Binance Labs invested in a perp dex:

🔥 $10B trading volume

🔥 Highest leverage you can find 1001x

🔥 Most number of tradeable pairs

🔥 Intent-centric driven

🔥 New high leverage trading bot

And built its Perp DEX SDK funnelling even more revenue into the protocol 🧵👇

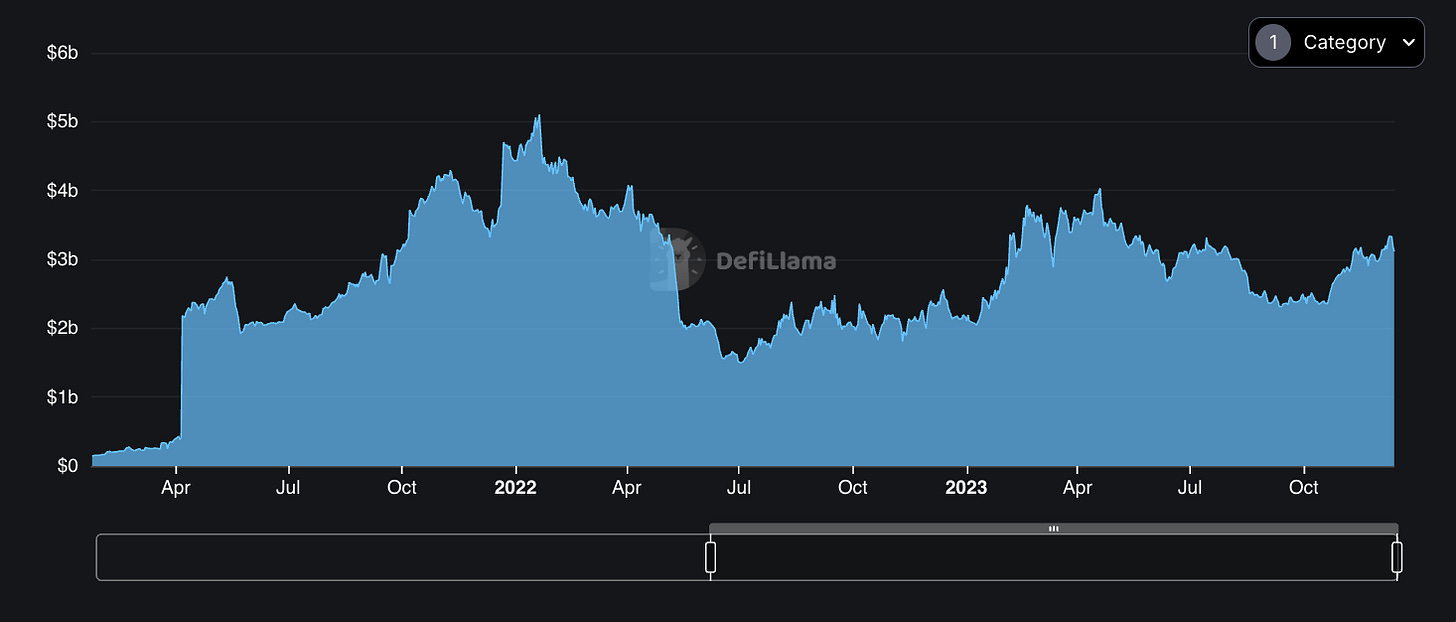

Derivatives have been on an uptrend despite the market volatility these days that we are seeing.

It has surpassed $3B in market size from DefiLlama’s data.

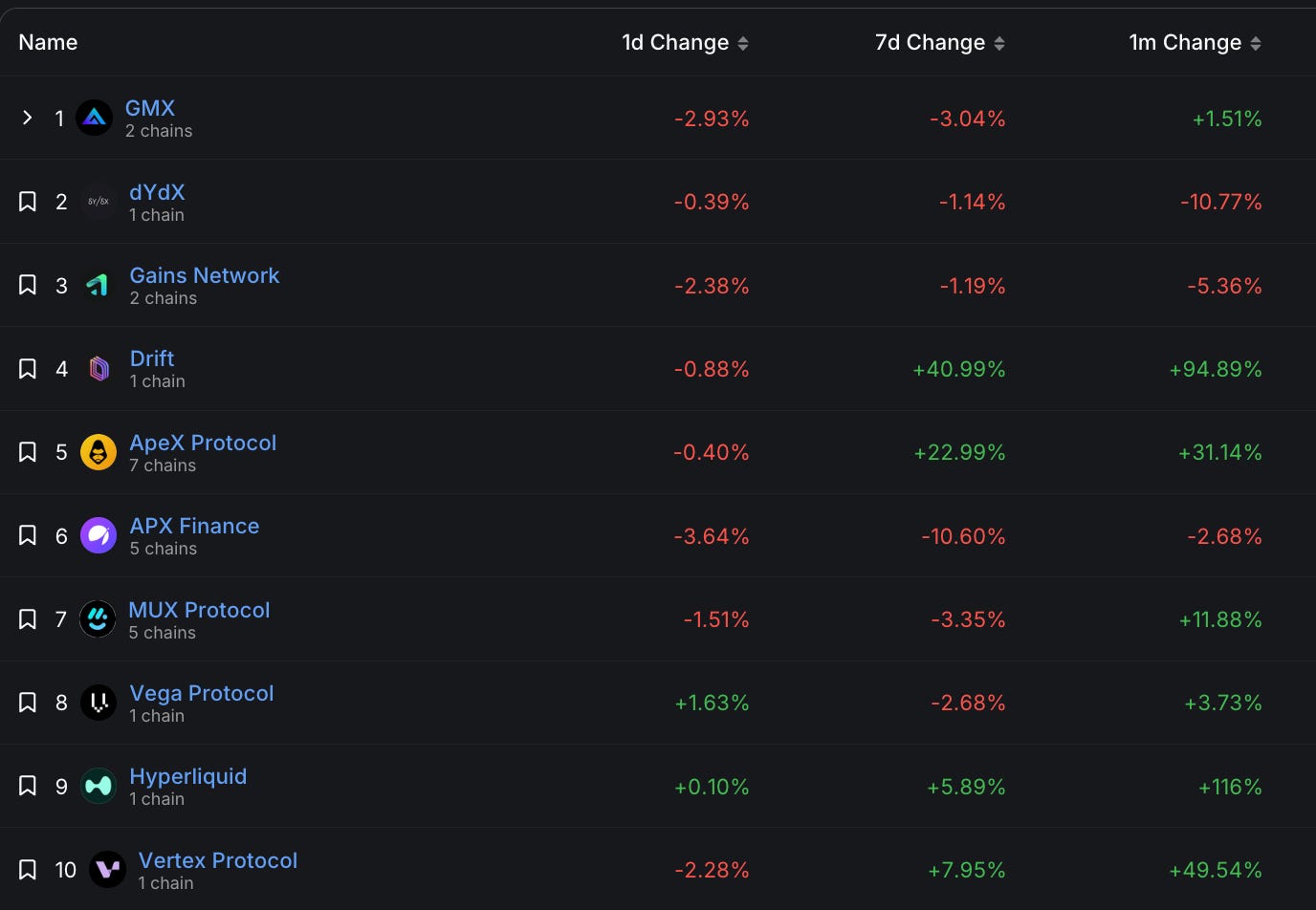

And the top 10 perp dexes are generally seeing a positive increase in volume

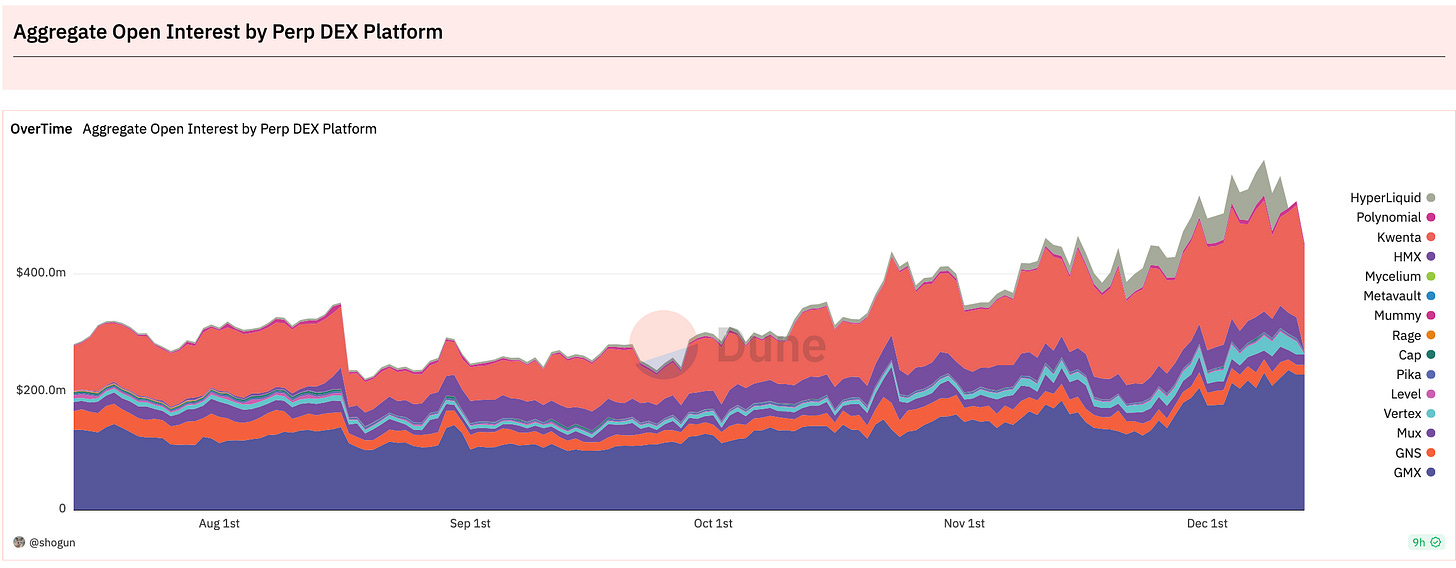

Open interest across board is rising, showing that perp dex trading activity is increasing

