I've been closely following the evolving narratives in the crypto space this year, and I wanted to share my thoughts on how things have shifted since January.

It's fascinating to see how certain themes have gained traction while others have faded into the background.

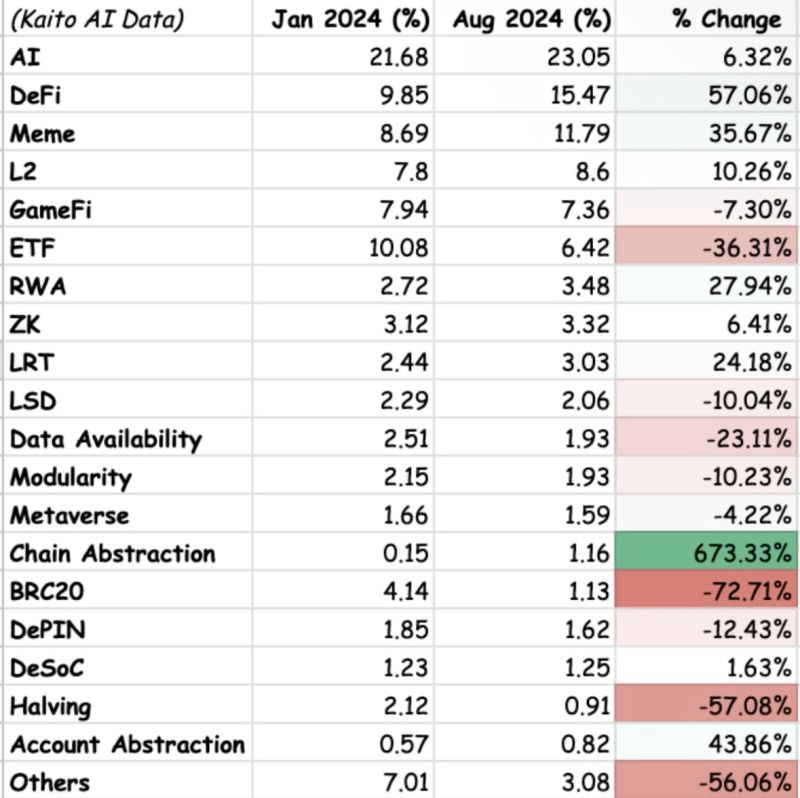

A breakdown of all the key narratives, The Good and The bad 👇

AI: Still Strong, But Facing Diminishing Returns

Artificial Intelligence remains one of the strongest narratives in crypto for 2024. However, its relative growth appears low due to the high base effect from 2023. The AI sector itself has seen parabolic growth, making further parabolic increases challenging. However, there are many catalysts that signals for the AI space to grow further, with GPT 5, 6, 7 releases all in the pipe, I believe we will see a resurgence for it. Moreover, projects like @zero1_labs already teased their testnet coming soon, but it might be earlier than they claim, seeing that its a good season for these couple of month to run testnet. You might want to get involve early in their community to participate early.

DeFi: The Institutional Response

With the influx of institutional players via ETFs, we're seeing a resurgence in DeFi. It seems like the crypto world is gearing up to accommodate the increased capital and need for sophisticated financial tools. $AAVE @aave and $COMP @compoundfinance are slowly gaining momentum, while newcomers like $ENA @ethena_labs are making a solid grounds.

Memes: A Brief Resurrection

Meme coins have seen a short-term spike, largely thanks to @justinsuntron and @trondao. We'll likely see this speculative energy flow back into more established ecosystems like @solana and @buildonbase soon.

L2s: The New Proxy for Ethereum?

There's an interesting debate around whether L2s should be viewed as extensions of Ethereum or as separate entities. Some traders are eyeing L2s as a potentially higher-upside proxy for Ethereum investments. The math makes sense from a retail perspective – it takes far less capital to move the needle on an L2case market cap compared to Ethereum itself. @movementlabsxyz doing really good testnet stats and probably one of only ones I am pretty bullish on.

The Stragglers: BRC20, Halving, and ETFs

BRC20 tokens have lost significant ground this year, overshadowed by other narratives. The Bitcoin halving and ETF launches have also disappointed many who expected immediate price action. Interestingly, ETFs seem to be extracting liquidity rather than adding it to the market. @babylonlabs_io @SolvProtocol

Building in the Background

What really catches my eye is the massive growth in chain abstraction (+673%) and account abstraction (+43%). Look out for projects like @EverclearOrg

Looking Ahead

While gaming and RWA haven't quite taken off yet, I'm keeping a close eye on these sectors. @plumenetwork is leading the RWAfi space and doing 140M transactions in a month with over 150+ partnerships built in their ecosystem. Recently, @jpmorgan (or was it @FTI_US, cant exactly remember) had their funds moved onto @avax. And if you recall, $AVAX had a lot of big name TradFi partnerships Q4 2023, likely we will see it becoming one of the leading chains for RWA and Gaming. On the other hand, Gaming, in particular, seems poised for a breakthrough once we see the first true AAA blockchain game. Keeping tabs on @playSHRAPNEL

And finally, are we seeing a genuine shift towards utility-focused development?