Tardfi gone parabolic in their quest to integrate with THE blockchain

Quadrillions in legacy finance assets are coming to crypto

Here is why I think $LINK will be the biggest winner 🧵👇

In this thread, I will share my bull thesis on $LINK:

Abstract

Introduction

The Legacy Landscape

Bridge Building Challenges

Oracle Networks as Ideal Bridges

Conclusion

If you enjoyed the read, please RESTACK, LIKE and COMMENT on what you like to hear next. It will be super helpful

Abstract

Blockchain technology promises to revolutionize finance through its transparency, security, and automation. However, trillions of dollars in assets remain locked in existing "legacy" financial systems built up over decades. This presents a challenge for mainstream blockchain adoption. Rather than risky and disruptive whole-scale replacement of legacy systems, gradual integration is a more prudent path forward.

This article shares about the technical, economic, and regulatory challenges involved in connecting legacy and blockchain systems. Integration-focused solutions like Chainlink's oracle networks represent the most viable bridge to the future Web3 economy.

My thesis on why @chainlink $LINK being the biggest winner.

Introduction

Over 50 years ago, financial institutions began digitizing their systems, giving rise to modern "legacy" information technology infrastructures for banking, insurance, and asset management. These legacy systems now process quadrillions of dollars in value each year. However, they suffer from opacity, fragmentation, manual processing, and other inefficiencies.

The emergence of blockchain technology over the past decade promised to revolutionize finance through peer-to-peer transactions, cryptographic security, transparency, automation via smart contracts, and decentralization. But while blockchain-based finance has exploded in scale, the vast majority of global financial assets remain locked within existing legacy systems.

This presents both a challenge and an opportunity. Blockchain integration offers legacy players efficiency gains, cost savings, new revenue streams, improved transparency, and upgraded security. However, replacing legacy systems is seen as far too risky, complex, and unnecessary. A bridge is needed between the old and new financial paradigms.

I will thereby breakdown the the landscape of legacy system integration with blockchain networks. Here, I present my belief that integration-focused solutions represent the most viable path to connecting trillions of dollars in legacy assets with Web3 innovations.

The Legacy Landscape

Legacy financial systems encompass a vast array of technologies, providers, and protocols built up over decades. Large banks rely on mainframe computers running assembly languages like COBOL to process transactions.

Centralized messaging systems like SWIFT move trillions daily between institutions.

Clearinghouses and custodians maintain fragmented data siloes holding securities and derivatives.

These legacy systems have numerous shortcomings:

Batch processing rather than real-time settlement

Opaque data formats

Manual reconciliation

Security vulnerabilities

Islands of trapped liquidity

But they also represent massive investments of time, capital, and expertise.

And they work - managing the global financial system day-in, day-out.

This legacy infrastructure processes quadrillions in value annually across custody chains, equities, bonds, foreign exchange, derivatives, commodities, and beyond. Upgrading or replacing any of these systems involves enormous risk. Financial institutions are understandably wary of fixing something that isn't broken, at least not fundamentally.

Bridge Building Challenges

Connecting legacy systems to blockchain networks entails both technical and economic challenges.

Technically, legacy systems were designed in an offline, centralized paradigm. Integrating them with decentralized blockchain networks requires translating between very different architectures. Legacy systems rely on centralized databases, message passing, and IP networks. Blockchains use peer-to-peer nodes, cryptography, and token-based incentives.

Bridging this divide means finding common protocols and data formats:

Legacy systems must be equipped to digitally sign transactions verifiable on-chain.

Smart contracts need reliable connection to off-chain data and events.

And bridges must provide bi-directional transfer of value between chains and legacy counterparts.

Economically, institutions must have sound profit motives to undertake integration. So what would motivate them?

Revenue opportunities from blockchain integration

Settlement savings, improved liquidity, new product offerings, and modernized market infrastructure must outweigh upgrade costs and risks.

Management and stakeholders have to take the long view on return on investment.

There are also regulatory and compliance risks to navigate. Unclear or unsettled policy creates uncertainty. Projects that enhance financial surveillance and transparency may face institutional resistance. And fragmented global regulations multiply compliance burdens.

Oracle Networks as Ideal Bridges

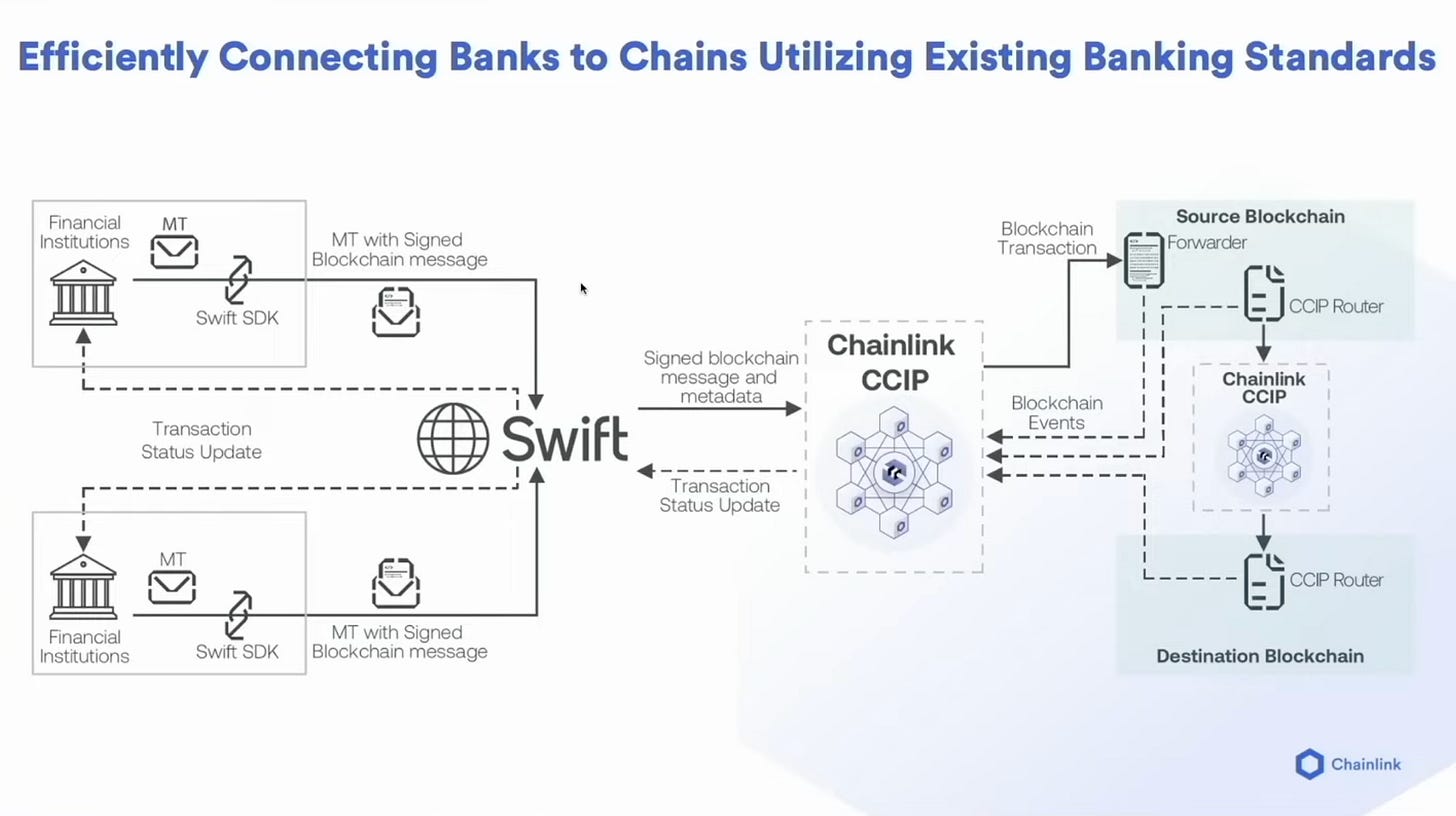

Purpose-built blockchain oracle networks like @chainlink provide the most viable pathway for integration. Oracles act as middleware - bridging on-chain and off-chain systems through external data feeds and computation.

Chainlink already secures over $75B in smart contract value across leading blockchains. Its decentralized oracle nodes allow smart contracts to access any external API. Nodes digitally sign data feeds, ensuring they are tamperproof and authentic.

Chainlink's extensive capabilities to bridge off-chain and on-chain systems are now expanding to connect with legacy infrastructure as well:

Securely delivering legacy data feeds to on-chain environments.

Enabling legacy systems to trigger chain transactions via "Chainlink Automation".

Allowing legacy private key infrastructure to digitally sign on-chain transactions.

Facilitating trusted bi-directional transfer of assets between chains and legacy counterparts.

These interfaces will provide the critical bridges needed to unlock trillions in legacy assets for Web3 applications. No reengineering of back-end systems required.

Chainlink also mitigates the economic hurdles:

Its network is backed by hundreds of independent node operators for reliability.

Usage fees align incentives for continued integration and development.

And institutions can outsource complex blockchain operations to Chainlink's proven oracle infrastructure.

For regulators and policymakers, Chainlink offers transparency into data sourcing, external impacts on contracts, and layered security. This answers many Web3 compliance needs. And its flexibility bridges disparate blockchain networks - connecting centralized and decentralized systems both new and old.

Here is a YouTube video on “How Banks Are Connecting Their Systems to Blockchains | Sergey Nazarov”

$LINK will benefit the most once all the 42 million messages that go through SWIFT goes through CCIP. SWIFT is a widely adopted and $LINK will massively benefit from it.

Conclusion

While revolutionary visions of wholly new blockchain-based financial rails are exciting, realizing this future requires a bridge from the present. Incumbent institutions are wary to abandon legacy systems that still function to process quadrillions annually. Purely decentralized solutions also lack maturity and adoption. Hybrid integration is the pragmatic path forward.

Chainlink's extensible oracle networks provide the essential middleware to link legacy and blockchain systems. This allows financial institutions to incrementally integrate blockchains leveraging their decades of investment in existing infrastructure. Solving the technical connectivity and economic incentives challenges is key to accelerating mainstream blockchain adoption.

The future of finance will be heterogeneous - hybrid ecosystems of centralized and decentralized systems, new and old. Stepwise integration, not abrupt replacement, is the bridge that will get us there. Chainlink oracles are paving this bridge to the Web3 economy of tomorrow.

Twitter: https://twitter.com/arndxt_xo/status/1726559297193324868