Unleashing the floodgates of $60k in incentives

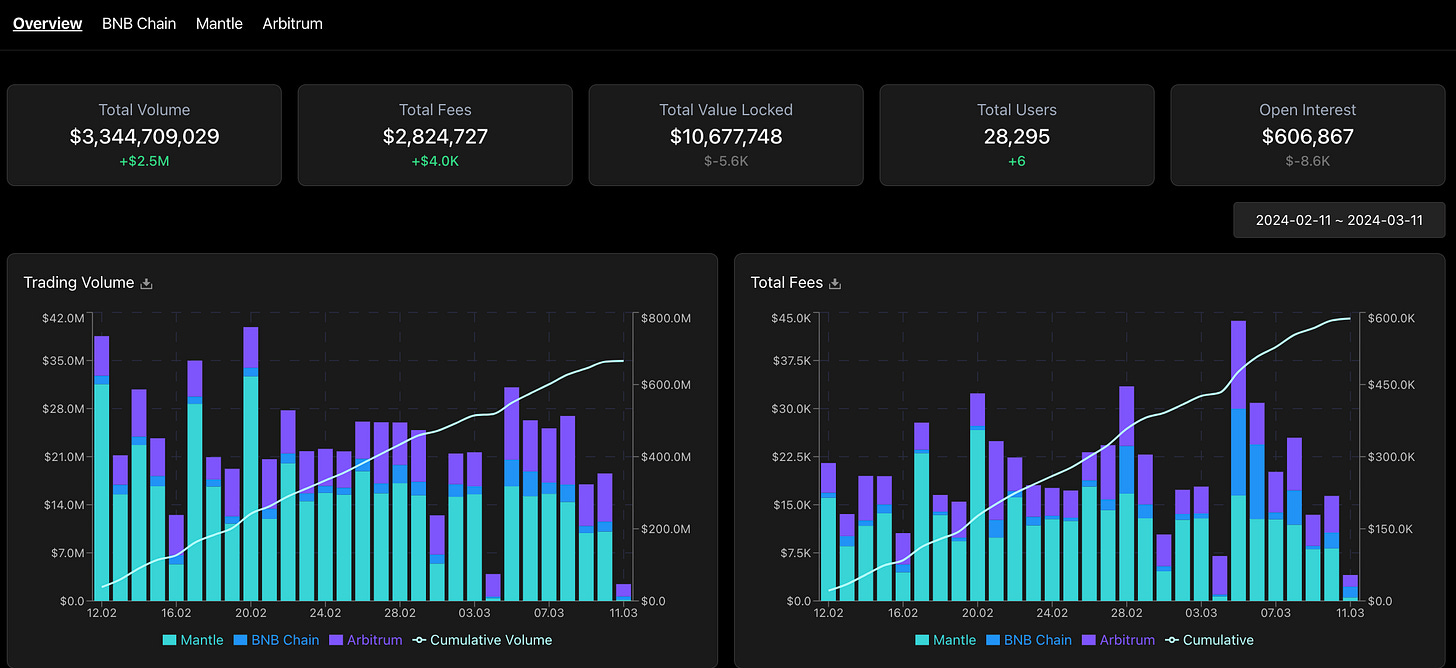

While we’re only through 11 days of March, they have generated more than $800k of fees

My bull thesis on this undervalued dark horse at only $3.5M MC 🧵 👇

TLDR on my bull thesis for $KTC:

Undervalued MC at $3.5mil only

Metrics smashing ATH after ATH

$3.3B in trading vol, $10M TVL, $2.8M in fees

Floodgates of $60k incentives

LTIPP grants could push @KTX_finance to be the top perp dex on Arb

Venturing into GambleFi narrative with gamified degen trading approach

Strong partnerships with some of the top protocols: @Vaultkaofficial @PolyhedraZK @PythNetwork @0xMantle

Here’s a deep dive into it 👇

🔷 Market Sentiments 🔷

The derivatives sector have reached nearly ATH from the peak of ~$3B we saw in 2022.

Onchain derivatives and perpetuals trading is coming back

And it is evident that the Perps sector is at the core of it

Derivatives volume have also been looking really strong reaching an all time for the year.

There’s is also huge growth across the past 30 days of up to 90% increase in TVL.

Highest record growth from @aevoxyz, probably also because of its binance launchpool listing.

But there is another perps dark horse at only $3.5m MC, with constant momentum for the past months going undernoticed @KTX_finance

🔷 Metrics 🔷

@KTX_finance aims to provide a permissionless, decentralized manner of trading perpetuals on-chain:

Good partners, such as Binance

Huge volume & fees

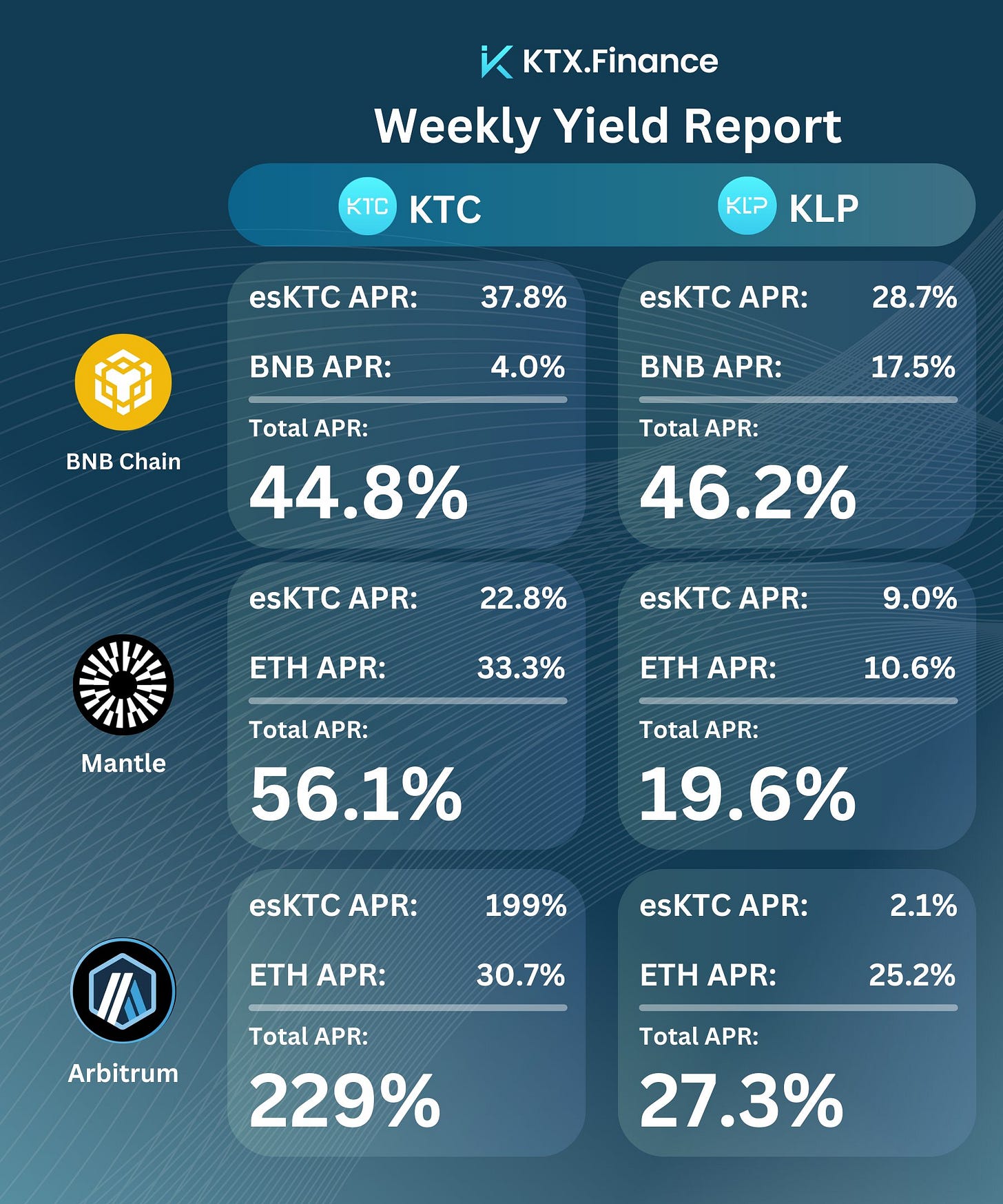

One of the best yield source on Arbitrum

Their metrics are smashing ATH after ATH and particularly very strong in March.

Till date they have $3.3B in trading vol, $10M TVL, $2.8M in fees

🔷 LTIPP 🔷

Also, @KTX_finance is asking for a 500k ARB (worth ~$1M) and I do see why, given the metrics that they have shown, they can be one of the best eligible candidates for it:

Their LTIPP’s objective is to increase total trading volume on KTX by introducing incentives and enhancing user and developer engagement.

Here is how they plan to do it:

Fee Reductions: Allocate 50% (250,000 ARB) to lower trading fees through rebates, encouraging higher trading volume.

Enhanced Incentives for KLP Depositors: Use 31.25% (156,250 ARB) to improve KLP APR and value of Arcade Points, incentivizing more KLP deposits.

Enhanced Mini Game Rewards: Dedicate 13.75% (68,750 ARB) to increase rewards for participating in mini-games, boosting engagement.

Builder Incentives: Reserve 5% (25,000 ARB) to motivate developers through incentives, supporting platform growth and innovation.

🔷 Roadmap 🔷

Q1 2024:

Increasing user base on Arbitrum through community-exclusive campaigns and NFT collection.

Q2 2024:

Launch of at least 2 new games to enhance the gamified trading experience

Tradingview integration for on-chart position adjustments.

Introduce Price Alert Bots for real-time position updates via Telegram or email.

Q3 2024:

Games expansion

Integrating account abstraction wallets for easier transaction management.

Q4 2024:

Plan to upgrade the trading engine, considering a hybrid model to enhance capital efficiency and support more trading pairs.

🔷 Leverage Vaults 🔷

They have also partnered with one of my favorite protocols: @Vaultkaofficial to introduce their KLP Leverage Vault:

Supercharged yields

$60K prize pool as trading rewards, which will incentvise trading

This will result in significantly more fees collected during this period

Limited Capacity to Tequila Vault

Vaultka has been facing overwhelming demand in the past months, and they couldn't accept fresh Vault deposits due to its USDC pool hitting its lending cap.

This time lending caps are open for a limited time and that users can finally deposit into the vault.

Conclusion

KTX_finance emerges as a promising dark horse in the DeFi space, with its undervalued market cap and strong performance metrics signaling vast growth potential.

Through strategic incentives, innovative partnerships, and a forward-looking roadmap, it positions itself for dominance in the onchain derivatives and perpetual dex sector on Arbitrum.

Twitter: https://twitter.com/arndxt_xo/status/1767148284991471746