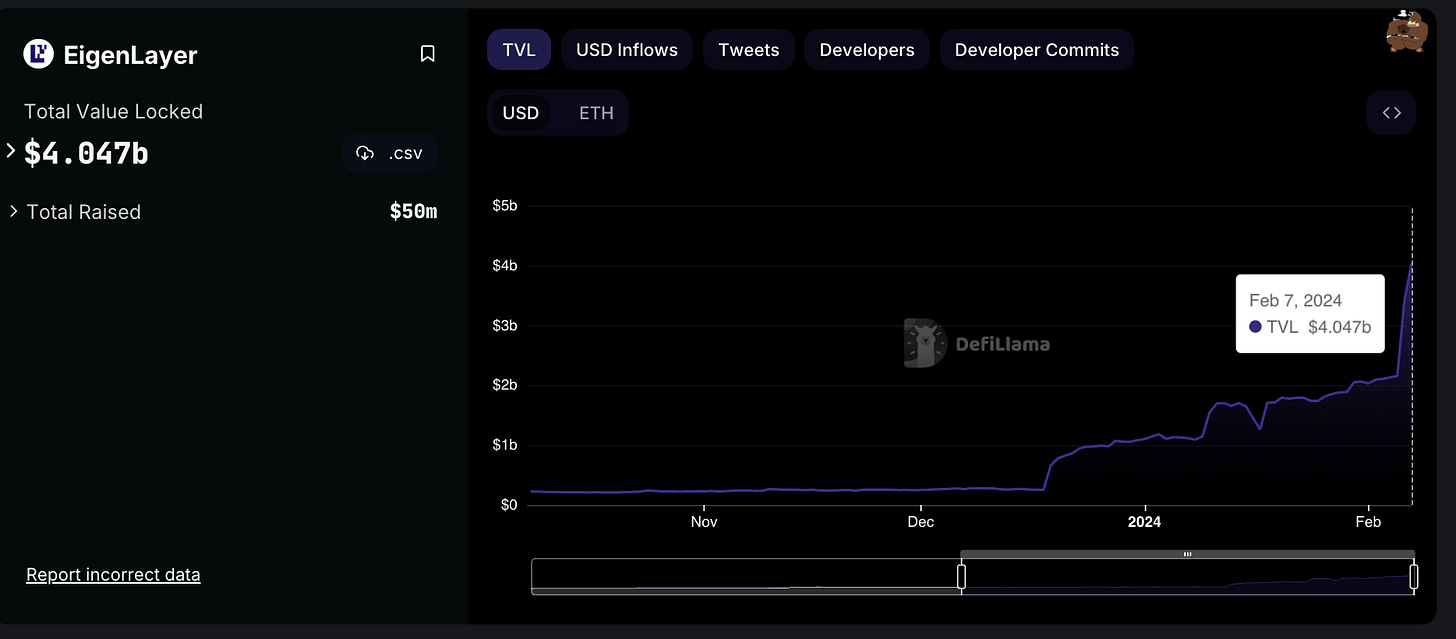

EigenLayer achieved $4B TVL of restaked ETH

They’ve just lifted deposits cap nearing 1.5% of $ETH total supply, including all of LST and $wETH combined.

A tier-1 restaking protocol launching at FDV 2M, here is how to get your IDO spots 🧵👇

In the first hour following the cap lift, over 360K ETH LSTs were deposited.

Since then, we've seen an influx of more than 600,000, and the numbers are still climbing:

352K in stETH

65K in mETH

60K in swETH from @swellnetworkio

5K in wbETH

44K in ETHx by @staderlabs

18K in sfrxETH, along with some smaller amounts in other forms.

As for the Tier 1 providers, like @ether_fi, @RenzoProtocol, @puffer_finance, @KelpDAO, and @Euclidfi, they are all building up anticipation for the Eigen main net release slated for Q2.

Right now, the LRT current supply is around 800K ETH, translating to roughly $1.8B.

@Euclidfi is one that caught me attention as it is raising at only 2M FDV. The IDO will be very limited.

$EQB has strong connections with the Pendle team and @tn_pendle is their advisor. An imminent partnership.

So in the past months, if you have been reading my posts, I have been sharing about $EQB being a yield powerhouse but beyond that, I see a lot of value-accural mechanisms from @Euclidfi and @Equilibriafi being with the @NGADfuture

And what you need to know to join their tournament for IDO spots:

Eigenlayer Points

E-Points (Boostable)

Token Airdrop

$2M FDV IDO Quota

@Euclidfi is one of the few restaking protocols that introduces an omni-chain LRT, called elETH.

It represents users’ restaking position, providing native ETH staking rewards, restaking rewards, and DeFi yield opportunities.

User can get elETH by:

Restaking through Euclid

Buying it from the secondary market

elETH can be redeemed to ETH or any other kinds of the LST you restaked for a period of a time window which is configured by Eigenlayer.

Euclid LRT Tournaments

This is where you want to pay attention to earn your IDO spots and airdrops through a point system.

There are 3 ways you can participate in this:

Referral Wheel - invite friends and grow your points

vlEQB and ePENDLE Run - Holding vlEQB or ePENDLE to get bigger boosts

Guild War - Join the guild and enjoy their boost benefits

Here are some features that makes Euclid stands out:

Simplifying Restaking

Euclid establishes a trustless and permissionless operator network without the technical expertise or a minimum 32 $ETH requirement.

Omni-chain Possibilities

elETH is an omni-chain LRT being the yield-bearing liquid wrapper representing the restaking position.

Restakers with Euclid earn:

native ETH staking rewards

restaking rewards

interact with DeFi protocols for more yield opportunities.

Trustless Operator Network

Euclid took their build-inspiration from @Rocket_Pool, so all operators are treated equally in their eligibility to join the Operator network.

As users can restake their ETH/LST through Euclid, Euclid will use their optmized and risk balanced strategies to restake with Operators Network from Euclid.

Restake users will receive a liquid wrapper called elETH which can be used in L2s and all the DeFi ecosystem on chain.

To be part of the Operator network through Euclid, operators must stake $ECL and restake ETH/LST independently.

There will be a minimum required ECL and restaked assets determined by each AVS.

Riskier AVS requiring more $ECL and restaked amounts and when events like slashing occurs staked ECL from operators acts as compensation to restakers.

Leverage possibilities in L2 and other chains

Personally excited for this because, it will probably be the first to roll it out plus it will expand the use case of LRTs further with leveraging across various DeFi protocols.

Fair Launched Tokenomics

IDO at $2m FDV

$ECL is the governance token

30% IDO

40% Community Treasury

15% Airdrop to early depositors

15% @NGADfuture

Twitter: https://twitter.com/arndxt_xo/status/1755212993124765933