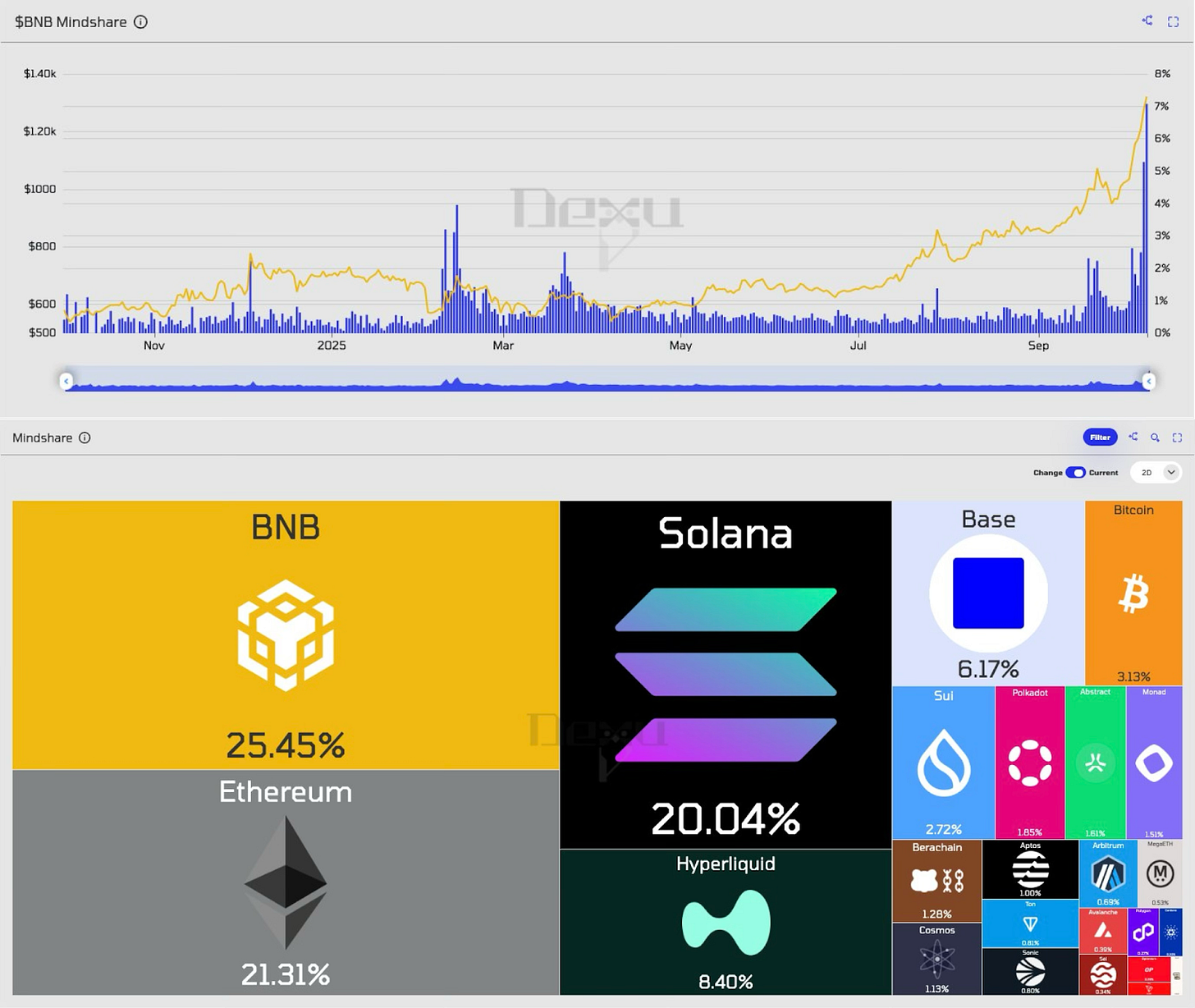

BNB Chain has rapidly evolved into one of the most dominant blockchain ecosystems in 2025, backed by record-breaking activity, strong token economics, continuous architectural innovation and more importantly mindshare metrics is at ATH

