America just green-lit a budget that knowingly spends $2B more than it earns each year.

Debt at 130 % of GDP and $425 000 per household within a decade, should read like a national hazard sign.

Fiscal reality

Congress is betting that higher tariffs (an implicit consumption tax) will paper over the gap. Even if tariff receipts do come in near 0.8 % of GDP annually, they barely dent the cost of extending 2017’s tax cuts. The baseline deficit remains stuck around 6-7 % of GDP, a level that historically only shows up in recessions or wartime. Markets are pricing this as “business as usual,” which is a polite way of saying they expect the Fed to monetize it.

DATcos: ICOs in Armani

Against that backdrop, we have a new speculation: Digital-Asset-Tech equities (DATcos). These stocks are a mash-up of lightly regulated crypto infrastructure plays, miners, and anything that can slip “blockchain” into an S-1, are posting ICO-era returns on public exchanges:

$BNMR +35× sees $5 B volume in four days

$SBET +45× is riding on the treasury-reserve narrative

$DFDV +90× has a float too thin to matter

Most of these companies have less cash flow discipline than the average meme-coin, yet they trade on NASDAQ multiples because institutions need “digital exposure” that their compliance departments can stomach. It’s 2017’s ICO mania, repackaged for the ETF crowd, a rally fuelled by passive flows, not fundamentals.

