Ethereum’s newest L2 MODE has seen an exponential growth since the start of the year, growing up to a $500M TVL.

Bringing you the best way to farm yield on $MODE, with their LGE going live next week on @BitgetGlobal.

A dive into MODE’s new powerhouse 👇🧵

Ironclad Finance is a decentralized, non-custodial liquidity market where users can be depositors or borrowers.

The project has been been developing lending protocols, stablecoins, and derivatives for nearly 4 years.

It’s safe to say their team is nothing short of experience.

Ironclad previously worked on Radiant Capital V2, managed security for 0xDAO (over $4B inTVL), and developed the Reaper Farm App.

Ironclad’s $iUSD is the first native stablecoin on MODE.

It’s CDP-backed and designed to deliver unparalleled support to LRT assets, BTC, and MODE.

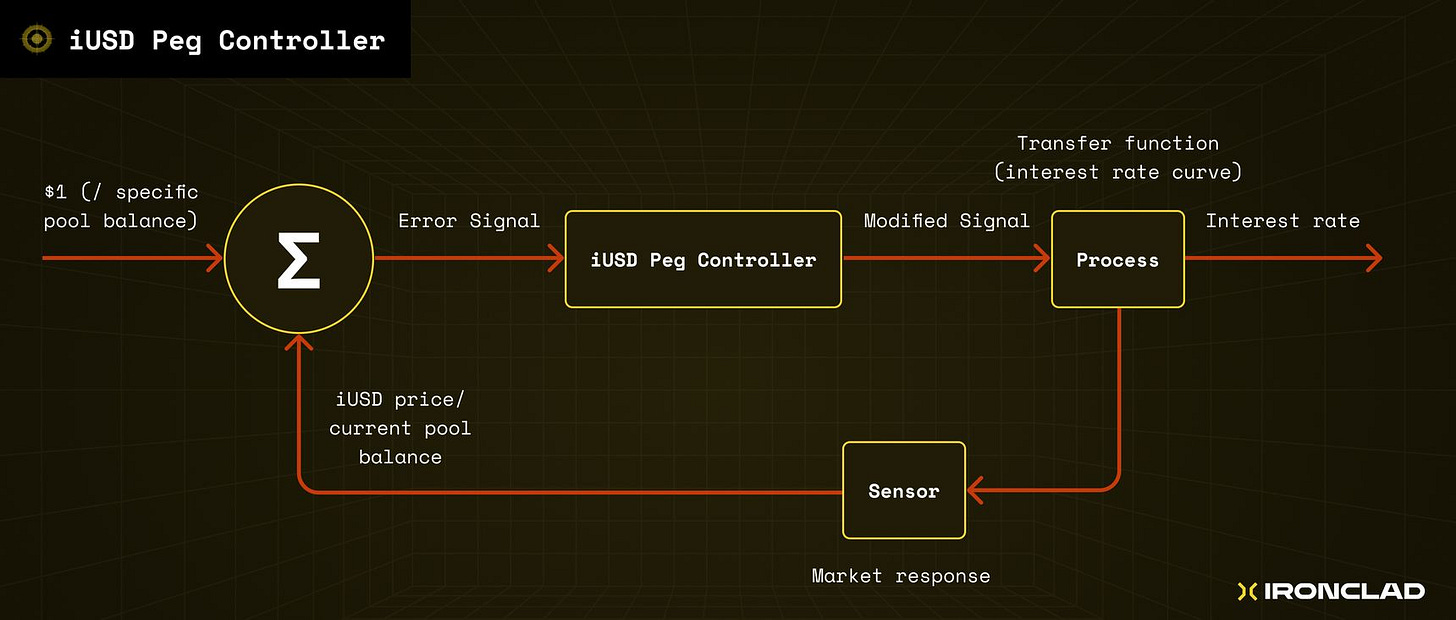

How does iUSD achieve stability? Through PID controllers—a pretty neat engineering trick.

Ironclad uniquely applies PID controllers by using a custom oracle to maintain a perfect 50/50 asset balance in its liquidity pool.

Adjusting staking yields and collateral management rates ensures the pool remains 100% healthy

What does Ironclad offer?

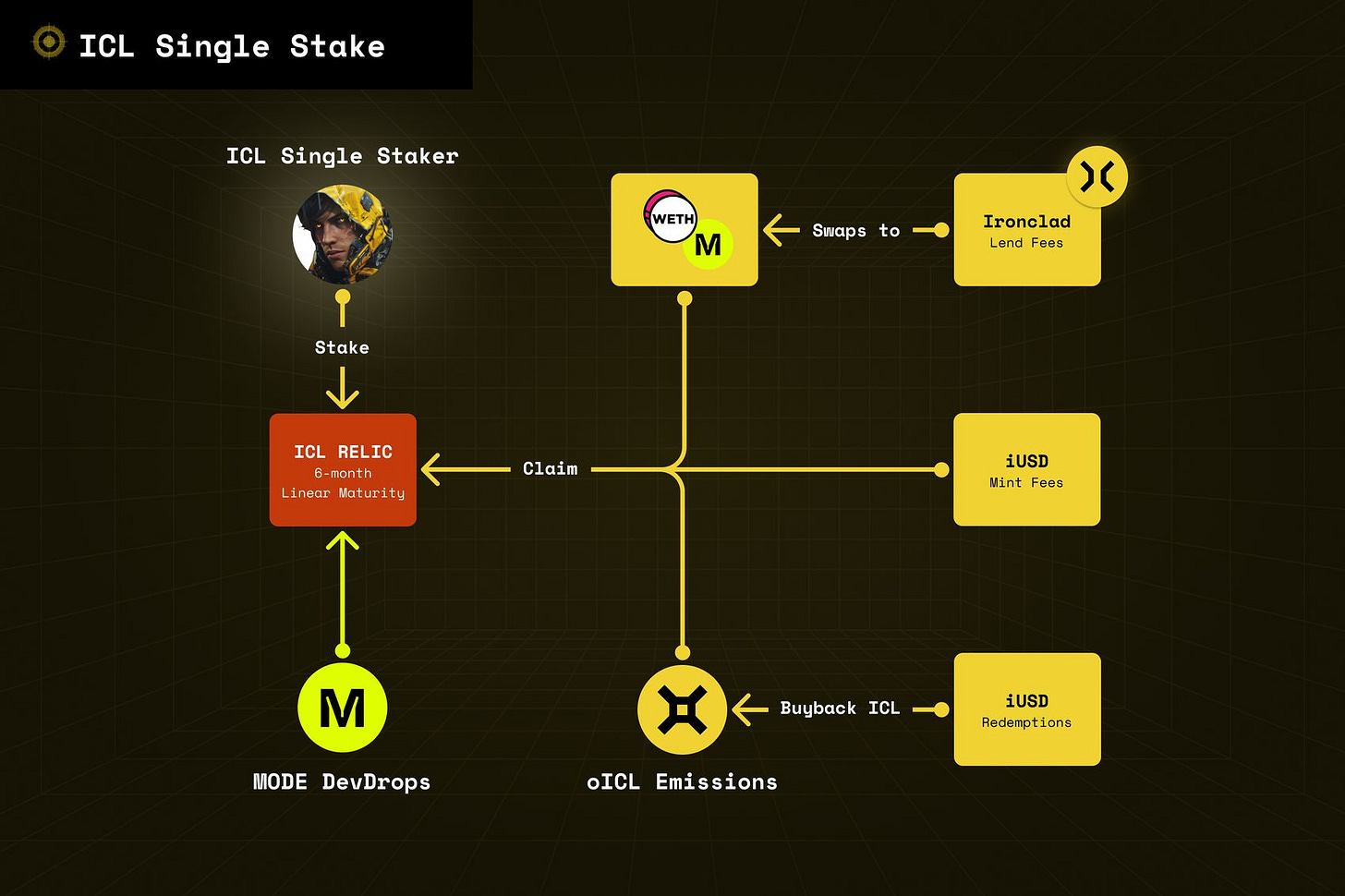

The ICL Staking unlike anything you’ve seen before.

It’s flexible and fully liquid, rewarding users based on stake size and duration.

By depositing ICL, users can earn WETH, MODE, and oICL emissions, with longer stakers receiving higher rewards.

Protocol revenue from the lending module and the upcoming Ironclad CDP is distributed to stakers.

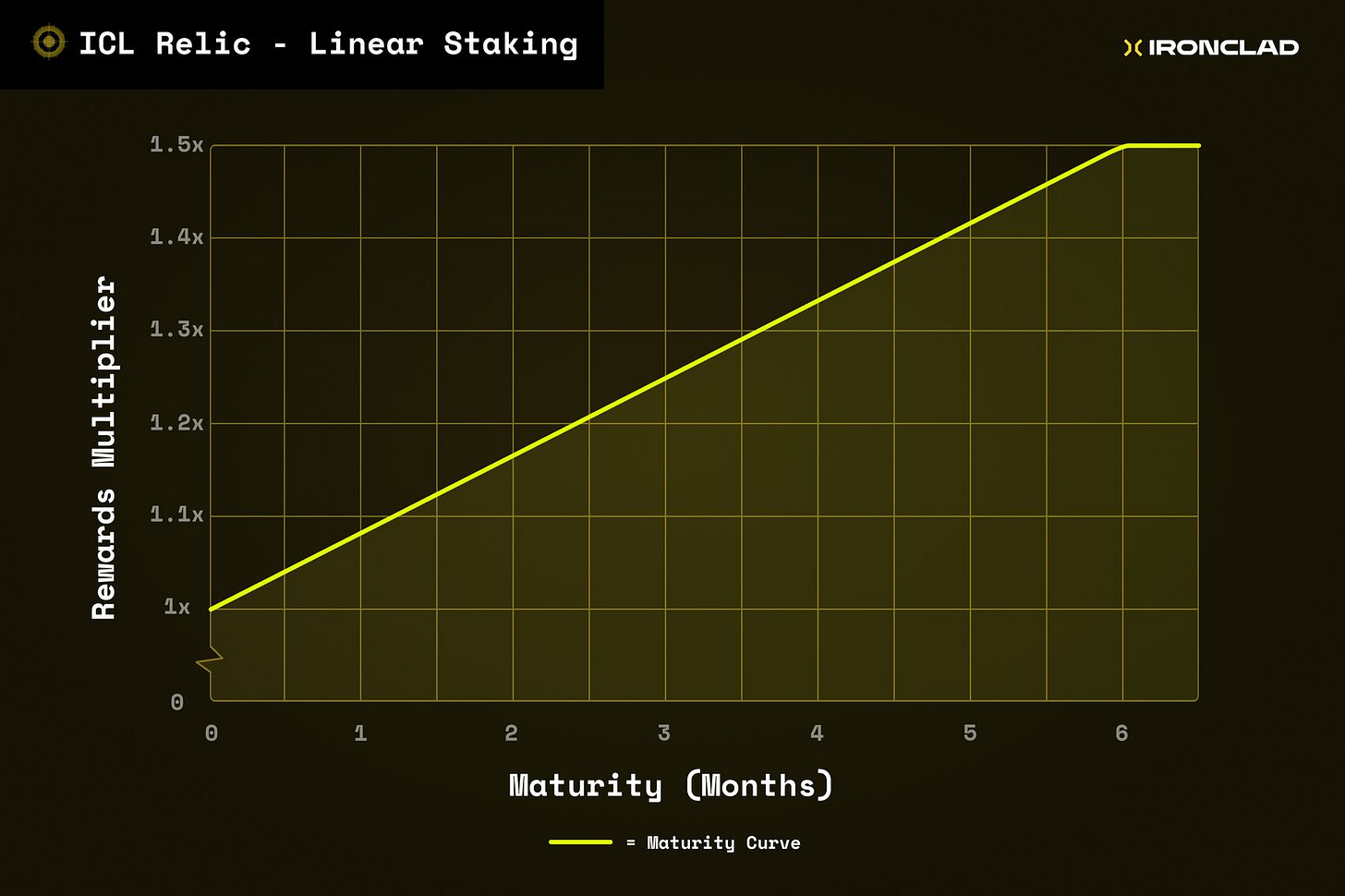

That’s not all - Maturity is rewarded with a linear boost over six months, up to a 1.5x multiplier!

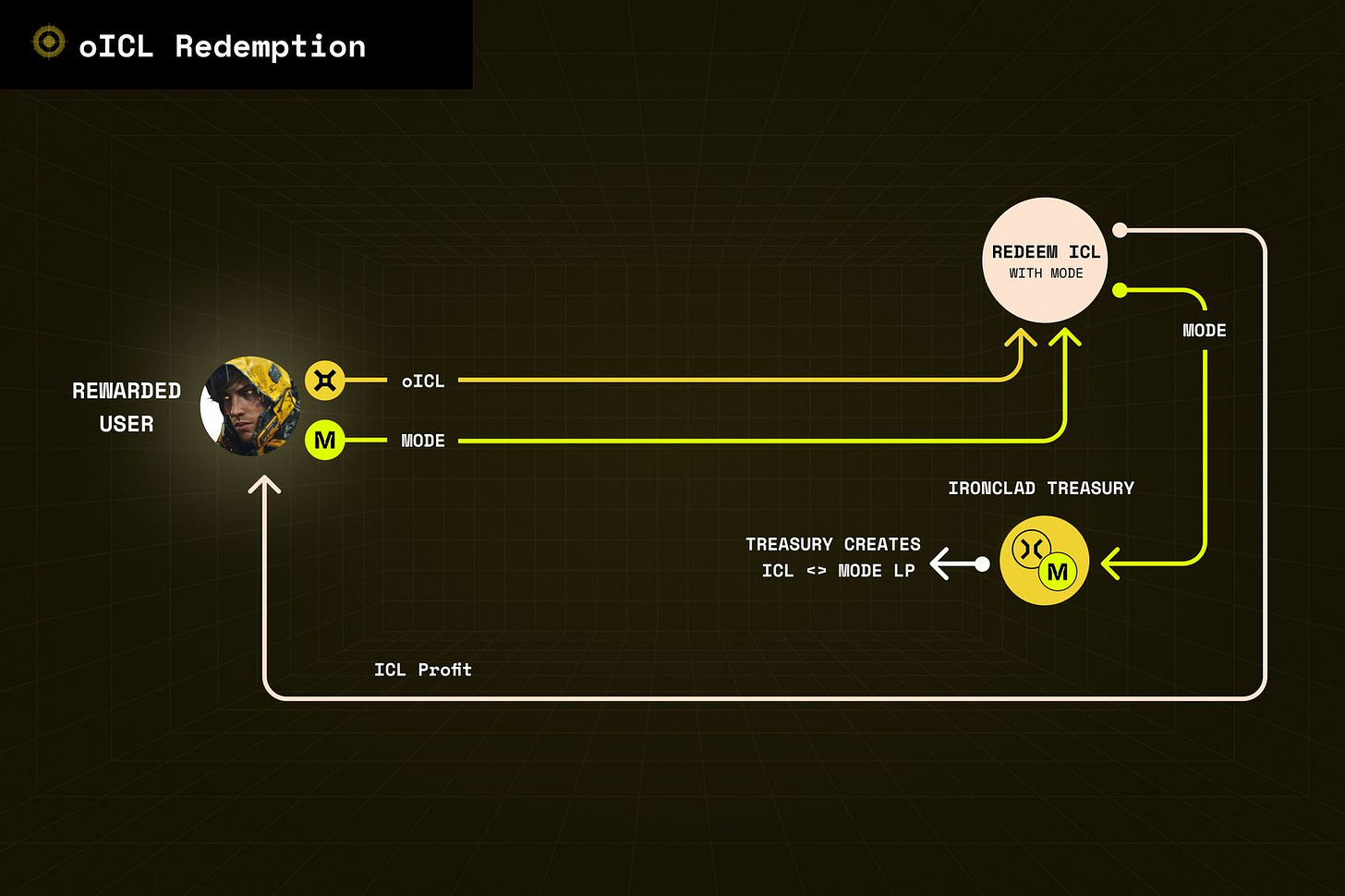

Their future incentives, including airdrops, will be in the form of oICL, an ERC20 option token redeemable for ICL at a 50% discount.

Adopting oICL also routes fees to ICL stakers, promoting sustainable growth and supporting long-term commitment to the protocol.

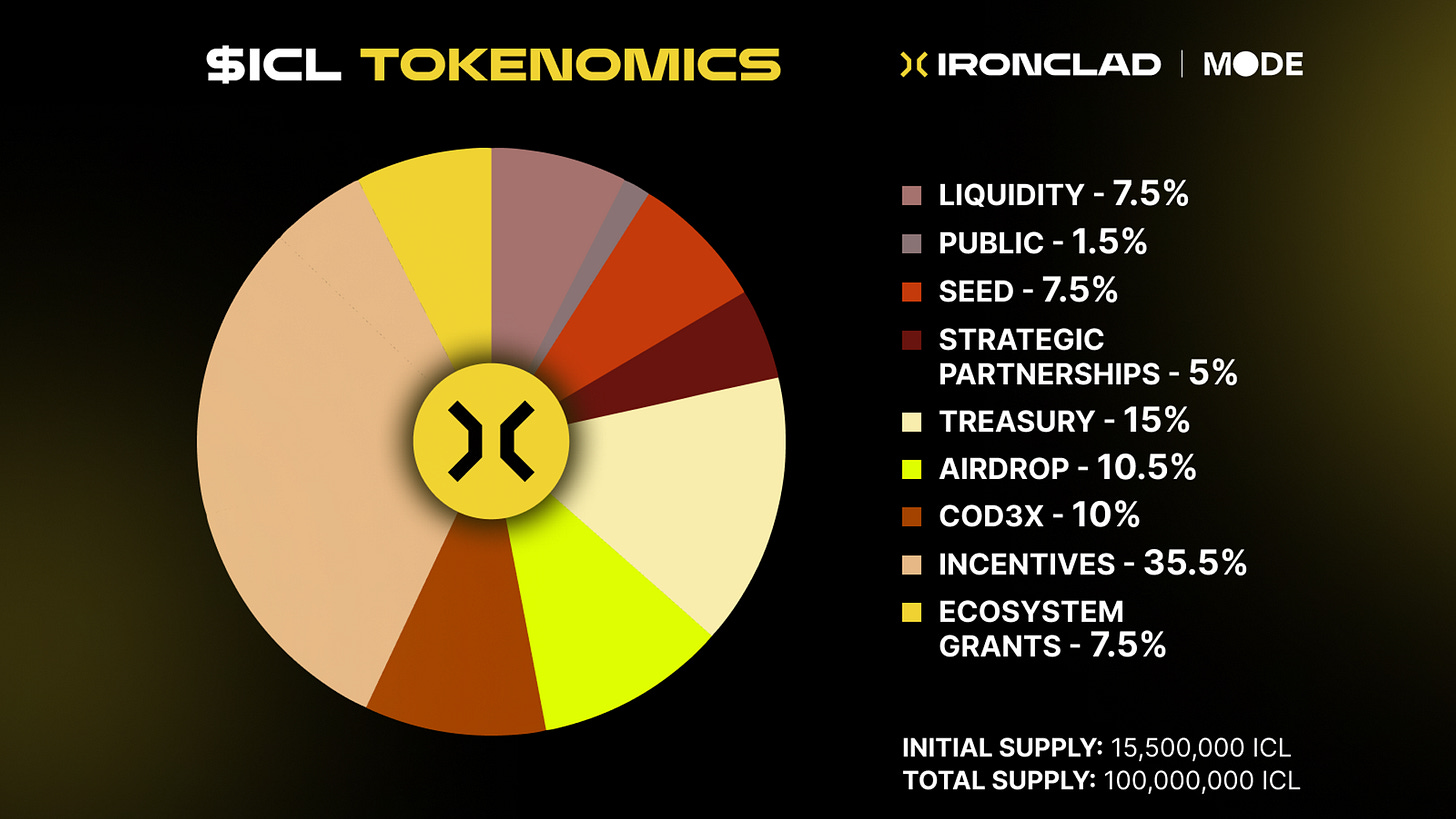

Here’s a glimpse at the $ICL tokenomics -

Ironclad’s LGE is all set for 15th July, marking the token's launch on a DEX.

The liquidity is seeded at a 20M FDV on Velodrome via an ICL-MODE pool.

https://x.com/IroncladFinance/status/1803171074588504500

On Day 1 of the LGE, ICL will also be listed @BitGet, which will support staking ICL with several months of rewards for stakers.

The airdrop will also follow shortly, allowing time to secure the TWAP oracle for oICL redemptions.

@Ironcladfinance has a exciting roadmap lined-up for Q3, including staked iUSD and the release of a CDP Module. It’s something you don’t want to miss out.

Twitter:

looks like good replacement for Radiant