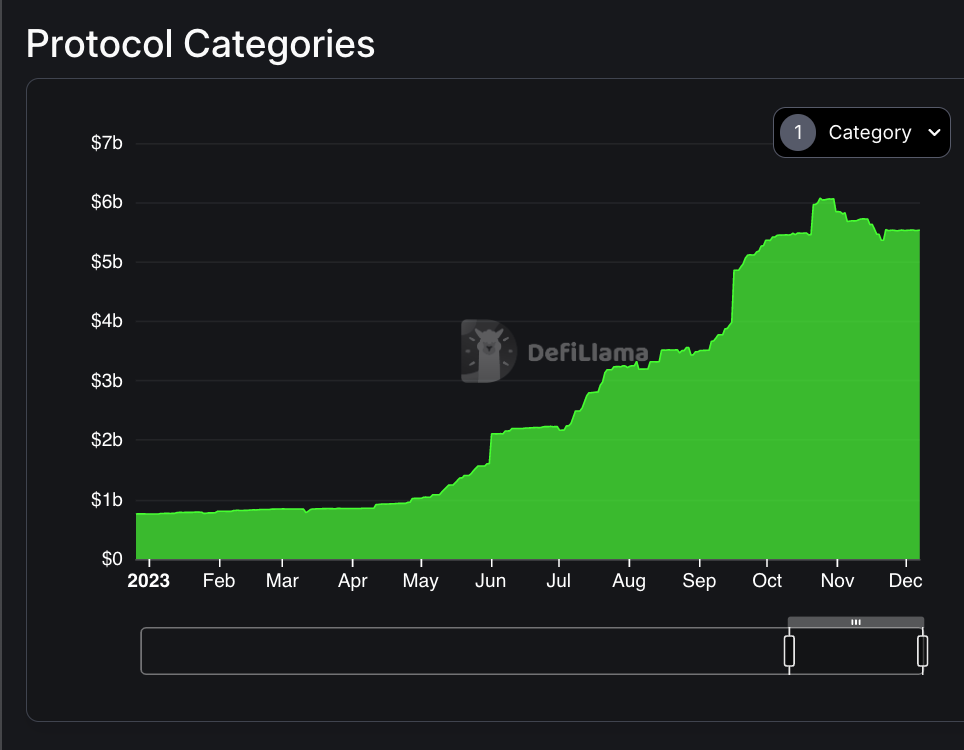

Tokenized assets will reach $10T in 2030

A blistering 180,000% growth potential from where we are at $5.5B market size now

This RWA project building over 2 years had its sale oversubscribed 🧵👇

In this thread, I will cover the following topics:

Market Potential

Product Market Fit

About $LNDX

How it works

xTOKENS

cTOKENS

Sale

Conclusion

If you enjoyed the read, please RESTACK, LIKE and COMMENT on what you like to hear next. It will be super helpful!

🔷 Market Potential 🔷

RWA is one of the biggest winner for the year

With big players like @justinsuntron, @avax and Project Guardian, it is the narrative that is still so early in its adoption.

Once the Tradfi inflows start to come in, it will go parabolic.

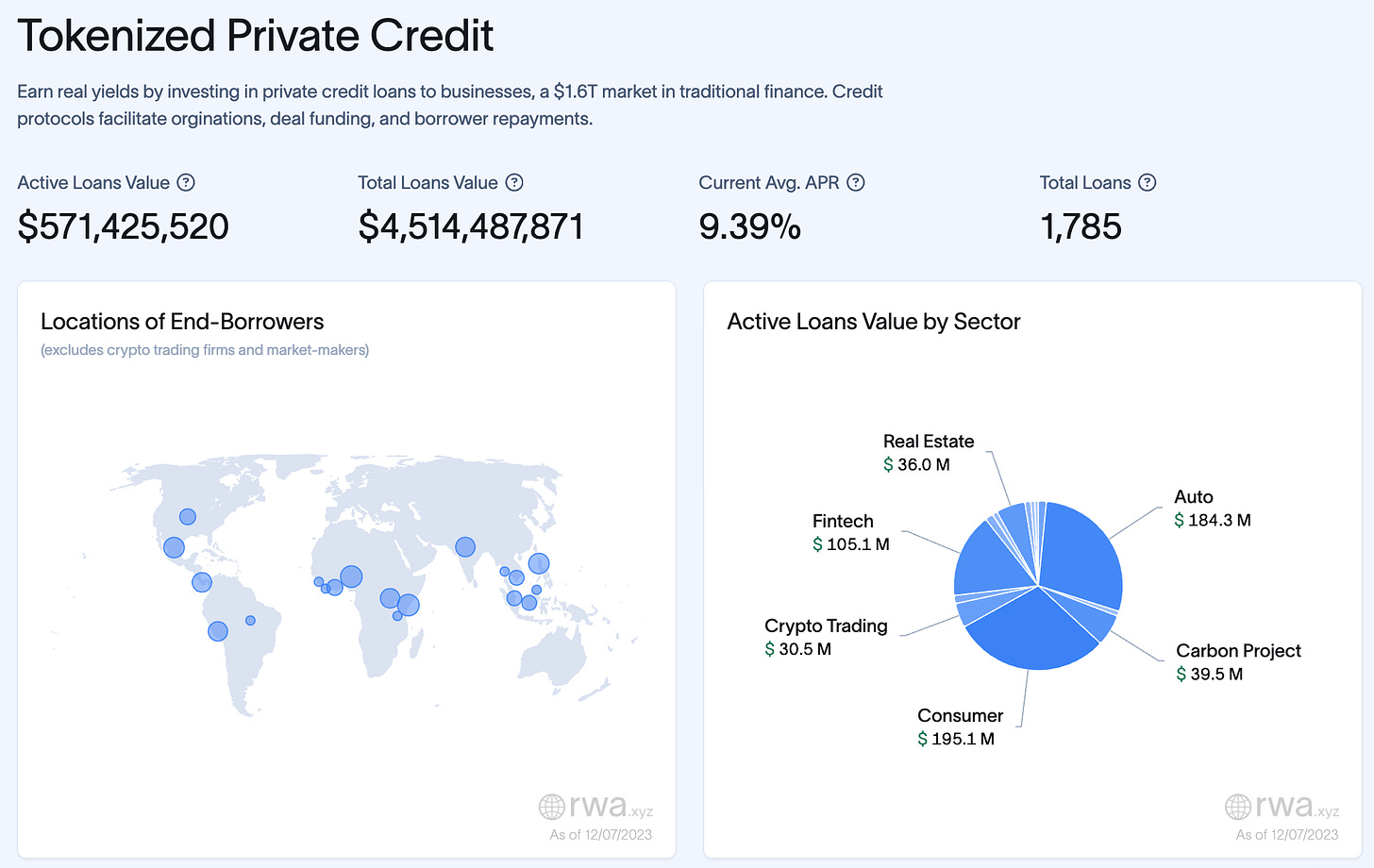

With just credit alone, RWA loans amount to a massive $4.5B of total loan value.

This metrics are just the beginning as we begin to see more RWA use cases in the realms of real estate, commodities and particular a subset called agriculture.

🔷 Product Market Fit 🔷

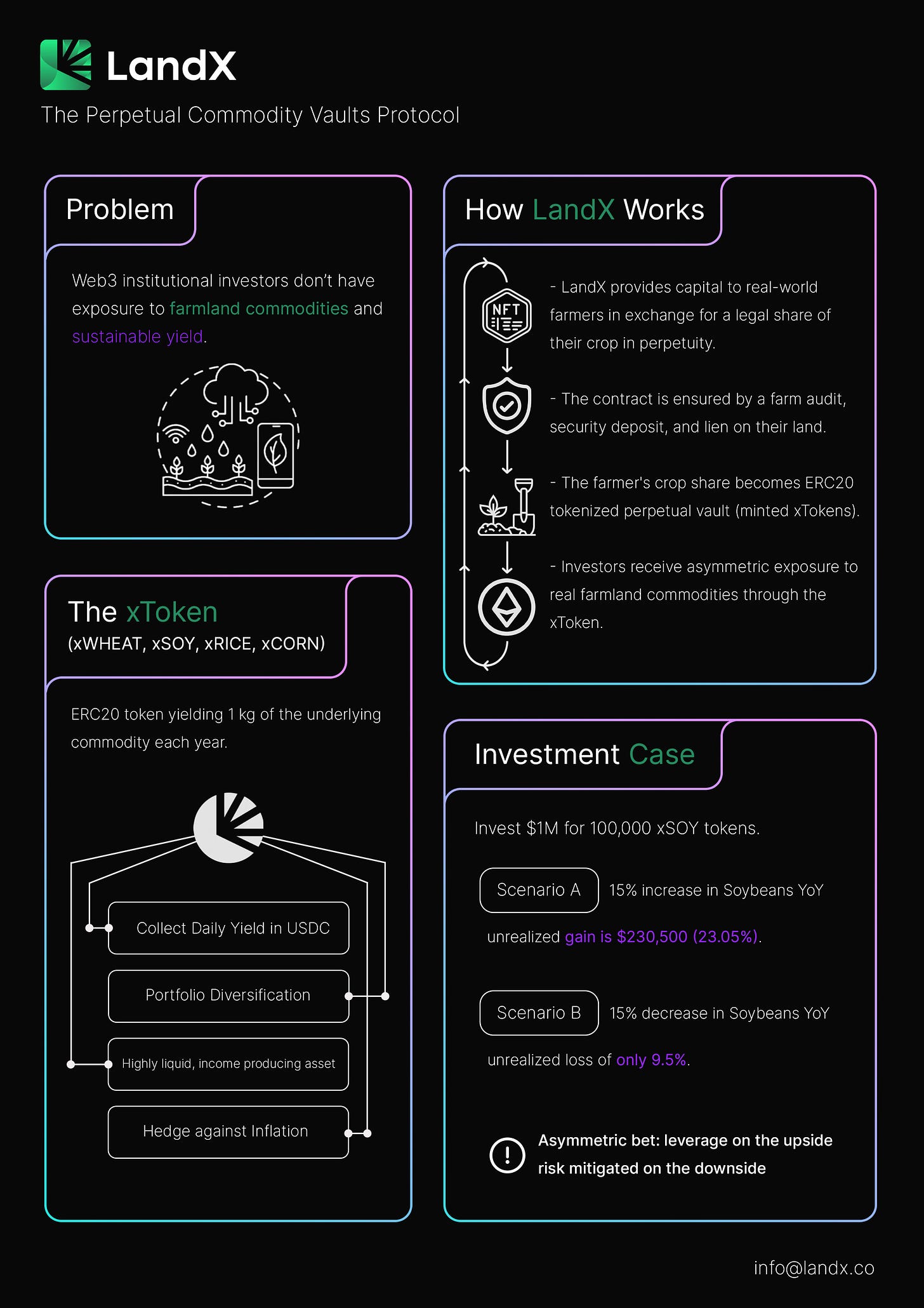

LandX bridges the gap between farmland owners and crypto investors through perpetual commodity vaults.

This model provides clear value propositions for both sides:

For farmers, LandX offers upfront capital in exchange for future crop yields, secured through liens on their land. These funds help farmers acquire more land, upgrade equipment, and improve facilities - endeavors key to boosting local food security.

LandX provides this financing by allowing farmers to tokenize future harvests into tradable tokens. Instead of waiting seasons to monetize crops, farmers can access immediate liquidity through the tokenized crop shares.

For crypto investors, LandX opens up exposure to real-world agricultural assets uncorrelated to crypto or equities. By providing capital to farmers, investors earn perpetual yield distributions from the harvested commodity crops.

🔷 About $LNDX 🔷

@landxfinance aims to be the marketplace for agricultural assets and tokenising them on-chain such as WHEAT, SOY, CORN, RICE, which are widely traded.

Investors can but into a basket that consists of these assets with equal weights.

🔷 How it works 🔷

In @landxfinance ecosystem, there are these participants:

Landowners: Commit farmland for capital, secured by a lien. Receive xTokens.

Validators: Onboard land, assist with legal/financial contracts, stake tokens. Get 1% commission.

Investors: Provide capital in exchange for xTokens tied to farmland yield.

The process begins with the landowner:

Landowner seeks capital, offers crop share secured by land lien

Validator connects landowner to LandX and manages lien contract

Investors get xTokens, tied to land yield distributions

Through this process used by $LNDX, it brings benefits to:

Landowner can access upfront capital based on future crop yield and ease of exit by buying back xTokens

Investors gain exposure to farmland assets and crop yields and can redeem yield for USDC anytime

Secured funding from a 1 year crop share reserve fund, where the Lien provides recourse if landowner defaults

🔷 xTOKENS 🔷

xToken represent each commodity and offers the following use cases:

Portfolio diversification into uncorrelated agricultural assets

Inflation hedge as yields track commodity prices

Yield paid in commodity-tracked cTokens

Farmers are required to keep a 12 months crop share deposited as security.

xToken stakers earns yields in terms of cTokens that can be exchanged via the platform based on a fair market value of the underlying product.

xTokens and xBASKET index token tradeable on Uniswap v3.

🔷 cTOKENS 🔷

cTokens have are used to:

Track prices of agricultural commodities

Offer new collateral type for DeFi protocols

Reduce volatility vs native assets like ETH

Avoid long-term devaluation of stablecoins

The are tradeable on internal LandX marketplace with their prices obtained from futures data via oracle. Investors receive cTokens while landowners get paid in USDC

Technology

ERC20 tokens deployed on Ethereum mainnet

Will bridge to layer 2 rollups (Optimism, Arbitrum)

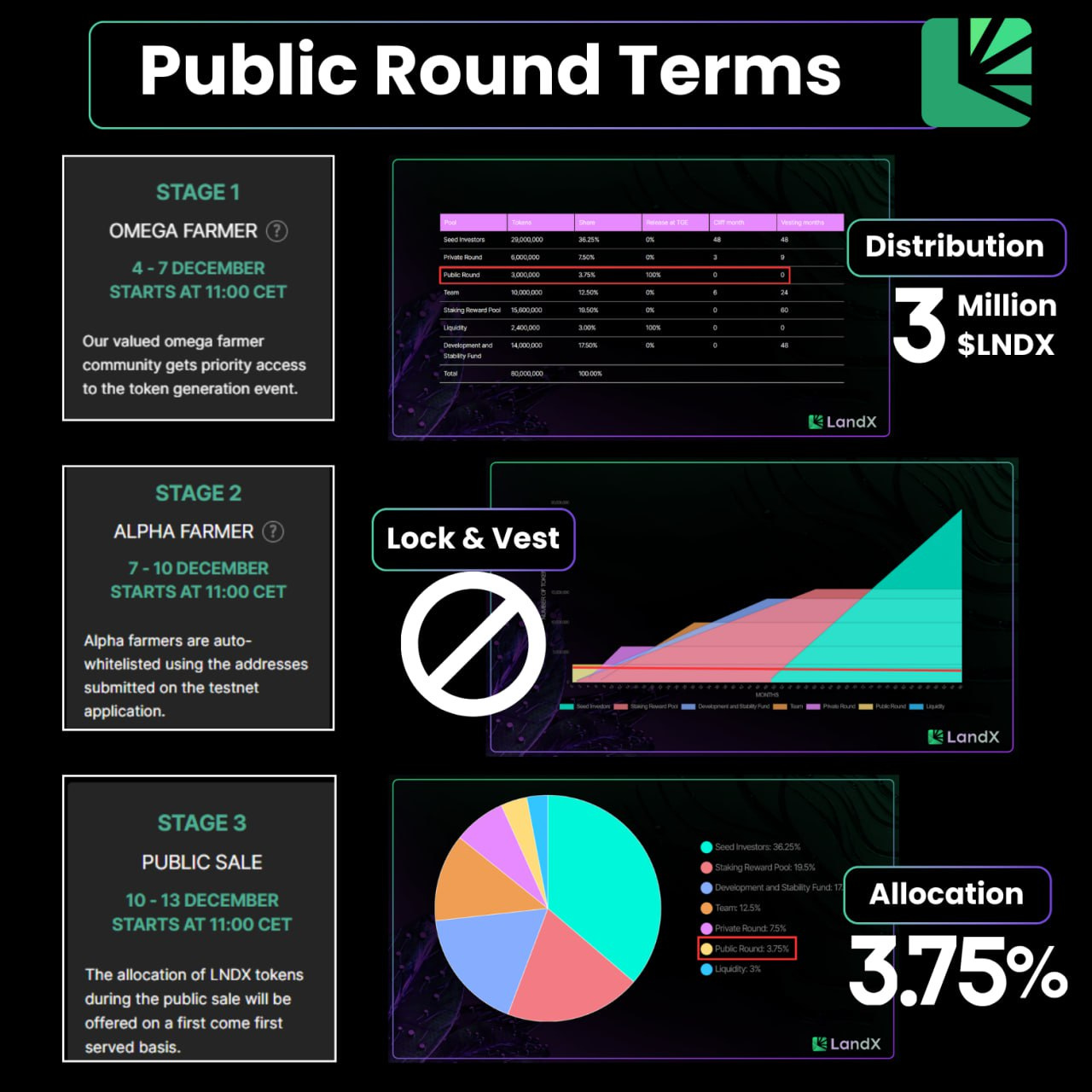

🔷 Sale 🔷

They raised over 900k for the private sale and $1.5M for public sale all have been sold out in stage 1.

Public Price: $0.50 and 100% unlocked at TGE

🔷 Conclusion 🔷

LandX offers a compelling solution aligning incentives for both farmers and crypto investors.

By tokenizing future crop yields, it provides farmers with upfront financing secured by liens on their land assets. This capital fuels local food production and security. For investors, LandX opens up exposure to agriculture, an uncorrelated asset class with strong fundamentals.

The perpetual vault structure generates stable-like yield streams tied to essential commodities.

Twitter: https://twitter.com/arndxt_xo/status/1732727086446768426