Ideally, we’d see $ETH take a break while $BTC plays catch-up on the higher timeframes. The market’s looking solid, and plenty of traders are eyeing that potential “alt pop” following ETH’s recent strength.

A healthier setup, though, would be $BTC leading a rally while $ETH holds its ground after such a strong move.

$BTC is currently trading ~31% below its Energy Value Model fair value of $145K. Historically, these rare undervaluation levels have marked deep-cycle accumulation phases, the kind that precede multi-month expansions.

With network fundamentals strong and macro liquidity conditions improving, the risk/reward should favor the upside.

The market told us this week that:

Flows are bifurcating, DAT, treasuries are strategic.

ETH’s validator stress was a liquidity event, it couldn’t bread demand.

High-utility L1s are the natural rotation hedge in macro uncertainty.

Jurisdictional clarity is now an alpha driver, where Hong Kong just claimed that role in Asia.

If you’re positioning for BTC to catch up, you’re essentially backing the idea that this cycle still has legs.

Next week should tell us a lot. Enjoy your Sunday. 👇🧵

Macro Pulse Update 09.08.2025, covering the following topics:

1️⃣ Macro events for the week

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ Tariff Spotlight

1️⃣ Macro events for the week

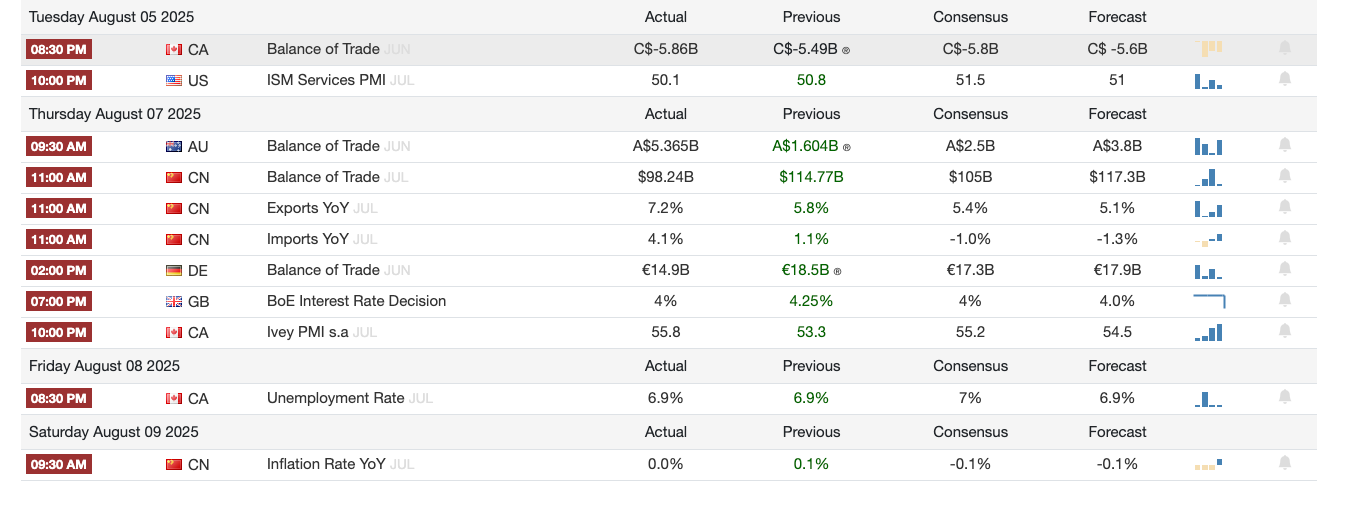

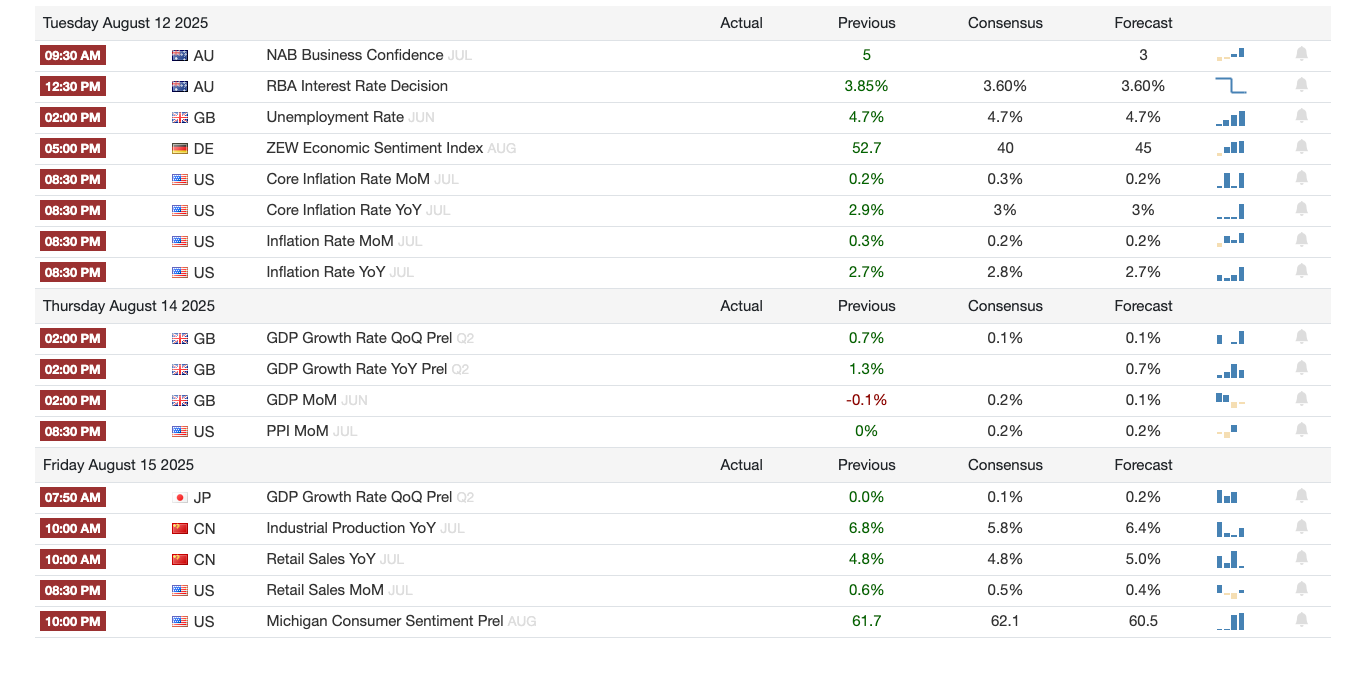

Previous week

Next week

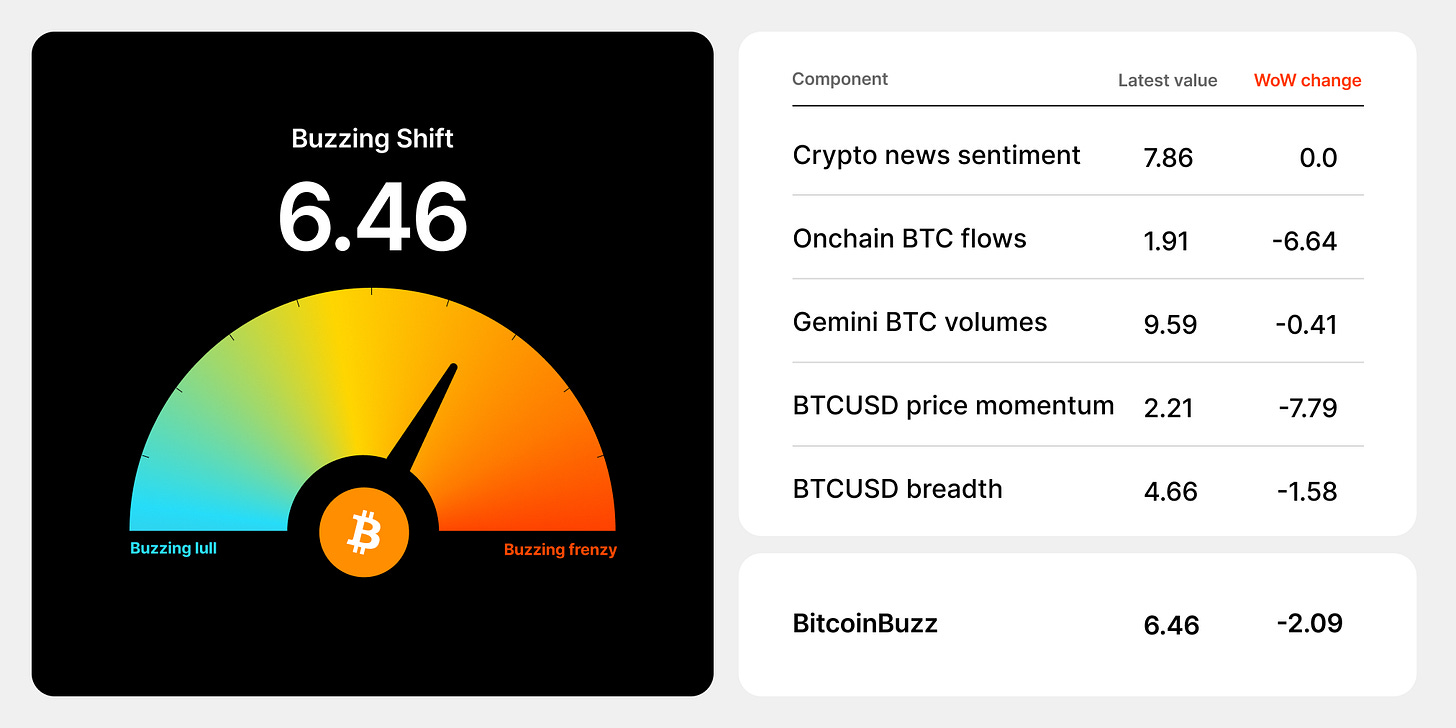

2️⃣ Bitcoin Buzz Indicator

Launches

@MercuryappHL launched iOS super app for Hyperliquid/HyperEVM with trading, deposits, Apple Pay, and native ecosystem access.

@superformxyz v2 Public Testnet adds cross-chain, multi-vault deposits, instant rebalancing, bundling, and a content competition.

@ventuals_ live on Hyperliquid Testnet lets users trade private company perps with 10× leverage.

@EveDexOfficial launched on Arbitrum mainnet with CEX-style self-custody trading, instant execution, XP, cashback, and affiliate rewards.

@revertfinance launched Discover Pools for LP yield hunting with filters and comparisons.

@puffer_finance launched Puffer Unifi appchains for Ethereum scalability.

@aave released V3 developer toolkit for fast vault/lending integration and yield strategies.

@YeiFinance launched money markets on Injective EVM testnet.

@KyberNetwork launched FairFlow LP model on Uniswap V4 with extra rewards.

@Theo_Network launched thBILL institutional-grade money market fund on Arbitrum.

@Trevee_xyz launched Auto-Voter for veNFT holders with multiple voting automation modes.

@pendle_fi launched Boros for trading funding rates via Yield Units on Arbitrum.

@DexariDotCom launched globally on iOS/Android with Hyperliquid-powered trading.

@0xspout testnet launched to tokenize US bonds/ETFs on-chain via KYC-gated Pharos Network.

@GammaSwapLabs launched gETH on Base for delta-neutral ETH yield with IL hedging.

@heurist_ai announced AI agent-focused Heurist Chain ZK L2 in partnership with @Asphere_xyz.

@GainsNetwork_io launched gTrade v10 with adaptive leverage and improved risk management.

Updates

@SharpLinkGaming raised $200M to grow its ETH treasury toward $2B with staking strategy.

@hyperlendx introduced Unified Trading Account linking HyperCore, HyperEVM, and HyperLend for triple incentives.

@eulerfinance launched zkVerified lending vault on Avalanche via Keyring Network with $570K incentives.

@sedaprotocol launched on Arbitrum with 11M+ institutional-grade data feeds.

yUSD live on EulerSwap for near-zero slippage swaps and unified lending/swapping.

@ryskfinance opened HyperEVM covered call options to all, targeting $10M TVL for rewards program.

Aave’s Umbrella staking module live on DeFi Saver with ETH, USDC, USDT, GHO yields.

@ethena_labs Liquid Leverage hit $1.5B TVL; Aave raised sUSDe/USDe caps ahead of another increase.

@superformxyz Foundation created to govern $UP token, upgrades, and incentives.

@boundless_xyz “The Signal” proof verification in mainnet beta to decentralize ZK verification.

MetaMask added Sei Network as default and to its Portfolio.

@pharos_network supported on Orbiter Finance testnet bridge for ETH bridging.

@maplefinance syrupUSDC supply surpassed $50M; $175K incentives launching.

Phantom acquired @solsniperxyz to expand into consumer finance.

@gauntlet_xyz curating Mantle’s cmETH restaking vault on Symbiotic with multi-strategy yield.

@reya_xyz integrated wstETH as collateral for trading margin.

@angstromxyz released v1 whitepaper introducing MEV-resistant DEX design.

@onrefinance launched ONyc on Kamino with high yields, points, and RWA exposure.

@ParticleNtwrk launched Universal Transaction Layer for cross-chain stablecoin/RWA settlements.

@AlchemixFi v3 to bring 90% LTV loans, Meta-Yield Token, and peg stability.

@Infinit_Labs introduced $IN token with staking, governance, and usage-based distribution; airdrop incoming.

@SuccinctLabs launched Prover Network mainnet with PROVE token and staking.

@noble_xyz launched Season 2 USDN points program starting with Hyperliquid integration.

@symbioticfi introduced Slashing Insurance Vaults for decentralized staking risk management.

@KyberNetwork integrated TrebleSwap liquidity on Base for better pricing.

@ether_fi added USDT support to etherfi/cash with cashback rewards.

@LiquidLaunchHL removed HYPE minimum for token creation and improved composability.

Upcoming

@worldlibertyfi launching USD1 Points Program for trading, holding, staking, and DeFi engagement.

@CurveFinance launching on Etherlink with yield via Apple Farm Season 2.

@Hyperwavefi hwHLP pool going live on Pendle HyperEVM with HLP yield, fees, PENDLE rewards, and Wave Points.

@Strata_BTC enabling fixed rate USDC borrowing against pUSDe/PT-pUSDe with high points rewards.

@0xfluid launching rsETH-ETH<>wstETH vault on Base with multi-yield and Kernel DAO points.

@ebisu_finance offering 50%+ APR in CRV on ebUSD-USDC Curve pool with StakeDAO boosts.

Angstrom to launch $UNI incentives for MEV-protected WETH/USDC pool.

@yieldbasis upcoming BTC yield protocol using leveraged crvUSD to track BTC price.

@satlayer opening SlayDrop airdrop registration.

@ClearpoolFin launching cpUSD and Credit Pools under PayFi initiative.

Airdrops

@KaminoFinance Season 4 with 100M KMNO rewards and APY boosts for staking.

@MezoNetwork $80K campaign with Threshold Network for MUSD vault deposits.

@KGeN_IO Phase 1 fairdrop claims now live.

@MagicEden Season 2 rewards increased to 10M $ME and distributed.

@campnetworkxyz Act 3 adds projects in gaming, music, marketplaces, and AI/IP tokenization.

Farms & Yields

@SolvProtocol launched BTC+ Vault with boosted yields and rewards campaign.

Kamino + Maple offering $175K incentives for syrupUSDC market over 3 months.

@OriginProtocol launched wOUSD Pendle market for fixed/variable yields.

Pendle launched sUSDe (Sep ’25) fixed yield markets on HyperEVM with $100M cap and incentives.

@OpenEden_X integrated Jigsaw for cUSDO Pendle LP strategy with dual rewards.

@SiloFinance added smsUSD to Silo Sonic with 24% APY, leverage, and points multipliers.

@0xCoinshift launched Season 2 of csUSDL Pendle market with high points incentives.

@liminalmoney added 3× leverage for BTC positions to boost APY.

@GetYieldFi launched USDC/yUSD pool on TermMax with 10.68% APY.

@TreehouseFi tETH added to Euler Finance Arbitrum for leveraged/fixed income strategies.

OpenEden & @ResolvLabs launched dual-yield cUSDO–wstUSR pool with bonus points.

@ArcadiaFi launched Season 2 points on Superform with high APY USDC pools.