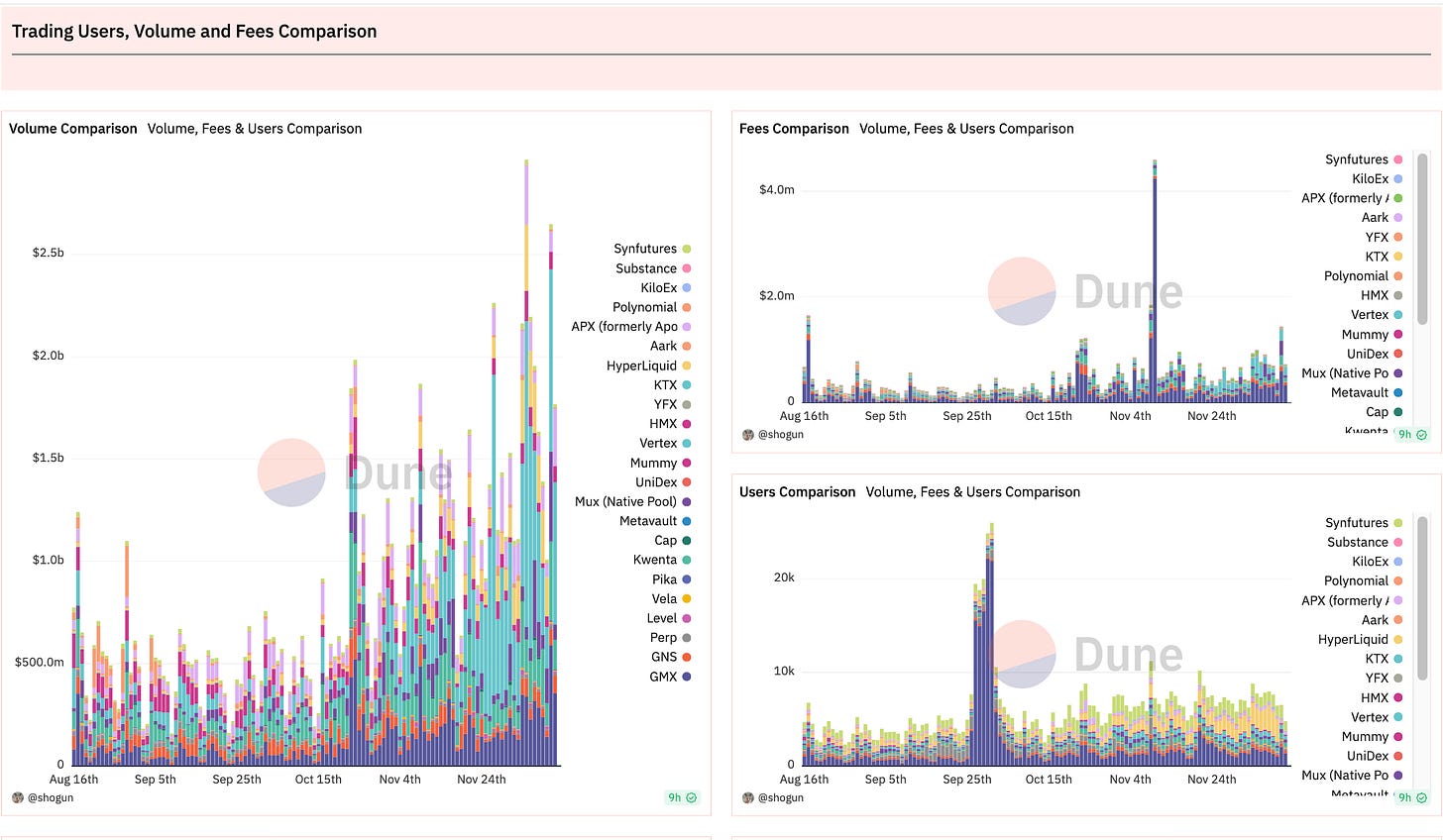

Trading volume surpassed $2.5b on a day basis and fees have been on the rise.

🔷 About 🔷

If you know ApolloX finance from the early days, they have since rebranded to @APX_Finance backed by @BinanceLabs

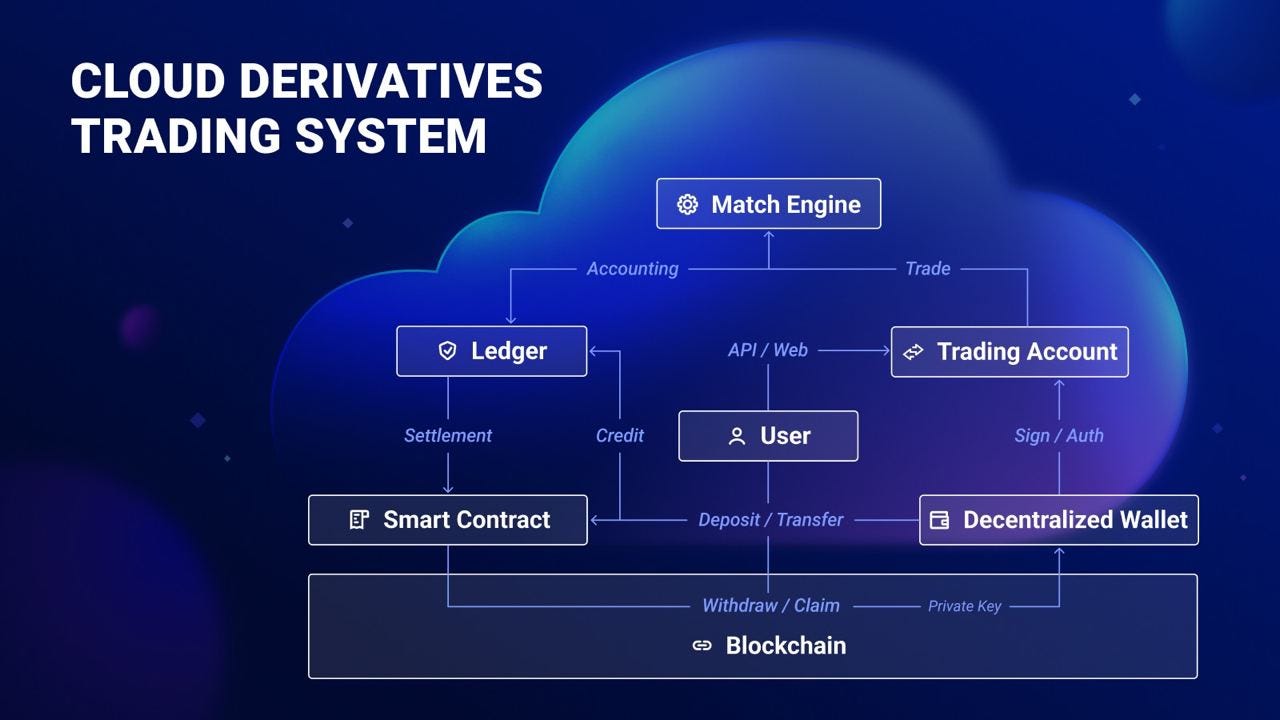

APX offers two versions of its perpetual trading platforms

V1 utilizes an order book model

V2 features fully on-chain liquidity for transparent and seamless trades.

