Miss the best 10 days in a year, and your returns could vanish entirely.

The 2025 cycle isn’t like 2017 or 2021, and anyone treating it the same is in for a rude awakening.

Here’s what’s really different this time👇

1️⃣ The Buyers Have Changed:

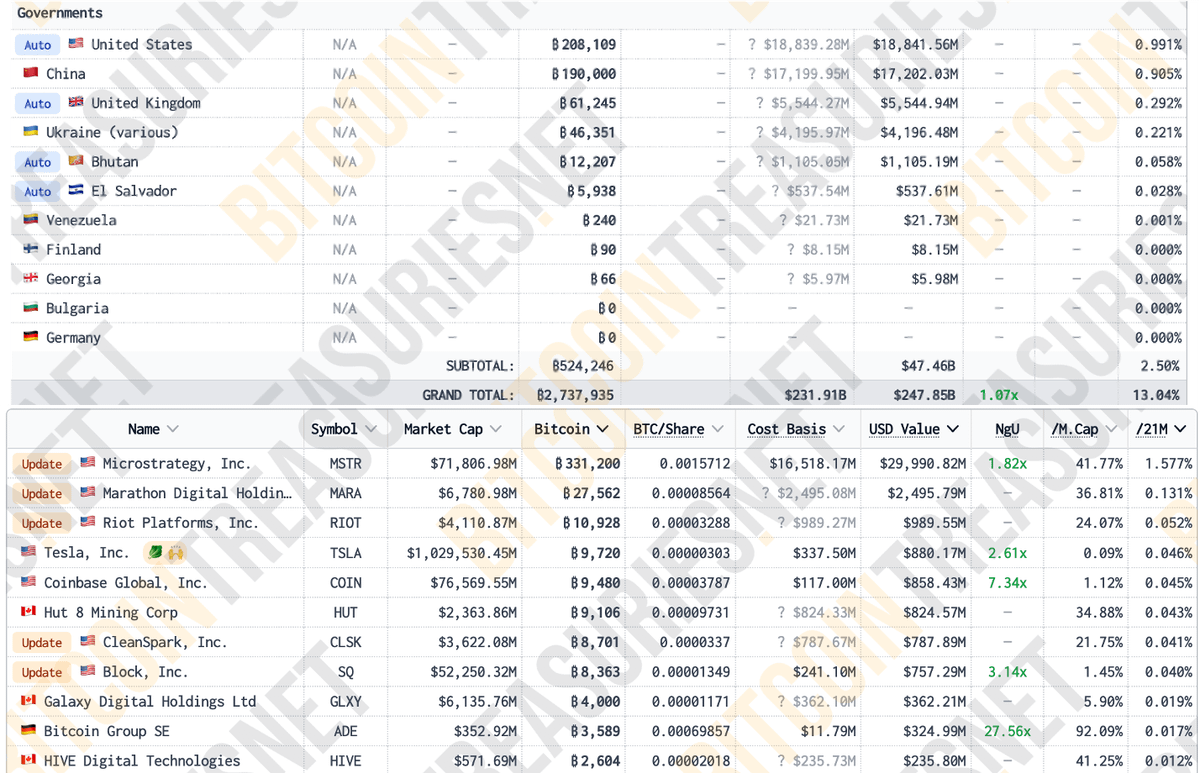

In 2021, it was wealthy individuals and companies like MicroStrategy and Tesla. In 2025? It’s governments, Wall Street, and institutional capital via ETFs. These are buyers looking to locking it up as a reserve asset, planning for decades.

Take MicroStrategy as an example: they’re working through a $42B BTC acquisition plan, which will likely absorb nearly all mining emissions for the next 2-3 years. Add in ETF flows, and by the next halving, there won’t be much Bitcoin left on the open market.

2️⃣ This Money Is Sticky:

Unlike retail FOMO or even corporate treasuries of the last cycle, institutional money is here for the long term fundamentally changing the supply dynamics. With governments and funds stepping in, we’re entering a phase where BTC’s is really scarce.

3️⃣ The Diminishing Euphoria Problem:

Historically, Bitcoin has “overshot” its price models during euphoric phases. In 2014, it soared well beyond projections. In 2021, the overshoot was far more muted. This trend points to a tempered upside in 2025, even as we move towards six-figure valuations.

The Bigger Question: What does this mean for the rest of the market?

Here’s where it gets tricky. Every cycle has its winners:

• 2017: ICOs made millionaires overnight.

• 2021: DeFi and NFTs became cultural phenomena.

• 2025? Memes, NFTs, DeFi, AI, and gaming are all contenders, but narrative saturation could limit runaway gains in established sectors.

👉 My personal view? If everyone agrees memes are the winners, then they’re already priced in. The real opportunity lies in underestimated sectors or hybrid narratives (e.g., AI x Gaming or DeFi x NFTs).

Play it smart, or get left behind.

Twitter: