I am accumulating this undervalued gem:

🔥 330k MC

🔥 50mil TVL

🔥 19% risk free APY

Here is my deep dive research and bullish view 🧵👇

In this research into @Equilibriafi, I will cover:

Overview of @Equilibriafi

$ePENDLE peg mechanism

$EQB deflationary model

4 Token System

Juicy Yields

Strategic Partnerships

🔷 Overview of @Equilibriafi 🔷

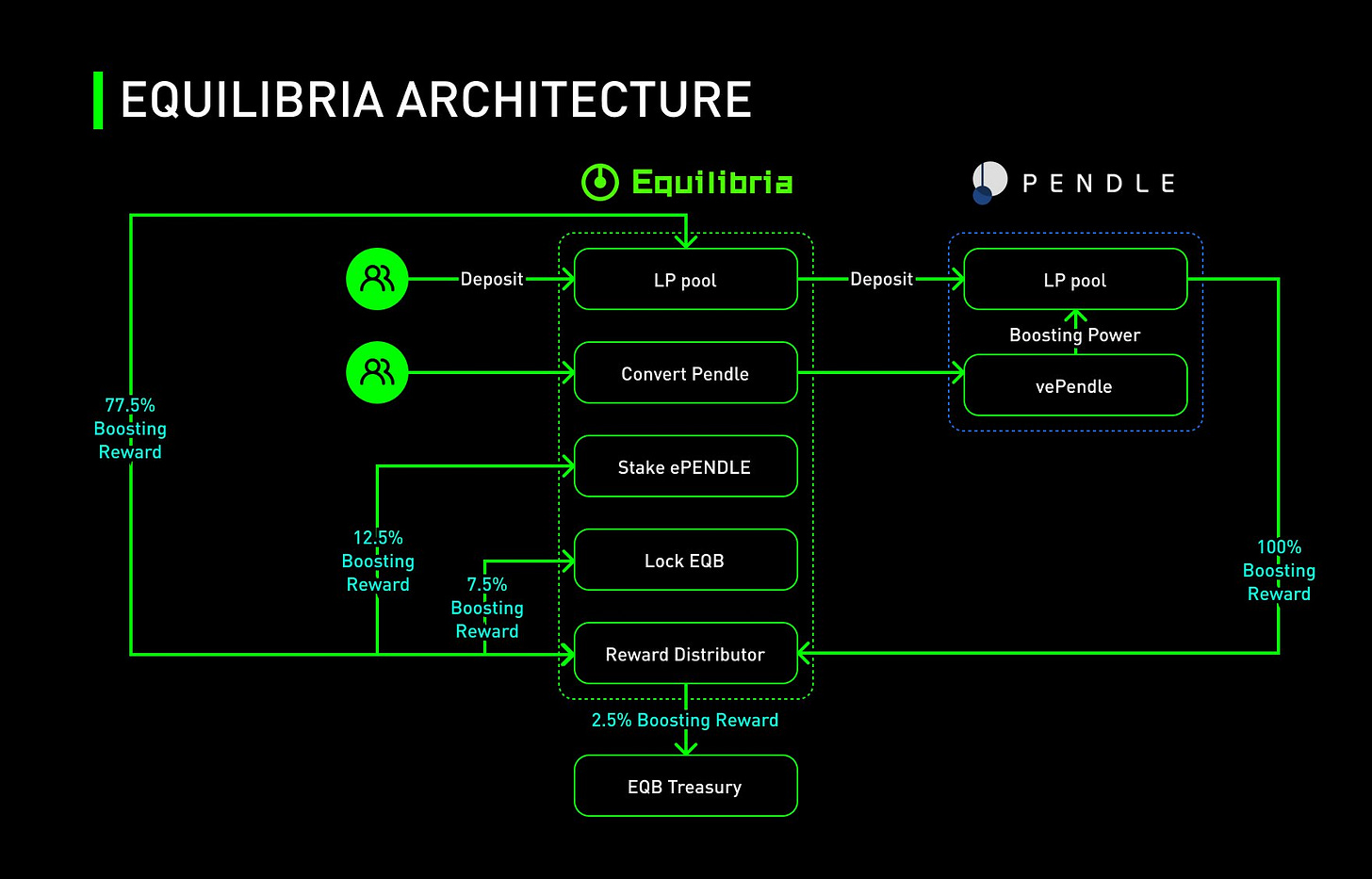

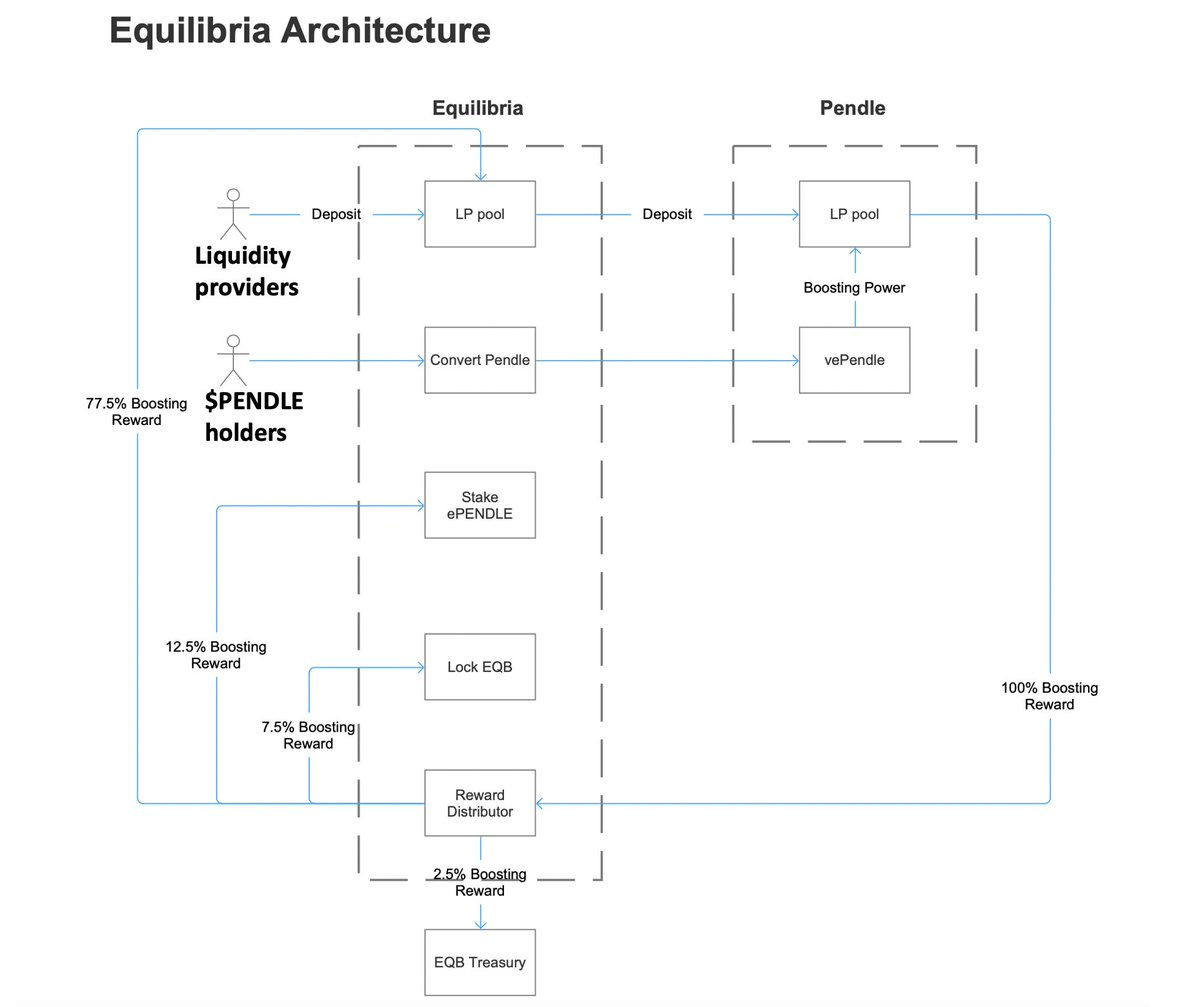

Equilibria is built on top of the @pendle_fi ecosystem, providing further boosts on yields for:

Liquidity providers

$PENDLE holders

Boosted yields are achieved through Equilibria $vePENDLE accumulated.

You can think of @Equilibriafi work similarly like how Convex would ontop of Curve.

@Equilibriafi participates in 5th largest defi token war.

Currently, $PENDLE wars is 5th in ranking

Here's a quick recap of how @Equilibriafi works to help users earn boosted rewards in $PENDLE and $EQB

Liquidity providers Provide liquidity to on Equilibria to Pendle

$PENDLE holders Convert $PENDLE into $ePENDLE, stake them. $ePENDLE is a liquid version of $vePENDLE allowing users to swap back to $PENDLE

Equilibria currently has accumulated around 7.4M $PENDLE which will be locked for 7.5M $vePENDLE.

Representing 26.8% voting power on Pendle Finance.

TVL has been steadily increasing in the depths of bear market at 50M

EQB current lock rate is 36%

$EQB current price at $0.11

$PENDLE $0.61

And there is 1.1 $vePENDLE per $EQB

1.1 * 0.6 / 0.11 = 6

This means that for $1 worth of $vlEQB you are controlling $6 of $vePENDLE

🔷 $ePENDLE peg mechanism 🔷

$ePENDLE plays a pivotal role in Equilibria's ecosystem.

And they have plans to safeguard it as a valuable long-term liquid wrapper asset.

The key goal for this peg mechanism would be to increase an concentrate liquidity by

Implementing a flat liquidity provision model, where the price is solely determined by the market price discovery process.

Deploying more boosted positions to concentrate liquidity within the 0.9–1 price range, while establishing robust liquidity support on the $PENDLE side of the active bin.

How peg stability can be achieved?

These are some strategies that Equilibria plans to implement to achieve peg stability:

Smart Converter will be enabled if peg falls by:

Directing conversion order to ePENDLE/PENDLE pool on the DEX instead of converting PENDLE on Equilibria

Buying ePENDLE rewards for vlEQB holders

Buy Back strategies enable for ePENDLE and EQB will occur within a certain price range using the 2.5% protocol fee sharing. The acquired ePENDLE & EQB will then be staked on our platform, generating additional revenue for the treasury.

More use cases for ePENDLE

🔷 $EQB deflationary model 🔷

Equilibria have implemented additional measure to ensure that $EQB is deflationary through:

Buybacks and burns, which can help reduce token supply over time, potentially making the remaining tokens more valuable. This can reward long-term holders.

This is done by allocating a revenue generated by the protocol for buybacks.

Redemption of EQB from xEQB creates in incentive to stake xEQB longer term and any excess tokens (above the redemption ratio at that time) are sent to an admin address to be permanently burnt.

xEQB is pegged 1:1 to EQB when minted, but the redemption ratio can be less than 1:1 depending on how long xEQB is staked.

The conversion ratio gradually increases over the staking period. Redeeming early results in fewer EQB tokens received in return while burning the excess tokens as penalty for early redemption

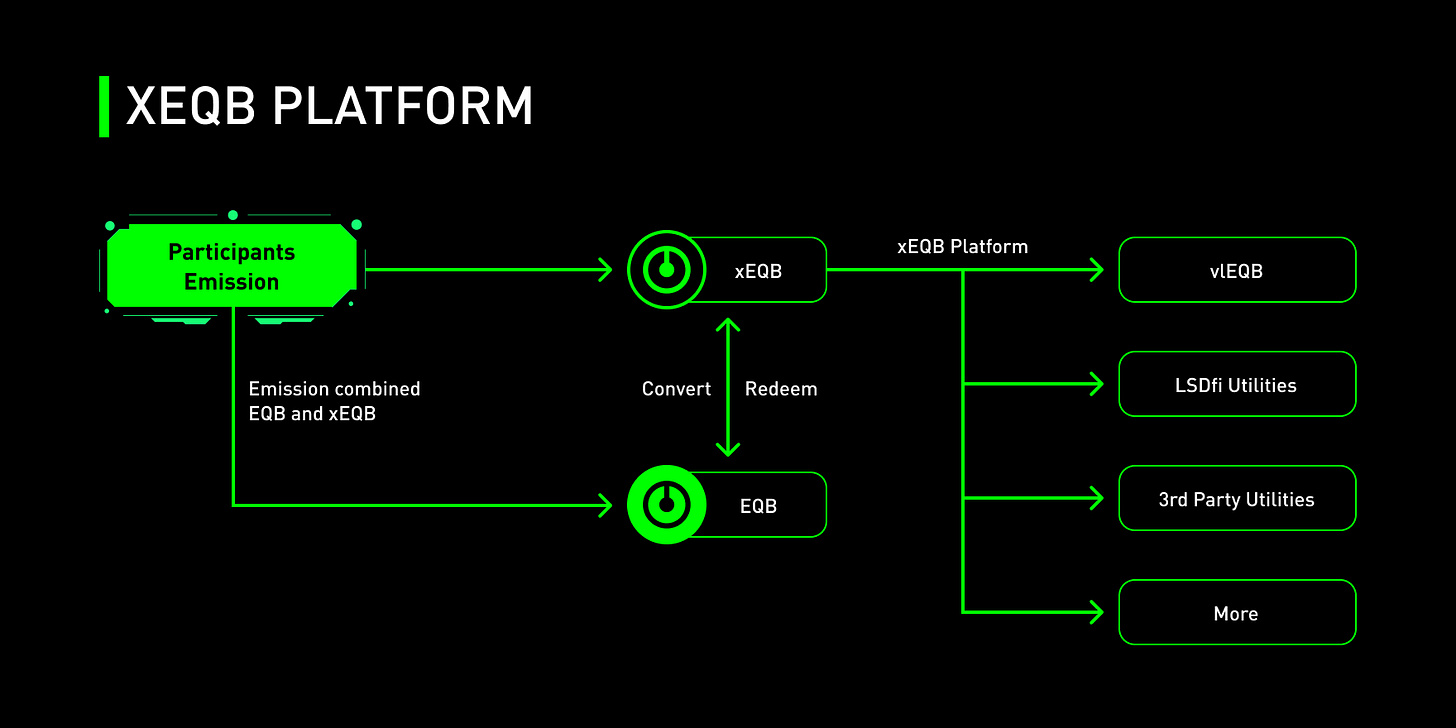

🔷 4 Token System 🔷

There are four kinds of tokens in the Equilibria ecosystem:

EQB

xEQB

vlEQB

ePENDLE

$EQB is the governance token of Equilibria

25% of emissions is distributed as EQB

EQB can be converted to xEQB and following the redemption schedule from xEQB to EQB

$xEQB is the escrowed version of $EQB

75% of emissions is distributed as xEQB

Can be converted to vlEQB or redeemed to EQB over 2-24 weeks

2 weeks = 0.5 EQB per xEQB

24 weeks = 1 EQB per xEQB

Use cases includes:

Voting rights to direct the next $PENDLE emissions

Fee sharing including fees generated from Limit Orders on YT/PT trading, leverage trading on YT/PT, and leverage yield farming based on Pendle Pools.

Dynamic yield boosting

$vlEQB gives users voting power

Users can obtain vlEQB by locking EQB and xEQB for up to 52 weeks

This gives the users voting rights to direct PENDLE emissions, and earns revenue from multiple revenue sources

Fee sharing

Vote rewards from PENDLE

Bribe rewards

$ePENDLE is liquid wrapper for $vePENDLE

It can be staked to earn 12.5% of Equilibria's revenue and this peg mechanism is already being worked on as mentioned above

🔷 Juicy Yields 🔷

The 19% APY yields from the $crvUSD comes from a variety of sources.

For instance for the crvUSD pool, it comes from:

$PENDLE

SY reward (from @SiloFinance)

$ETH (Swap fees)

$EQB

$xEQB

While for the swETH pool, it comes from:

$PENDLE

Swap fee

$ETH

$EQB

$xEQB

🔷 Strategic Partnerships 🔷

Equilibria partners with @redactedcartel

Redacted’s hidden hand is a leading marketplace for governance incentives known as "bribes."

Protocols can increase their $PENDLE emissions by bribing $vlEQB holders.

What does it mean for users?

For bribers

It allows both users and protocol who wish to be bribers to add incentives to Redacted’s UI

For voters, they can choose to be:

Yield Harvester by consolidating gas costs for claiming various bribe tokens and converting them into $wETH.

Delegate voting power: Hidden Hand utilizes an algorithm to identify the most profitable strategy for voters.

Here is a thread that I have written previously.

Twitter: https://twitter.com/arndxt_xo/status/1713877899441586644

Can you post contract address plz ? Seeing couple of eqb on dextools ,none with the right mic.