@ShadowOnSonic deployed $S token incentives on Sonic for LPs.

Mezo launched BTC-backed Mezo Pools for fees and mats rewards.

3️⃣ Market overview

Overview

Institutional On-Ramps: Trump’s 401(k) order and the SEC’s LST clarification both remove major barriers to mainstream adoption. Expect asset managers to fast-track crypto retirement offerings.

Geopolitical Divergence: While the US is pushing pro-crypto policies, the UK’s ETN reopening shows Europe’s willingness to cautiously re-engage retail participation.

Corporate BTC Accumulation: Metaplanet’s aggressive buying mirrors early MicroStrategy playbooks — expect similar moves from Asia-based corporates.

DeFi Legitimacy Boost: SEC stance on staking tokens could catalyze a new wave of compliant, yield-bearing DeFi products for institutions.

1. Trump Signs Pro-Crypto Executive Orders

401(k) Access to Crypto: Directs the Department of Labor to ease restrictions on retirement accounts investing in alternative assets — including crypto, private equity, and real estate.

Anti-Debanking Measures: Orders regulators to investigate banks for politically motivated account closures, with specific focus on crypto-related businesses.

Impact: Potential $12.5T US retirement market opens to digital assets; boosts institutional adoption and reduces banking friction for crypto companies.

2. SEC Clarifies Liquid Staking Rules

Not Securities: Under specific conditions, liquid staking tokens (LSTs) and related activities are not considered securities.

Industry Reaction: Seen as a regulatory green light for DeFi staking products, paving the way for institutional-grade staking solutions.

Cautionary Note: Commissioner Crenshaw warns of oversight gaps, signaling that scrutiny on operational practices will remain.

3. Metaplanet Expands Bitcoin Treasury

New Purchase: Acquired 463 BTC ($53.7M), raising holdings to 17,595 BTC (~$1.78B).

Strategy: Funded via perpetual preferred share issuance to continuously grow BTC per share.

Positioning: Now the second-largest BTC treasury among Asia-listed firms, reinforcing corporate Bitcoin adoption trends.

4. UK Opens Crypto ETN Market to Retail

Effective Date: October 8, 2025.

Conditions: Must be FCA-approved, comply with Consumer Duty rules, and follow financial promotion guidelines.

Investor Impact: Expands regulated retail access to crypto-linked investment products, but without FSCS protection.

4️⃣ Key Economic Metrics

US Economic Update

Labor Market Weak Beneath the Surface: Unemployment ticked up to 4.2% in July as the labor force shrank and job growth stalled outside health care. Revised data shows the slowest 3-month hiring pace since the pandemic recovery.

Wage Growth Resilient: Pay rose 3.9% YoY — the highest since March — despite weaker hiring, likely due to tight labor supply from lower immigration. Real wages still outpace inflation, but tariff-driven price spikes could reverse this.