Both platforms provide crypto leveraged trading with high leverage, minimal slippage, low fees, and opportunities to earn yields.

🔷 V2 Perp Trading 🔷

The V2 on-chain perpetual trading platforms (Base, BNB Chain, Arbitrum, opBNB) use a pool-based model, executing all trades against the ALP liquidity pool on each chain. This maximizes capital efficiency across trading pairs and enables 0.01% slippage for Classic Mode trades.

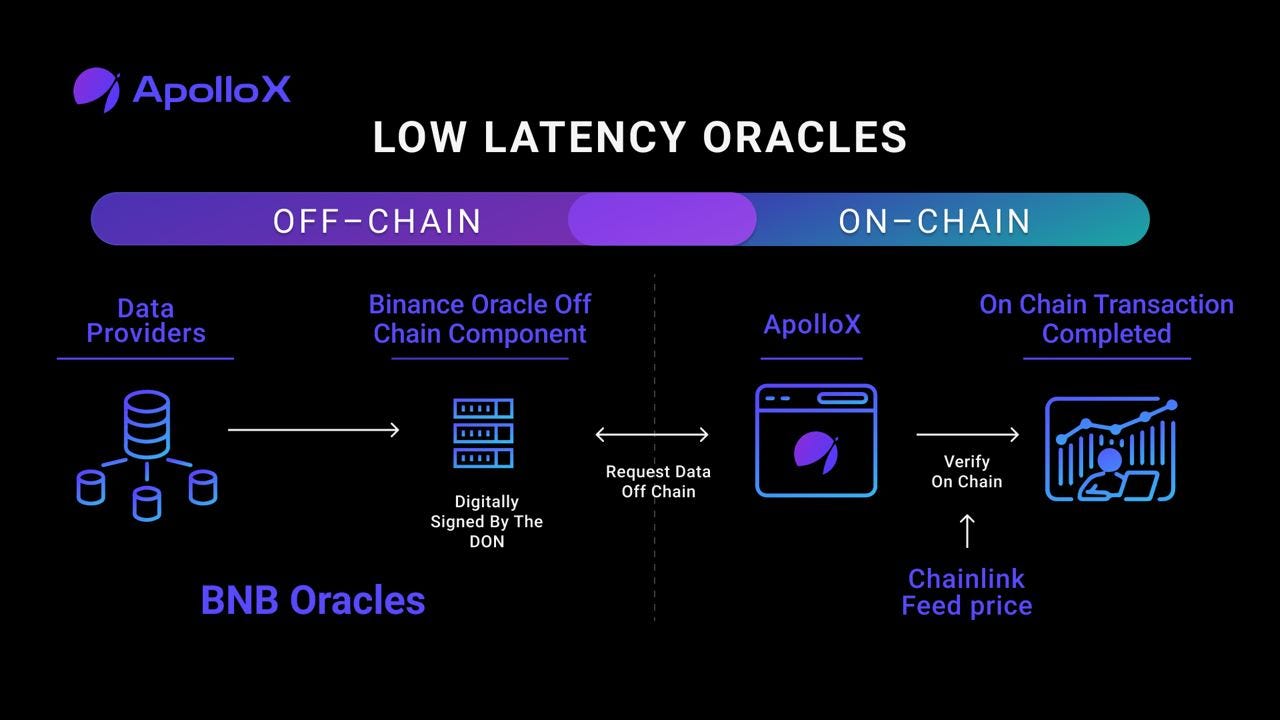

V2 leverages a dual oracle system with Binance Oracle and Chainlink for highly accurate pricing.

V2 Classic Mode offers trading with up to 250x leverage, 0.01% slippage and 0.02-0.08% fees.

Under Degen Mode, trades allow up to 1001x leverage, 0 slippage, and 0 open fees.

For time-bound bets, APX Dumb Mode offers 60sec, 5min, or 10min expiry price prediction trading.

