Memecoins have made its way as strategic assets into portfolios of prominent entities like Binance and Hayes

Their market size have tripled in just 2024 alone.

Here I expound on GCR’s theory for an explosion of a meme narrative that will be bigger than the previous bull run👇🧵

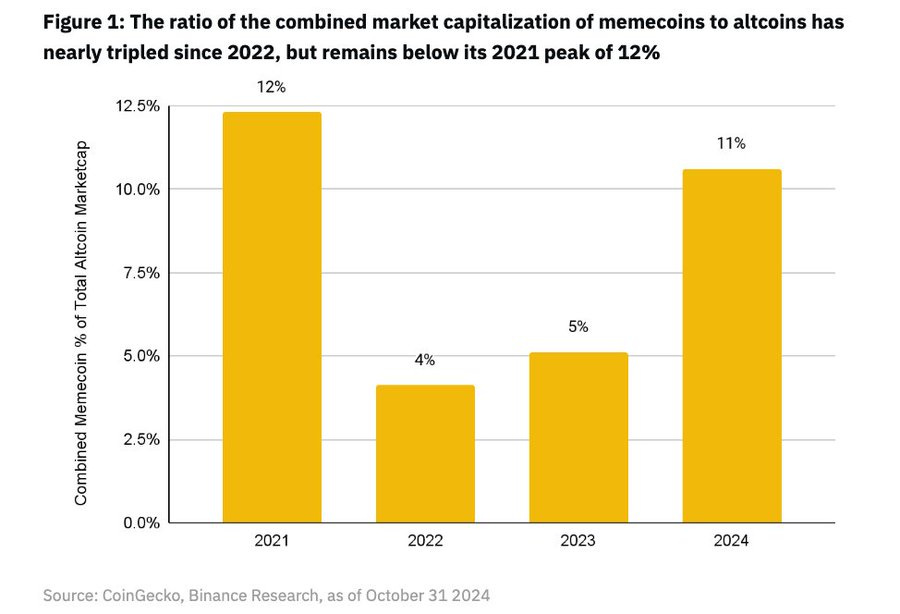

Key Context: Global Money Supply Expansion & Investment Behavior

As global money supply expanded rapidly, so did the appeal of high-risk investments.

Here’s how this trend breaks down:

Most funds still flow into traditional assets (S&P 500, real estate).

A portion reaches top cryptocurrencies like $BTC & $ETH.

At the highest risk end, meme coins emerged as high-risk, high-reward tools, attracting overflow capital.

Financialization of Internet Culture

A shift in retail investor mindset is underway as they seek new wealth creation paths, often disillusioned by traditional finance.

Meme coins try to embody these values by promoting equal access and minimizing insider advantages.

Since the early internet days, memes have thrived on viral appeal and community-driven engagement.

Through crypto, memes have entered finance, birthing a new phenomenon: the financialization of memes.

Insights & Lessons

Popular meme coins have showcased the value of fair launches and low circulating supply tokenomics. These traits are worth noting for any future token projects aiming to capture attention.

