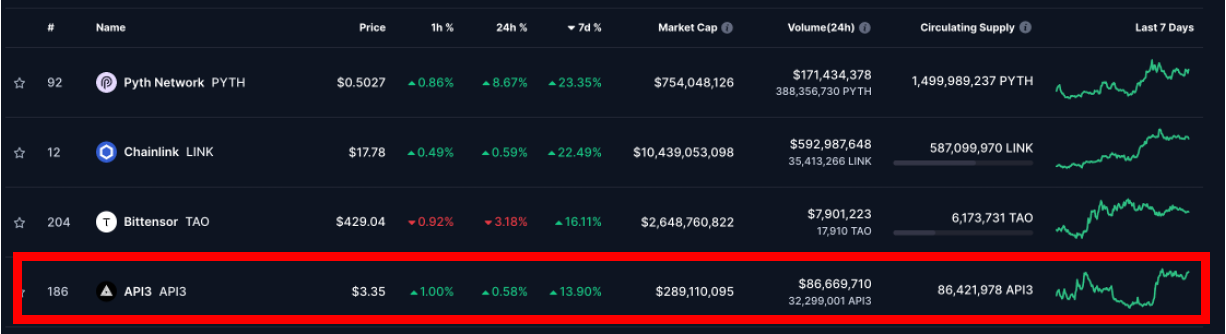

While altcoins were bleeding, only the Oracle sector was gaining.

$PYTH $LINK were making 20% gains in a week

$API3 is the first mover for capturing OEV as they approach ETH Denver and is set to be the leader with this innovation 🧵 👇

If you enjoy the read, please RESTACK, LIKE and COMMENT on what you like to hear next. It will be super helpful

Last week, altcoins took a dump, but the only sector that was still green was Oracle.

It was the only one with a 0.15% increase in market cap.

And zooming into the Oracle projects, I found…

The biggest mover was @PythNetwork and then followed by @chainlink

Ranked 186 was @API3DAO came in third seeing a 7D growth of 13%

They are an underdog pioneering a novel solution for capturing OEV and is set to change the Oracle landscape for DeFi

DeFi apps often faced issues like centralized points of failure, opacity in data feeds, and MEV extraction siphoning value from protocols.

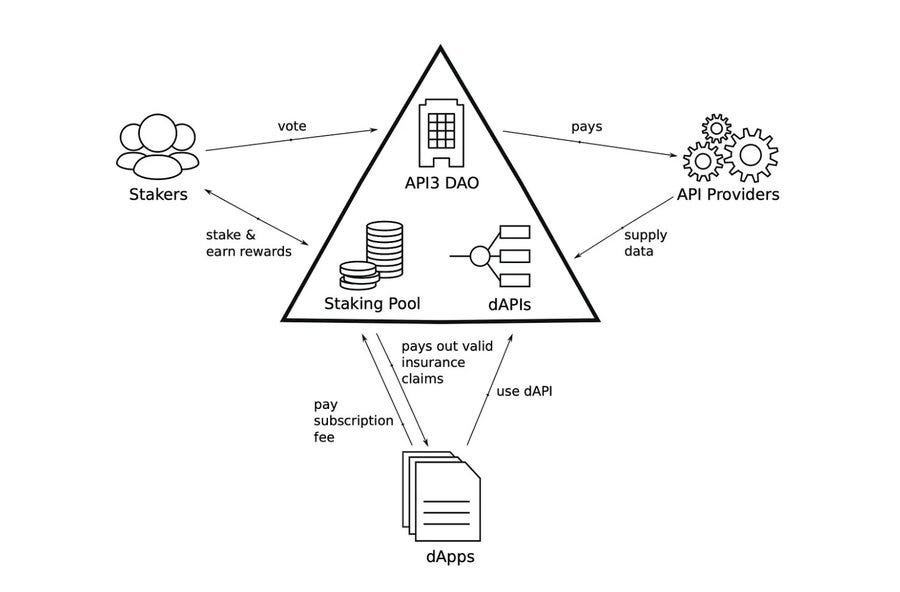

So @API3DAO is built to be the next-gen bridgeless first-party oracle solution.

Their core products includes:

Decentralized APIs (dAPIs) hosted on the API3 marketplace.

OEV capture helping protocols recover value typically lost to miners and improve performance.

First-Party Oracle

So here's the key thing to understand about first-party vs third-party oracles: it's all about who's actually running those oracle nodes that feed data into blockchains.

If the API provider themselves decides to spin up nodes that shuttle their data directly onto chains - boom, that's a first-party oracle setup. They cut out the middlemen and host things in-house.

On the flip side, if you've got a separate third-party company being paid to run nodes for that API provider - basically acting as the middle layer shuttling the data - that's a third-party oracle.

The thing that makes Airnode at API3 a first-party system is that they don't force APIs to outsource their node infrastructure. They built Airnode so API providers can stand up their own nodes directly within their existing cloud services or servers.

So for any protocols that wanna serve up data into smart contracts, they can leverage API3 tech and do it in a first-party way. No more delegates or middlemen extracting fees. Just pure data flowing from source to contract.

Competitive Advantage

Let me break down why API3 is a big deal:

Re-captures MEV money back into your protocol

Aave alone has produced at least $100M in MEV that they could have recovered with OEV!

So, API3 can capture that value and funnel it right back into your protocols.

So instead of paying API3, you get paid just for plugging into our decentralized API data feeds.

Value Accural for Token Holders

More value for token holders as more projects begin to realize the magic that they can do with API3.

And more recently they’ve partnered with Manifold and DWF for marketing and business development partnerships.

No protocol would want to use other oracles

But here's what matters most: API3 invented OEV capture, and no protocol would pick any other oracle without massively ripping off their users on liquidations.

It just makes zero sense once the option to recover value exists!

OEV Network, the first Oracle extractable value Network, powered by @0xPolygonLabs zk-Rollup technique!

OEV Network

So TLDR - Capturing OEV lets API3 turn oracle profits back over to the DeFi protocols.

OEV is similar to MEV that comes specifically from liquidations and other transactions involving Oracles.

So any time a DeFi app uses an oracle price feed to trigger something like a liquidation, there's OEV created that gets snatched by MEV searchers before the dApp can get it.

How this works is that API3 runs auctions to let the highest bidder actually update their Oracle feeds.

Whoever wins the auction gets the right to both update the Oracle

And they can extract that juicy OEV themselves

The auction fees they just paid go right back to the DeFi dApp using their Oracle

So they essentially let the MEV searchers keep doing their thing, except now it funnels cash back to protocols instead of getting lost.

dApps have a major advantage using API3 oracles, because they can utilize OEV capture to claw back tons of value from liquidations and other transactions.

Individual OEV opportunities can be measured in up to millions of dollars per transaction, while the entire MEV industry just between 2020 and 2022 (pre-merge) produced over $675M to searchers and block producers.

VS UMA's OEV capture

UMA recently released their OEV capture tool called Oval build with Chainlink’s data feeds and flashbots.

There are some drawbacks here:

Chain is restrictive to Mainnet only as these are chains that flashbots supports with MEV-Share

It’s only auctioning off chainlink updates that would happen normally (a.k.a a 1% deviation feed stays at 1%)

Layers of centralization are introduced as a result of underlying chainlink feed not misreporting

If there is no competition for the chainlink updates, chainlink updates are delayed by up to 36 seconds, effectively exposing the project to an insane amount of delay and risk

What is the main thing making API3 better?

Integrated into data feeds which means that if your chain gets our data feeds, it also automatically is ready to recapture OEV

No dependency on Chainlink or Flashbots

API3 auctions are continuous and have real-time market data. Infinitely more granular auctions can occur, whereas UMA can only auction off when chainlink updates.

API3 acts as an auction host for signed data provided by 1st party oracles.

So UMA made a cool wrapper idea. But API3 is actually innovating the base oracle layer with OEV capture.

Conclusion

While oracle projects like Pyth and Chainlink saw gains recently, API3 is poised to leapfrog the competition with its groundbreaking OEV capture technology. It recaptures value lost to MEV and redirecting it back into DeFi protocols and provides a sustainably profitable model for both dApp developers and token holders.

And unlike UMA's Oval solution, that is a Chainlink/Flashbots wrapper, API3 has vertically integrated Oracle infrastructure for maximum decentralization and value capture.

Twitter: https://twitter.com/arndxt_xo/status/1754528096131440900