Team has been building for more than 2 years

Recently announced partnerships with giant DeFi protocols

A deep dive into one of my top token for the bull 🧵 👇

🔷 Market Potential 🔷

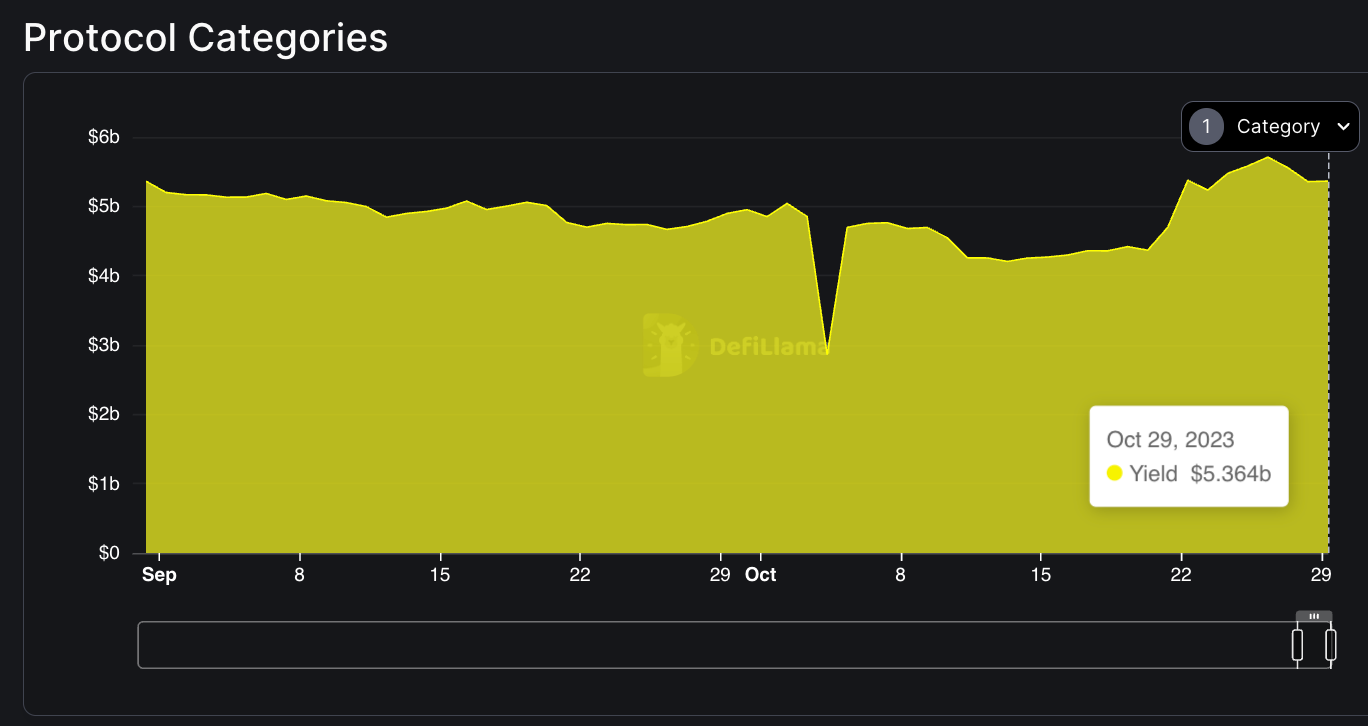

Thanks to Cointelegraph intern that caused the bullrun, the Yield segment on Defillama grew by 25% a huge increase of $1 bil in TVL.

It is one of the category with the largest bull potential yet most versatile to narratives.

If I look at market sentiments just last week, from bear to instant bull…

Yields are not dead and people want more of it

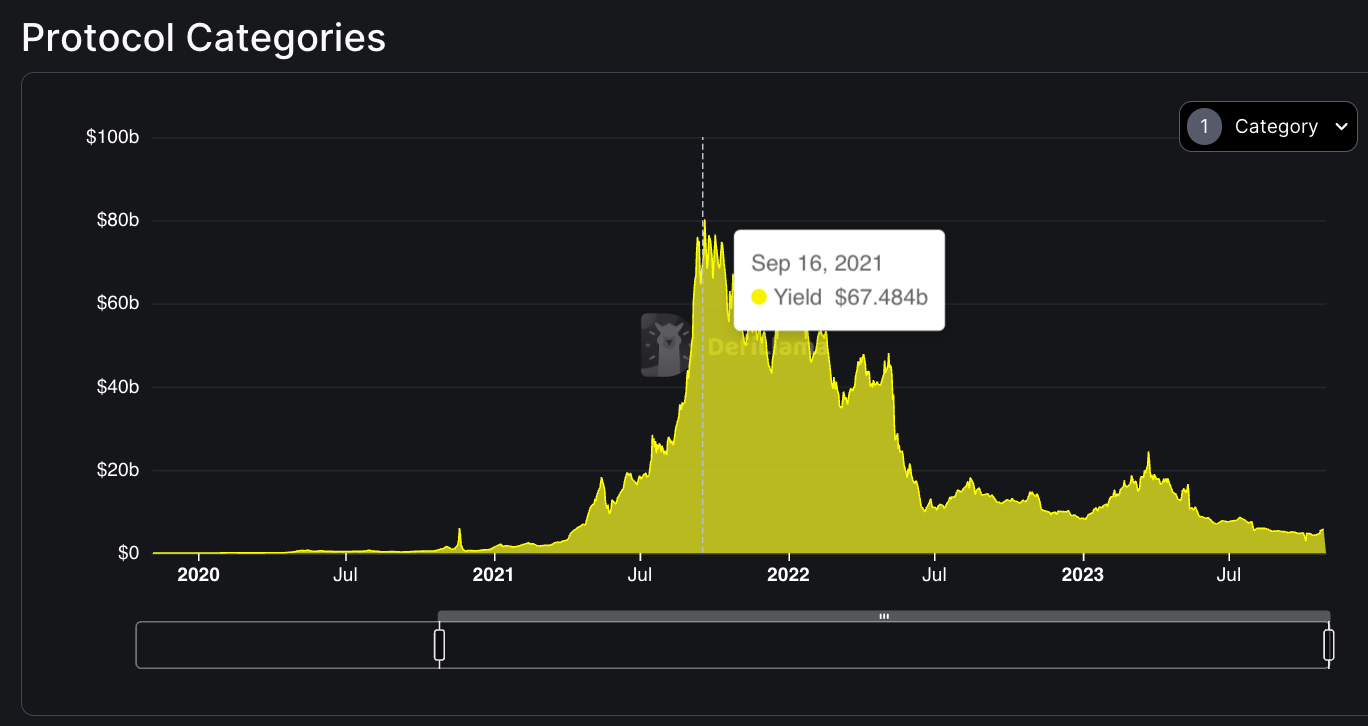

At the peak of the bull in 2021 we saw the yield category amassed a TVL of $67 bil, thats 10x from where we are at now

Protocols building products around yield also ride on some of the hottest narratives.

For instance, @EefiFinance would benefit from the flatcoin narrative by forming a partnership with @AmpleforthOrg on its $SPOT which is a flatcoin.

To put this market growth potential into perspective, @yearnfi grew 200k% from $30 to $60k in 2020.

With such strong partnerships at the onset, I am positive that @EefiFinance will be one of the dominators in the bull run and I am accumulating $EEFI.

🔷 About $EEFI 🔷

@EefiFinance generates leveraged yields for elastic assets such as $OHM and $AMPL in the core vaults.

Yields earned through core vaults are fundamentally built around the $AMPL token rebasing capabilities.

How this works 👇

Users begin by depositing $AMPL into the core vaults or providing OHM/EEFI Liquidity to earn $OHM and $EEFI rewards.

We also need to understand the characteristics of $AMPL. It has 3 kinds of rebase:

When AMPL < $1, AMPL token supply reduces

When AMPL = $1, AMPL token supply remains constant

When AMPL > $1, AMPL token supply increases

$1 is based in 2019 USD terms.

During times where AMPL <= $1, $EEFI is minted to users.

During times where AMPL > $1, $AMPL is sold to buy $OHM and distributed to vault stakers and OHM/EEFI LP token stakers.

During times where AMPL > $1, vaults will use OHM/EEFI liquidity on Uniswap to buy and burn $EEFI

🔷 Tokenomics 🔷

$EEFI will be the rewards token of the protocol and holder of $EEFI can get $EFT airdrop.

Until $EFT is officially launched, EEFI will serve as the de facto governance token of the protocol.

It is the basis for amplified yield during market uptrends and protects from downside action during downtrends.

And it is also the basis of a multichain effort as more strategies are added to the protocol.

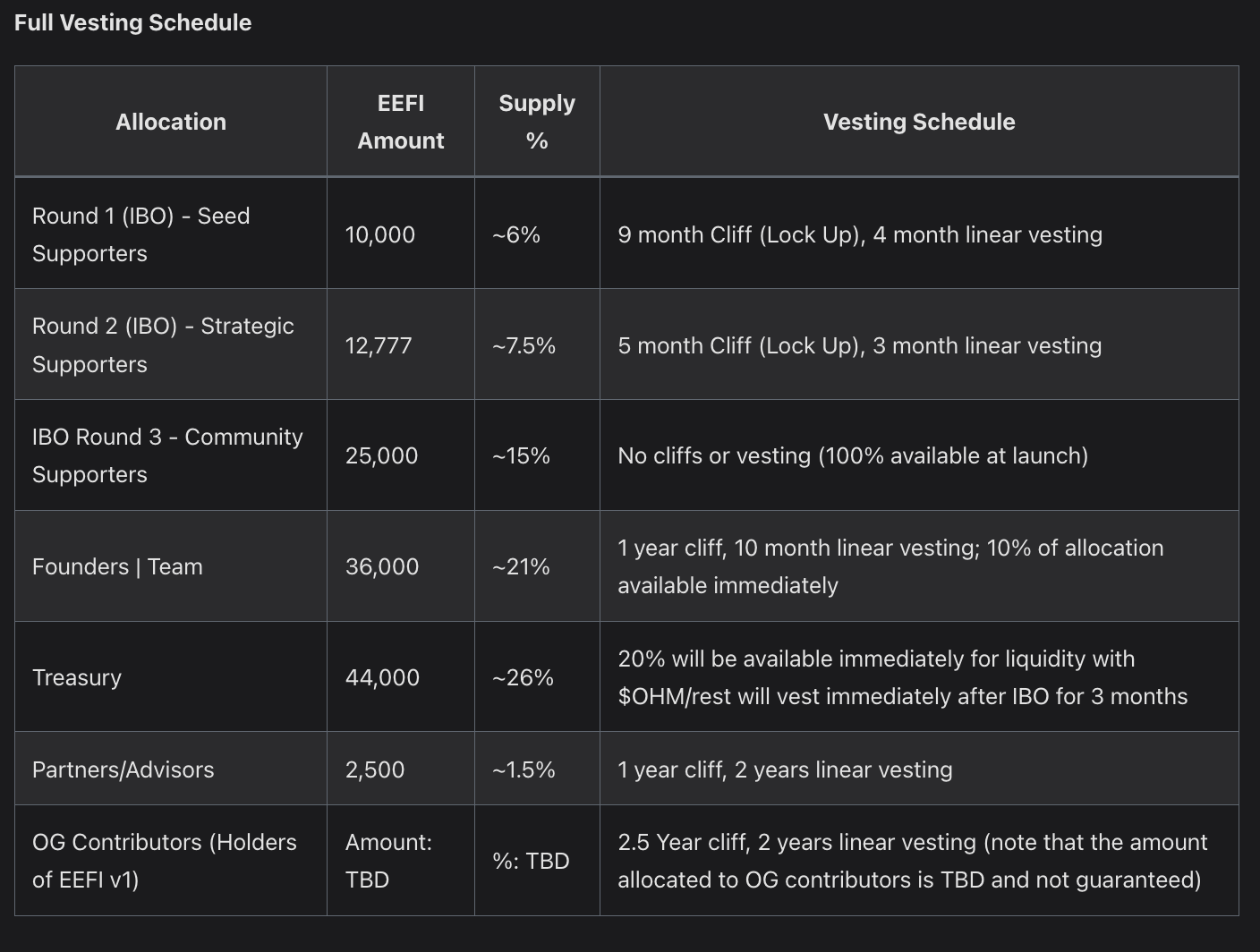

~ 35,000 $EEFI will be in circulation during the first year post-launch (depending on market dynamics (AMPL rebase cycles)

To determine how much $EEFI rewards you will get, you can use this rewards simulation tool.

There will also be a governance token $EFT with the following utility:

Governance - Decide on rebasing tokens for strategies, Control treasury utilization, Have a voice in the vaults deployed

Revenue sharing - collect protocol fees $EEFI and other assets

$EFT tokenomics is still not yet decided

🔷 Evolution to v2 🔷

@EefiFinance have been building since 2021, alpha for a year. I have my faith in the team and product.

@EefiFinance formerly focused exclusively on @AmpleforthOrg but to build a scalable ecosystem they will move forward with a v2 updates that include:

Seed Presale for $EEFI

They are holding a seed round of $120k at a price of $12 per $EEFI with a 9 month cliff and 4-month linear vesting.

If vestings are a concern, a strategic and public round could be interesting.

New partnerships

It has grown its partnership to include a bunch of strong partners like @AmpleforthOrg @OlympusDAO @Bond_Protocol @FjordFoundry

They even secured a $25k grant from @OlympusDAO and this is no easy feat.

Improved vaults

Core elastic vaults are updated, which was in alpha last year to include the rebase function callable by anyone. Callers will receive a $EEFI reward

🔷 Conclusion 🔷

Given the large market potential and innovative product, Eefi Finance seems well-positioned to be a dominant player in the next bull run.

My conclusion is that $EEFI could provide strong returns as adoption grows.

The yield market segment has high growth potential, with room to grow 10x from current levels based on 2021 peaks.

Eefi Finance generates leveraged yields for elastic assets like AMPL and OHM. The yields are amplified during market uptrends when AMPL supply increases, and protected during downtrends when AMPL supply decreases.

EEFI serves as the rewards and governance token for now. EFT governance token for governing the protocol and sharing revenue.

Twitter: https://twitter.com/arndxt_xo/status/1718988427688071640