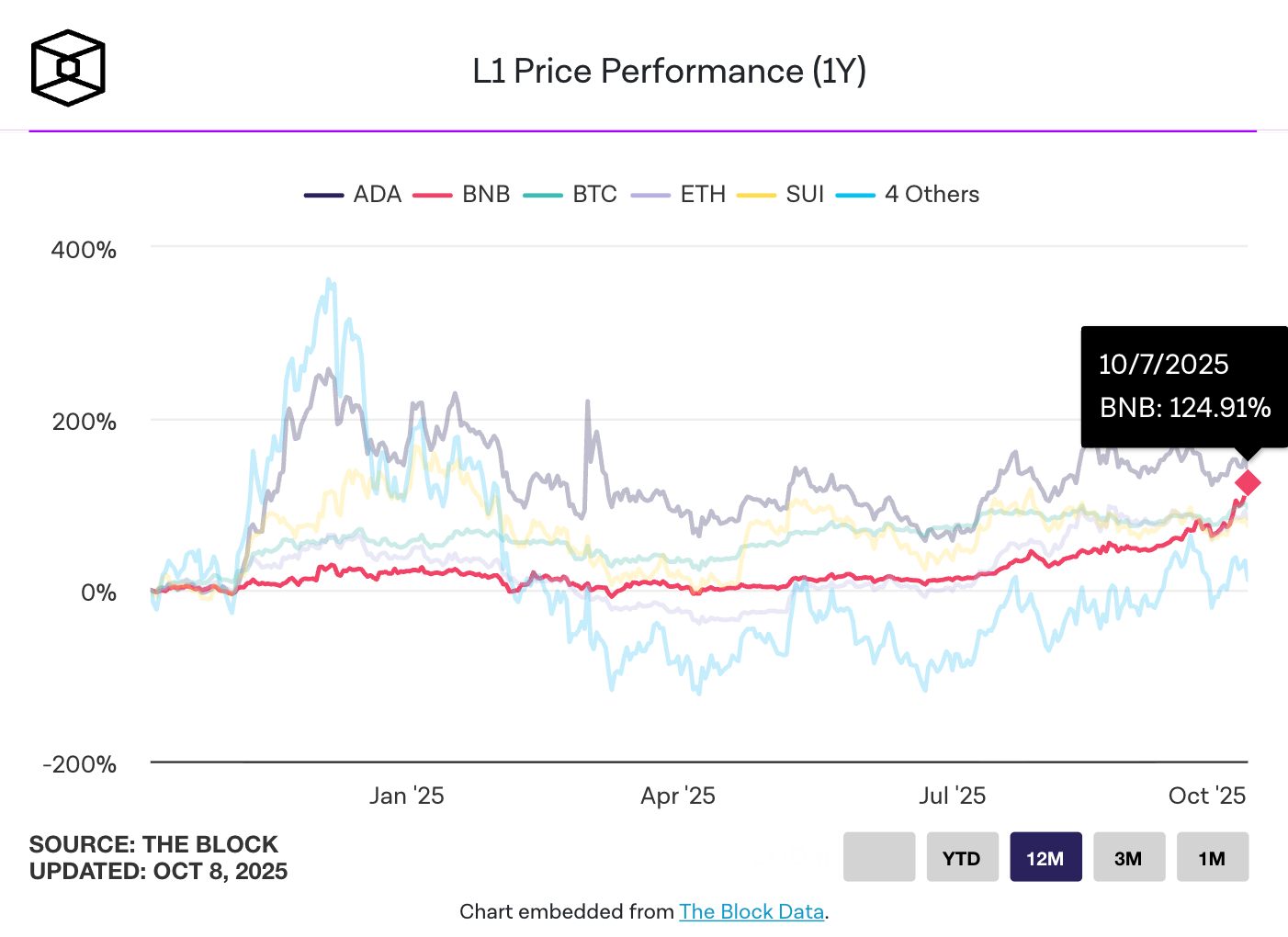

$BNB has rallied over 80% in the past three months, overtaking $XRP to become the third-largest cryptocurrency by market capitalization, fueled by both speculative demand and fundamental network growth .