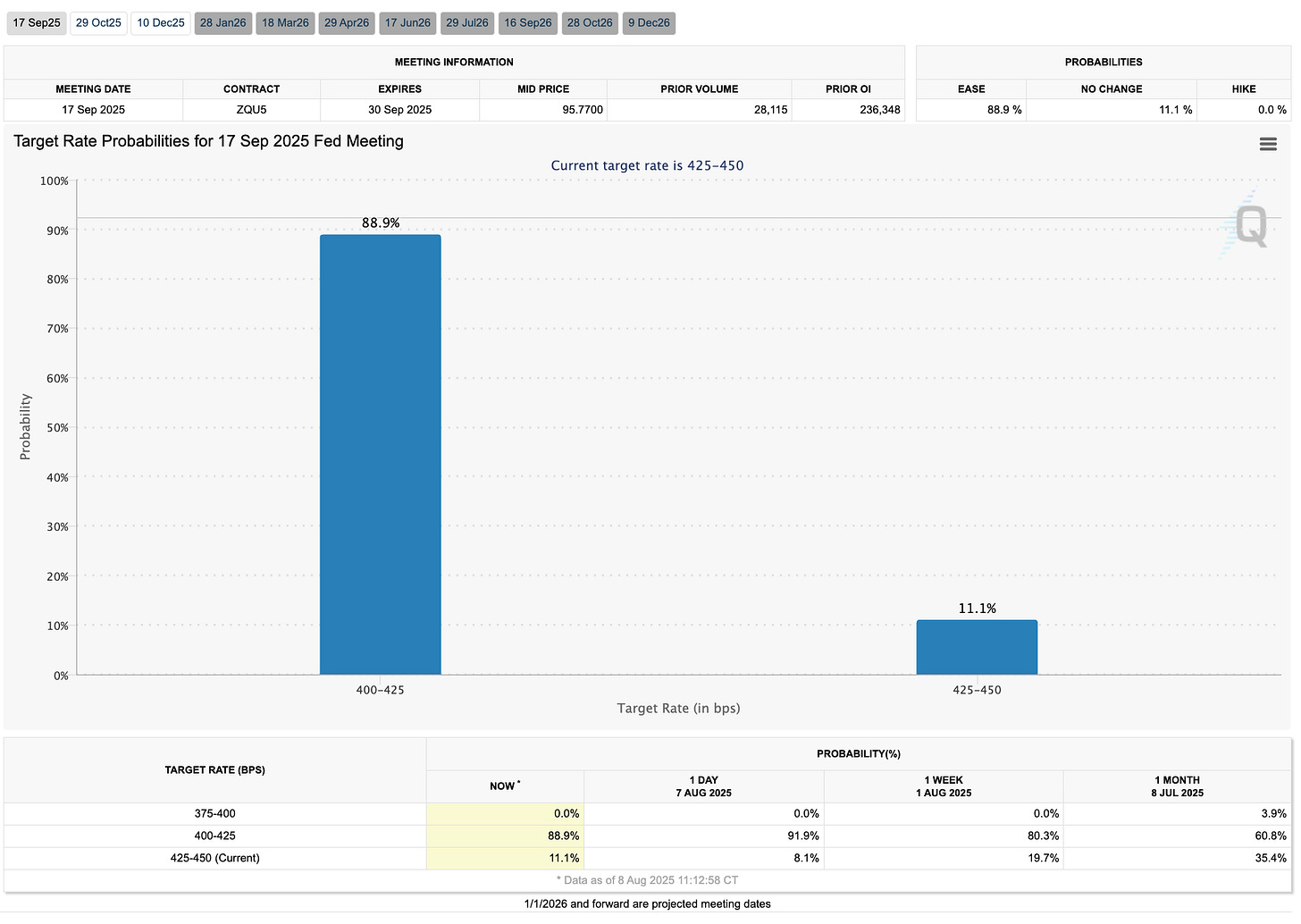

Markets Signal Slowdown: Stocks, the dollar, and bond yields dropped sharply. Rate-cut bets jumped from 8% to 42% for three cuts by year-end, reflecting mounting slowdown fears.

GDP Headline Masks Weak Demand: Q2 growth of 3% was almost entirely due to a collapse in imports (+5 points to GDP); domestic demand rose just 1.1%, showing underlying softness.

Consumers Front-Load Spending: Durable goods purchases jumped 3.7% as households rushed to buy ahead of tariffs — a short-term boost that may sap future demand.

Business Caution Deepens: Structures investment plunged 10.9%, signaling companies are shelving long-term projects amid trade and policy uncertainty.

Housing Still Weak: Residential investment fell for the fourth time in five quarters, reflecting high financing costs and cooling demand.

Tariffs and Their Potential Impact

Historic Tariff Levels: The US effective average tariff rate has surged to ~18%, the highest since the early 1930s and 15 percentage points higher than at the start of 2025 — a jump far exceeding the infamous 1930 Smoot-Hawley increase.

Growth Drag: Yale Budget Lab estimates current tariffs will cut 2026 GDP growth by 1 percentage point and shave 0.5 points annually thereafter, hitting manufacturing and construction hardest, despite possible gains in some durable goods production.

Hidden Tax Shock: At current import volumes ($3.3T in 2024), tariffs represent ~$600B in extra annual revenue (~2.1% of GDP) — a tax hike large enough to outweigh recent Congressional tax cuts, with either consumers paying higher prices or businesses suffering margin compression.

Trade & Supply Chains: Sustained high tariffs are likely to redesign global supply chains, shift trade patterns, and reduce imports, creating a negative spillover to foreign exporters while steering US production toward lower value-added activities.

Inflation Dynamics:

So far, inflation has been muted as foreign exporters and domestic sellers absorbed costs to protect market share, expecting tariffs to be temporary.

With permanence now clear, price pass-through is inevitable — e.g., a major consumer goods firm will hike US prices 5% to offset a $1B tariff hit.

Durable goods prices — normally falling — are now rising (+0.5% MoM in April & June; +0.9% YoY in June), early signs that tariffs are lifting import costs.

Yale Budget Lab warns that full pass-through could nearly double US inflation over the next year.

Investor Sentiment:

Breakeven inflation rates have risen ~20bps as markets price in lasting tariff-driven inflation.

Many investors expect the inflation bump to be short-lived but growth damage to be deeper, leading futures markets to price in 2–3 Fed rate cuts before year-end.

Policy Trade-Off: While tariffs bring in much-needed revenue amid a large budget deficit, they distort industry incentives, hurt investment, widen inequality, and risk long-term productivity losses — a poor substitute for broad-based tax reform.

US–EU Trade Agreement

Avoided a Trade War but Locked in High Tariffs: The US will impose a 15% tariff on most EU imports — lower than the threatened 30% but still historically high, especially for pharma and semiconductors (previously 0%) and a cut for autos (down from 27.5%). Steel and aluminum remain at 50%.

Selective Tariff Reductions: Both sides agreed to zero tariffs on €70B in trade (aircraft, parts, semiconductor equipment, some agriculture), but uncertainty remains over key products like wine and spirits.

Energy & Investment Commitments: EU pledged $750B in US energy purchases over 3 years and $600B in US investments — a scale requiring major supply shifts from other suppliers to the US, raising doubts about feasibility without driving up US energy prices.

Economic Winners & Losers:

Germany benefits from lower auto tariffs but faces pain from the broader 15% rate.

France calls the deal “unsustainable.”

Relief in avoiding harsher measures is tempered by concerns over long-term competitiveness.

Market Reaction:

European equities initially rose, then fell as implications set in; German automakers dropped sharply.

USD rose vs EUR, consistent with tariff theory and expectations of weaker EU export growth.

A weaker euro could stoke inflationary pressures in Europe, complicating ECB policy.

US Impact: Tariffs on $600B in EU goods will lift import costs on key products like pharma and autos; given high tariffs elsewhere, trade diversion is unlikely.

This deal trades escalation risk for entrenched protectionism — stabilizing relations but embedding structural costs into transatlantic trade.

5️⃣ Tariff Spotlight🔴

New US Tariff Decisions

Broad Global Reach: Final tariffs now set for multiple countries, with Mexico’s decision delayed 90 days and China talks ongoing (deadline Aug 12).

Notable Tariff Levels:

India: 25% – punitive, tied to oil and arms purchases from Russia; part of US secondary sanctions strategy.

Canada: 35% – excludes USMCA-covered goods; raises uncertainty ahead of 2026 USMCA review, likely chilling big investment plans.

Switzerland: 39% – shocks political and business leaders; hits pharma exports, making them less competitive vs. EU.

Taiwan: 20% – raises tension with a key chip supplier; perceived US tilt toward China negotiations.

SE Asia: Malaysia, Thailand, Cambodia at 19%; Laos, Myanmar at 40%; Singapore at 10%. Vietnam and Indonesia secured deals; 40% penalty for goods transshipped from China.

South Korea & Japan: 15%; Australia: 10%, seeking reduction.

Political Over Economic Drivers: Many decisions — notably on Canada and Brazil — appear rooted in political considerations, highlighting the unpredictability of tariff policy.

Legal and Policy Uncertainty: Ongoing court challenge could overturn country-specific tariffs, potentially replacing them with broad product-based tariffs. The administration has a history of sudden rate changes tied to foreign policy developments.

Economic Risks: Wide disparity in rates will distort supply chains, create competitive imbalances (e.g., Swiss pharma), and may trigger retaliation or re-shoring shifts. Persistent uncertainty will discourage long-term corporate investment planning.