Bitcoin’s First $100K Monthly Close | Macro Trends, Market Moves & What’s Next

Macro Pulse Update 01.02.2025

We just hit the first-ever monthly close above $100K for BTC.

The market isn’t screaming bearish, just shaking out weak hands.

Odds are we have at least one more macro leg up, but it won’t be a straight line.

Chop, consolidation, then continuation.

Here’s how I see it 👇🧵

Macro Pulse Update 01.02.2025, covering the following topics:

1️⃣ Macro events for the week

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ Japan Spotlight

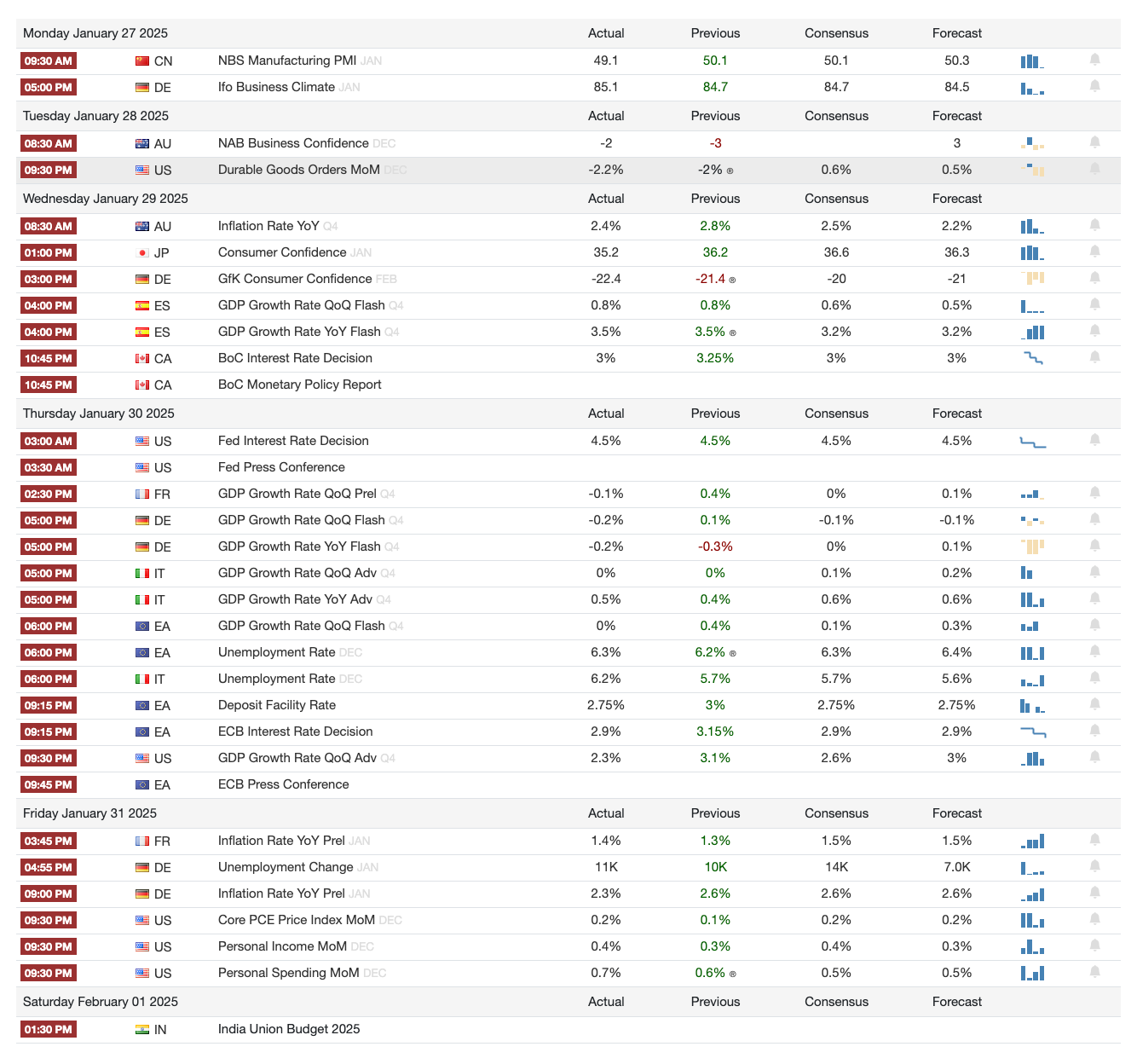

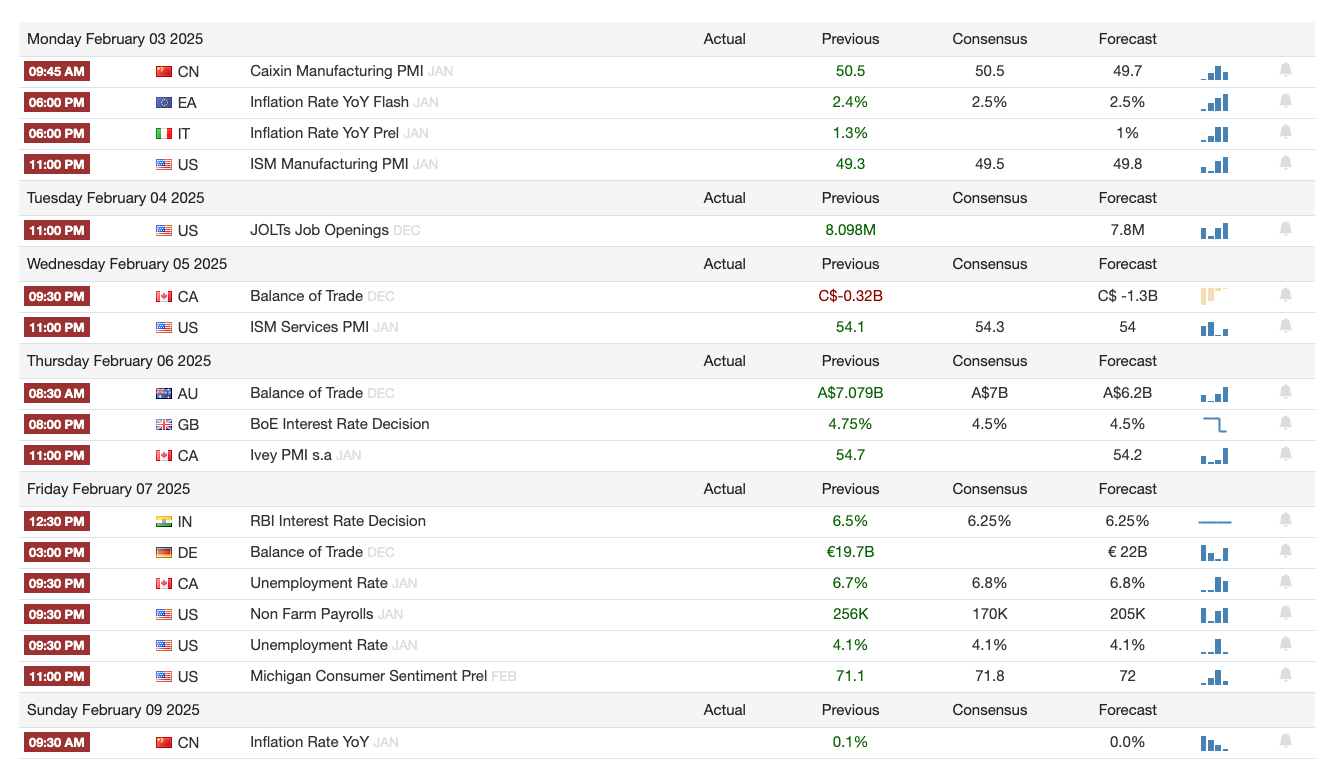

1️⃣ Macro events for the week

Previous Week

Next Week

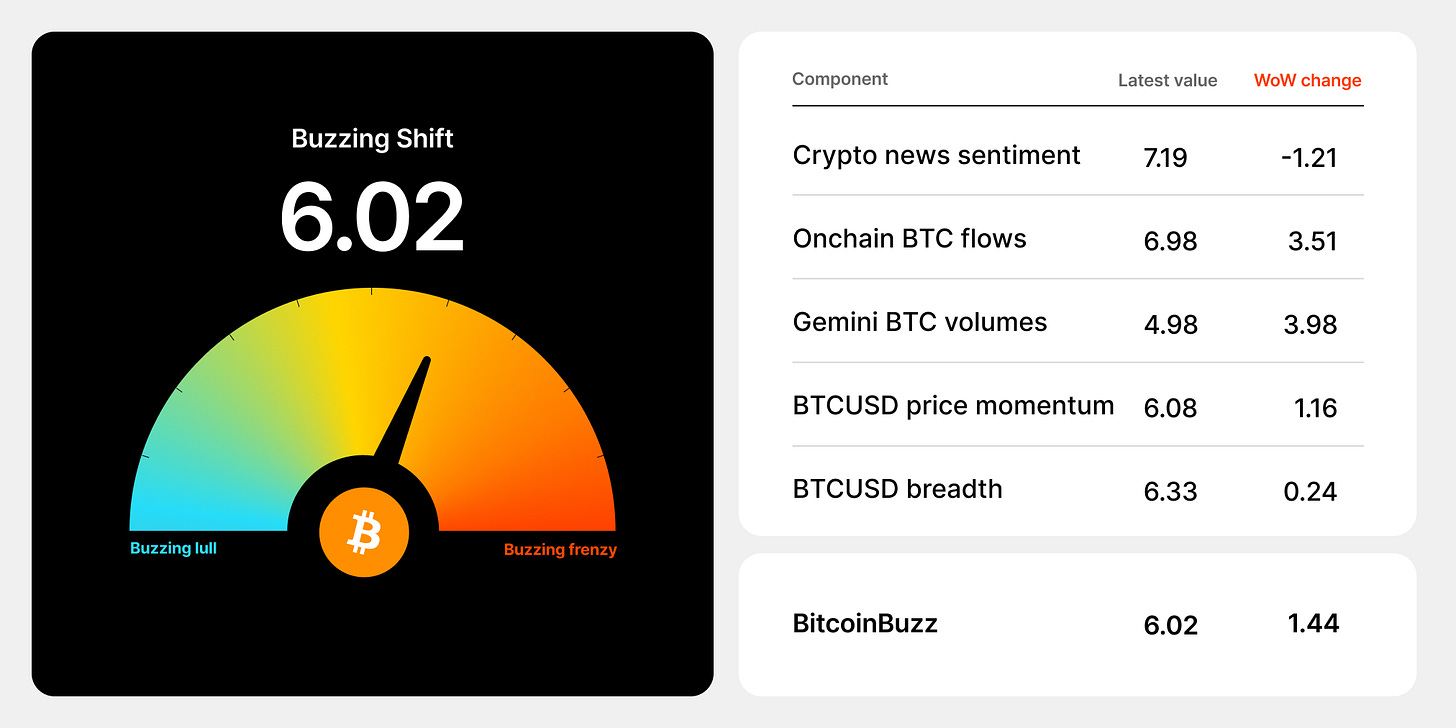

2️⃣ Bitcoin Buzz Indicator

Launches & Protocol Upgrades

Abstract Live: New streaming platform rewarding creators with Abstract XP.

f(x) Protocol v2.0: Fixed leverage trading on ETH with no funding fees or liquidations. Triple yield for Stability Pool users.

Major Updates

Virtuals Protocol expands to Solana, introducing Meteora Pool and Strategic SOL Reserve to reward agents/creators.

US Govt explores blockchain under the Department of Government Efficiency (DOGE), led by Elon Musk, evaluating ledgers for federal operations.

Jupiter Exchange now allocates 50% of protocol fees to $JUP buybacks, aligning incentives with holders.

Liquity V2 integrates Chainlink CCIP for cross-chain transfers of its ETH-backed stablecoin, BOLD.

King Protocol (formerly LRT²) unifies restaking rewards under $KING, replacing multiple reward tokens.

Airdrops & Rewards

Quai Network’s Rewards Claim Page is now live.

Sonic Labs announces an airdrop for Fantom users who bridged to Sonic.

Farms & Yield Opportunities

LBTC launches on Aave as the first Bitcoin Liquid Staking Token (LST), with $800M in liquidity at launch.

Pendle introduces sUSDa (Bitcoin-backed stablecoin), offering ~50% APY.

Spectra offers 37% APR on GHO liquidity for stkGHO Mar 2025 PT.

What’s Next?

Phantom Wallet to launch on Sui, with a raffle for early users.

Analog’s Token Generation Event (TGE) for $ANLOG set for Feb 6.

Usual launches Stability Loans (USL) to boost liquidity and stabilize USD0++.

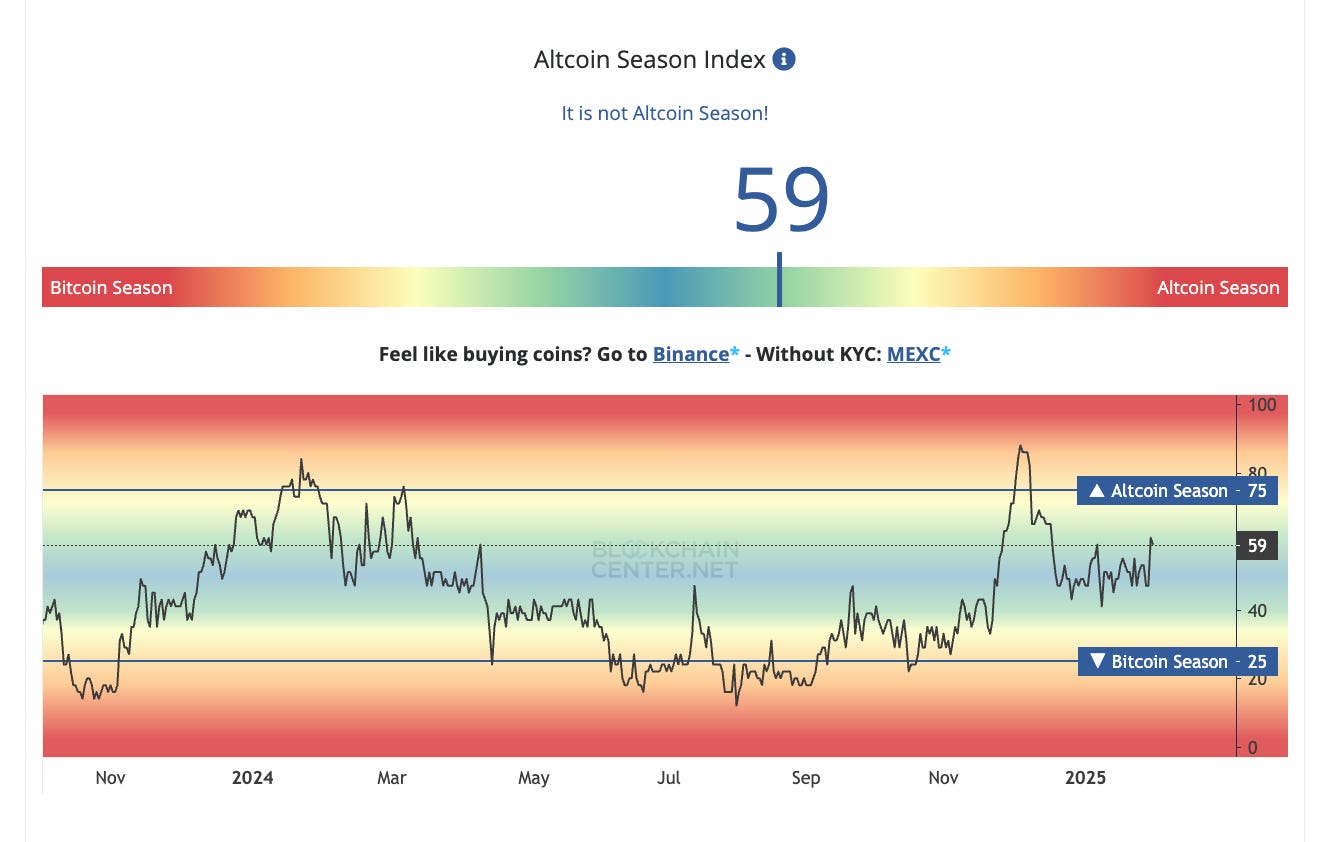

3️⃣ Market overview

Bitcoin Rebounds After DeepSeek AI Scare & Fed Decision

DeepSeek’s AI breakthrough initially caused panic, triggering $860M in liquidations and a $600B market cap drop for NVIDIA.

