Forget Sell in May - The Quiet Start of a New Crypto Supercycle

Macro Pulse Update 26.04.2025

I have long preached about paying attention to global liquidity.

BTC historically lags M2 by ~85 days and some models now project $142K by July 2025.

Now that U.S. tax season is over, the old “Sell in May and go away” mantra doesn’t apply the same way for crypto. Liquidity pressures are easing, and this time, May could mark the beginning of an acceleration, not a pause.

Technically, Bitcoin just completed a clean inverse head and shoulders retest, a structure we last saw play out perfectly before the 2020–2021 bull run. Add to that Fed pivot talks, tariff easing rumors, and Quantitative Tightening slowing down, and the macro backdrop looks more bullish than most people realize. Stocks are falling. Crypto and gold are rising. That kind of divergence is a signal that capital is reallocating toward hard assets.

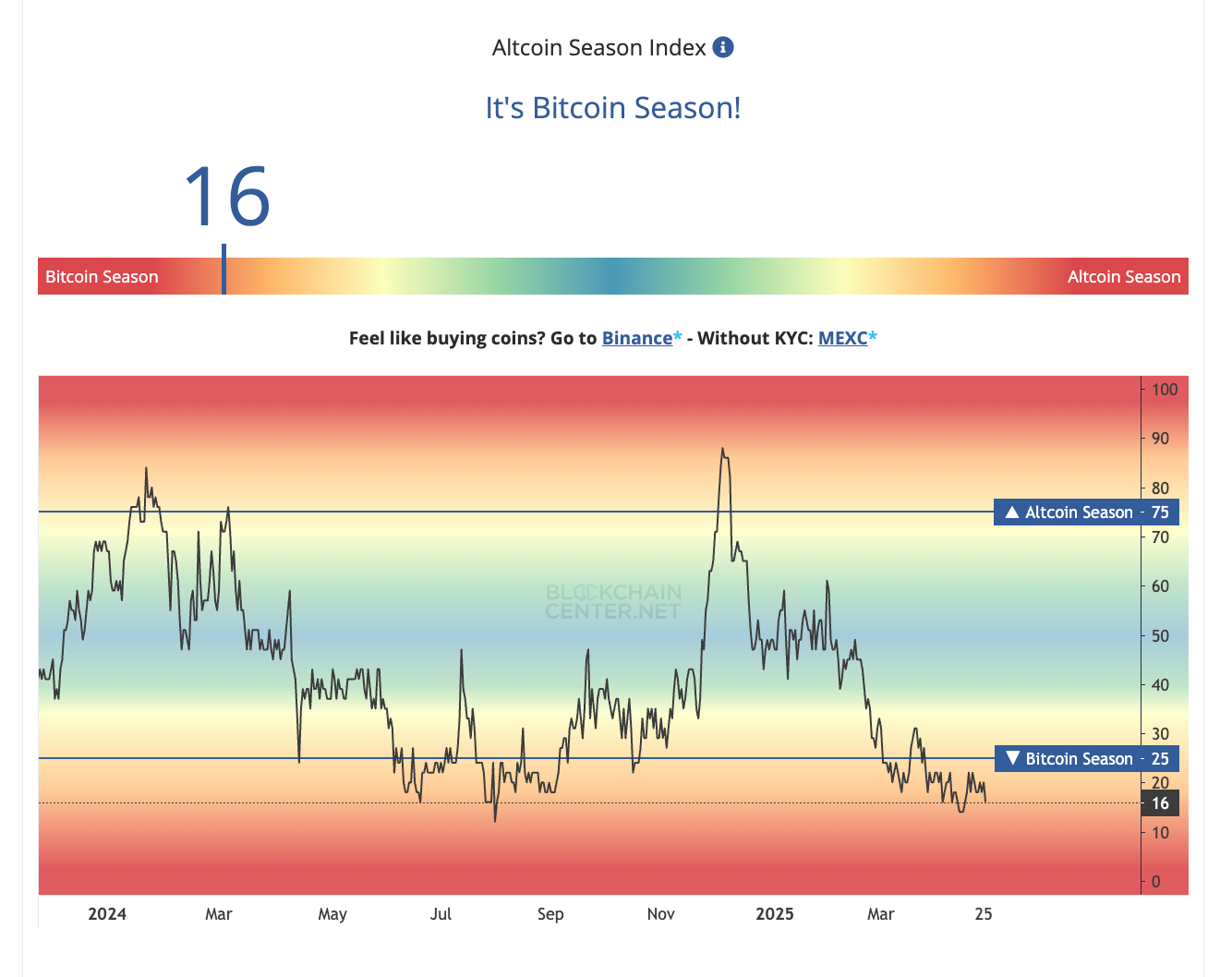

Altcoin season is also setting up. Altcoin market cap bounced cleanly off $835B, just like before previous rallies. Smaller-cap coins are starting to outperform the majors, which historically has been the early sign of explosive alt moves. Layer on macro fuel like altcoin ETF filings and potential rate cuts and Q2 could easily be the catalyst window.

Ethereum is playing the long game by building a network effect bigger than any one asset, even Bitcoin or gold, because eventually, everything will settle on Ethereum. The narrative of ETH evolving into the world’s ultimate Store of Value will slowly becoming reality.

But the liquidity flow this cycle is different: it’s more selective. BTC still leads, ETH captures infrastructure demand, high-quality altcoins follow, but micros won’t run unless broader risk appetite returns. Following liquidity and positioning carefully is critical now and blind gambling won't work like it did in early 2021.

One final confirmation for me: Bitcoin’s decorrelation from the S&P 500 is happening right now. Historically, that shift has always preceded Bitcoin’s biggest moves higher. April 2025 is showing the same pattern.

In my view, the next phase of the cycle is already quietly beginning.

