Decoding 2lambroz Alpha: Pre-Market Listings, Layer 1 Resurgence, and Yield Farming Secrets

Every day, new projects launch, while older ones strive to remain relevant by finding innovative ways to engage users and investors.

Right now, we are witnessing pre-market listings gaining popularity, debates surrounding listing fees intensify, and Layer 1 chains seek comebacks. All that say here is where I got all my alpha from.

In this article, I’ll break down key elements of these trends with a focus on alpha, metrics, and strategies to watch out for as we navigate the broader crypto landscape.

Credits to @2lambro and @ManoppoMarco for putting together this podcast series here also give

a follow on his amazing substack1. Scroll’s Pre-Market Listing on Binance

Scroll, a zkEVM scaling solution for Ethereum, recently garnered attention with its pre-market listing on Binance, marking the exchange’s first experiment into this listing model.

While the concept of pre-market listings isn’t new—Perpetual Protocol (PERP) and dYdX pioneered this concept—seeing it on Binance signals a trend we’re likely to see more of, especially in how projects choose to enter the market.

Why Pre-Market Listings Matter:

Pre-market listings offer an opportunity to gauge sentiment around a token’s future value before its official launch. Traders can speculate on the upcoming token, often with limited liquidity, which opens the door for both opportunities and risks. With Scroll’s pre-market listing, for example, the trading volumes hover around $100k–$200k, which isn’t much, and could lead to price manipulation. It’s a useful gauge for early interest, but it doesn’t always reflect where the market will go once the token officially launches.

Scroll’s Total Value Locked (TVL) Growth:

For those more data-driven, Scroll’s:

TVL has risen impressively from $20 million in early 2024 to over $850M.

Seeing an influx of X follower growth

Daily transactions have seen a surge since the start of Oct

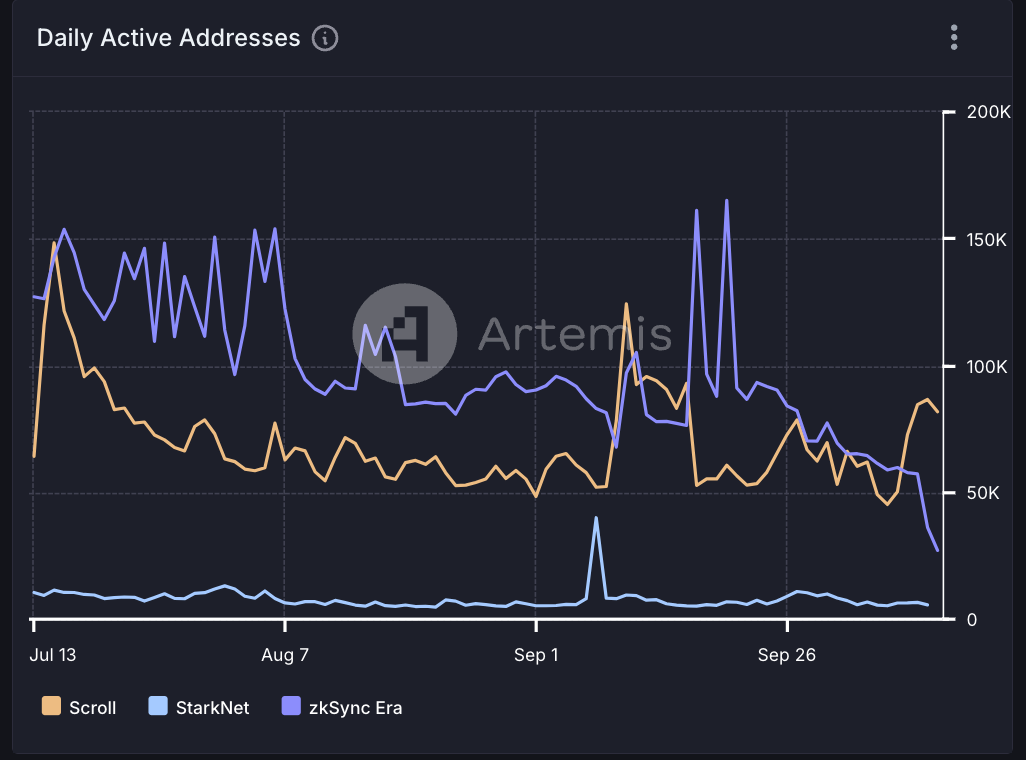

This growth is a direct indicator of the traction Scroll has garnered, despite being a relatively new player in the zk-rollup space. It’s a significant leap and worth noting when comparing Scroll to zkSync or StarkNet.

Does this mean Scroll is undervalued compared to its peers? Possibly, but we must wait and see how the market reacts post-launch.

Projects on Scroll

1. Tranchess Finance

@Tranchess s yield-enhancing protocol designed to offer varied risk-return solutions through asset tracking and tranche-based investments. Inspired by traditional tranche funds, Tranchess allows users to choose their risk and return profiles by splitting investments into different tranches (sections) with different risk levels. The protocol primarily tracks specific crypto assets such as BTC, ETH, and BNB, offering a way for users to enhance yields while managing risk.

2. Pencil Protocol

@pencilsprotocol a leverage farming protocol, offers auction services for blockchain-native assets and real-world assets (RWAs), along with unified and leveraged yield aggregation services. It serves as the Scroll-native gateway for liquid staking, restaking, and scalable, private DeFi services, enhancing yield farming and vaults for maximized asset utilization. It also has market-neutral strategies and on-chain synthetics,.

3. Rollie Finance

@rolliefinance an AI-powered perpetual trading platform on Scroll, offering one-swipe trading for crypto, forex, commodities, and real-world assets (RWA). Non-custodial trading, 1000x leverage (coming soon), social trading, and a simple, gamified user experience

4. LazyOtter

@lazyotter_fi is a DeFi risk management platform designed to help users invest securely by proactively identifying and mitigating risks, automating tasks like yield generation, and fostering a supportive community. It allows users to confidently navigate DeFi while letting smart contracts handle the complexities, ensuring a safer and smarter investment experience.

2. The $100 Million Question: Listing Fees and the Binance Ecosystem

The most contentious point surrounding Scroll’s Binance listing has been the alleged 5.5% token allocation (approximately $100 million) that critics argue is essentially a hidden listing fee. Binance doesn’t charge traditional fees but structures its airdrop and staking incentives around $BNB and $FDUSD, creating an indirect cost for projects.

This brings us to a fundamental question:

Are these kinds of fees justified? From an ecosystem perspective, I believe this is akin to user acquisition. Think of it like paying for customer acquisition in traditional startups; the difference is that Binance’s ecosystem takes a hefty cut.

Should smaller projects balk at giving away 5% or more of their supply? It depends on how quickly they want access to Binance’s massive liquidity pools and user base. It’s not just a fee—it’s a cost of scaling fast. However, the long-term consequences can lead to early dumping of tokens by larger holders, making price stability harder to maintain.

3. Arthur Hayes on Listings and the DEX vs. CEX Debate

Arthur Hayes, recently talked about his PVP blog post, outlining how projects that list directly on CEXx tend to see downward price performance in 2024. His view is that: listings on top CEXs have resulted in 45%-50% declines for most altcoins this year. In Hayes’ words, listing on a DEX first allows projects to focus on product development, avoid excessive valuation hype, and grow organically.

Some Key Takeaway:

Listing early at high valuations often backfires. We’ve seen it time and again, especially with Arbitrum and Optimism—two massive Layer 2 projects that suffered after launching at inflated valuations.

This raises the question: should projects be listing at lower valuations to preserve upside potential? In my opinion, finding that sweet spot is crucial.

Listing too early on a DEX without building enough liquidity and hype might backfire just as much as an overinflated CEX launch. Timing, as always, is everything.

4. Yield Farming: A Key Strategy for Alpha Seekers

Now, let’s talk about yield farming—a strategy that has become central for savvy traders looking to maximize returns. The premise is simple: lend or stake assets, earn yields, and hold onto the tokens you farm.

It’s a strategy that many overlook, thinking the returns are only 10%-20%. But, when done right, yield farming can unlock substantial returns over time.

Case Study: Sui Network

Remember farming Sui when its token was around $0.07, only to see it skyrocket to $2. By holding onto those farming rewards, the seemingly modest 15%-20% APR turned into 60% returns over a nine-month period. This highlights one of the golden rules of crypto farming: sometimes, the greatest returns come from holding through bear periods.

Why Yield Farming Matters:

Farming is a way of evaluating a chain’s overall health. Yield farmers are often the first to notice whether a project has robust support, developer engagement, and consistent liquidity. By actively farming, you’re getting an inside look at how well a network is running, which often gives clues as to which projects are worth longer-term investments.

5. The Resurgence of Layer 1 Chains: Can Sleeping Giants Wake?

Historically, L1 chains that lost traction during market downturns have struggled to recover. But Solana’s recent success is proof that sleeping giants can wake. Solana managed to rebrand, improve its technology, and position itself as the “Nasdaq of blockchains” with blazingly fast transactions.

Factors Contributing to a Comeback:

Clear Value Proposition: Solana differentiated itself with speed and the Firedancer validator client, giving it a technical edge over many competitors.

Developer Activity and Ecosystem Growth: Solana attracted new projects and maintained a dedicated community, which is key to its revival.

Can Other L1s Do the Same?

Other L1s like Fantom (now rebranded as Sonic), Klaytn, and Sui might have what it takes to stage a comeback. Sonic, in particular, has strong leadership in Andre Cronje, a brilliant DeFi architect. Klaytn, on the other hand, could leverage its connections with Kakao and Line, two of the most popular messaging platforms in Asia, positioning itself for mass adoption.

The key to revival lies in innovation and capturing narratives. Just as Solana leaned into speed, these L1 chains need to find their niche and hammer it home. The market always makes room for compelling stories and functional ecosystems.

6. Paid Marketing in Crypto: Misunderstood or Necessary?

There’s been a lot of skepticism toward paid marketing in crypto, with projects like Sui facing criticism for their aggressive marketing campaigns. However, I believe marketing is a tool, not a flaw. It’s about delivering the right message to the right audience. While over-hyping a product can lead to unrealistic expectations, well-executed campaigns that clearly disclose incentives (e.g., #ad) can build transparency and trust.

The reality is: crypto projects need visibility. Paid marketing is one way to achieve it. What’s essential is the balance between paid outreach and organic community building. Sui, for instance, has been clear about its grants program, and while some may meme about it, they’ve at least made transparency a priority. Compare that to projects that go full-stealth on their promotional efforts, and I’d argue Sui is doing it right.

Conclusion

From Scroll’s pre-market listing and Binance’s fee structure to Arthur Hayes’ warnings about inflated valuations, it’s clear that timing, strategy, and innovation are the key pillars of success. Yield farming continues to be a valuable tool for both accumulating returns and gaining insights into ecosystems, while the revival of Layer 1 chains like Solana shows us that comebacks are possible—with the right execution.

As investors and participants in this space, we must pay attention to the metrics, from TVL growth to treasury sizes, and stay open to how different projects choose to market themselves. The landscape is dynamic, and with the right perspective, there are always opportunities for alpha.

Closing Thoughts

As more projects innovate, don’t underestimate the power of well-timed entry points, strong fundamentals, and ecosystems that continue to build through adversity. Whether it’s farming, trading, or watching for the next big L1 comeback, the crypto space rewards those who stay informed and act decisively.

Twitter: https://x.com/arndxt_xo/status/1845786277234508142