Bitcoin recovered above $105K despite Fed’s rate pause decision.

Jerome Powell reassures banks they can serve crypto clients if risks are managed.

Pro-Crypto Scott Bessent Confirmed as U.S. Treasury Secretary

A hedge fund billionaire and crypto advocate, Bessent replaces Janet Yellen.

Expected to push for a clear federal regulatory framework while opposing a U.S. CBDC.

His confirmation aligns with Trump’s pro-crypto stance, boosting industry optimism.

Jupiter’s Expansion Fuels Solana Growth—But Raises Concerns

New 50% fee buyback program + acquisitions (Moonshot & SonarWatch) boost JUP price.

Critics worry about centralization & increased swap fees (5 basis points) on Jupiter.

Debate grows over Solana’s long-term DeFi vision.

SEC Scores Partial Victory in Kraken Lawsuit

A federal judge rejects Kraken’s "Major Questions Doctrine" defense, strengthening the SEC’s case.

However, Kraken's "fair notice" argument remains, leaving room for legal challenges.

The case continues over allegations of operating an unregistered securities exchange.

Spot Solana ETFs Resubmitted Amid Regulatory Hope

Cboe BZX Exchange re-files multiple SOL ETF applications after previous rejections.

Optimism grows as Trump’s crypto-friendly stance may improve chances in 2025.