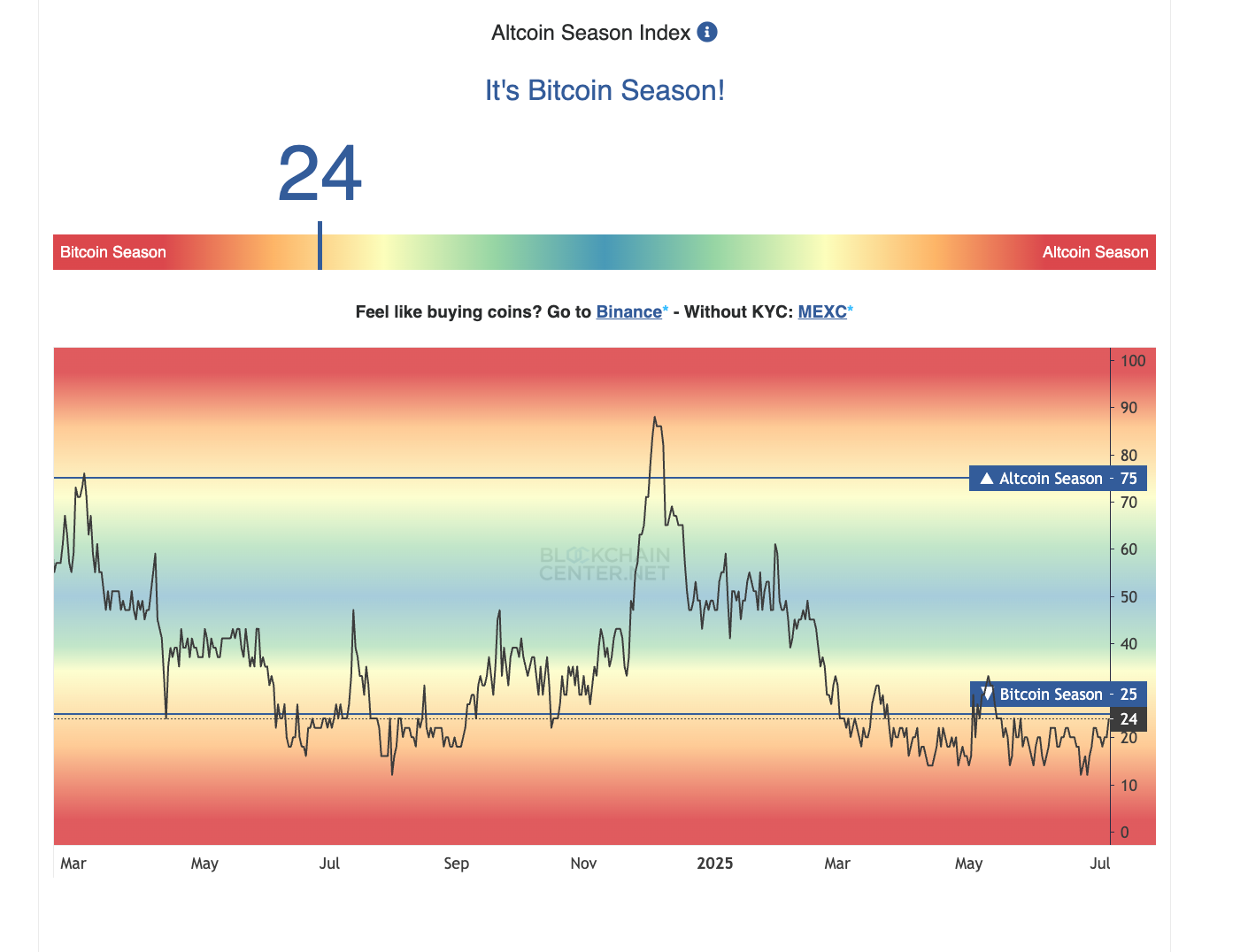

Bitcoin: structurally bullish but emotionally flat

Bitcoin sits just under its all-time high, with corporates soaking up supply (over 60k coins added to treasuries in June).

Social sentiment is eerily muted, no TikTok dances. Historically, that combination of strong on-chain accumulation and retail disinterest is bullish.

Policy complacency: A government running trillion-dollar interest bills is still piling stimulus on stimulus.

Capital-market distortion: The longer it persists, the harsher the eventual repricing.

Narrative bifurcation: Hardcore macro bears yell about debt traps while the equity tape flashes “risk-on.”

In other words, we’re watching long-term fiscal erosion subsidize a short-term speculative melt-up.

👇🧵

Macro Pulse Update 05.07.2025, covering the following topics:

1️⃣ Macro events for the week

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ Asia Spotlight

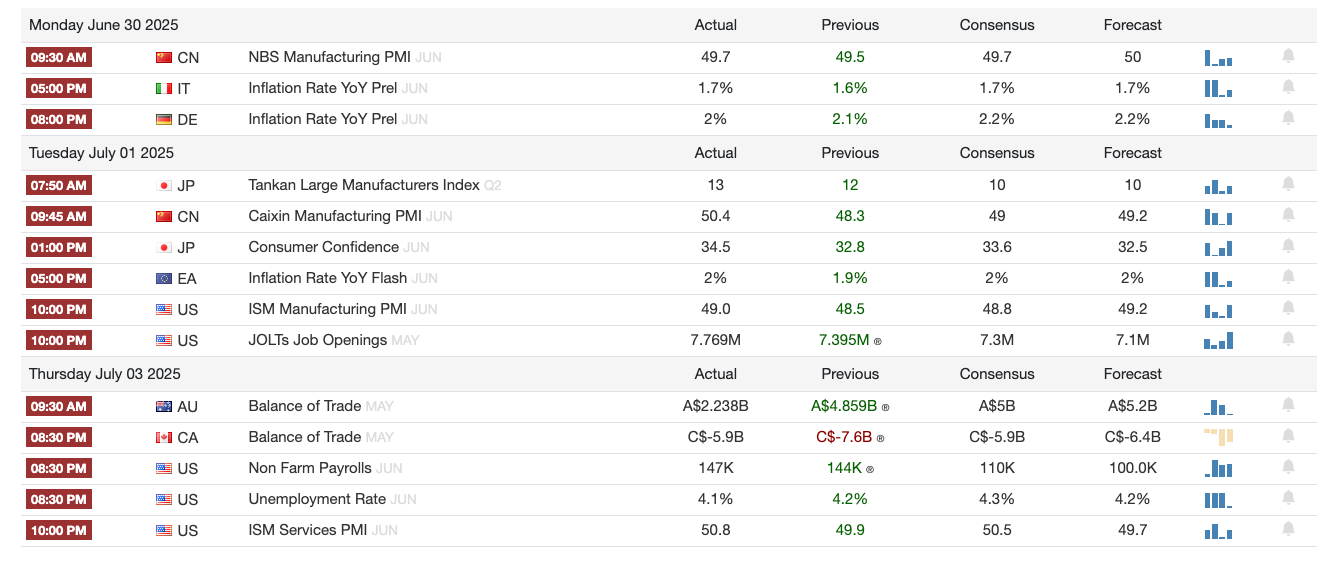

1️⃣ Macro events for the week

Last Week

Next Week

2️⃣ Bitcoin Buzz Indicator

Launches

HLP0: Launches as the first real-time HLP wrapper on LayerZero with zero fees and instant rebases.

ONyc (OnRe): Debuts as a multi-collateral yield asset targeting 16%+ APY through regulated reinsurance.

Stable: Introduces a USDT-powered stablechain with gas-free payments and EVM compatibility.

Across V4: Goes live with ZK-proof support via SP1, eliminating canonical bridges for faster bridging.

Celo Eclair Testnet: Combines OP Succinct Lite and EigenDA v2 in Celo’s first Ethereum Layer 2.

Spectra on Avalanche: Brings fixed rates, yield leverage, and liquidity tools to Avalanche users.

BOB Testnet BTC: Enables native Bitcoin DeFi using BitVM, with mainnet set for Q4 2025.

Index.fun on Sonic: Launches gamified onchain index creation and trading with rewards.

GMX on Botanix: Expands decentralized perps to Bitcoin-native Layer 2 with EVM support.

Botanix Mainnet: Launches Bitcoin Layer 2 with 5s blocks and $0.001 fees, integrated with GMX and Dolomite.

Zama Confidential Testnet: Unveils FHE-powered smart contracts for private blockchain computation.

Robinhood x Arbitrum: Tokenized stocks and ETFs live onchain for EU users via Arbitrum One.

Tokenized Stocks on Solana: Kraken and xStocks enable 24/5 equity trading with self-custody.

Teva Protocol on Base: Launches onchain guilds framework with game-native integration.

App + UI Upgrades

DeFi Saver: Launches mobile UI with customizable alerts for Morpho, Fluid, and automated strategies.

Protocol Updates

Velora on Sonic: Enables ultra-fast, low-cost trading on Sonic’s EVM Layer 1.

Frax Full-Stack OS: Launches compliant stablecoin stack (frxUSD, FraxNet, Fraxtal) for yield-bearing rails.

SolvBTC x Lista: Enables BTC-backed USD1 borrowing with 15% APY through Re7Labs vaults.

BNB Chain Maxwell Fork: Brings sub-second blocks and validator upgrades via BEPs 524/563/564.

Safe Harbour Prototype: Adds fully onchain multisig queues live on Gnosis and EVM chains.

pufETH on Euler: Lend/borrow LRT with 7M $CARROT and rEUL incentives.

Dolomite on Ethereum: Becomes first money market to support USD1 with ZAPs and Strategy Hub.

infiniFi x Spark Protocol: Offers 4.5%–13.99% APY on sUSDS/PT-sUSDS via curated portfolios.

xStocks x Chainlink: Chainlink to provide oracles for pricing, cross-chain, and corporate actions.

Velodrome Superswaps: Enables single-app cross-chain swaps across Optimism Superchain.

Maple adds weETH: 2% APY rebate on borrowing with weETH collateral.

Wormhole x Stacks: Enables sBTC/STX cross-chain flows secured by Bitcoin.

Gauntlet x Katana: Moves $85M+ to five live Morpho vaults on Katana mainnet.

Research & Ecosystem

Rex-Osprey ETF Launch: First SOL-staking ETF ($SSK) to debut in the U.S. with regulatory workarounds.

ETH ETF Filing: SEC gives “no further comments,” signaling ETH staking ETFs likely coming soon.

Sharplink Gaming: Builds ETH reserve strategy, mirroring MicroStrategy’s BTC play.

Today’s Premiums: Feature delta-neutral 12% APY stablecoin farming and 20%+ ETH leverage loops.

Airdrops

Eclipse $ES Checker: Now live at claims.eclipse.xyz to check airdrop eligibility.

Enso Speedrun: Earn up to 5,000 NOS points with crosschain DeFi actions.

Kinto: Distributes 23,900 SPX in first airdrop, second coming in 3 weeks.

Fragmetric: Opens Season 1 claim and $FRAG staking for one month.

Aegis: Launches weekly points program allocating 0.3% of $AEG supply.

Echo Protocol: 48-hour “Road to TGE” campaign with Aptos ecosystem rewards.

Jumper x Katana: Supports bridging assets into Katana.

Galxe x Nibiru: Launches Earndrop campaign with ecosystem missions.

Shadow Exchange Season 2: Rewards only real DeFi activity; 85% of Sonic revenue generated.

Optimism SuperStacks: Ends July 1, $OP claims open July 15, World mini app July 22.

Katana Krates: Closed, but new rewards from Turtle Clubhouse ongoing.

Sonic Labs: Updates $S airdrop rules and multipliers for Season 2.

Matchain: Fixes snapshot issues; top-ups and distribution coming next week.

Nexus Testnet III: Live in 10+ regions, including US, Vietnam, Nigeria, and India.

KiiChain ORO Challenge: Earn $ORO by completing testnet tasks and social engagement.

Farms

Varlamore Falcon Vault: Offers 19% APR (10.2% base + 8.9% xSILO rewards).

Contango Shift Points: Leverage farming earns up to 85x rewards on csUSDL loops.

Origin x Spectra: Launches OUSD PT/YT swap pool for yield + trading fee income.

Falcon sUSDf on Rivo: Auto-compounding staking live with Falcon Miles rewards.

Pendle stkGHO: Offers ~8.4% APY for staked GHO on Aave; vote live via vePENDLE.

Lista x Re7 USD1 Vault: Offers 15%+ APY, collateral options include BTC, ETH, pufETH, and more.

Kamino x Jito: Increases JitoSOL multiplier to 12.5x and boosts SOL incentives.

Term Labs Meta Vault: Starts July incentives, offering 26% APY for USDT deposits.

Spark x Sky SPK Farm: Lets users earn SPK by supplying USDS in Sky ecosystem.

Term Strategy Vaults: Launches on Avalanche with $40K in AVAX incentives and idle-yield strategies.

3️⃣ Market overview

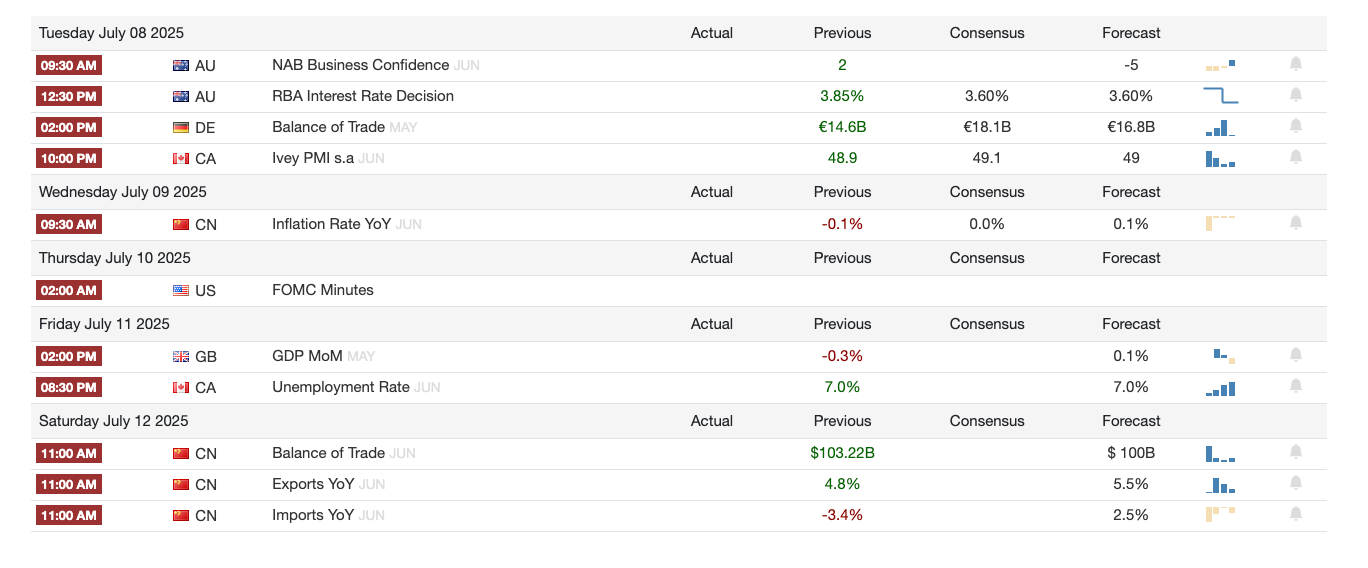

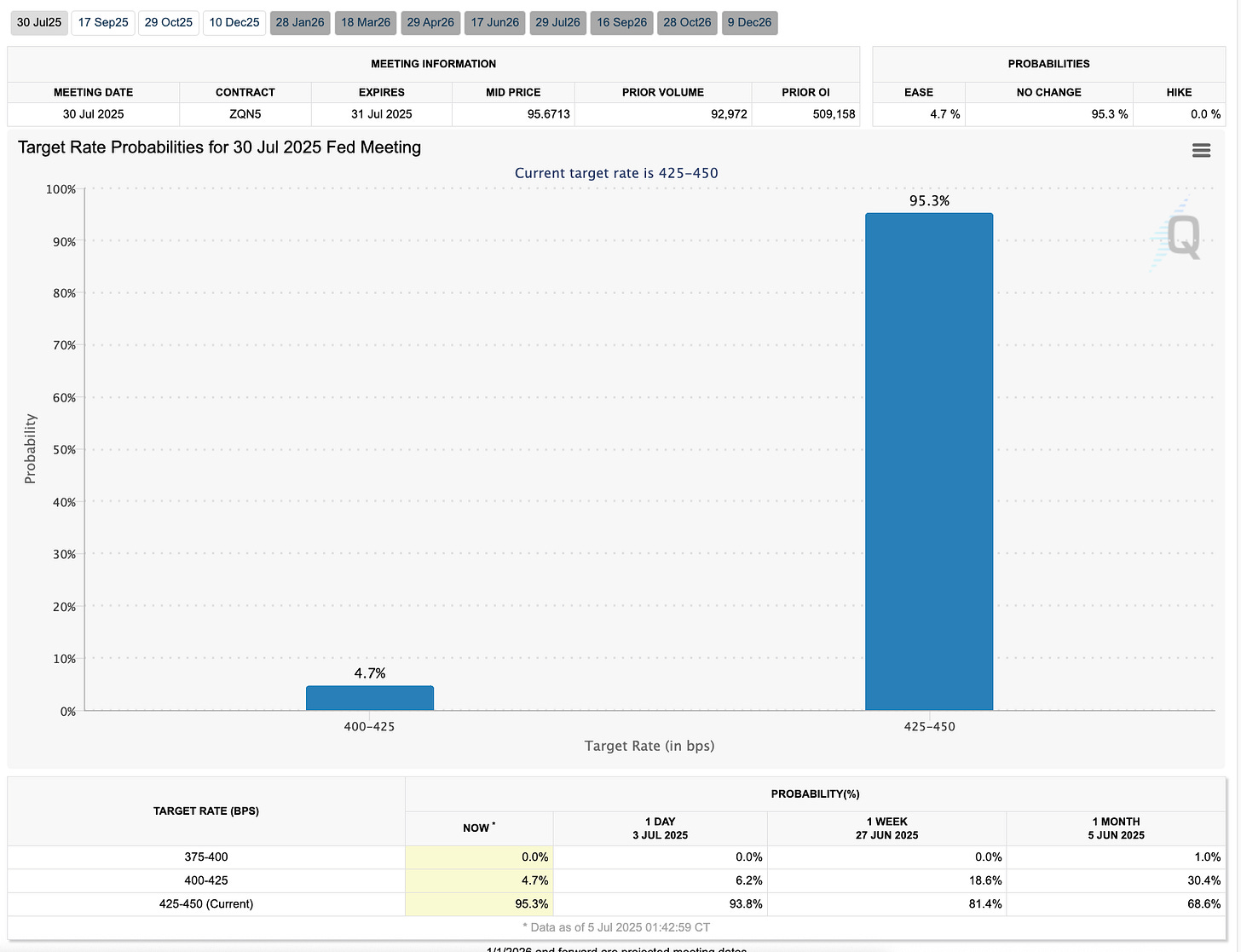

The labor market headline numbers suggest resilience, but hiring is uneven, and weakness in cyclical sectors shows cracks beneath the surface.

Trade policy uncertainty and tariff-induced costs are feeding inflation and weighing on capex, hiring, and construction—putting downward pressure on growth.

Despite stronger jobs data, underlying demand weakness and rising jobless claims support the case for a rate cut beginning in September.

Initial claims are up slightly, but not at recession-triggering levels. However, rising continuing claims and unemployment duration suggest deterioration is underway.

Import/export data is still normalizing after pre-tariff stockpiling, temporarily masking the slowdown in underlying economic activity.

With the July 9 deadline approaching, tariff policy clarity—or lack thereof—will dictate business sentiment and investment decisions in Q3.

4️⃣ Key Economic Metrics

U.S. Economic Review

Jobs Report – A Mixed Picture

Headline jobs growth came in at +147K in June, beating expectations and matching the 3-month average.

Unemployment rate dropped to 4.1%, strengthening the Fed’s stance against an imminent rate cut.

Rate cut bets for July have faded, but a September cut remains likely.

Narrow Hiring Base

Gains were concentrated in state & local education (+64K), health care (+59K), and leisure & hospitality (+20K).

Most other sectors were flat or declining, including manufacturing and temp help, both posting consecutive declines.

Signs of Labor Market Friction

Despite large tech layoffs, national layoffs remain low.

However, continuing jobless claims hit a post-2021 high, signaling longer unemployment spells and tighter hiring conditions.

Tariffs and Activity Drag

ISM surveys show tariff concerns and weak demand weighing on manufacturing and services.

Construction spending fell for the 7th straight month, hurt by tariffs, high rates, and uncertainty.

Trade Weakness & Policy Watch

U.S. trade deficit widened to $71.5B, with exports down 4% and imports down slightly, reflecting post-tariff pull-forward.

July 9 marks the expiration of the 90-day pause on reciprocal tariffs, with 57+ countries still unresolved.

5️⃣ Asia Spotlight🔴

Asia – Stabilizing Growth & Cautious Optimism

China: Gradual Stabilization

Official June PMIs improved slightly:

Manufacturing PMI: 49.7 → still contraction, but rising.

Non-manufacturing PMI: 50.5, beating expectations.

Caixin Manufacturing PMI: 50.4, back to expansion territory.

Growth aided by policy support and easing trade tensions.

Outlook: Growth to moderate from 5.0% (2024) → 4.7% (2025) amid structural headwinds.

Japan: Business Sentiment Supports Tightening

Q2 Tankan Survey:

Large manufacturers’ index rose to +13 (vs. expected +10).

Non-manufacturers eased slightly to +34, still near multi-year highs.

Rate Outlook: BoJ likely to hike 25 bps in October to 0.75%.