As 2024 ended and 2025 began, I reflected on my crypto journey and drawing insights from OpenGuild Vietnam discussions, yappers around Ethereum and Optimism Superchain.

Here’s a deep dive into the key technical and strategic developments shaping Polkadot and Ethereum in 2025👇

General Crypto Market Overview

The market at large is poised for regulatory and technological shifts, particularly in Vietnam and across the AI x Crypto intersection.

1. Vietnam’s Legalization of Crypto

The government’s plan to finalize a legal framework for crypto by May 2024 may herald a new wave of legitimate crypto enterprises.

Regulatory clarity can reduce uncertainty, attracting higher-quality projects and institutional interest. If properly structured, Vietnam could become a hub for blockchain startups, bridging Southeast Asia’s vibrant tech scene with global crypto markets.

2. Stablecoins and User Adoption

Stablecoin usage has grown significantly and is likely to continue doing so. Enhanced stablecoin infrastructure could drive broader adoption, especially in regions where local currencies see volatility.

Stablecoins remain one of crypto’s most potent gateway use cases. By providing a safe medium of exchange, they facilitate everyday transactions and protect value in times of local currency fluctuation. Continued improvements, such as more efficient on/off ramps, could further embed stablecoins into global finance.

3. AI Agent Ecosystem

Since late 2024, the rise of AI x Crypto solutions has garnered increasing attention from investors and incubators like Y Combinator.

AI agentic ecosystems (e.g., fully autonomous trading bots, decentralized AI modules, on-chain AI oracles) promise to streamline tasks that traditionally require human intervention. As these systems mature, they could introduce nuanced legal and technical questions around governance, accountability, and data privacy.

4. Proof of Personhood

The fusion of AI and crypto naturally raises concerns about identity verification, especially as deepfakes and AI-generated personas proliferate. Proof of Personhood builds upon decentralized identity solutions to ensure unique human verification.

If AI can emulate human-like behavior on-chain, robust identity mechanisms become more critical. Proof of Personhood may become a standard for social apps, DAO membership, or token airdrops. Expect further innovation in cryptographic methods (e.g., zero-knowledge proofs) to maintain privacy while verifying authenticity.

Ethereum Ecosystem

Ethereum’s 2025 evolution centers around chain abstraction and protocol-level upgrades designed to enhance network efficiency, L2 throughput, and user experience.

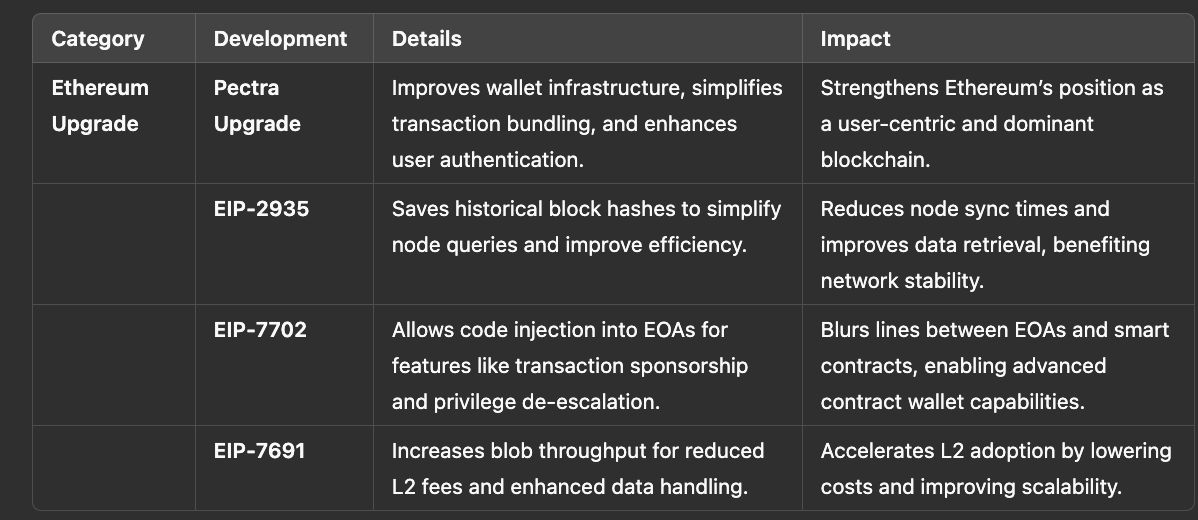

1. The Pectra Upgrade

The Pectra upgrade on Ethereum stands out as a critical milestone, focusing on wallet infrastructure improvements and addressing broader ecosystem challenges. With chain abstraction becoming a key priority across blockchain platforms, Pectra’s success could redefine how users interact with Ethereum.

From my perspective, Ethereum’s mainnet is at a crossroads. The rise of powerful L2s like Optimism, Arbitrum, and zkSync has amplified the pressure to maintain Ethereum’s status as the “gold standard.” Pectra has the potential to bridge critical gaps—simplifying wallet experiences by tackling pain points such as high gas fees, transaction bundling, and user authentication. If implemented effectively, it could significantly enhance user onboarding while reinforcing Ethereum’s dominance in an increasingly competitive ecosystem. To me, this is Ethereum doubling down on user-centric innovation, a move that could future-proof its position in the blockchain hierarchy.

2. Notable EIPs for 2025

EIP-2935: Save Historical Block Hashes in State

Storing block hashes over a defined period simplifies node queries for block verification, boosting efficiency and reducing overhead.

Analysis: This is a “network plumbing” improvement that isn’t flashy but matters deeply for node operators. Improved data retrieval can also help reduce chain reorganizations and node sync times.EIP-7702: Set EOA Account Code for One Transaction

Extends Externally Owned Accounts (EOAs) by allowing code injection via a specialized transaction type. Unlocks functionalities like batching, sponsorship (paying gas for someone else), and privilege de-escalation (lowering permissions without changing addresses).

Analysis: This EIP could blur the lines between EOAs and smart contracts, potentially driving more sophisticated contract wallets (e.g., ERC-4337-based solutions). If adopted widely, it might catalyze user-friendly features like transaction sponsorship or advanced multi-sig solutions.EIP-7691: Blob Throughput Increase

Building upon EIP-4844 (Proto-Danksharding), which introduced “blobs” to reduce L2 fees, this EIP increases the number of blobs per block, further lowering L2 costs and enhancing throughput.

Analysis: The synergy between L1 and L2 scaling is crucial for Ethereum. By expanding blob capacity, Ethereum reaffirms its commitment to maintaining an affordable L2 environment. If L2s can handle more data without incurring high fees, user adoption of layer-two solutions will likely accelerate.

Polkadot Ecosystem

Polkadot remains a hotbed for cross-chain experimentation. In 2025, several developments aim to solidify Polkadot as the go-to infrastructure layer for interoperable and high-throughput decentralized applications.

1. JAM Chain and Its Innovations

JAM Chain stands out as a next-generation blockchain protocol generating substantial buzz within the Polkadot ecosystem. If successful, JAM could underscore Polkadot's commitment to plug-and-play style multi-chain architecture.

Milestone 1 & JAM SDK

A significant marker for the JAM team is completing [JAM Milestone 1], which includes rolling out a development toolkit known as the JAM SDK. This SDK should simplify building on top of JAM, potentially attracting a broader range of developer types (from traditional backend engineers to specialized blockchain devs).JAM CoreVM

The introduction of JAM CoreVM may redefine how real-time transactions and application execution are handled. By swapping the conventional block finalization method for a “[Refine-Accumulate]” mechanism, JAM CoreVM aims to provide near real-time finality.

This approach could significantly reduce latency, which is a perennial challenge for blockchains striving for quick confirmations without sacrificing security. If executed efficiently, it might encourage more latency-sensitive dApps—think high-frequency trading, real-time gaming, or event-driven DeFi—to migrate to or launch on Polkadot’s parachains powered by JAM.CoreChains, CorePlay

Upon completing the virtual machine layer, the JAM team plans to expand functionality via CoreChains and CorePlay. While further details are limited, these solutions appear to extend the architecture of JAM, likely targeting niche use cases such as gaming ecosystems, or enterprise-level blockchains where modular design is critical.

The Polkadot ethos revolves around specialized parachains. JAM’s approach to building out CoreChains suggests a potential shift towards sector-specific functionality. If these specialized chains each address unique challenges—like compliance, gaming, or data management—it can enrich Polkadot’s value proposition as a multi-chain network.

2. Polkadot Network-Wide Improvements

Outside of JAM’s initiatives, Polkadot itself will undergo notable upgrades, reflecting lessons learned from the past year’s network stress tests and community feedback.

Polkadot Hub (Plaza)

The completion of [Polkadot Hub (Plaza)] focuses on consolidating ecosystem tools, infrastructure, and documentation.

Analysis: As the ecosystem expands, a unified hub makes sense for newcomers and seasoned developers alike. Centralizing resources can significantly reduce complexity, a vital step to attracting more developers and end-users amid fierce competition from other L1s and L2s.XCM v5

Cross-chain messaging (XCM) is key to Polkadot’s interoperable vision. The arrival of XCM v5 promises more robust cross-chain communication and an improved user experience.

Analysis: Cross-chain operability remains a holy grail in crypto. While existing solutions like Wormhole and LayerZero help bridge ecosystems, XCM is Polkadot’s specialized tool. Making XCM more efficient and secure could make inter-parachain operations feel “native,” potentially lowering friction for both users and developers.Elastic Scaling

After a critical spam attack on Kusama in December 2024, Polkadot’s Elastic Scaling mechanism demonstrated the ability to reach up to 143k TPS. This achievement underscores Polkadot's capacity to adapt under high load.

Analysis: A chain’s ability to handle sudden traffic spikes is critical. The successful response to a spam attack can be a marketing boon, demonstrating resilience and reliability. However, the real test comes in managing legitimate traffic surges—particularly if Polkadot-based dApps achieve mainstream popularity.

3. Chain Abstraction & Omni-Network Developments

Polkadot’s overarching strategy increasingly revolves around making the network more accessible to developers and users, ensuring that underlying complexities remain behind the scenes.

Unified Address Format

By offering a single address format across parachains, Polkadot aims to remove the confusion caused by multiple wallet standards.

Simplifying addresses is no small feat, but it’s a surefire way to cut friction in cross-chain interactions. It is reminiscent of how large ecosystems (e.g., Apple’s iOS) unify user experiences across multiple apps and services.Omni-node & Polkadot SDK

Maintaining up-to-date node software for dozens of parachains is resource-intensive. Omni-node aims to streamline this by optimizing resource allocation.

From a developer’s standpoint, fewer operational overheads are always welcome. However, the complexity of Polkadot’s multi-chain approach might require continuous improvements in developer tooling, so expect iterative enhancements beyond Omni-node.

Final Thoughts

Meanwhile, broader market trends, including Vietnam’s regulatory moves, stablecoin enhancements, and AI-driven agentic systems, underscore how rapidly the crypto sphere is evolving.

Ethereum continues to iterate with the Pectra upgrade and new EIPs, solidifying its L1 as a reliable settlement layer for the booming L2 ecosystem.

On Polkadot, innovations like JAM Chain, Omni-node, and improved XCM aim to refine cross-chain usage and scaling.

Ethereum and Polkadot in the same publication?? You don’t like money right? 🤣