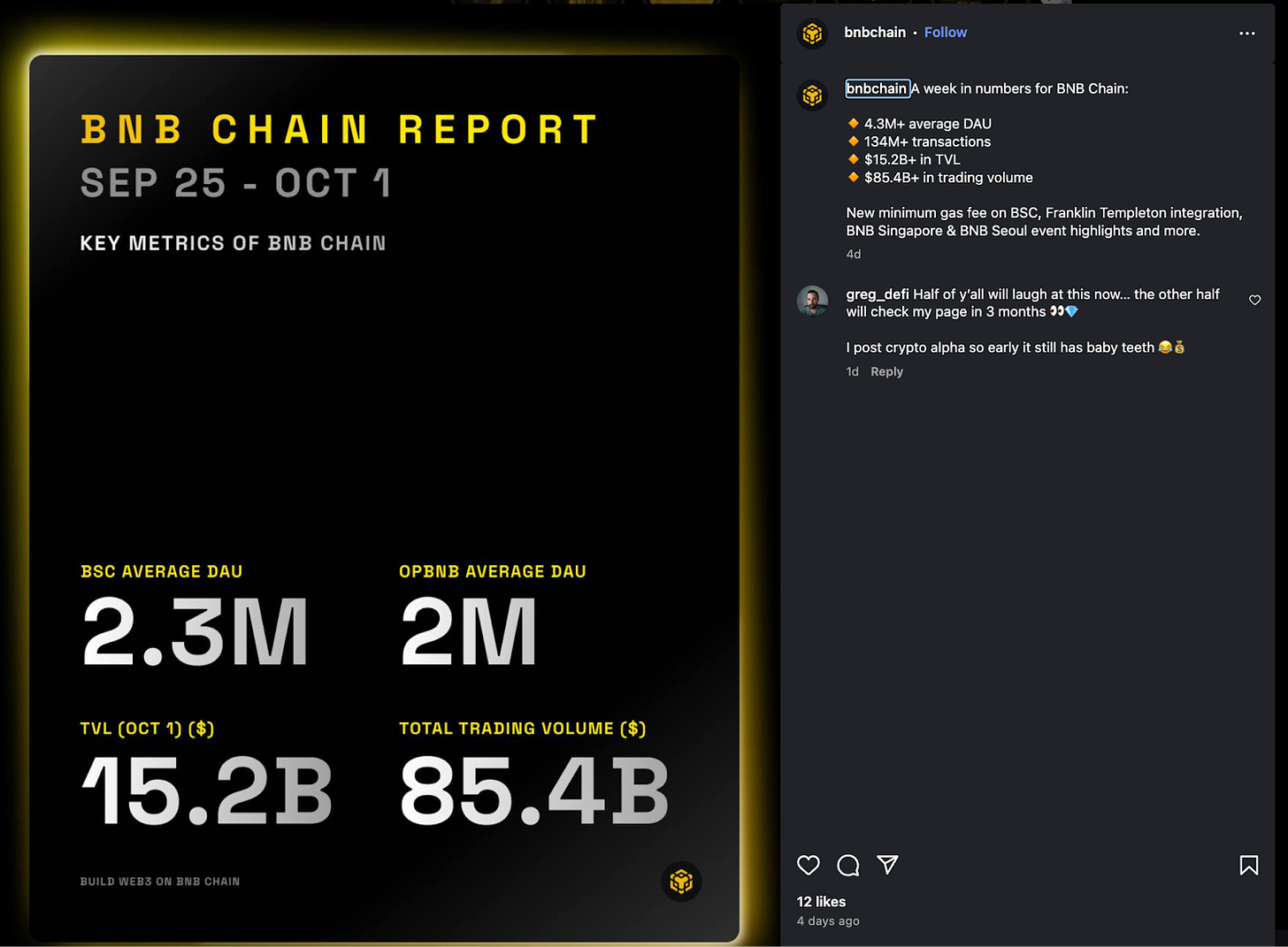

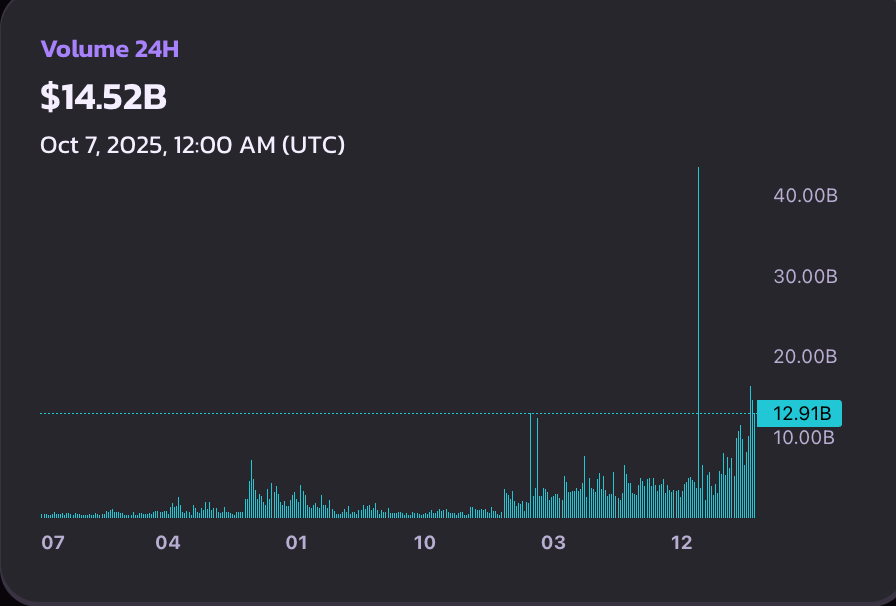

Recent on-chain data shows unprecedented network utilization:

134 million transactions processed in a single week,

$15.2 billion in total value locked (TVL), and

$85.4 billion in trading volume,

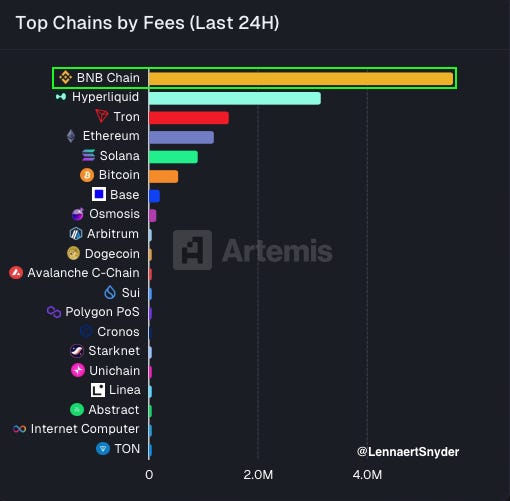

making @BNBCHAIN the top blockchain by daily fees — surpassing Ethereum, Solana, and Tron with over $5.6 million in fees in just 24 hours .

This surge in throughput reflects BNB Chain’s growing dominance in DeFi, memecoins, and cross-chain trading.

PancakeSwap alone handled nearly $80 billion in volume in September, its highest since late 2021, signaling a revival in both user and liquidity activity . Additionally, integrations like Binance Alpha and fiat on-ramps have funneled Binance’s massive user base directly into the BNB ecosystem, giving it a structural onboarding advantage over competing networks .

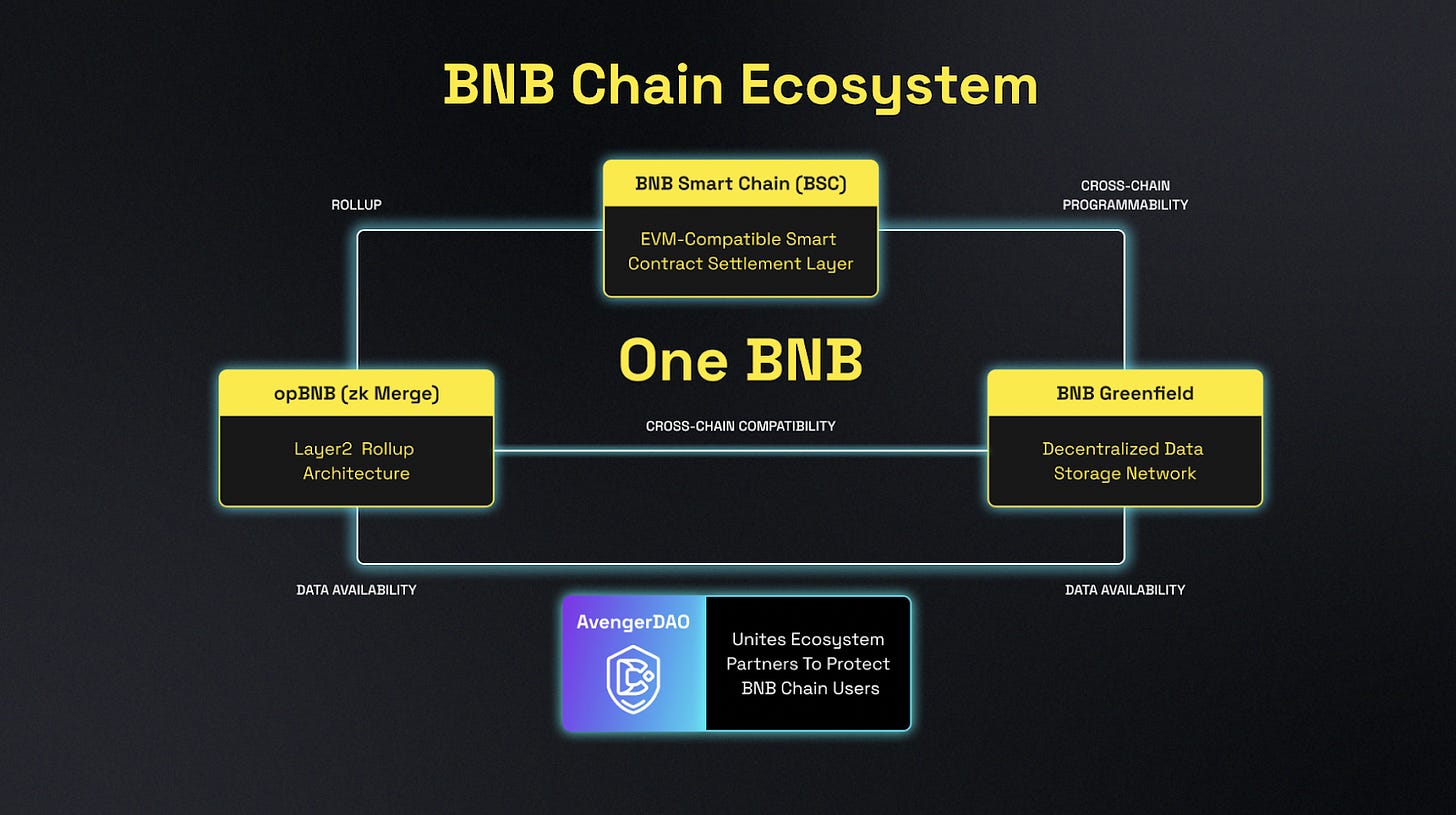

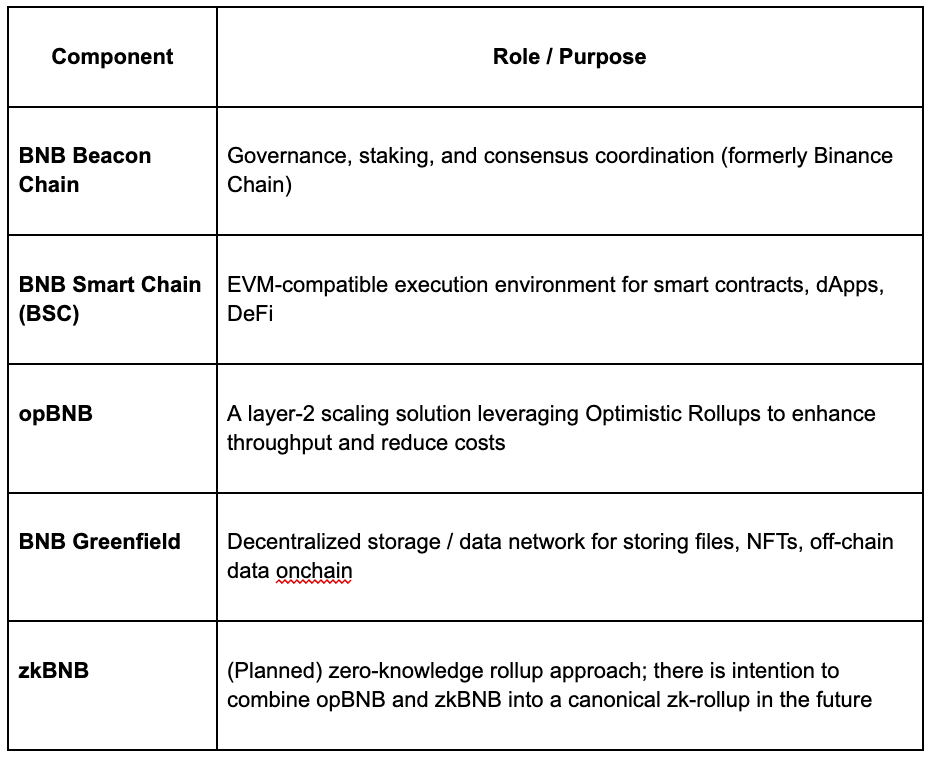

Beyond market momentum, BNB Chain’s technical architecture continues to differentiate it from peers. Its multi-chain framework:

spanning BNB Smart Chain (EVM layer)

opBNB (Optimistic Rollup for scaling)

zkBNB (privacy and compression)

Greenfield (decentralized data storage)

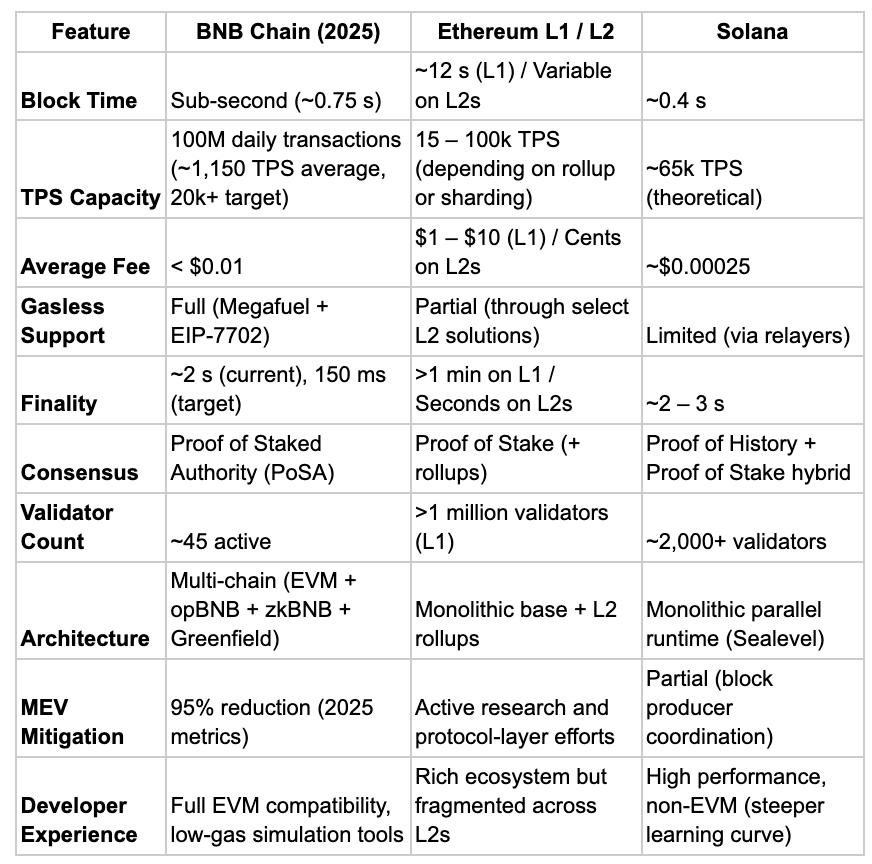

establishes a modular, performance-oriented network optimized for high-frequency dApps and DeFi scalability. With sub-second block times, a target of 20,000 TPS, and gas fees below $0.01, BNB Chain’s infrastructure has matured to rival and, in many cases, outperform both Ethereum’s fragmented L2 ecosystem and Solana’s monolithic runtime.

BNB Chain vs Competitors

BNB strength and advantage:

Strength in real-world performance + cost tradeoff: BNB Chain today already offers a compelling combination: low latency (~0.75 s blocks, ~2 s finality), very low fees, and decent throughput (~200 tx/s average). These are strong figures for an EVM-compatible chain, and make many dApps and interactions practical.

Room to outpace competitors: Many chains (Ethereum L1, Avalanche L1, Polygon PoS) have lower throughput or slower finality under current setups, so BNB is well-positioned to lead among EVM / general-purpose chains in many use cases.

Ambitious roadmap could shift the curve: The target of 20,000 TPS + ~150 ms finality is transformative. If realized, BNB Chain could leap beyond many existing L2 / rollup solutions in aggregate performance.

Tradeoffs & risks remain:

Decentralization: With only ~45 validators, BNB’s design is more centralized than more permissionless models.

Execution risk: The jump from current ~200 tps to 20,000 tps is massive; it requires breakthroughs in parallel execution, improved state handling, block propagation, and client (e.g. Rust implementation).

Real-world vs ideal conditions: Many throughput numbers assume favorable conditions (uniform transaction size, minimal contention). Complex DeFi or cross-contract operations may not scale linearly.

Competition evolves: Other chains are not static — Ethereum + rollups, Polygon’s upgrades, Solana’s improvements, subnet strategies in Avalanche, etc.

1. Introduction & History

BNB Chain is a blockchain ecosystem originally developed by Binance, intended to serve as an infrastructure platform for decentralized applications (dApps), decentralized finance (DeFi), and Web3 more broadly.

The BNB token (initially “Binance Coin”) was launched in 2017 as an ERC-20 token on Ethereum, used within the Binance ecosystem.

In 2019, Binance launched Binance Chain (later rebranded BNB Beacon Chain) to support fast trading, but with limited programmability.

In 2020, Binance Smart Chain (BSC) was launched in parallel to support smart contracts and more advanced dApps.

Over time, the ecosystem has been unified and rebranded into “BNB Chain” (from around 2022) to denote a broader, multi-chain vision, decoupling identity from Binance the company.

Thus, BNB Chain today is an ecosystem composed of specialized chains serving different roles (smart contract execution, governance, data storage, scaling).

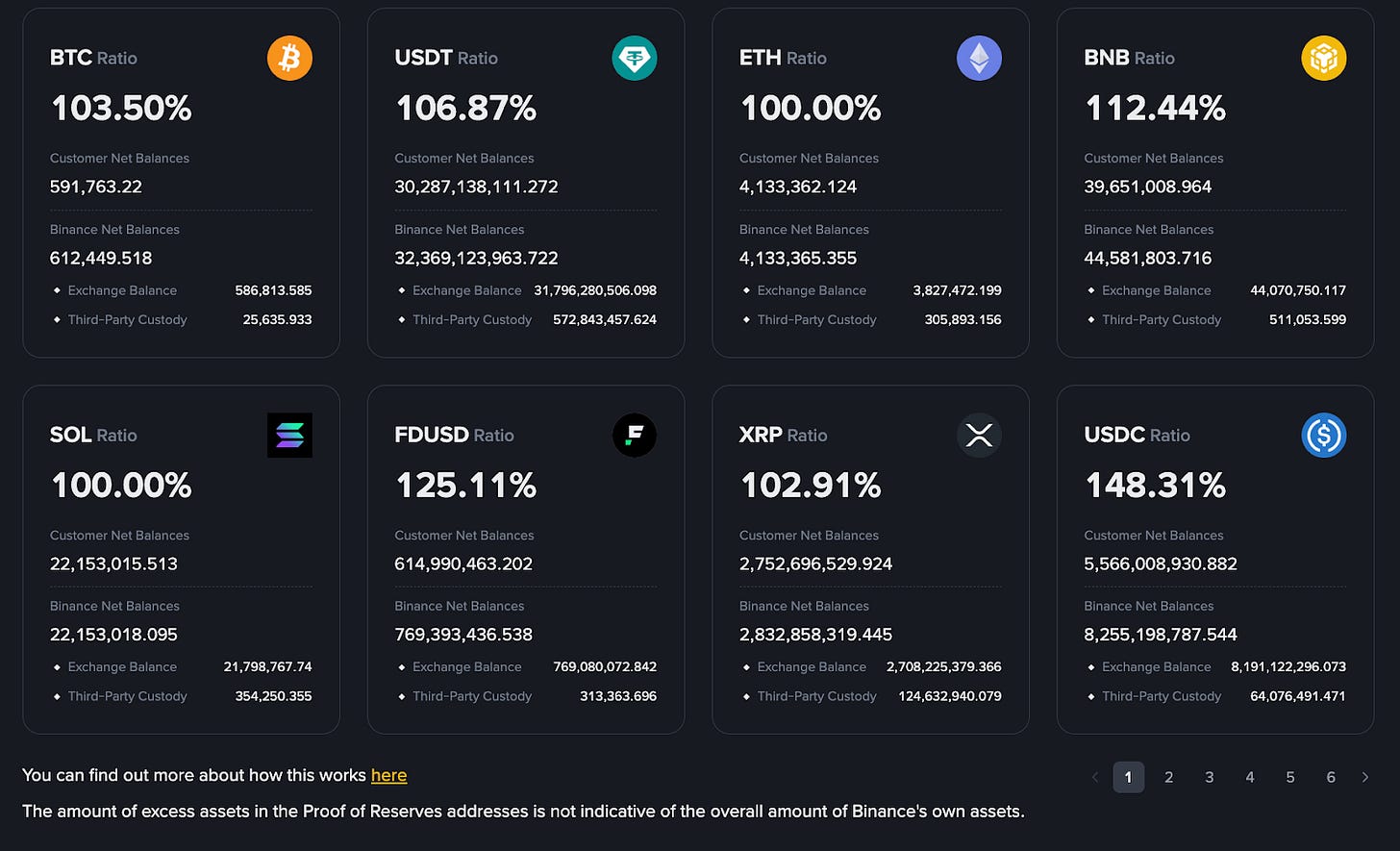

Binance released its 35th Proof of Reserves (PoR) report on October 1, 2025, reaffirming full collateralization of user assets across major cryptocurrencies.

According to the snapshot,

User BTC holdings stood at 591,000 BTC, marking a 2.67% decrease (−16,200 BTC) from the previous report dated September 1.

User ETH holdings totaled 4.13 million ETH, down 4.78% (−207,000 ETH)

User USDT holdings reached 30.28 billion, reflecting a 3.10% decrease (−968 million USDT) month-over-month.

Despite these fluctuations, all audited assets remain over-collateralized, with reserves exceeding 100% across every major token, reinforcing Binance’s position as the most transparent and institutionally aligned exchange in the market.

2. Architecture & Components

2.1 High-Level Structure

BNB Chain is designed as a multi-chain ecosystem where different chains specialize in different tasks. Some of the principal components include:

This modular architecture allows BNB Chain to optimize each part (governance, execution, storage, scaling) rather than forcing one chain to do everything.

2.2 Consensus & Staking

BNB Chain uses a Proof of Staked Authority (PoSA) consensus mechanism (a hybrid concept combining aspects of Proof of Stake and authority/distributed validator set). Validators in the network stake BNB to participate in block production and consensus.

Some relevant notes on consensus / decentralization:

The network has a relatively small number of validator seats compared to some more permissionless PoS networks, which raises questions around centralization and accessibility of participation.

In comparative studies, BNB Chain has been assessed as having lower openness (in terms of validator count, entry cost) compared to some other chains.

2.3 Interoperability & Bridges

BNB Chain supports cross-chain interoperability, allowing users and assets to move between chains (e.g. via bridges). In its roadmap and designs, integration and composability with external chains (and cross-chain messaging) are part of its vision. However, bridges also introduce security risks (as is well known in the broader blockchain space).

3. Tokenomics & BNB Utility

The native token BNB plays multiple roles in the BNB Chain ecosystem:

Gas / transaction fees — Users pay BNB for executing transactions, running smart contracts, etc.

Staking / governance — BNB holders can stake and delegate to validators, and participate in on-chain governance decisions.

Burn / supply control — BNB Chain employs an auto-burn mechanism, where a portion of fees or network activity leads to burning BNB, reducing circulating supply over time.

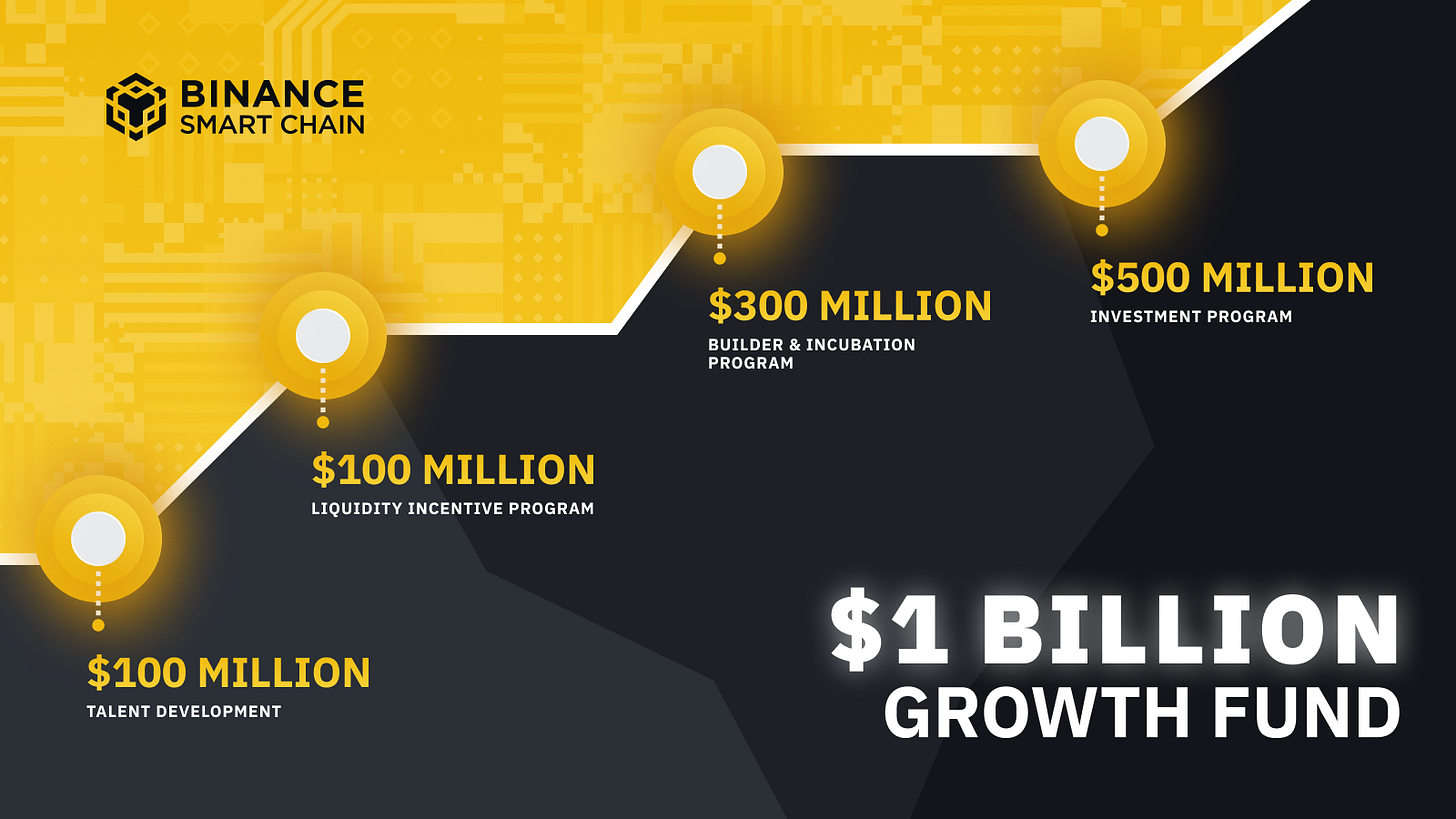

Incentives & rewards — BNB is used in incentives (liquidity mining, developer grants, ecosystem programs) to bootstrap growth.

Recent metrics:

In Q2 2025, the auto-burn feature reportedly destroyed around US$1.02 billion worth of BNB, linking network usage with tokenomics.

According to the 2024 Annual Report, BNB Chain achieved reductions in security-related losses by 67% year-over-year (from $162M in 2023 to $53M in 2024).

Thus, BNB is not just a fee token but a central economic mechanism tying together usage, governance, supply pressure, and incentives.

4. Ecosystem & Use Cases

BNB Chain supports a wide variety of applications and verticals.

Key areas include:

DeFi Focus

Decentralized Finance is one of the strongest use areas on BNB Chain. Highlights:

As of end-August (year unspecified in that report), BNB Chain had the third highest total value locked (TVL) among DeFi ecosystems, with a ~9.1% share.

BNB Chain reportedly processes more transactions year-to-date compared to Ethereum (1.2B vs 301M), while average transaction fees remain vastly lower (e.g. $0.32 vs $13.10).

The DeFi ecosystem is somewhat concentrated; the top 5 DeFi dApps hold more than 85% of TVL, and PancakeSwap is the largest DEX on BNB Chain (≈ 55% share in that ecosystem).

Other DeFi verticals such as lending, liquid staking, yield aggregator platforms are present in the ecosystem.

The Institutional Shift

BNB Chain use case is gearing towards the institutional backbone of global blockchain finance.

The data is staggering: over 134 million weekly transactions, $85.4 billion in trading volume, and $5.6 million in daily network fees, surpassing both Ethereum and Solana in real economic activity. Their architecture is ready for institutional blockchain adoption.

BNB Chain’s evolution from a trading platform ecosystem into a vertically integrated financial infrastructure is just the beginning.

In 2025, 10X Capital, backed by @yzilabs, launched the BNB Treasury Company, a regulated investment vehicle designed to hold and manage BNB as a reserve-grade digital asset for U.S. institutional investors.

Public companies including Nano Labs, Windtree, and Liminatus Pharma have begun integrating BNB into their treasury strategies, with combined reserve targets approaching $1 billion.

This institutional alignment is being reinforced by real-world integrations.

Partnerships with Kraken, Backed, and Ondo Finance have brought more than 100 tokenized U.S. equities, ETFs, and funds onto the BNB ecosystem, effectively enabling 24/7 tokenized capital markets. Meanwhile, Circle’s US Yield Coin (USYC), a yield-bearing, Treasury-backed stablecoin issued directly on BNB Chain, establishes the network as a settlement and liquidity layer for regulated financial instruments.

BNB Chain is no longer competing for DeFi dominance; it’s building a regulatory bridge between on-chain finance and traditional capital markets.

BNB Chain as the Institutional Layer of Web3

BNB Chain now checks the boxes that define institutional infrastructure:

Financial-grade performance: Sub-second block times, under-two-second finality, and peak throughput surpassing 4,000 TPS.

Transparent tokenomics: A predictable, deflationary design, with the auto-burn mechanism eliminating $1.02 billion in BNB in Q2 2025, aligning token value directly with network utilization.

Multi-vertical reach: A single ecosystem supporting both institutional finance (tokenized treasuries, stablecoins, ETFs) and high-velocity consumer markets (e-commerce, payments, and gaming across Asia, Africa, and LATAM).

In effect, BNB Chain is becoming the connective tissue between Wall Street and the world’s retail economies, the base layer for permissionless markets that institutions can actually trust. The 2025–2026 roadmap, which targets 1 billion gas per block and <200 ms confirmation times, represents not just technical ambition, but a redefinition of what institutional-grade blockchain throughput can look like at global scale.

5. Performance, Upgrades & Roadmap

BNB Chain has ambitious performance goals and ongoing upgrades to support its growing ambitions.

5.1 Baseline Performance

As of the first half of 2025, some achieved metrics include:

Block time reduced to 0.75 seconds

Finality of about 1.875 seconds

Average gas fees dropped to approximately $0.01

Malicious MEV (miner/extractor value) reduction by ~95%

5.2 Upcoming Goals & Innovations

Some of the roadmap goals and infrastructural upgrades include:

Achieving 20,000 transactions per second (TPS) and ~150 ms finality by 2026, through improvements like a Rust client, parallel execution, optimization, etc.

Raising the block gas limit significantly (e.g. from 100M to 1 Gigagas per second) to enable more swaps per second and complex smart contract execution.

Continuing integration across chains, further optimizing user and developer experience, refining AI and storage functionalities.

Continued development of Greenfield and combining opBNB + zkBNB into canonical zk-rollups.

5.3 Ecosystem Growth & Metrics

In its 2024 Annual Report, the ecosystem saw a 58.2% increase in total value locked (TVL), and a 17.7% rise in unique addresses.

The number of security incidents and financial losses due to exploits dropped significantly (66-67%) in 2024 compared to 2023.

The “One BNB” multichain strategy consolidates development and branding across BNB Smart Chain, opBNB, and Greenfield.

6. Strengths, Challenges, and Risks

6.1 Strengths & Competitive Edges

Low fees and high throughput — One of BNB Chain’s key value propositions is offering cheap, fast transactions relative to many alternatives.

Ecosystem momentum & liquidity — As an established chain with broad adoption, it’s able to attract liquidity, developer interest, and user base.

Modular architecture — The separation of roles (execution, storage, scaling) can allow more focused optimization and innovation.

Tokenomics integration — The auto-burn mechanism, incentives, and governance alignment help tie network activity to economic value for BNB holders.

Ambitious roadmap and developer focus — The chain has clear goals around scaling, AI integration, storage, and performance.

6.2 Challenges & Risks

Centralization / validator concentration

With a limited number of validator slots, the network may be more centralized compared to more permissionless PoS architectures.

Entry costs and design might favor large actors over small validators or users.

Security & bridge risk

Cross-chain bridges are notoriously vulnerable. Past incidents (e.g. hacks) in the broader BNB / Binance ecosystems have shown the risk vectors of bridging.

Maintaining security while scaling aggressively is nontrivial.

Competition from alternative L1s / L2s

Ethereum (and its rollups), Solana, Avalanche, etc., present stiff competition. BNB Chain must continue to differentiate and perform.

Some chains offer higher decentralization or novel scaling techniques.

Regulatory / legal risks

Given Binance’s regulatory scrutiny globally, association with Binance or perceived centralization could attract regulatory pressures.

Token classification, securities laws, cross-border compliance pose challenges.

Ecosystem concentration risk

The DeFi ecosystem on BNB Chain is somewhat top-heavy (few dApps controlling large share of TVL). This concentration can lead to systemic risks if one major protocol fails.

Newer or smaller projects may struggle for visibility or liquidity against established incumbents.

Technical complexity & execution risk

Ambitious roadmap features (e.g. combining opBNB + zkBNB, achieving 20k TPS) require careful architectural, security, and performance tradeoffs.

Ensuring backward compatibility, developer tools, and smooth upgrades is nontrivial.

7. Comparative Position & Market Metrics

BNB Chain is among the more actively used blockchains in terms of transaction count; in some periods, it has exceeded Ethereum in raw transaction volume (though on much smaller average fees).

It holds a nontrivial share of the DeFi TVL rankings (e.g. third place in certain reports)

In terms of openness and decentralization, in comparative analyses, BNB Chain is rated lower than some more open blockchains, reflecting tradeoffs in performance vs permissionless design.

Its market capitalization and ecosystem valuation have seen strong growth; for instance, CoinMarketCap reports that the BNB Chain sector has hit a new peak mcap (e.g. $242.8 B in one recent snapshot)

Thus, BNB Chain occupies a middle ground: competitive performance, strong adoption, but also facing scrutiny and tradeoffs in decentralization.