BNB Chain’s DEX stats exploded, though in Polyhedra’s case the “explosion” is mostly bots wash-trading for ZK points.

Ethereum still claims the heavyweight flows, but look at what those flows are: AAVE, UNI, LINK, PEPE, large caps. Retail farm-and-dump seasons now live on side-chains; mainnet has become, well, the main street.

Meme Velocity, Buybacks and the Hunt for Beta

AAVE’s governance-driven buybacks turned the token into an institutional accumulation favorite, generating the cleanest spot inflows we’ve seen since early spring. Meme coins are splintering into two tribes: the “rotation leaders” (PEPE, VIRTUAL, SPX6900) that institutions can size into, and the disposable lottery tickets (DINNER, Fartcoin) that retail punts until the music stops.

One curiosity: on Solana, flows are less concentrated—MEW’s Robinhood listing, JUP’s steady faucet, and sleeper plays like BRETT and KAITO are all nibbling mind-share. If you’re crafting growth content, spotlighting that fragmentation is a way to differentiate from the Ethereum-centric narrative everyone else recycles.

NFTs: The Forgotten Frontier

Ordinal hype is gone, volumes have flat-lined, and “ancient whales” aren’t coming to rescue floor prices. Until we get outright monetary easing, or at least a fresh story that reframes JPEGs as utility rather than flex, the capital that used to chase NFTs has found a better lottery ticket in meme coins with embedded points systems.