We're not witnessing a classic risk-off.

We’re seeing the slow erosion of market depth. Price action is being amplified by impaired liquidity.

Liquidity, not sentiment, is the real fragility in this market.

Retail hasn't capitulated yet. ETF inflows remain strong.

But once the buy-the-dip reflex fails a few more times and excess wealth expectations from the 2019–2024 cycle are challenged, real deleveraging begins—and that’s when retail will hit the wall.

And Bessent understands this better than most.

He helped orchestrate the legendary short of the British pound in 1992, ran Soros Fund Management as CIO during one of its most active periods, and later built Key Square into a $5B global macro powerhouse. Now at the helm of U.S. economic policy.

We’re heading into a phase where market moves will increasingly be policy-shaped, not just data-driven. Watch for language like "smooth functioning," "temporary," and "facility" from the Fed.

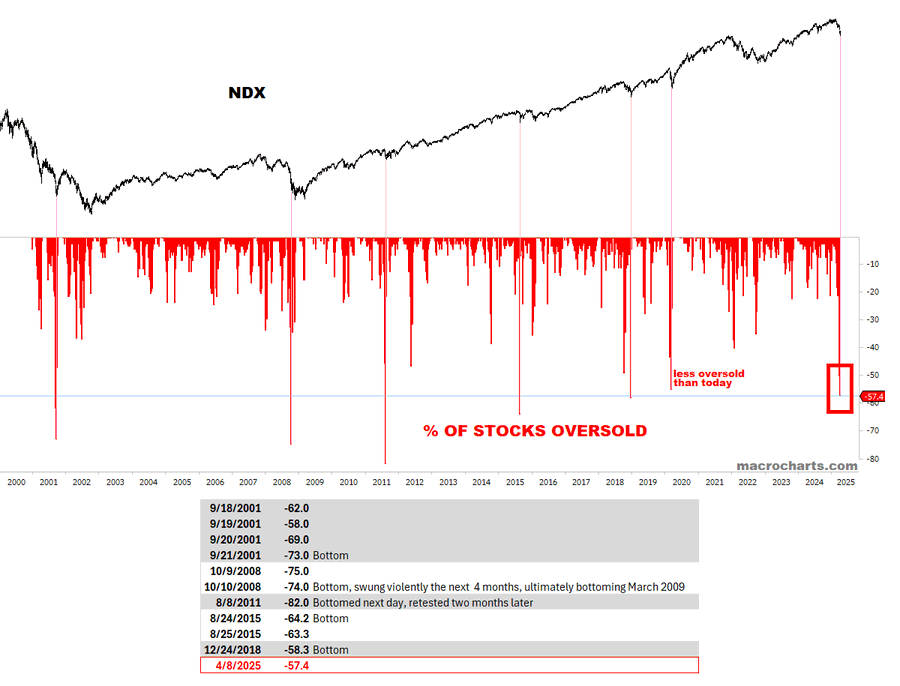

How are we are right in the most oversold conditions 👇🧵

Credits to @MacroCharts

Macro Pulse Update 12.04.2025, covering the following topics:

1️⃣ Macro events for the week

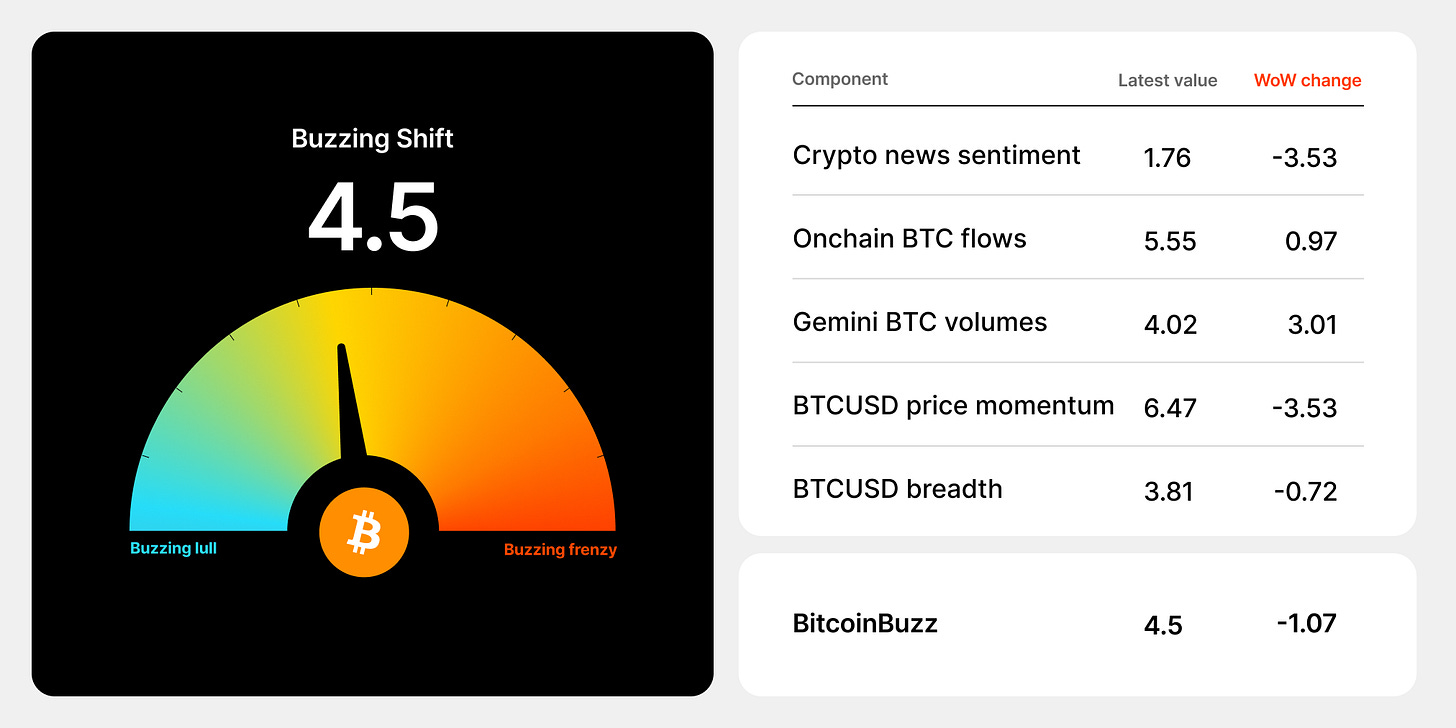

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ China Spotlight

1️⃣ Macro events for the week

Last Week

Next Week

2️⃣ Bitcoin Buzz Indicator

Launches

DIA Oracles go live on Arbitrum via Lumina for decentralized, verifiable price feeds.

Layer3 V3 launches with Layer3 Wallet for seamless, gasless onchain engagement.

Felix Protocol launches on Hyperliquid EVM, offering high-LTV feUSD borrowing.

PumpFi by Pump.fun launches "Ape Now, Pay Later" on Solana for memecoins/NFTs.

Lens Chain mainnet launches, integrating zkSync, Avail, and modular Social Primitives.

Chainlink Payment Abstraction goes live, enabling cross-asset LINK fee payments.

Kamino Meta-Swap debuts with real-time simulation and zero-slippage swaps.

Morpho Prime suite launches with Curator and Rewards Apps for vault and reward management.

Updates

Axelar x Babylon integration brings BTC staking to 72+ chains with self-custody.

Clearpool’s Ozean x Dinari enables tokenized ETF access via Port.

DeFi Saver now displays all earned rewards from >10 tokens in the portfolio page.

USDT₀ goes live on Sei Network, powering low-cost stablecoin trading.

Aave DAO approves buyback program for AAVE via aEthUSDT in Collector contract.

Euler launches on Avalanche with $500K stablecoin incentives for lending/borrowing.

KyberSwap reduces gas fees 15–40% across all trades with new router upgrade.

M^0 Protocol deploys $M stablecoin infra on Solana with integrations via Squads and Kamino.

LayerZero integrates with XDC Network, enabling cross-chain connectivity.

Synthetix Accounts offer gas-free, 1-click perp trading with social logins.

Acelon Oracle goes live on peaq with real-time decentralized market data.

Ethena Labs launches USDe/sUSDe on BNB Chain across PancakeSwap, Venus, Pendle.

Babylon Foundation releases official BABY tokenomics guide.

Magic Eden adds cross-chain swaps across Solana, Bitcoin, Ethereum, and Base.

DoubleZero introduces 2Z tokenomics with validator-only token sale.

ParaSwap rebrands to Velora with intents-based cross-chain trading.

ether.fi’s eBTC now available on Aave for lending and borrowing.

Shardeum mainnet delayed to May 5, 2025, citing market timing.

LayerEdge reveals roadmap with zk-proof aggregation and Bitcoin settlement.

Initia integrates weETH across its app ecosystem with loyalty rewards.

Mantle launches Mantle Banking + $400M-backed MI4 crypto index fund.

Berachain announces updated PoL vault guidelines for RFRV compliance.

EigenLayer slashing goes live April 17 with new 14-day withdrawal period.

Usual proposes raising USD0++ floor price to $0.92, redistributing 47M USUAL.

Airdrops

Wayfinder launches $PROMPT claim on Ethereum and Base.

Huddle01 Nexus campaign lets users earn $tHUDL via onchain meetings.

Layer3 Leagues go live with Bronze–Diamond ranks affecting rewards.

Somnia quests now live with dark-fantasy RPG Nkdemons.

Solv Protocol drops $BABY to 120K+ eligible xSolvBTC wallets.

Fleek launches Points Program ahead of token airdrop.

Eigen Season 2 EIGEN stakedrop claims close April 14.

Arcadia opens AAA airdrop checker for Season 1 with 10% supply.

dYdX Surge Program kicks off $20M reward leaderboard across 9 seasons.

StakeStone opens $STO claims April 3 with long-term vesting.

Ooga Booga slashes TGE FDV to $10M and triples launchpad allocations.

Reserve offers RSR rewards via Zealy quests and social missions.

Infinex + Synthetix launch campaign with 52% APR and $10K SNX rewards.

Farms

Pendle + Resolv Labs launch new $USR pool maturing Sept 2025 with 45 points/day.

Pendle expands Berachain pools with Dolomite’s dBERA, weETH, and LBTC.

Avalon’s $USDa/sUSDa spotlighted with BTC-backed stablecoin and 15–25% APR.

Spectra + SmarDex integrate USDN pool for fixed yield + SPECTRA rewards.

OpenEden launches 10x Bills rewards on Pendle for $cUSDO holders.

Maple introduces SyrupUSDC pool with up to 12% APY and 5x Drips Boost.

Compound Blue vaults live on Superform with USDC, USDT, WETH + 10x CRED.

Pendle adds Base pools: sUSDz (14.5% APY) + relaunched USR with 45x multiplier.

Silo Finance debuts 8 isolated Pendle markets for leveraged PT strategies.

Swellchain introduces 8x $SWELL rewards for rswETH/weETH restaking on Euler.

RateX x KyrosFi launch campaign for kySOL-2506 market with 5x/4x points.

Sturdy Finance launches DeFAI with >40% APR via AI-managed USDF/wFLOW vaults.

Bedrock highlights WBTC-uniBTC vault with 66% APR via $BGT rewards.

Penpie x Silo launch scUSD (Silo-46) pool with 18% APY + Sonic/Silo/Rings boosts.

Wasabi + Infrared add $iBGT staking to $BERA vault.

Puffer BTC Vaults offer WBTC, tBTC, etc. with 3.28% base + 8.9% extra rewards.

3️⃣ Market overview

Markets Spike, Then Slide

Bitcoin surged to $83K and ETH to $1,660 midweek after Trump announced a 90-day tariff pause for non-retaliatory countries.

But prices dropped again Thursday as the US hiked tariffs on China to 145%, sparking a broader sell-off.

IBIT saw $127M in outflows as investors trimmed spot ETF exposure.

First-Ever XRP ETF Launches in US

Teucrium’s leveraged “XXRP” ETF began trading on NYSE Arca, offering 2x daily XRP exposure with a 1.85% fee.

A spot XRP ETF could be approved soon, post-Ripple’s settlement with the SEC.

Ripple is also acquiring Hidden Road for $1.25B to expand prime brokerage offerings.

Paul Atkins Confirmed as SEC Chair

The Senate approved Paul Atkins as the new SEC head.

Known for his pro-crypto stance, Atkins is expected to scale back regulation by enforcement and bring clearer guardrails for digital assets.

Galaxy Digital Eyes Nasdaq Listing

SEC approved Galaxy Digital’s US listing, paving the way for a Nasdaq debut under ticker GLXY post-May 9 vote.

The firm will redomicile to Delaware to better serve institutional crypto investors.

Tether Considers US-Only Stablecoin

Amid US regulatory shifts, Tether may launch a USD-only version for domestic use.

The move would strengthen compliance and transparency, aligning with Trump’s crypto-forward agenda.

Hong Kong Greenlights Staking

The SFC released strict new rules allowing licensed platforms to offer staking services.

No third-party outsourcing allowed—all assets must remain under direct platform control.

Part of Hong Kong’s ASPIRe roadmap to foster a secure, regulated crypto environment.

4️⃣ Key Economic Metrics

🔴 U.S. Economic Outlook

Retail Sales: March retail sales likely rose 1.4%, driven by early car purchases ahead of tariff hikes. But consumer sentiment is weakening, suggesting slower spending in Q2.

Industrial Production: Expected to dip 0.2% in March as trade uncertainty, labor shortages, and cautious business investment weigh on output. February's auto-driven boost looks unsustainable.

Housing Starts: Forecast to fall to 1.416M annualized units. High costs, tariffs, and weak builder confidence continue to pressure residential construction activity.

🟢 United States: Tariffs Take Center Stage

Tariff U-Turn: President Trump announced a 90-day pause on most reciprocal tariffs, but China still faces a 145% tariff, keeping overall trade costs high.

Inflation Eases: March CPI fell 0.1%, core inflation saw its smallest gain since Jan 2021, signaling softening consumer demand.

Producer Prices Down: PPI dropped 0.4%, with widespread declines in both goods and services.

Fed Outlook: FOMC remains cautious; despite inflation drops, tariff-driven price hikes may persist, dovish tilt possible if growth weakens.

Consumer Sentiment Slumps: NFIB and University of Michigan surveys show worsening outlook; 2/3 of respondents concerned about tariffs.

Fiscal Policy in Motion: Congress advanced a reconciliation bill including tax cuts and spending, but impact won’t be felt until 2026.

Next Week (US): Retail Sales (Wed), Industrial Production (Wed), Housing Starts (Thu)

🟢 International: Dovish Central Banks Amid Trade Jitters

New Zealand, India, Philippines all cut rates 25 bps, citing trade risks and weakening domestic demand.

Mexico’s benign CPI opens door for further rate cuts starting May.

Brazil Likely to Hike: Strong inflation and economic activity suggest 50 bps Selic rate hike in May.

Next Week (Global): China GDP (Wed), Bank of Canada Decision (Wed), ECB Rate Decision (Thu)

🔴 Interest Rate Watch: Treasury Market in Flux

Yields Whipsaw: After dropping post-tariffs, 10-year Treasury yields rebounded to 4.57%, above pre-tariff levels.

No Inflation Panic: Market-based inflation expectations still stable; longer-term inflation pricing has declined.

Speculation on Foreign Selling & Basis Trades: No firm evidence yet, but possible role in market turbulence.

Fed Cuts Still on Table: Markets expect ~80 bps in rate cuts this year, with first cut likely in June.

2025 Forecast: 10-year yield expected to drop to 3.75% by year-end, before climbing back to 4.15% by end of 2026.

5️⃣ China Spotlight🔴

China in the Crosshairs

Trump's 90-Day Tariff Pause: On April 9, the administration paused reciprocal tariffs on most nations, replacing them with a 10% baseline tariff—except for China, which now faces an effective 145% tariff.

China Becomes the Main Target: The new policy intensifies trade pressure on China. This continues Trump’s earlier strategy, where China’s share of U.S. imports dropped from 22% to 13% post-2018 trade war.

Tariff Burden Shifts, Not Shrinks: Despite the reshuffling, the overall U.S. effective tariff rate remains ~30%, but now disproportionately impacts China.

Limited Escape Routes: While firms previously rerouted imports through other Asian, Latin American, and European suppliers, those countries now face tariff threats too, limiting diversification options.

Negotiation Window Open—but Narrow for China: Trump’s 90-day pause may yield lower tariffs for non-China partners, but tariffs on China are unlikely to ease due to trade deficits and geopolitical tension.

Manufacturing-Focused Strategy: The administration seems committed to keeping tariffs high to boost U.S. manufacturing jobs, even if it increases economic friction.

Forecast Outlook: Wells Fargo expects tariffs may decline to ~15%, depending on deals struck during the pause—but not for China.

Ongoing Risk: Uncertainty remains elevated. Further escalations—or deals—are possible, and businesses should monitor the Tariff Tracker for real-time updates.