Cross-chain liquidity is broken; its expensive, fragmented, and inefficient.

$CLEAR saw over 3x MoM growth and fees as low as 0.008% for cross-chain transactions

And they just underwent a 360 tokenomics revamp and introduced a a yield-bearing asset.

A deep-dive into the first Clearing Layer🧵

Key Takeaways

Clearing Layer: Everclear's first-of-its-kind Clearing Layer powers chain abstraction and institutional adoption.

Cheapest Bridge: Everclear boasts 0.02% fees, offering the lowest cost solution for cross-chain rebalancing.

Innovative Tokenomics: With the $CLEAR migration and vbCLEAR staking, Everclear introduces a yield-bearing asset with governance-driven emissions.

Season 1 Rewards: CLEAR rewards are live, providing lucrative incentives for early adopters.

The DeFi ecosystem has exploded across chains, but liquidity has struggled to keep up. Institutions and protocols spend millions annually on inefficient asset transfers.

This is where Everclear positions itself as the first Clearing Layer in crypto, enabling seamless, cost-effective rebalancing across ecosystems, offering a unifying solution for fragmented liquidity.

Why it matters:

Institutions need efficiency to adopt blockchain at scale.

Protocols save resources, boosting profitability.

Users benefit from reduced fees and seamless cross-chain access.

What is Everclear?

Everclear (formerly Connext) is the pioneering Clearing Layer—a decentralized network designed to streamline global liquidity settlements across chains.

By leveraging netting, the project aims to drastically cut the cost and complexity of cross-chain liquidity rebalancing.

Last year, Connext pioneered Chain Abstraction as a vision for Web3 without fragmentation.

https://x.com/EverclearOrg/status/1661439482950811650

Today, the Chain Abstraction ecosystem is growing, but bottlenecks remain.

Solving intents is still too centralized and capital-intensive, limiting support for all chains and assets.

Intents let users outsource cross-chain actions to solvers—providers who use their own funds on target chains, like Uber finding a driver to get you home.

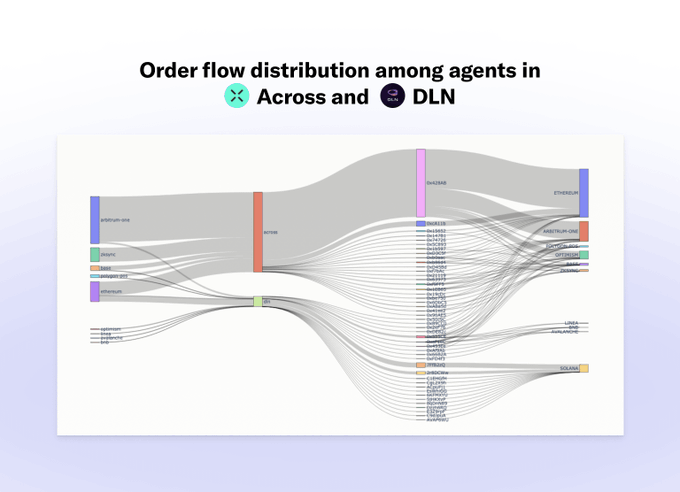

But solvers need to rebalance funds to stay operational. Rebalancing is costly, profitable only for a few big players on major chains, limiting scalability.

The real issue? Interchain liquidity is fragmented, with everyone competing instead of collaborating.

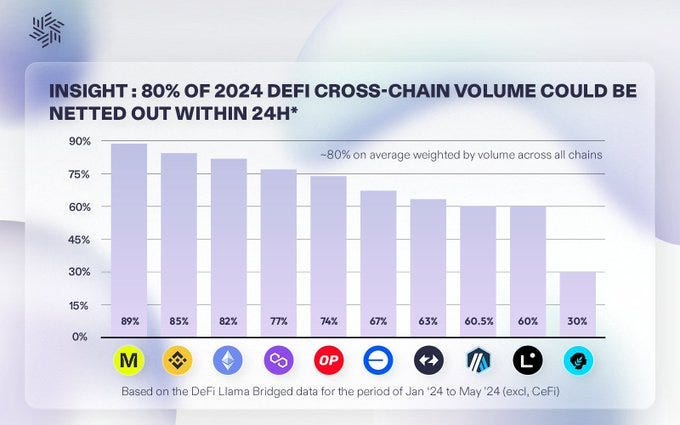

Surprisingly, ~80% of daily cross-chain flows are nettable. Coordinating could cut bridging fees by over 5x for solvers, MMs, and CEXs!

Here’s a short explaination of what the Chain Abstraction stack currently looks like -

https://x.com/EverclearOrg/status/1865441187123118317

This is why Everclear introduced Clearing Layers—decentralized networks that net and settle interchain capital flows, cutting rebalancing costs by up to 10x.

Think of it like Visa: aggregating transactions to simplify settlements across chains.

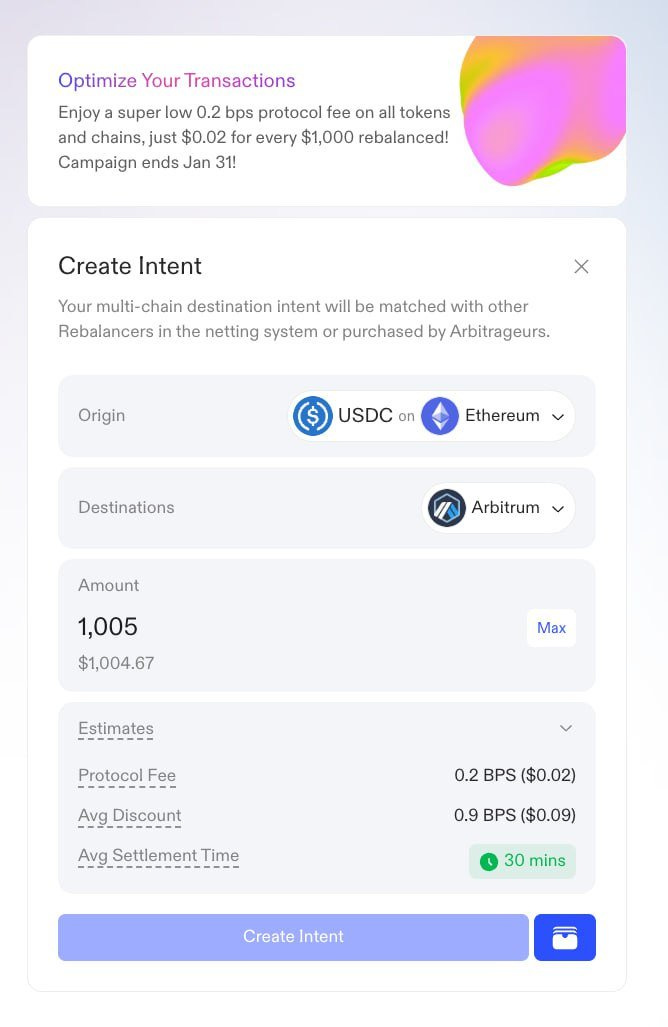

Everclear is currently the most cost-efficient cross-chain rebalancing solution, with fees as low as 0.8-1.1 bps and 30-min settlement times for all tokens and chains.

It’s already netting 50% of transactions in beta, with 3x M/M growth and rising efficiency.

$CLEAR Migration

And that’s not all— the $NEXT to $CLEAR migration is now finally live.

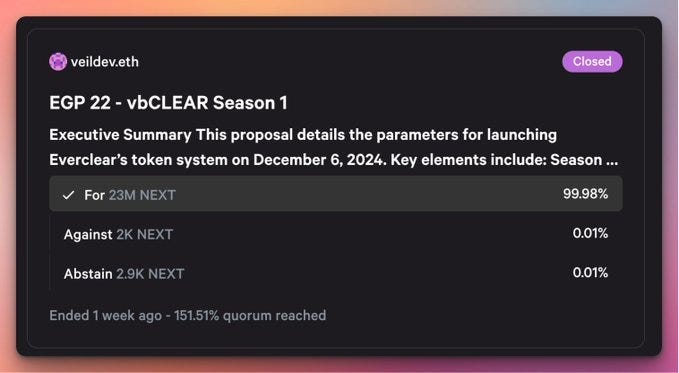

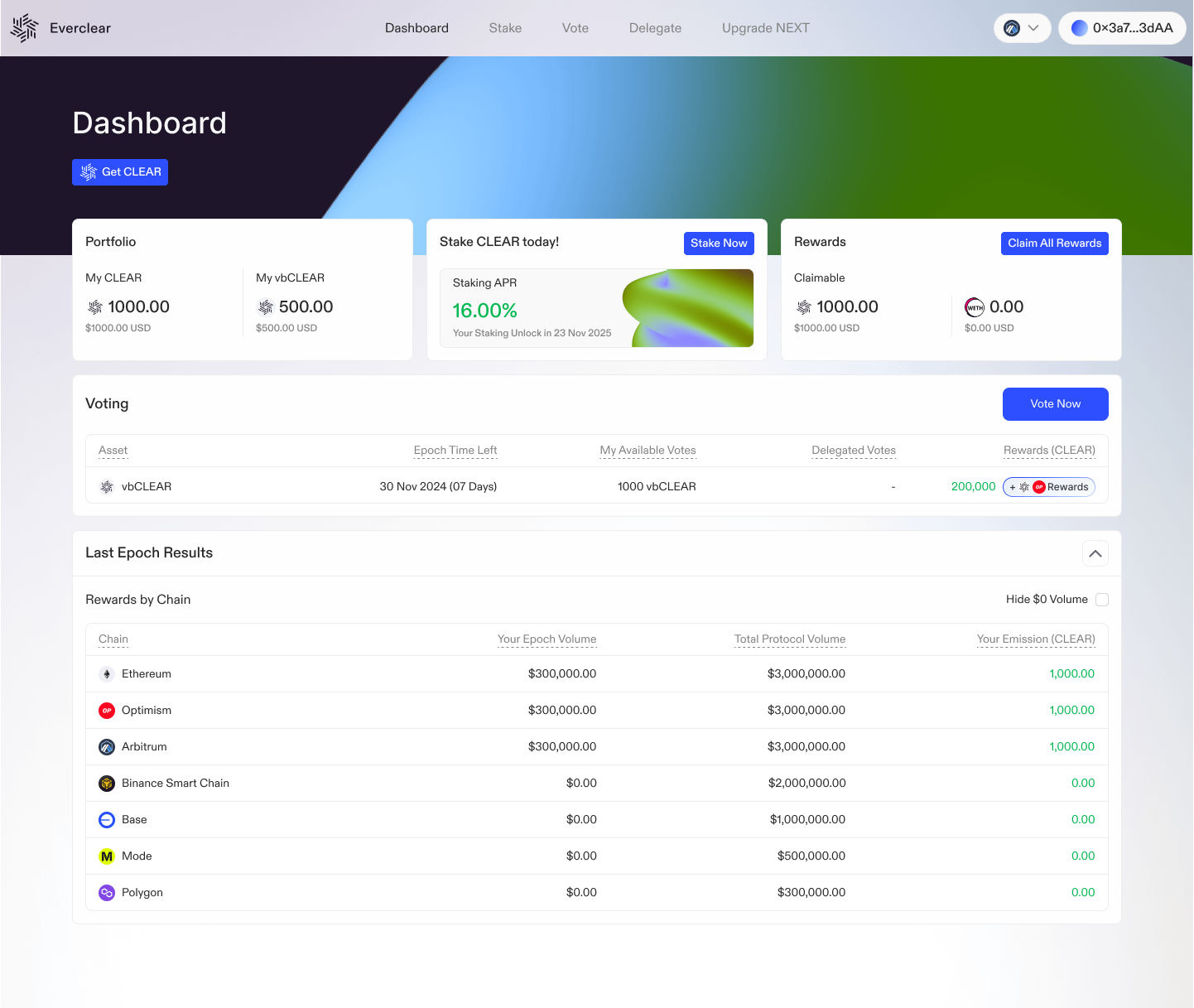

The CLEAR upgrade introduces a vote-bonding system (vbCLEAR), where stakers can vote on liquidity incentives and earn fees from protocol activity.

Over 75% of the token holders have already migrated to CLEAR -

https://x.com/EverclearOrg/status/1866202336244224147

This is a breakthrough for new L2s and chains, which often struggle to bootstrap liquidity and require 1:1 relationships with bridges and solvers.

vbCLEAR is the first marketplace for cross-chain liquidity incentives, allowing chains to lock CLEAR and vote to incentivize solvers, ensuring a smooth liquidity inflow from day one.

To participate, users stake CLEAR to receive vbCLEAR, which they then use to vote on liquidity incentives, attracting liquidity and reducing the cost of cross-chain transactions.

This system is perfect for bootstrapping new ecosystems.

The flywheel effect begins as chains and DAOs incentivize liquidity and solvers, while solvers earn emissions by efficiently rebalancing liquidity.

vbCLEAR Season 1

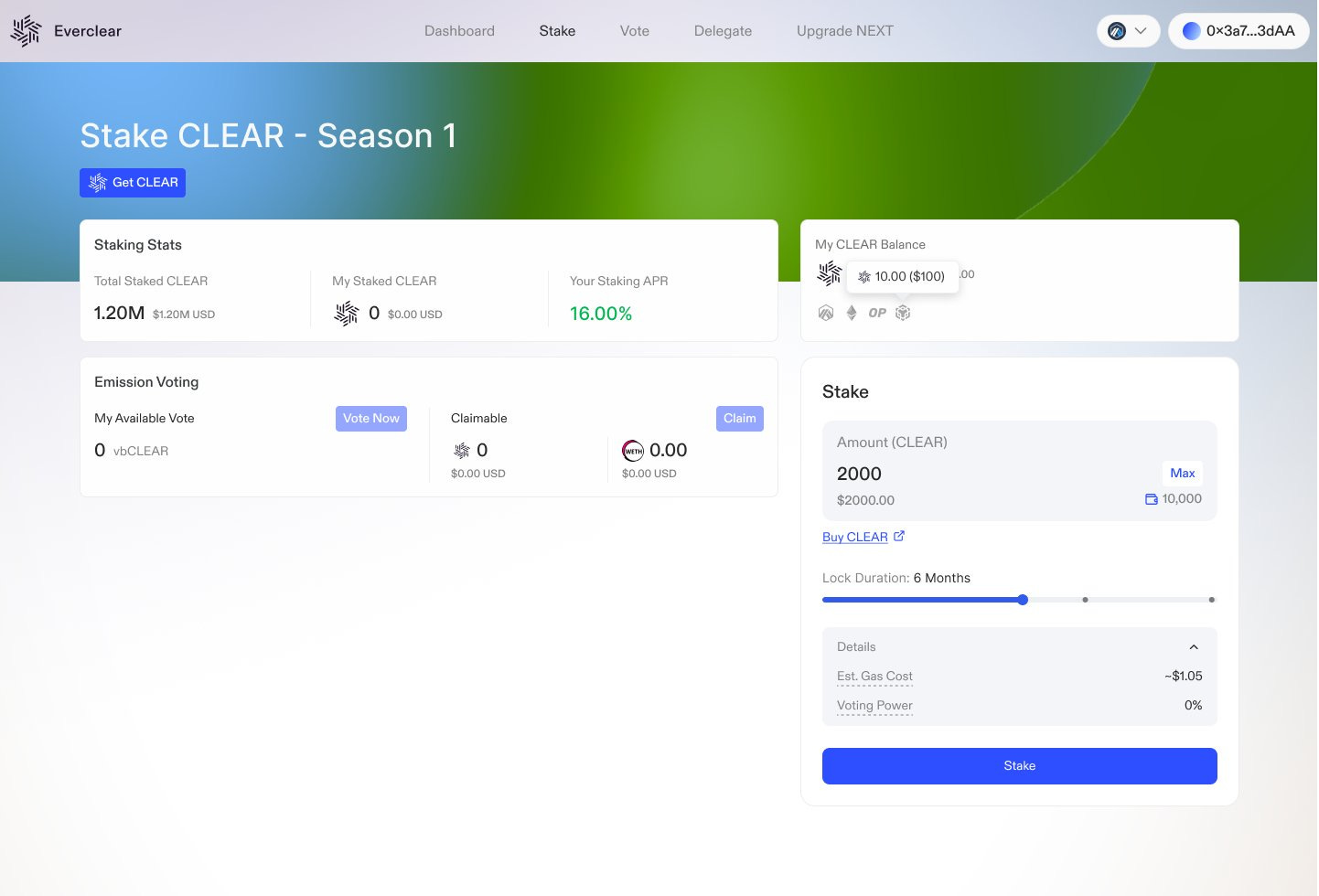

The Season 1 Rewards will began only a few days ago.

Early stakers can receive 1.75M CLEAR as part of a 3-month rewards program designed to encourage participation. This is a great opportunity to maximize your impact early.

Here’s how to participate -

L2 NEXT holders: Automatic wrapping to CLEAR.

Mainnet NEXT holders: 1:1 manual wrapping available.

Stake CLEAR to earn vbCLEAR and start voting.

Solvers can earn emissions by actively contributing to Everclear’s settlement activity.

Unwrapping between NEXT and CLEAR will always be available.

Head over to https://stake.everclear.org/stake to get started.

Case Study: How Renzo Took Off with Everclear

Let’s talk about Renzo Protocol—proof of what Clearing Layers can really do.

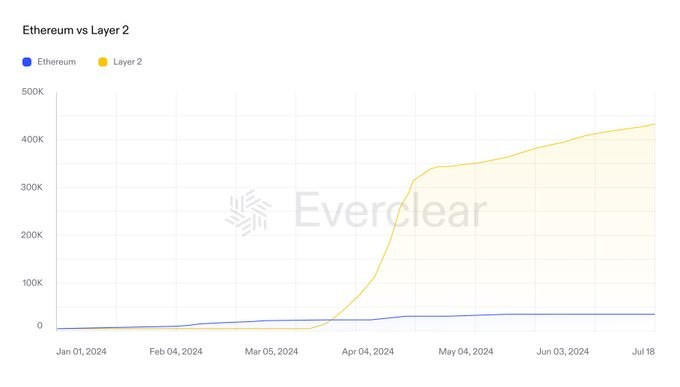

By tapping into Everclear’s Chain Abstraction, Renzo launched L2 restaking and saw explosive growth:

$1B in new TVL, boosting its market standing.

10x growth in unique wallets, showing how quickly users jumped on board.

90% lower gas fees, making transactions cheaper and smoother than ever.

Within just a month of launching L2 restaking on @arbitrum and @modenetwork, Renzo’s L2 wallets surpassed those on Ethereum.

Fast forward four months, and the ratio of L2 wallets to Ethereum wallets skyrocketed to an impressive 10:1. 📈

And it’s not just about wallets—Renzo’s TVL saw explosive growth too.

From ~$614M in February 2024, it jumped by over $1B within just three months of integrating Chain Abstraction. 🚀

Today, Renzo stands as the largest chain-abstracted app out there, proving the power of meeting users where they are—no matter the chain.

It’s a real-world win for cross-chain efficiency and scalability.

The Future

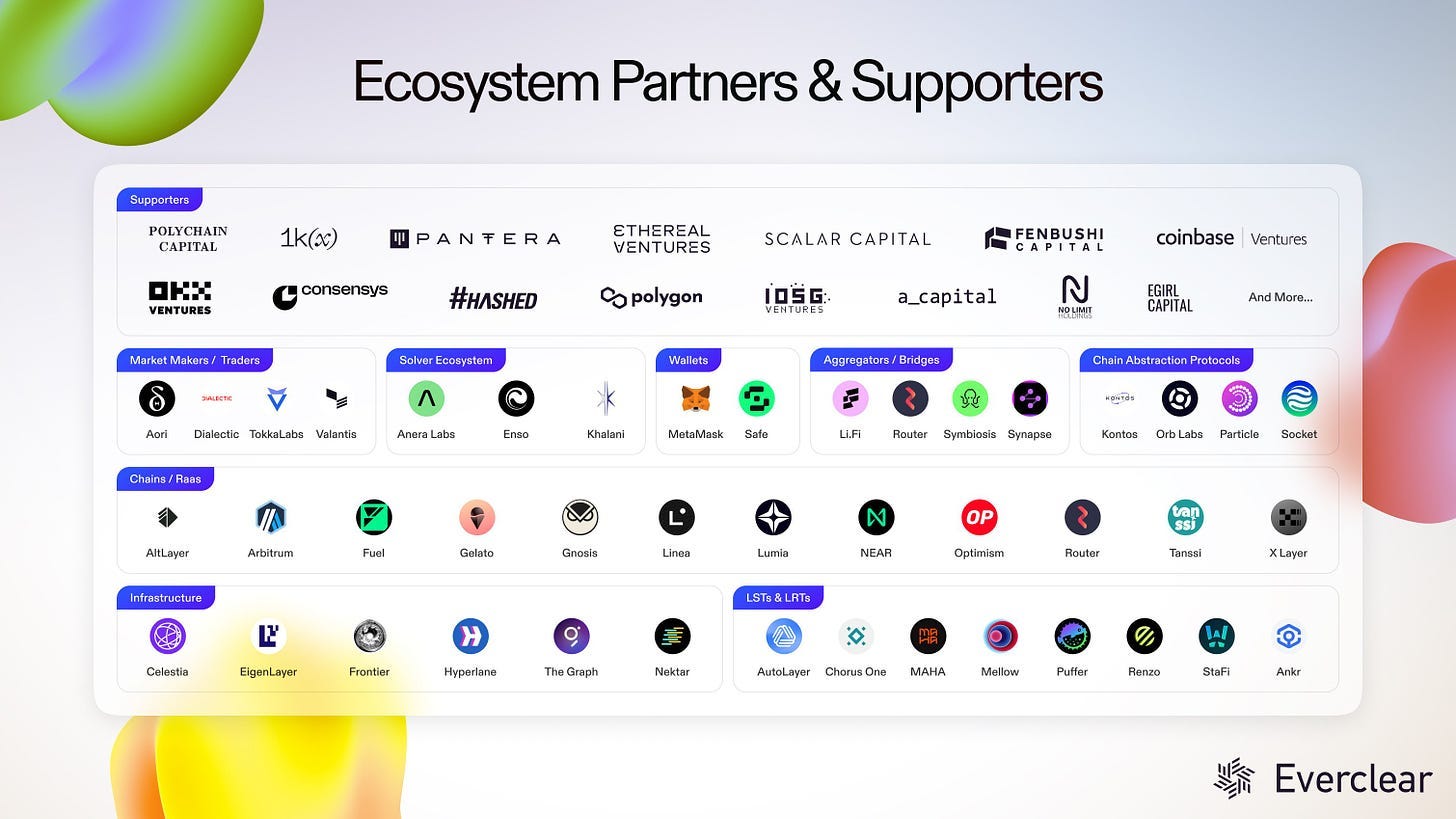

Everclear has been collaborating with leading rebalancers and solvers to enhance liquidity across chains for a while now.

$CLEAR staking now live: https://x.com/EverclearOrg/status/1866830311402901714

Key partners have included Synapse Protocol, Router Protocol, Tokka Labs, and Aori, all of which played a critical role in optimizing cross-chain transactions and driving the protocol's growth.

The ecosystem continues to expand, and with the migration to CLEAR, Everclear reaches a significant milestone.

The transition introduces institutional-grade efficiency and a powerful staking model that delivers immediate rewards for early participants.

And it’s pretty clear that the introduction of the vbCLEAR system and strategic liquidity incentives, positions Everclear to capture significant cross-chain settlement volume in the near future.