Most won’t see it until it’s obvious. We’re not in the hype yet. We're still early.

Stay sharp, stay positioned 🧵👇

Image credits to @ZakaWaqar

Macro Pulse Update 26.04.2025, covering the following topics:

1️⃣ Macro events for the week

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ China Spotlight

1️⃣ Macro events for the week

Previous Week

Next Week

2️⃣ Bitcoin Buzz Indicator

Launches

Initia Mainnet live; airdrop claim open till May 24 via airdrop.initia.xyz.

LayerZero unveils vApp framework; massive zkVM efficiency upgrades.

Meteora launches Dynamic Bonding Curve (DBC) SDK for rapid launchpad integrations.

DIA xReal launches 100+ RWA price feeds for DeFi platforms.

Soul Labs launches incentivized testnet for cross-chain lending (earning Seeds → $SO).

OPEN releases equal-weight decentralized stablecoin index (DTF) on Reserve Protocol.

Halo introduces HUSD, Hyperliquid’s native stablecoin with full collateral transparency.

N1 Testnet goes live via invite-only access.

Updates

Solv Protocol becomes first institutional guardian with Zeus to bring BTCFi to Solana

Morpho Labs deploys smart contracts on HyperEVM (Vaults 1.1, Oracles, Rewards Distributor).

Mantle’s MI4 Fund ($400M) offering diversified exposure to yield-bearing assets.

USDT0 launches on Bitfinex with cross-chain transfers + validator on Hyperliquid.

Lombard enters Phase 2 Bitcoin staking on Babylon (5,000+ BTC staked).

Euler integrates with Beefy Finance for new stablecoin yield strategies.

Resolv Labs launches USR and RLP on BNB Chain with high-yield opportunities.

RedStone integrates price feeds into Citrea (1,250+ assets supported).

Arbitrum adds support for custom gas tokens to enable builder flexibility.

Dinero launches superETH staking token for Optimism Superchain ecosystem.

Ethena Labs enables USDtb as margin collateral on Bybit.

Project Zero launches on peaq, enabling AI agents in Machine Economy.

f(x) Protocol launches fxSAVE, yield-bearing stablecoin backed by real yields.

KiloEX successfully recovers all stolen funds after breach.

Initia launches Vested Interest Program (VIP) to incentivize cross-rollup liquidity.

Jupiter and Rain.fi introduce liquid-staked $JUP on Solana.

Meteora integrates Dynamic AMM v2 with Jupiter Exchange.

Apostro adds PT-sUSDe as collateral on BNB Chain via Euler.

Astar reduces inflation rate and rebalances rewards via Dynamic Tokenomics update.

Exploits Issues

Tenderize staking project exposed to stealth backdoor; ETH skimmed and withdrawn via Kraken.

KiloEX breach fully resolved with user refunds and bounty issued.

Upcoming

Coinbase x PayPal partnership to advance stablecoin (PYUSD) adoption.

Ether.fi building a permissionless DeFi “bank” for portfolio management.

Gyroscope announces Dynamic CLPs for adaptive DeFi liquidity.

Nexus Labs Mainnet I launches in Q3 2025.

Pareto unveils $USP credit-backed synthetic dollar launching early May.

Frax North Star Upgrade launches April 29 (FXS → Frax transition).

Vitalik Buterin proposes replacing Ethereum’s EVM with RISC-V for future upgrades.

Scroll Phase 2 upgrade goes live April 22 with 90% lower fees and 4x throughput.

Airdrops

Dolomite airdrop ($DOLO) claim live + liquidity pool incentives.

Rumpel Labs Chapter 3 Straw rewards ongoing (March 1–June 1).

Clearpool Ozean Pre-Deposit Campaign for earning Droplets.

Vertex Season 2 Trading Rewards (40,000 $AVAX over 4 weeks).

Solv Protocol extends SolvBTC airdrop with OKX partnership.

Infrared Points Program live for vault liquidity providers.

Zora airdrop ($ZORA) claimable starting April 23.

BOB launches $BABY airdrop claim.

Shadow Exchange opens $SHADOW/xSHADOW reward claims.

deBridge opens $DBR airdrop claim.

Hyperlane $HYPER airdrop claim live (expansion rewards ongoing).

Wormhole Staking Reward Period 1 (SRP1) rewards claim live.

Balance opens $EPT token claim.

PAWS airdrop claim live.

KGeN Phase 0 airdrop claim (rKGEN rewards).

Farms

SolvBTC.BNB live on Pendle with BTC-denominated yields.

Relend Network launches $5M rUSDC money market on Swellchain (Euler + Velodrome).

Spectra launches GHO-USR pool (104% baseline yield).

Coinshift launches csUSDL yield-bearing stablecoin on Pendle.

Dinero’s superETH now live for farming on Velodrome.

Steakhouse Financial releases Smokehouse ETH (4% APY on Morpho).

Falcon Finance’s USDf tradable and LP-able on Bunni (10.1% APY).

f(x) Protocol offers 17%+ APR on USDC deposits via Morpho vault.

Spectra live on Hemi, offering 34x boosted bfBTC strategies.

Level Finance adds Pendle pools for lvlUSD and slvlUSD with 40x XP.

Superform integrates Morpho Seamless USDC vault into SuperUSDC.

Core DAO + Maple Finance launch native BTC yield program.

Bedrock boosts BR/wBERA yield strategies and expands BTC farming on BNB Chain (227% APR).

3️⃣ Market overview

Bitcoin Breaks $94K: Bitcoin soared past $94,000 after US officials hinted at lower China tariffs, surpassing Google to become the fifth largest asset by market cap.

Paul Atkins Named SEC Chair: New SEC Chairman Paul Atkins pledged a rational and investor-focused crypto framework, signaling a shift from previous enforcement-heavy policies.

Cantor Fitzgerald’s $3.6B Bitcoin Play: Cantor Fitzgerald, Tether, SoftBank, and Bitfinex are launching Twenty One Capital with 42,000 BTC, aiming to dominate corporate bitcoin holdings.

Galaxy Digital Swaps ETH for SOL: Galaxy Digital exchanged 65,600 ETH for 752,240 SOL, reflecting declining Ethereum dominance and rising institutional interest in Solana.

Metaplanet Buys More Bitcoin: Tokyo-based Metaplanet added 331 BTC to its treasury, now holding nearly 4,855 BTC, solidifying its reputation as “Asia’s MicroStrategy.”

4️⃣ Key Economic Metrics

🔴 Tariffs and Trade Impact

Temporary Tariff Relief on Tech Goods:

Computers and smartphones are exempt from the 125% China tariff—for now. Short-term relief for tech markets, but potential future price hikes if tariffs are reinstated.Tariff Uncertainty Chills Investment:

Selective exemptions create an unpredictable business environment. Companies may delay expansion or hiring decisions, impacting economic growth and job markets.Inflation Threat from Tariffs:

US tariffs could push inflation above 5%, reducing household purchasing power by ~$4,900 annually. Consumers may face higher prices on everyday goods, tightening household budgets.China Frontloads Exports, Reduces US Imports:

Chinese exports surged, but imports from the US dropped sharply. Trade imbalances could deepen, fueling further economic tensions.China’s Strategic Leverage on Rare Earths and Aviation:

China is weaponizing rare earth minerals and halting large jet purchases. US tech and aerospace sectors could face serious supply chain risks and revenue losses.Global Ripple Effects on Steel and Aluminum:

Japanese and Korean steel exports to the US plummeted post-tariffs. Higher material costs could feed into higher prices for cars, construction, and appliances.Stalled US-Japan Trade Negotiations:

High-level talks ended with no agreement despite President Trump’s direct involvement. Continued trade friction could destabilize international partnerships and delay global economic recovery.

🔴 Disruption to Global Finance

Fed Chair Powell Warns on Tariffs:

Powell flagged that tariffs will likely raise inflation and slow growth, putting pressure on the Fed’s dual mandate. Expect more market volatility ahead; Fed policy responses remain uncertain, making interest rates harder to predict.ECB Cuts Rates Amid Trade Uncertainty:

The European Central Bank cut rates by 25bps to 2.25%, citing disinflation and trade-driven economic risks. Eurozone borrowing costs could stay low longer, but growth worries are rising.US Dollar Weakens Unexpectedly:

Despite new tariffs, the US dollar dropped to its lowest since March 2022, with the yen hitting highs not seen since 2024. Currency moves signal deep investor anxiety over US policy unpredictability and potential recession risks.Spike in Currency Volatility and Hedging Demand:

Currency volatility has surged to levels last seen during the March 2023 banking scare; demand for hedging is soaring. Businesses and investors may face higher hedging costs and should prepare for continued forex instability.

🔴 Japan’s Inflation Challenge

Rice Prices Surge, Driving Food Inflation:

Rice prices soared 92.1% YoY in March, pushing food's share of household spending to a 43-year high at 28.3%. Japanese consumers face rising living costs, with no quick fix due to strict domestic food security policies limiting rice imports.Overall Inflation Remains Stubbornly High:

Headline inflation hit 3.6% YoY in March; core-core inflation (excluding food and energy) climbed 2.9%, both well above the BOJ’s 2% target. Inflationary pressures persist despite a slight slowdown, keeping consumer purchasing power under strain.BOJ Faces a Policy Dilemma:

Higher inflation suggests tightening monetary policy, but a strengthening yen and trade war risks argue for caution. The BOJ is likely to delay major rate hikes, adopting a "wait and see" approach as external risks could naturally cool inflation.

5️⃣ China Spotlight🔴

China’s Economic Growth Acceleration

China's Q1 GDP Growth Stronger Than Expected:

China's real GDP rose 5.4% YoY in Q1 2025, matching last quarter’s strong performance despite tariff pressures.China’s economy remains resilient for now, but growth could slow later as the full effects of tariffs hit.Retail Sales and Industrial Production Rebound:

March retail sales jumped 5.9% YoY and industrial production surged 7.7% YoY, driven by manufacturing strength. Consumer and industrial demand are stabilizing, signaling domestic momentum even as external risks grow.Business Investment Strength Offsets Property Weakness:

Fixed asset investment rose 4.2%, with non-property sectors showing robust gains despite a continuing property market slump. China's economic shift toward non-property-driven growth is gaining traction, reducing overreliance on real estate.Policy Support Likely Behind the Resilience:

Recent government measures to boost domestic demand helped buffer the economy against export challenges. China may continue using stimulus tactics to sustain growth, but sustainability will depend on internal consumption trends.

Twitter: