“Crypto and AI boom will create a tech mania”

Breaking down 163mins with @CryptoHayes

Here are 9 crypto predictions and insights 🧵 👇

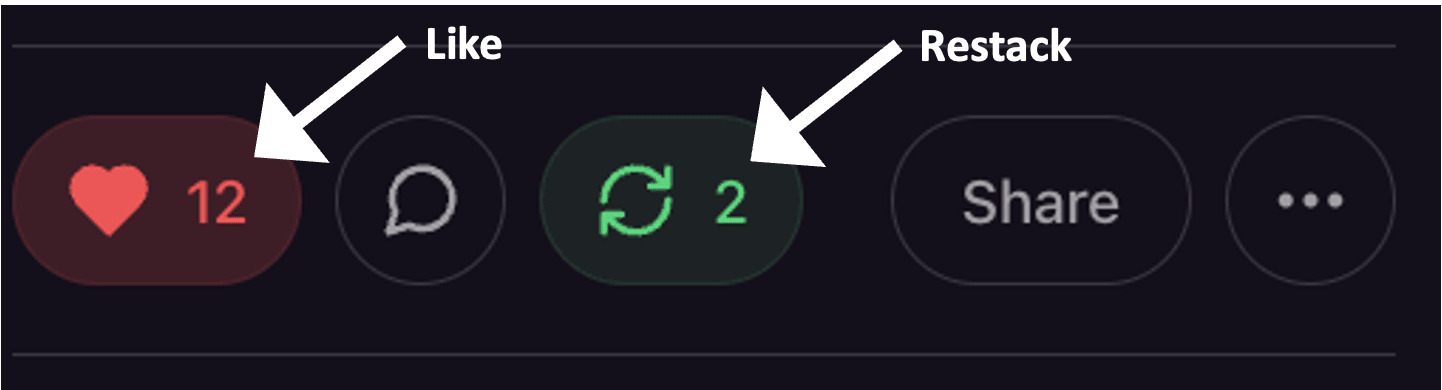

If you enjoyed the read, please RESTACK, LIKE and COMMENT on what you like to hear next. It will be super helpful!

Hayes talks about the potential for a new economic crisis worse than the 2008 financial crisis. Overall, he shares valuable insights and strategies for surviving and thriving during the new economic reset.

He highlights various issues such as the insolvency of the US banking system, the problem of commercial real estate in the US, China's real estate issue and deleveraging, and Japan's dilemma between saving its government bond market or its currency.

Hayes acknowledges that it is uncertain which specific issue will cause widespread panic.

He also discusses the importance of structuring a portfolio to minimize costs and maximize potential gains during economic downturns, as well as the need to understand and manage volatility in investing.

Additionally, Hayes expresses his bullishness on AI and cryptocurrencies, suggesting that decentralized cryptocurrencies like Bitcoin and Ethereum are well-suited for AI economic agents.

He also highlights potential investment opportunities in sectors related to AI technology.

However, he advises caution and to not get caught up in market euphoria, emphasizing the importance of liquidity and having discipline in investing.

Hayes also touches on the potential challenges from dollarization and resource scarcity in Europe.

🔷 Worse than 2008 Crisis 🔷

Hayes discusses the potential for a new economic crisis worse than the 2008 financial crisis.

US banking system is insolvent and major buyers of US treasury debt are not buying, which means the treasury needs to issue a lot of it.

Commercial real estate in the US is also a problem, and China is facing a massive real estate issue and deleveraging, limiting its ability to contribute to global growth.

Additionally, Japan has to choose between saving its government bond market or its currency.

All these known problems could serve as early dominoes that start a larger crisis.

However, Hayes admits that it is uncertain which specific issue will cause the spark for widespread panic.

🔷 Impact on the sovereign debt markets 🔷

Hayes discusses the impact on the sovereign debt markets.

With global debts relative to GDP at 360%, investors may refuse to buy long-end bonds of certain governments, leading to higher bond yields.

To address this, governments may resort to measures like closing down the banking system and forcing deposits to buy government bonds, known as fiscal dominance.

Another approach is yield curve control, where central banks fix the price of bonds by expanding their balance sheets indefinitely.

However, if large asset holders revolt and seek alternative investments like stocks or cryptocurrencies, the authorities may resort to printing money to maintain the fixed yield level.

The crisis intensifies when people look for ways to move their money outside of the system to preserve their purchasing power, potentially leading to the collapse of the banking system.

🔷 Printing Money as +EV Outcome 🔷

Printing money has not had adverse effects in the past is because of China's role as the workshop of the world.

China's low-cost labor and willingness to degrade their environment have lowered the cost of goods across sectors.

However, China's population is declining, and they are prioritizing protecting the environment, which means they will no longer degrade themselves to benefit the rest of the world.

This means there won't be another big country like China to maintain the same dynamic.

As for India, if there is a way to keep the party going, it would require financial autonomy and freedom, similar to what Japan has done.

🔷 Unique situation of Japan 🔷

Hayes discusses the unique situation of Japan and why its success cannot be directly applied to the United States.

Japan has accumulated significant assets and its banking system is relatively closed, preventing foreign investors from buying Japanese bonds on a large scale.

Additionally, Japan has benefited from cheap labor from China and Southeast Asia, which has helped reduce labor costs.

However, this situation is running out as other countries that did not benefit from the last 80 years seek higher wages and resources.

Inflation is also beginning to rise in Japan.

Hayes emphasizes the importance of understanding the differences between Japan and the United States, particularly in terms of debt ownership and financial dependence on foreigners.

He suggests structuring portfolios to benefit from both situations, including holding cash in money market funds and investing in assets that could benefit from money printing, such as stocks or Bitcoin.

🔷 Portfolio Strucutre 🔷

Hayes discusses the importance of structuring a portfolio that minimizes costs and maximizes potential gains during economic downturns.

Having an "optionality portfolio" that covers day-to-day expenses while also allowing for potential profits.

By diversifying between high-volatility investments (such as crypto and tech stocks) and fixed supply instruments, like cash or short-term government bonds, investors can participate in the upside during favorable market conditions and safeguard their finances during downturns.

Hayes compares this strategy to a race car driver who speeds up during straightaways and applies brakes during corners to avoid crashes.

He emphasizes the need to make the most of profitable periods while minimizing losses during downturns.

It is a personal preference and recommends focusing on assets or markets that investors understand and are comfortable with.

Maintaining a portion of your portfolio in safe, stable assets such as cash or low-risk investments to cover expenses and provide income.

When market panics occur and the central bank intervenes, invesotrs can reasses investment strategy and adjusting accordingly.

Hayes warns against actively trading unless you have the expertise and time to dedicate to it, and suggests diversifying your investments to spread risk.

Advice is to focus on long-term investing and to be cautious and informed when dealing with high volatility.

🔷 Artificial Intelligence 🔷

Hayes discusses his belief that artificial intelligent economic agents inherently require decentralization and should utilize cryptocurrencies such as Bitcoin, Ethereum, and Filecoin for various purposes.

Current money printing and the upcoming AI boom will create a tech boom mania, making anything related to artificial intelligence a potentially lucrative investment.

He expresses his bullishness on AI and crypto, stating that the combination of the amount of money being printed and the disruptive nature of AI technology will create fantasies of growth that may not be realized in the expected timeframe.

Wait for signals from central banks before making investment decisions and emphasizes the importance of not trying to time the market.

He acknowledges that the central banks will transparently communicate their actions in order to instill confidence in the investing public and stimulate economic activity.

The consensus view that the central banks can effectively manage the business cycle and achieve a soft landing, but he disagrees with this optimistic outlook.

He suggests that going against the consensus and being right is key to achieving success in the market.

🔷Soft Landing🔷

Hayes discusses his skepticism about the idea that the global economy can experience a soft landing after printing massive amounts of money and rapidly rising interest rates.

With the massive global debt and historical examples of collapse, it is unlikely that a small group of people can accurately determine the outcome of such a situation.

It is not worth risking investments on the assumption that "this time is different" and instead advises investors to focus on probabilities and expected values.

He invests in uranium mining companies, believing that the world's move towards nuclear energy will create a demand for refined uranium, leading to potential gains in those companies' stocks.

🔷 Euphoria Discipline 🔷

Hayes discusses how he thinks about euphoria as and the importance of being liquid during a market euphoria and the need for discipline in investing.

He expects people to invest their stimulus checks or bailouts into the hype of the moment, which he believes will be AI.

However, he also acknowledges the challenges of investing in AI and crypto, as it often takes several years to see any liquidity.

Hayes emphasizes the importance of having liquidity by 2025 and 2026 so that when he senses that the market has gone too far, he can liquidate his portfolio.

He cautions against getting caught up in the euphoria and investing in illiquid assets that cannot be sold when the market turns.

He advises against investing in illiquid assets and getting caught up in risky ventures.

Hayes then discusses the potential end of the party, where the system breaks due to factors like soaring prices of essential commodities and social unrest.

He mentions the possibility of conflicts arising from resource scarcity and the importance of data ownership in the modern world.

Hayes hopes that conflict can be avoided, but acknowledges the potential for cyber warfare and aggressive hacking between countries.

🔷 Dollarization 🔷

Hayes discusses the potential threat of dollarization and its impact on the average person.

Dollarization negatively affects the financial elite of America but may have little to no impact on the average American.

Current fiat financial system benefits major cities like New York and San Francisco, while the average American is not significantly impacted.

America has the resources to sustain itself and become self-sufficient, but the current power players would lose their standing in such a scenario.

Higher risk in Europe, citing energy and food security concerns.

Europe's reliance on external resources may lead to internal conflicts as the euro's structure is unable to address these differences, causing a shortage of resources.

Twitter: https://twitter.com/arndxt_xo/status/1728009120014561318

Very, very nice work.