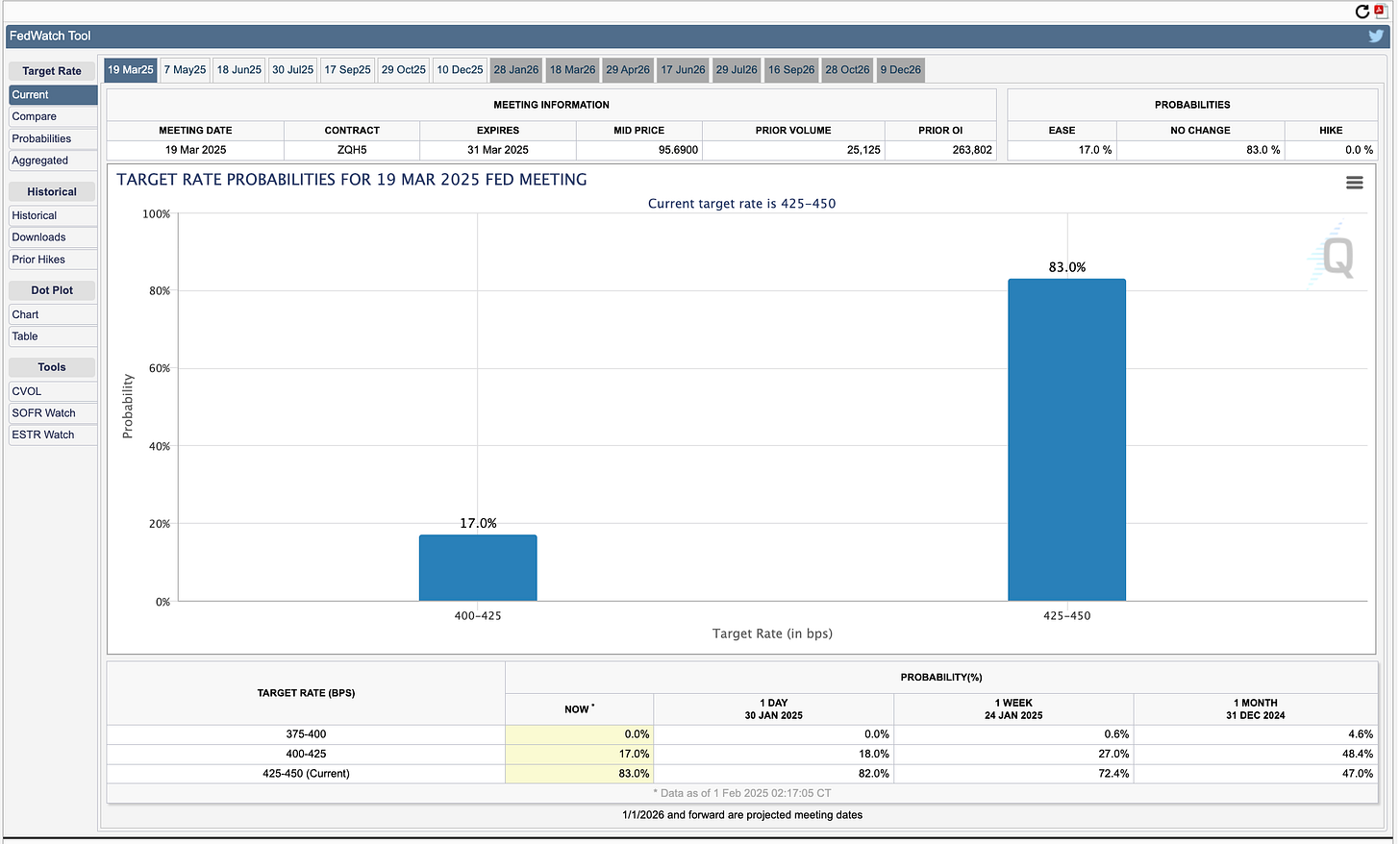

4️⃣ Key Economic Metrics

Investors & Governments React to Potential Tariffs

🔴 U.S. Trade Policy Uncertainty Creates Market Volatility

New administration’s tariff stance remains unclear, causing fluctuations in the U.S. dollar and global markets.

Initial signals suggested a pause, but later statements hinted at 25% tariffs on Canada/Mexico and 10% on China.

A 100% tariff on Chinese imports could be imposed if Tic Toc isn’t sold to a U.S. company.

Markets reacted sharply—dollar surged after tariff announcements, then fell when Trump softened his stance.

🟢 Global Central Banks Respond to Currency Pressures

Bank of Japan raised interest rates to stabilize the yen, fearing inflation from currency depreciation.

European Central Bank (ECB) may cut rates to stimulate demand amid trade uncertainty.

🟡 Global Trade Realignments Underway

Countries are diversifying trade partners to reduce reliance on the U.S.:

Thailand signs FTA with EFTA (Norway, Sweden, Iceland, Liechtenstein).

Negotiations underway with EU, South Korea, UAE, and Canada (via ASEAN).

Southeast Asian nations pledge to block trans-shipment of Chinese goods to avoid U.S. tariffs, while Chinese manufacturers invest $9B in the region to bypass direct tariffs.

🟡 U.S. Trade Deficit Reduction Strategy

Some countries may reduce trade surpluses with the U.S. by increasing domestic demand, addressing U.S. complaints about trade imbalances.

🔴 U.S. Companies Accelerate China Exit Plans

American Chamber of Commerce in China survey:

30% of U.S. companies have shifted or plan to shift sourcing/production out of China.

This number has doubled since 2020, signaling growing corporate unease.

5️⃣ Japan Spotlight🔴

First Rate Hike in 17 Years: BOJ raises its benchmark rate to ~0.5%, marking a shift toward monetary policy normalization.

Fighting Inflation & Stabilizing the Yen:

Inflation remains high by Japan’s standards (3.6% YoY in December).

Weaker yen → higher import costs → more inflation, so BOJ is acting to support the currency.

Economic Confidence & Wage Growth:

BOJ sees a strong growth trajectory and rising wages, signaling a shift in corporate behavior toward higher wages & prices.

More Hikes Expected?:

Markets anticipate another rate increase later this year.

Impact on Borrowers:

Japanese mortgage payments could rise by ~$50/month.

Many thanks for all of the insights! Appreciate it . 🙏