Metrics

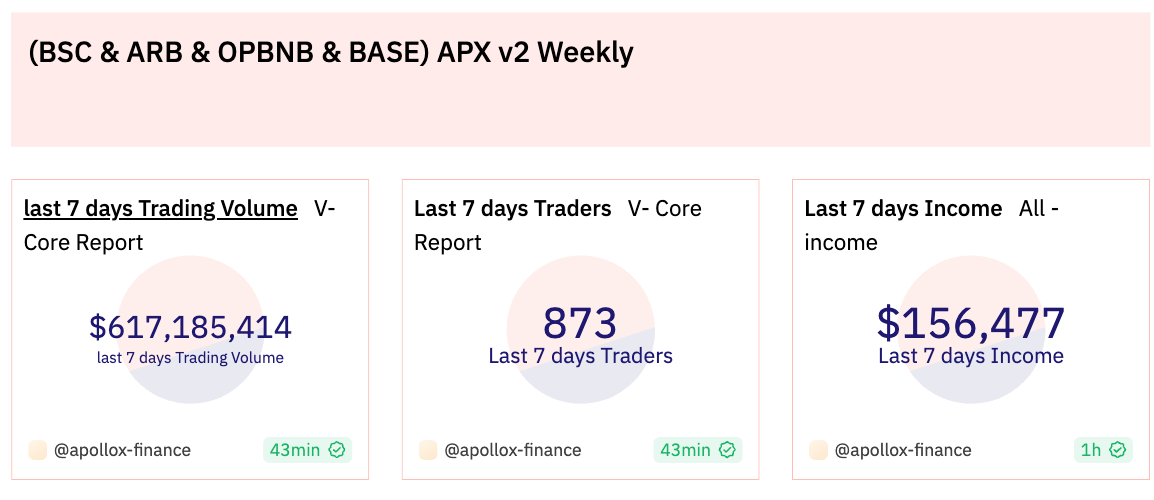

APX seen a life time trading volume of $10B

While in the last 7 $APX did:

$617M in trading volume

873 traders

$156k in income

ALP

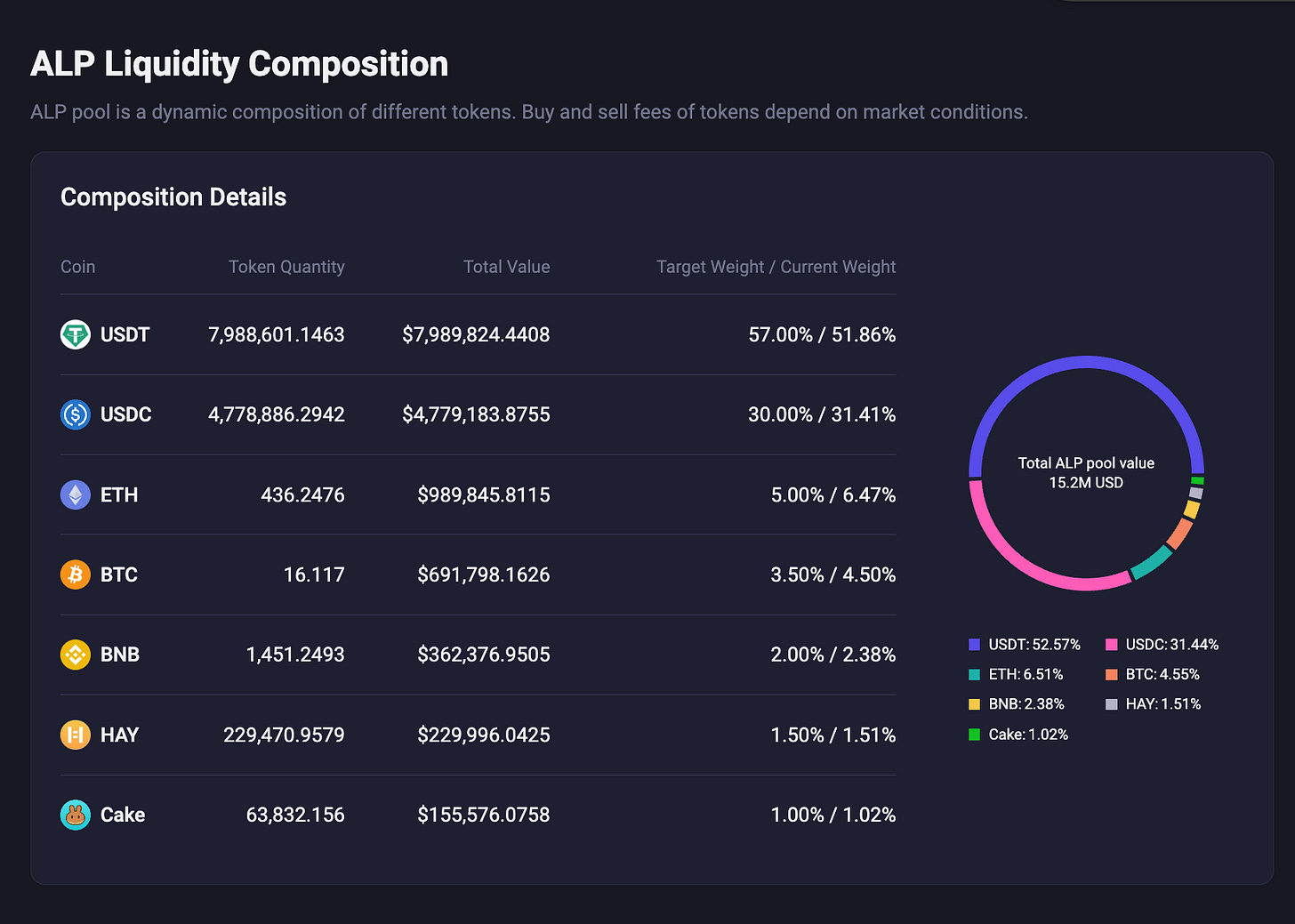

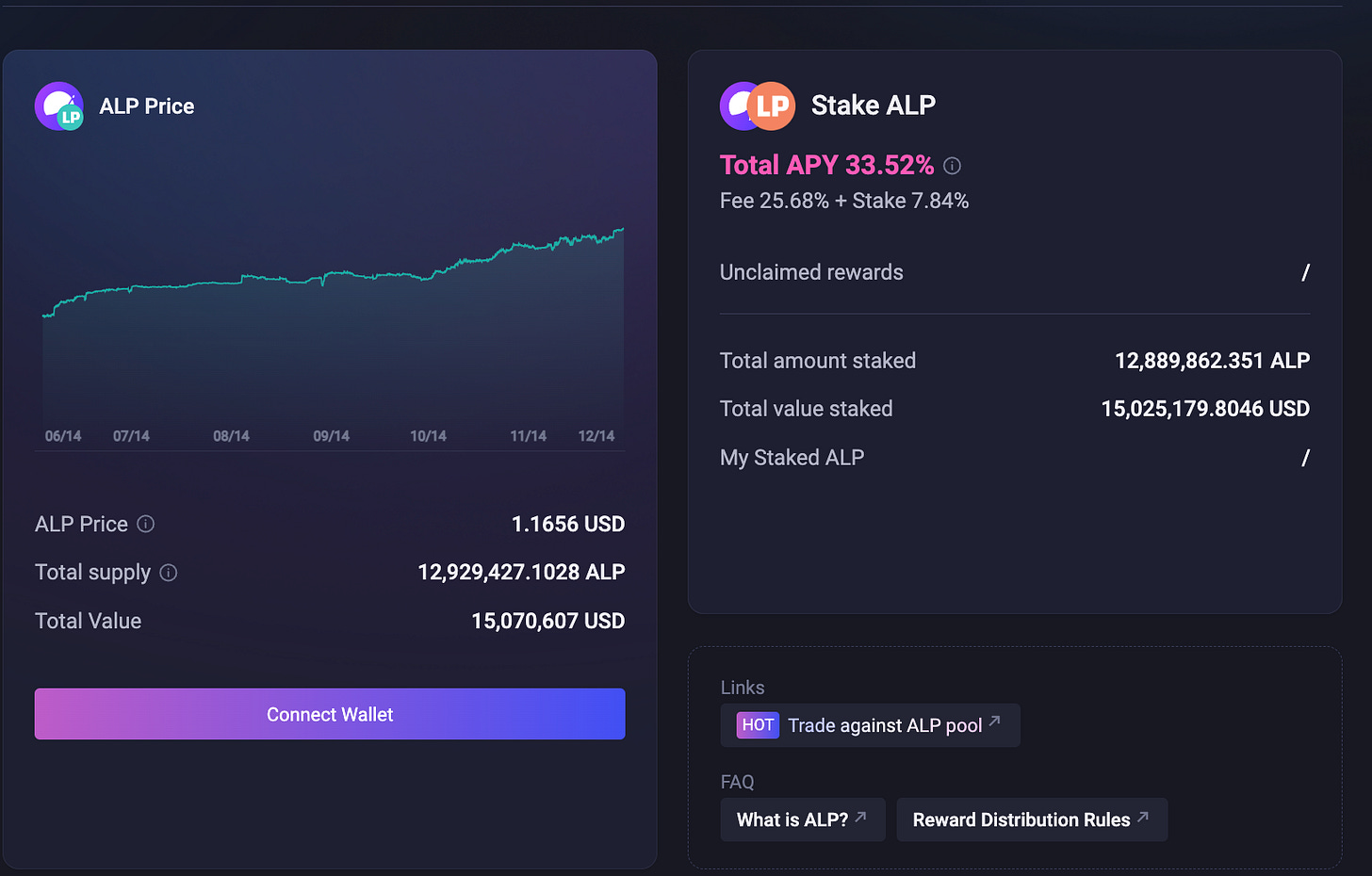

$ALP (APX Liquidity Provider) tokens make up the core incentive structure powering APX Finance's platform. ALP tokens are minted by liquidity providers (LPs) who supply funds to liquidity pools that consist primarily of stablecoins (80% or more) paired with blue-chip crypto assets like $BNB, $ARB.

Each pool is made up of different tokens. The screenshot below reflects the ALP pool on BNB Chain.

By minting ALP tokens to provide liquidity, LPs can earn APY from platform trading fees. LPs can also stake their earned ALP to receive additional staking rewards, providing compelling incentives for market making. Currently, staking rewards are not offered on two newer chains: opBNB and Base while minting functionality is enabled across opBNB, Base, and more established chains.

This incentive design attracts consistent liquidity to APX, fueling trading volume while rewarding LPs with yields from fees and ALP staking that are eye-catching even for stablecoin pairings. As more LPs mint ALP and supply trading pools with deep liquidity, it kickstarts a flywheel spurring organic user growth and network effects for the APX Finance platform.

🔷 DEX SDK 🔷

APX also has a Permissionless DEX Engine SDK that allows projects to launch customized on-chain perpetual DEXs leveraging APX's robust trading infrastructure. This will create an endless value funnel back into APX as these SDKs become more widely adopted.

Partners integrate the SDK to benefit from shared liquidity via the ALP pool, high 1001x leverage trading, customizable interfaces, and revenue share opportunities.

As we gear towards mass adoption, SDK will be a key infrastructure for many projects that want to build something of their own. It would make sense for new projects that will be more likely to build on top of existing infrastructure, and these will drive a lot of value into projects with SDK toolkits.

🔷 APX Advantages 🔷

Key advantages of APX's platforms include:

Dual product, V1 and V2 offering with order book and on-chain perpetuals

Industry-leading 1001x leverage trading

Minimal spreads and tight liquidity

Low fees, zero-cost trades via rewards

Yield opportunities through staking

With innovative perpetual trading protocols optimized for high leverage, transparency, and profits, APX empowers traders to capitalize on crypto market volatility.

🔷 Catalyst 🔷

APX is deployed on @BuildOnBase. I am personally bullish on the chain as I am beginning to see more projects building there and the TVL for base is increasing even as we see an $AVAX season now.

They have also launched on #opBNB with $5000 of trading incentives up for grabs.

Furthermore, with their partnership launch of @1001TradingBot a trading bot with 1001x leverage, there is more winnings to be won.

🔷 Conclusion 🔷

APX and perp dexes platforms continue to see strong growth and adoption. With over $10 billion in lifetime trading volume, APX offers leading leverage of up to 1001x, minimal spreads, low fees, and opportunities to earn yield through its native ALP token incentives.

APX's V2 on-chain perpetual trading platforms utilize pooled liquidity and dual oracles for accuracy, enabling seamless trading. The ALP liquidity pool and incentive model attracts liquidity providers, fueling further volume and network effects. APX has also launched a Permissionless DEX Engine SDK allowing partners to launch customized perp dex platforms while benefiting from shared liquidity and revenue.

Twitter: