I’ve said this again and again, Bitcoin moves with liquidity and now we are seeing the liquidity thesis playing out, BTC > ETH > ALTS.

$ETH season is here.

Last week, BTC touched $120K before pausing at $114K amid profit-taking and summer volume fatigue. While sentiment indicators are rebounding, many mistake that for strength. But markets rise when the macro backdrop supports it.

And right now? It’s complicated.

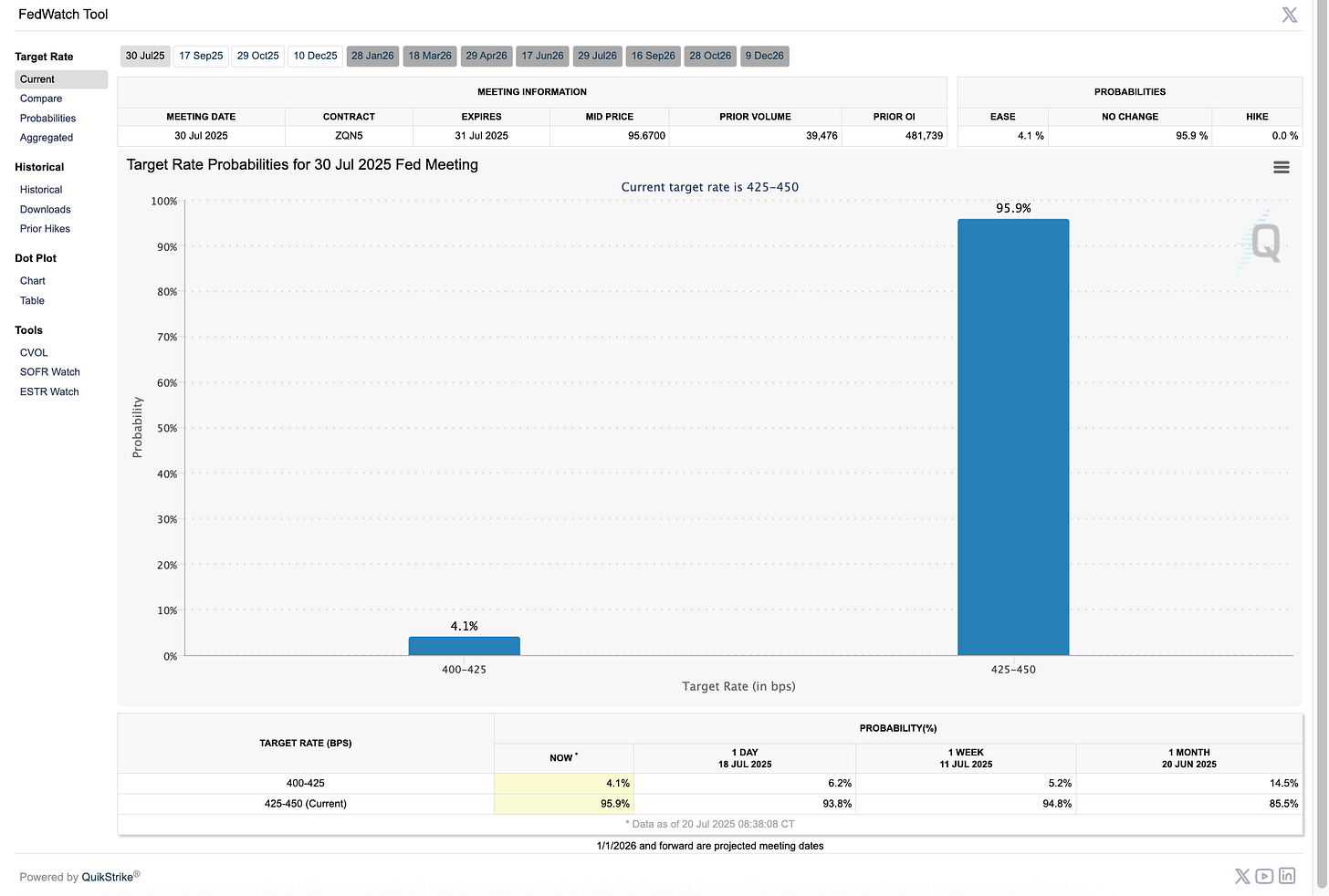

Rates remain elevated. QT continues. The Fed hasn’t pivoted yet. Treasury is flooding the market with supply. This is not 2009 or 2020. Back then, we had ZIRP, QE, and fiscal ease. Today we’re climbing with weights on and any rally is fighting a headwind.

Yet BTC is holding. Why?

Because the deeper signal is in global M2 liquidity. BTC at $1M isn’t a meme, it’s an inevitability tied to $300T+ in global debt, relentless fiat devaluation, and collapsing trust in institutions.

Meanwhile, macro positioning remains fragile:

The DXY is down 10% YTD, boosting risk assets, but positioning is turning short, raising the risk of a USD rebound and potential correction.

US inflation is stuck at 2.5%, limiting the Fed’s maneuverability and introducing uncertainty around timing for cuts.

NVDA continues to lead S&P gains, but breadth is narrowing. Without broader equity participation, sustainability is in question.

Amid this, the passing of the GENIUS Act may prove historic, akin to the Telecom Act of 1996. That bill unlocked broadband. This one unlocks stablecoins as money infrastructure. Regulatory clarity scales crypto innovation.

Bottom line: Bitcoin and macro markets are at a critical inflection. The sentiment bounce may not reflect economic health. Liquidity hasn’t returned in full. But when it does, it’ll be sudden, because in a world out of better options, BTC remains the only asset with perfect supply discipline.

Stay sharp. The rally’s real but so is the fragility. 👇🧵

Macro Pulse Update 20.07.2025, covering the following topics:

1️⃣ Macro events for the week

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ Inflationary impact of US tariffs

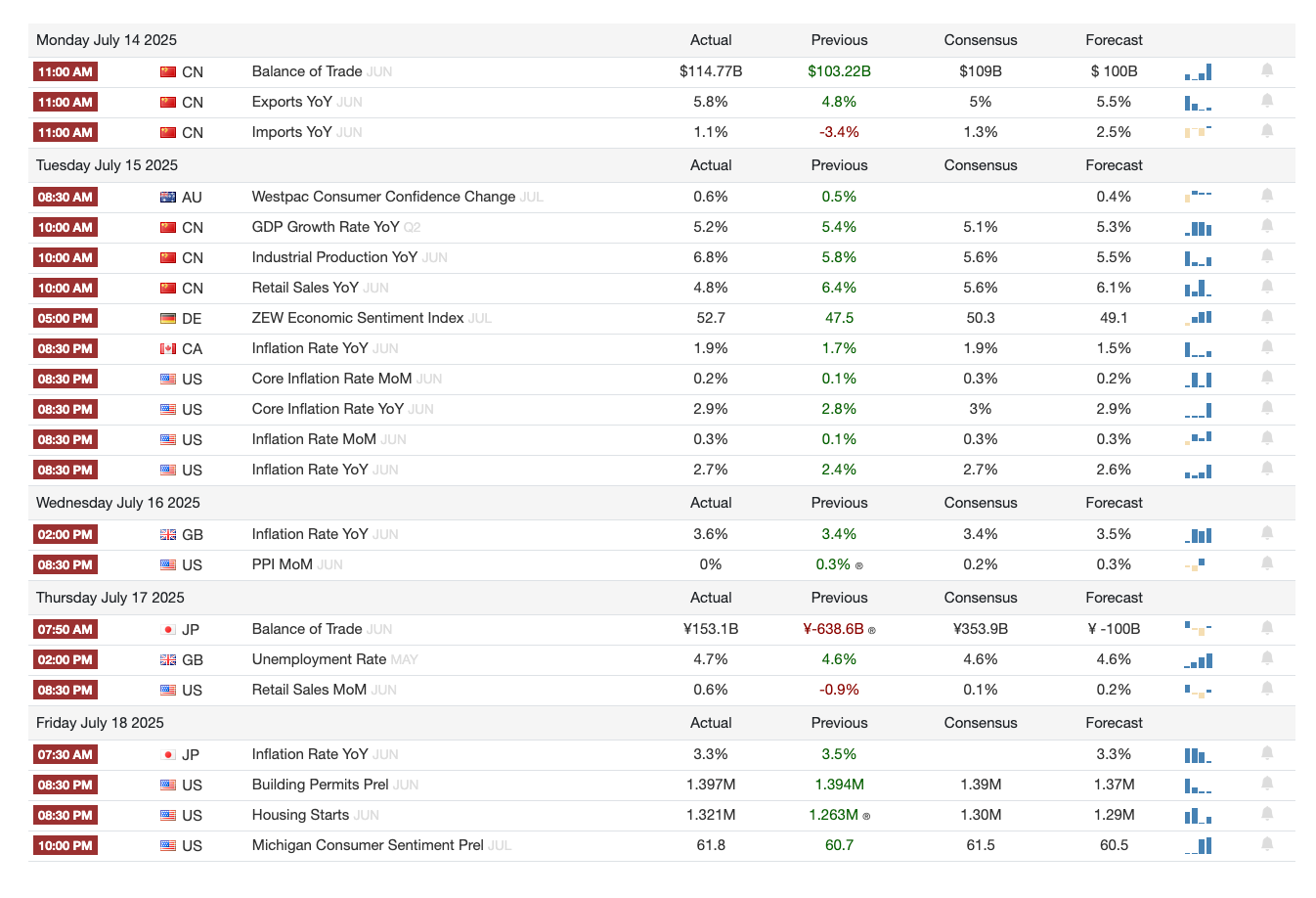

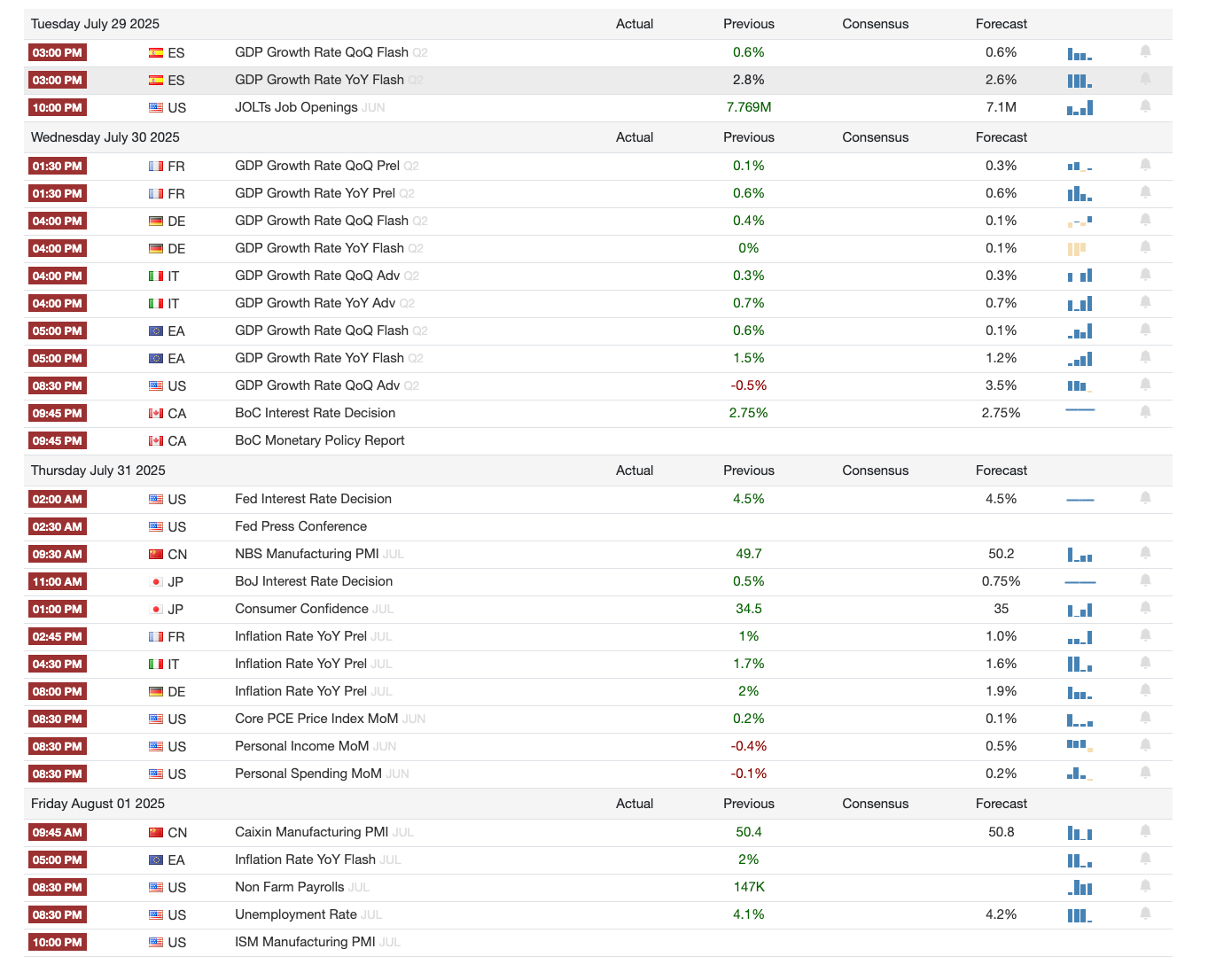

1️⃣ Macro events for the week

Last week

Next week

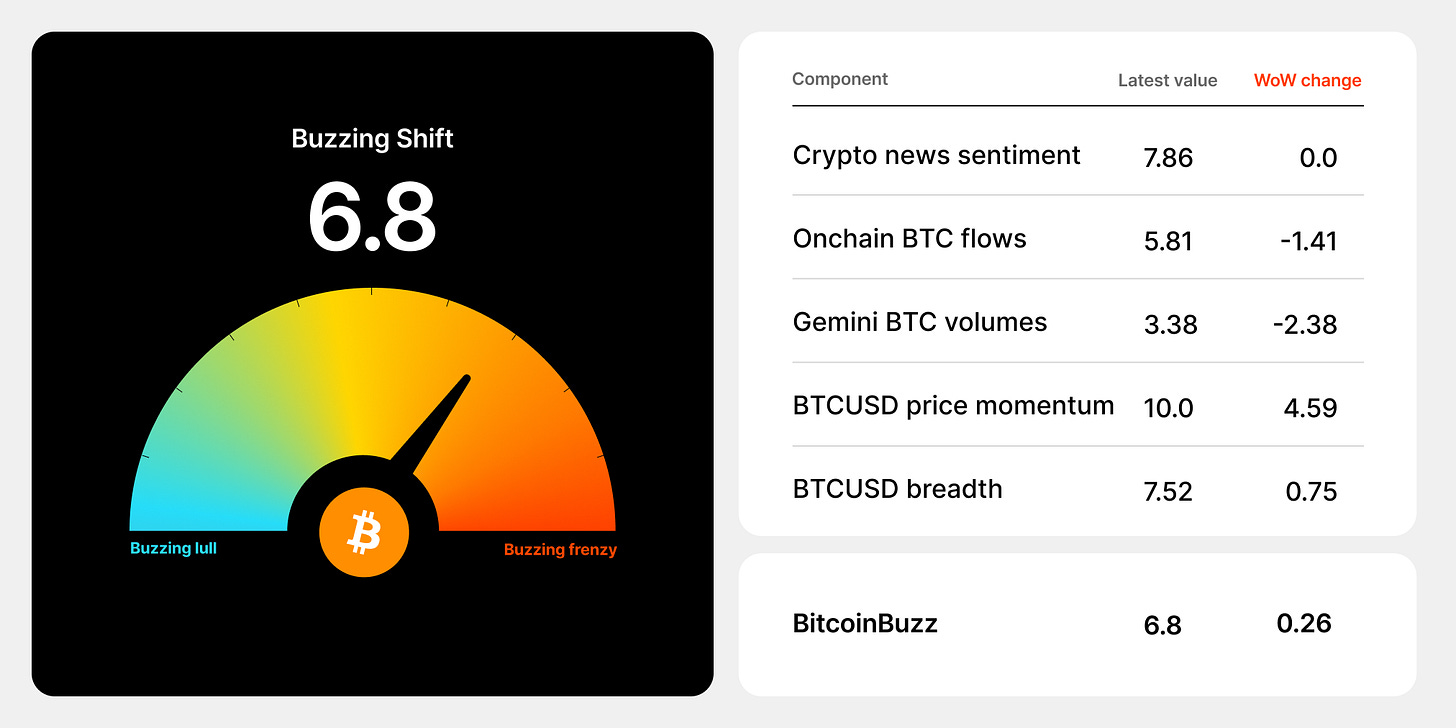

2️⃣ Bitcoin Buzz Indicator

Launches

Project X launched a HyperEVM DEX with 1M daily point rewards and no VC backing.

Ramses expanded to HyperEVM with liquid emissions, xRAM burns, and RXP rewards.

Nerite debuted $USND on Arbitrum with Superfluid streaming and integrations like Gearbox, Teller, and Bunni.

Cashmere Labs launched a public devnet for instant, slippage-free cross-chain transfers.

Boundless released Mainnet Beta with “The Signal” ZK consensus client for universal Ethereum verification.

Kinetiq launched kHYPE staking on Hyperliquid with live audits and kPoints rewards.

Plasma testnet went live—stablecoin-focused Layer 1 with PlasmaBFT and Bitcoin bridging.

ReyaChain launched as a perp DEX rollup with deep liquidity and CLOB execution.

Catex launched as Unichain’s MetaLayer using ve(3,3) + Uniswap v4 hooks.

Curve and Euler launched Telegram bots for mobile-first DeFi access.

Jupiter launched JLP Loans to unlock idle USDC with up to 86% LTV.

Aave Umbrella Staking launched on DeFi Saver with up to 12.55% APY.

Updates

GENIUS Act passed U.S. House, advancing stablecoin regulation via CFTC oversight.

Starknet integrated with Hyperlane for custom bridge deployment across 140+ chains.

Ondo Finance acquired Strangelove Labs and expands tokenized stocks to Bitget Wallet.

Origin Protocol begins OGN Buyback Blitz doubling to $200K/week.

xStocks collateralized on Kamino for stablecoin borrowing with Chainlink pricing.

YO launched smart lending vaults for yoUSD, yoETH, and yoBTC with 4x points.

USDT0 launched on Rootstock to unify stablecoin liquidity on Bitcoin’s EVM sidechain.

Aave integrated Sonic swap adapters for seamless collateral/borrow flows.

Neutrl added USDe to its treasury for synthetic dollar strategies.

GMX recovered $40M GLP from exploit; V1 paused, V2 unaffected.

infiniFi launched USDC vault on Morpho with loop-optimized iUSD strategies.

Lido V3 released testnet stVaults for customizable institutional staking.

Kamino updated incentives for USDS lenders and launched zBTC market on Solana.

Felix integrated kHYPE for leverage-looping and stablecoin CDPs.

Hamilton Lane expanded $SCOPE tokenized credit to Ethereum and Optimism.

PayPal’s PYUSD went live on Arbitrum, boosting Layer 2 adoption.

Kai Finance rolled out vaults with real-time LP analytics and UX upgrades.

PancakeSwap added ZKsync & Linea to crosschain swaps.

Bungee now enables gasless swaps across 25+ chains via Katana.

Issues

Kinto suffered $1.55M exploit via proxy attack; proxy-less $K v2 coming.

Arcadia Finance lost $2.5M from Rebalancer exploit; permissions should be revoked.

Safe experiencing UI issues from indexing service disruptions (not security-related).

Phantom faced swapper outage and data feed issues (now resolved).

Katana bridge withdrawals delayed to Ethereum due to prover congestion.

BigONE hot wallet compromised; $27M lost, user funds pledged as safe.

Upcoming

BlackRock to add ETH staking to ETF, aiming for 3–5% returns.

Ondo to launch tokenized stocks on BNB Chain and Sei.

ether.fi + Hyperliquid teased collaboration.

Inverse Finance proposed $2.6M raise to repay DOLA bad debt.

Sonic Labs hinted at major upcoming reveal.

Strata x Ethena collab vault teased with multi-reward yield.

Airdrops

Nexus launched Point Incentive 1.0 for Testnet III (1st dist. by July 22).

Satsuma launched Pre-Satsummer Quest on Galxe for early roles & boosts.

Pear Protocol Season 2 airdrop claim live via stPEAR.

Boundless launched $ZKC provers airdrop via competitive auctions.

Catex airdrop live for Uniswap v4 ecosystem users (some rewards $90K+).

DIA opened 91.5K token airdrop for DAO voters.

Turtle.Club launched TAC airdrop (fully unlocked + vesting phase live).

Farms

DeFi Saver added support for Pendle PT-sUSDE rollovers on Aave.

Falcon Finance extended USDC rewards on Euler with up to 24% APY.

Euler added USDtb lending rewards to Prime program.

HyperLend listed kHYPE with looping opportunities and liquidation warnings.

Hyperbeat launched lstHYPE vault for delta-neutral & yield-max strategies.

Resolv Labs TVL hit $413M, with RLP pool APRs reaching 40%.

3️⃣ Market overview

Landmark Crypto Legislation Passed by US House

The House passed two pivotal bills: the GENIUS Act, regulating stablecoins, and the CLARITY Act, establishing a comprehensive framework for digital assets.

After delays caused by Freedom Caucus opposition, a third bill banning a CBDC was passed separately to appease dissenters.

GENIUS Act heads to President Trump for signing Friday; CLARITY Act moves to the Senate next.

Why it matters: This is the most significant regulatory step the U.S. has taken to legitimize crypto markets since the inception of the industry.

Bitcoin Becomes the World’s 5th Largest Asset at $2.4T

Bitcoin’s price surged past $122K, topping Amazon, Google, and silver in market cap.

Fueled by ETF inflows exceeding $16B, policy optimism, and dovish Fed expectations.

Analysts forecast a potential rise to $150K, contingent on retail FOMO joining institutional flows.

ETH also climbed above $3,400, showing broader market strength.

Standard Chartered Debuts Institutional Spot Crypto Trading

The bank’s UK division now offers spot BTC and ETH trading to institutions, integrated with its FX platforms.

Clients choose between in-house custody or external ones like Zodia Custody.

The rollout marks the first global crypto trading launch by a major bank.

Future offerings to include non-deliverable forwards (NDFs) and structured crypto products.

DeFi Rebounds as TVL Surges to $126B (Up 46% Since April)

After a Q1 slump, DeFi TVL jumped from $86B → $126B—led by Ethereum ($72B) and Solana ($9B).

Key growth drivers:

Return of liquidity via spot BTC ETFs.

Regulatory clarity via GENIUS/CLARITY Acts.

Soaring stablecoin demand—USDC up 85% YoY, USDT up 41%.

Protocols leading the charge: Lido, Aave, and other staking/lending platforms.

Strategy Breaks 600K BTC Barrier with $472.5M Buy

Strategy (formerly MicroStrategy) acquired 4,225 BTC this week, now holding 601,550 BTC (~$73B value).

Funded through a mix of common stock and three preferred shares (STRK, STRF, STRD).

Q2 earnings showed $14B in unrealized gains; now targeting $84B raise through 2027.

Still the largest corporate bitcoin holder, dwarfing the next closest.

Additional Insights

Institutional adoption continues to outpace expectations, with banks, ETFs, and public companies doubling down.

Stablecoins are now a systemic pillar of DeFi, reinforcing the need for regulatory frameworks like GENIUS.

Political tailwinds are accelerating, with pro-crypto stances gaining ground ahead of the 2026 midterms.

4️⃣ Key Economic Metrics

Update on US Equities

1. US Equities Show Unexpected Resilience

Despite trade war tensions, US equity markets have rebounded strongly.

This recovery is partly explained by a weaker dollar, which boosts:

The USD value of foreign earnings for US companies.

The competitiveness of US exports, potentially lifting corporate profits.

2. Dollar Weakness Defies Expectations

Classical economic theory predicts tariffs should strengthen the currency.

In contrast, the dollar has depreciated, likely due to capital flight outweighing tariff impacts.

This surprised investors and added a valuation boost to equities.

3. US vs. European Equities—Depends on Currency Lens

In local currencies, US equities closed the gap with European markets.

But when evaluated in USD, European equities outperformed, boosted by rising euro and pound.

Suggests global investors may favor European prospects over the US due to trade tensions.

4. Mixed Investor Sentiment & Risk Perception

Low bond yield spreads (junk vs. Treasuries) suggest modest perceived risk.

Investors may be comforted by:

The “One Big Beautiful Bill” potentially lowering corporate taxes.

A still-healthy economy with low inflation expectations.

Some believe trade threats are just negotiation tactics, not policy certainties.

5. Markets Ignoring Tariff Warnings… For Now

Equity markets shrugged off Trump’s threats of massive tariffs on pharma (200%) and copper (50%).

But copper prices spiked ~10%, showing not all sectors are immune to tariff threats.

Investor complacency may mask long-term risks as historically high tariffs remain in place.

6. Uncertainty Is Hurting Investment Decisions

Constant shifts—tariff threats, implementations, reversals, delays—create strategic paralysis.

Companies are likely delaying investments, which can dampen economic activity.

If more firms postpone capital decisions, this may drag on GDP and productivity.

7. Complacency May Be Temporary

Final tariff decisions due before August 1 could reshape investor expectations.

With markets stable (equities up, bond yields low), there’s little immediate pressure on the administration to pull back on trade policy.

This could change swiftly if sentiment or data turns.

Renewed US trade war update

1. A Shift Toward Sustained, High US Tariffs

Recent trade deals (UK, China, Vietnam) have kept tariffs historically high, signaling a new norm.

Final tariff determinations are due August 1, but the framework is already in motion.

If implemented, average US tariffs may surpass levels not seen in over a century.

2. US Targets South Korea and Japan with 25% Tariff Threats

Trump threatens to end the US-Korea free trade agreement unless Korea boosts investment in the US.

Japan is rattled, despite being the largest foreign investor and job creator in the US.

These moves prioritize bilateral trade deficits over broader economic logic, risking economic harm to both partners and US consumers.

3. Southeast Asia Now in the Crosshairs

Tariffs between 25% to 40% are being considered for countries like Indonesia, Malaysia, Thailand, and the Philippines.

These nations have absorbed China-diverted investments—now at risk.

Could severely disrupt global supply chains and hit US consumer prices hard.

4. Canada Faces 35% Tariff and Geopolitical Pressure

Tariffs exclude current FTA-covered goods but may change.

Tied to geopolitical issues, including cooperation on fentanyl control.

Markets wavered: CAD fell, equities dipped, but some expect it’s negotiation theater.

Canada responded with a $1B anti-fentanyl program.

5. Brazil Faces 50% Tariff—For Political Reasons

Despite a US trade surplus, Brazil is threatened with a 50% tariff due to the Bolsonaro prosecution.

Hits likely to include:

Coffee (Brazil = #1 supplier to US)

Steelmaking coal, regional airplanes

Led to a plunge in Brazilian equities and currency, and a surge in coffee futures.

6. Copper: The First Confirmed 50% Tariff

Effective August 1, the 50% copper tariff will hit an import-heavy supply chain (US imports 60% of its copper).

Prompted price spikes and inventory surges in anticipation.

Mining company stocks fell due to global market disruption risks.

7. Broader Economic Risks Emerging

Tariffs likely to:

Raise inflation, pressuring Fed policy.

Weaken consumer purchasing power.

Slow GDP growth, risking recession.

Countries may retaliate or divert trade partnerships, as signaled by the EU and Malaysia.

8. Strategic Uncertainty Is Mounting

Constant tariff threats, delays, and reversals have created strategic paralysis.

Companies are delaying investments due to policy unpredictability.

If tariff levels continue rising, the US economy and global trade may face structural consequences.

5️⃣ Inflationary impact of US tariffs 🔴

1. Tariffs Haven’t Spiked Consumer Prices

Despite expectations, US inflation hasn’t surged, even after significant tariff hikes.

The Biden/Trump administration claims this as a win, citing falling import prices like Japanese vehicles, which have seen sharp price cuts as exporters absorb costs to protect market share.

2. Lag Effect Likely Masking True Inflation

The lack of inflation may be temporary:

Producers are taking margin hits, not passing on costs (yet).

Tariff impacts may be delayed as they ripple through supply chains.

Inventory buffers built in late 2024 are dampening immediate pricing pressures.

3. Pre-Tariff Import Surge Distorted Signals

After the 2024 election, importers front-loaded shipments to beat the tariff clock.

Result: a temporary inventory glut, allowing companies to sell without adjusting prices upward.

Once these inventories are exhausted, price hikes may follow, especially if tariffs remain high.

4. Inflation Risk Still Looms

The current phase may represent the “quiet before the storm”.

As supply tightens and margin compression becomes unsustainable, consumers could face rising prices, especially in:

Durable goods (e.g., autos, electronics)

Raw materials (e.g., copper, steel, aluminum)

Consumer staples imported from Southeast Asia

5. Political Spin vs. Economic Timing

The White House is using current price stability to frame tariffs as pro-growth.

However, experts warn that this may be a misleading early signal and the inflationary drag is still loading.