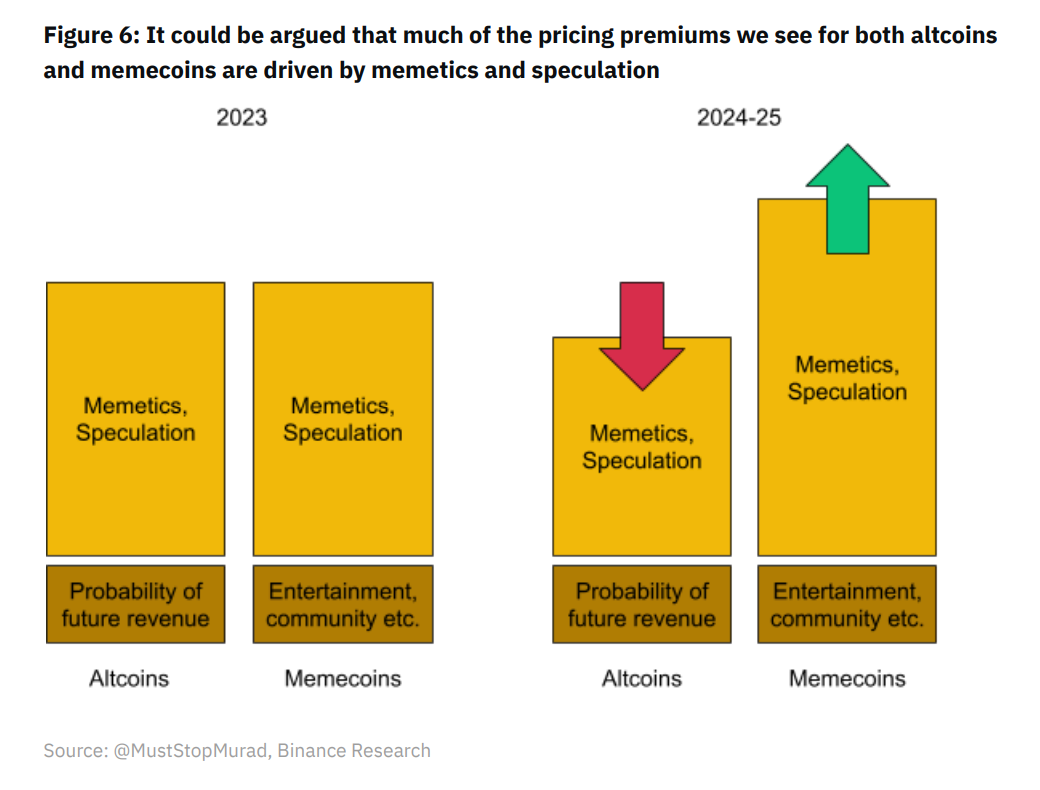

Macro Stats: Meme Coins Are Financial Gains Over Tech Advancements

Meme coins cater to a market that values financial gains more than tech innovation. Since 2022, meme coins’ market cap share (excl. $BTC, $ETH, and stablecoins) grew from 4% to 11% in 2024—nearly tripling within two years.

Meme Coins in Global Economic Context: Money Printing & Financial Nihilism

Three factors form meme coins’ unique context:

Fiat Printing and Money Supply Surge: During the 2020 crisis, central banks accelerated fiat supply, increasing global money supply by 25% (from $81T in 2020 to $102T in 2022).

Inflation & Rising Commodity Prices: U.S. inflation hit 7% in 2021, then 6.5% in 2022. Rational actors look for assets with long-term value to counter fiat depreciation. Wages can’t keep up with housing, with the years needed to buy a median-priced home nearly doubling from 1963 (4.4 years) to 2021 (8.1 years).

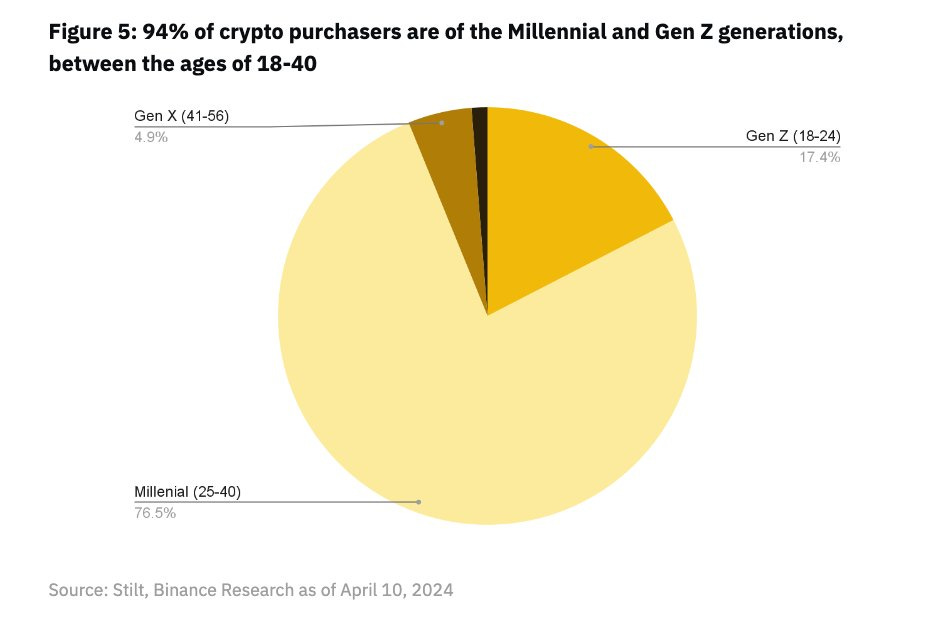

Youth and Financial Nihilism: The macro landscape is reshaping young generations’ attitudes, particularly in crypto. 94% of crypto buyers are Millennials or Gen Z (aged 18-40). Events like the 2021 GameStop short squeeze reflected young investors’ skepticism towards traditional finance.

Meme Coins’ Value Proposition: Appeal Over Utility

Meme coins may lack clear utility, but they hold an undeniable allure. Defined by internet culture, they represent fun and equal wealth creation opportunities. 75% of meme coins were created in the past year alone!

Key traits:

No pre-mining, team allocation, or VC distribution.

Equal access at launch.

Simple narratives make them accessible to retail investors.

Heavily influenced by sentiment and group psychology.

Risk Considerations: High Stakes and Manipulation

Meme coins are high-stakes investments with significant risks:

Failure Rate: 97% of meme coins fail. Only a few have long-term relevance.

Manipulation & Rug Pulls: Conspiracies and scams are common. You might be “exit liquidity.”

Volatility: Low liquidity can lead to sharp price swings, making exits challenging.

Market Saturation: The meme coin market may already be saturated, diverting attention and resources from innovative projects.

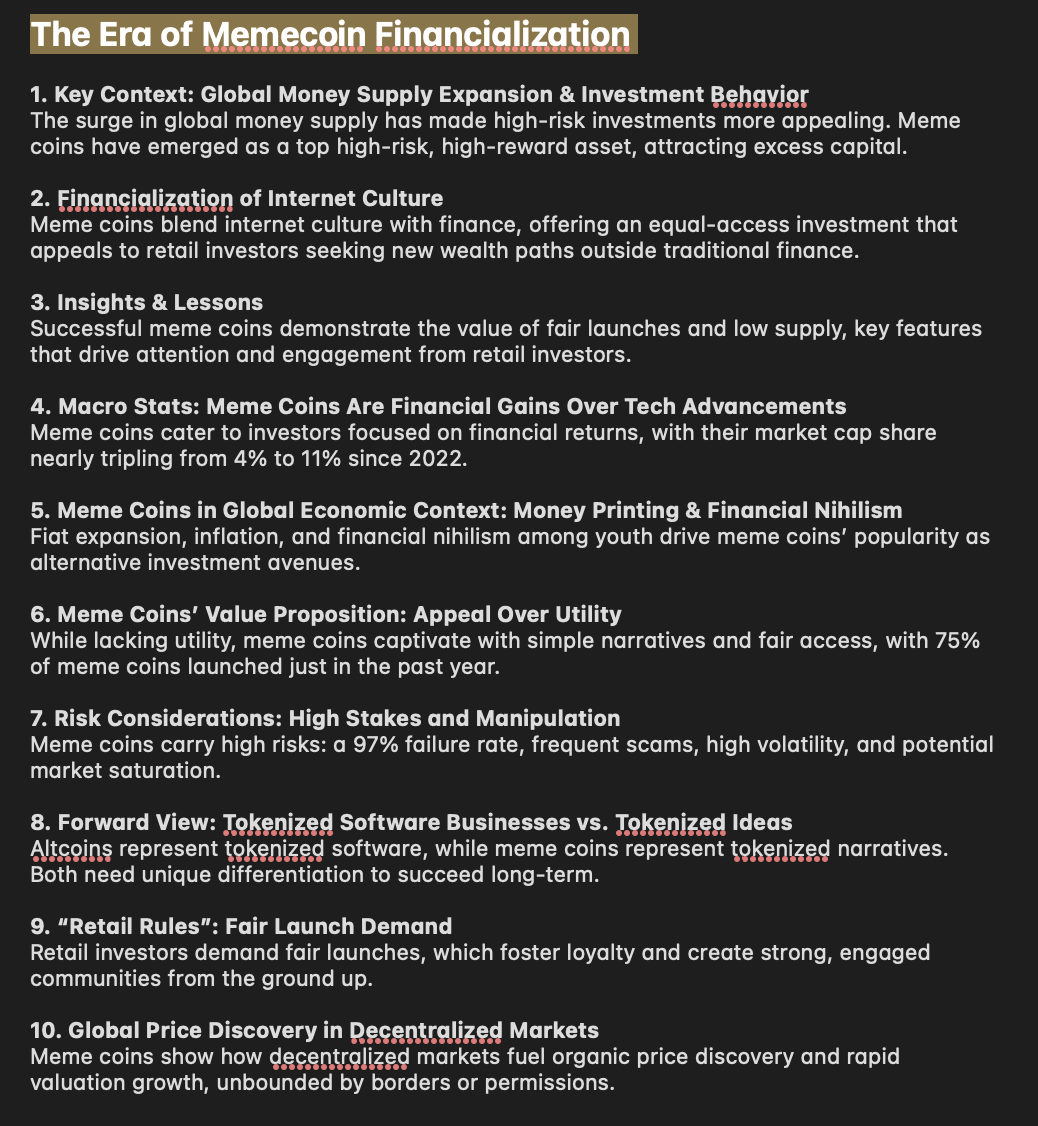

Forward View: Tokenized Software Businesses vs. Tokenized Ideas

Altcoins vs. Meme coins:

Altcoins: Represent tokenized on-chain software businesses. Long-term success hinges on creating useful, differentiated products with real market fit.

Meme Coins: Represent tokenized ideas and narratives. The most successful will need to maintain unique, differentiated storytelling.

“Retail Rules”: Fair Launch Demand

Meme coins show a clear demand for fair launches open to all blockchain participants. While VC support can help a project’s brand, retail investors are essential for building any strong community. Giving retail a chance to invest early fosters loyalty and a strong base.

Global Price Discovery in Decentralized Markets

Meme coins demonstrate how tokens can reach substantial market caps through organic price discovery on decentralized, borderless, permissionless platforms.