TL;DR: No Quantitative Easing this cycle.

The playbook is clear, and history is on our side.

The markets are primed to go higher—even without QE.

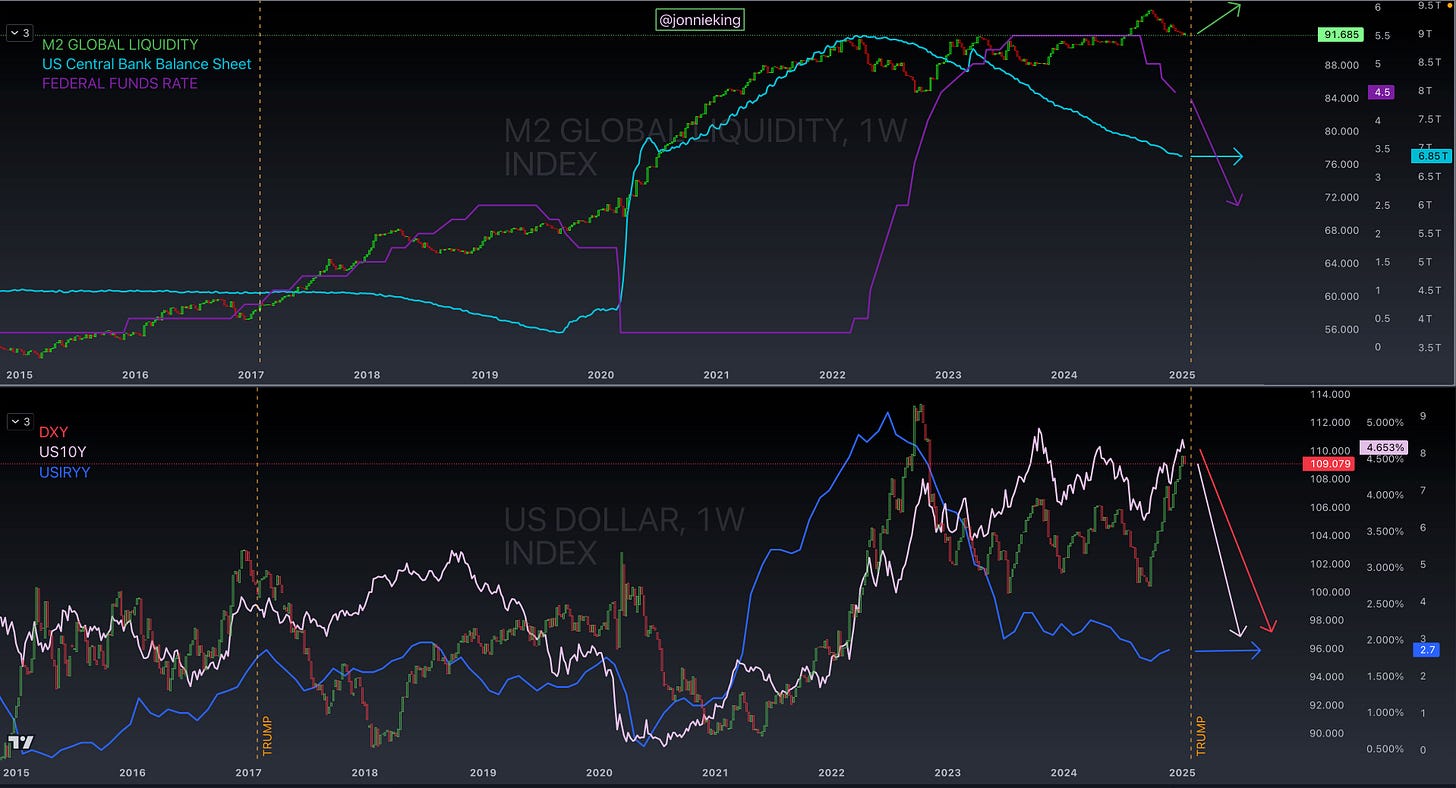

Liquidity drives markets higher. Full stop.

Global M2 money supply has an inverse relationship with the US Dollar and the 10-Year Treasury Yield (10Y). That’s why we’ve seen the DXY and 10Y Yield rise as Global M2 declines.

However, history tells us a reversal may be near.👇🧵

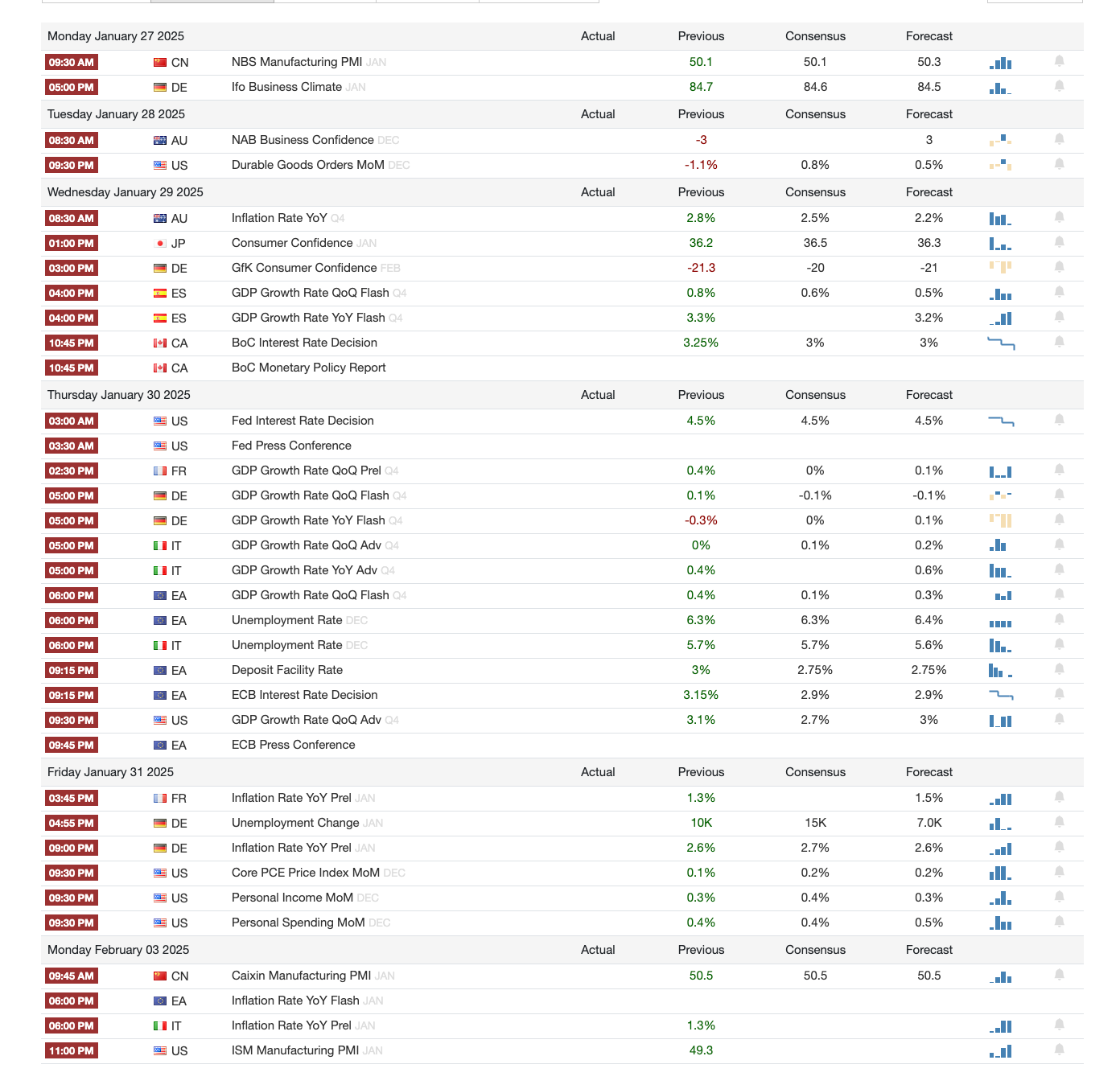

Macro Pulse Update 25.01.2025, covering the following topics:

1️⃣ Macro events for the week

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ January 2025 Market Strategy

5️⃣ The Liquidity Paradox: Growth without QE

1️⃣ Macro events for the week

Last week

Next week

2️⃣ Bitcoin Buzz Indicator

U.S. Political and Regulatory Updates

Trump Signals Shift in Crypto Policy

Trump’s Meme Coin Makes Wave After Launching on Solana

Ethereum and Governance Updates

Ethereum Leadership Faces Criticism Amid Decline

DeFi and Platform Highlights

WLFI Buys $100M in Crypto to Celebrate Trump Inauguration

Institutional and Market Developments

Institutional Adoption Soars in January 2025

Corporate and Strategic Rebrands

Binance Labs Rebrands to YZi Labs

Blockchain Ecosystem Partnerships

Telegram Partners Exclusively with TON Blockchain

DeFi Liquidity Challenges

THORChain Pauses Lending Amid Insolvency Concerns

Crypto Exchange Security Updates

Phemex Loses $70 Million in Security Breach

Controversies in Memecoin Markets

ZachXBT Sparks Controversy With $4M Cashout

Crypto and Cultural Integration

Azuki Founder Launches ANIME Culture Coin

Solana Optimistic Network Raises $22 Million

Altcoins:

TikTok restored its services in the US.

Students for Trump co-founder denied rug pull accusations after selling half of the 'TIKTOK' memecoin supply.

Bitcoiners donated $270K to fund Ross Ulbricht’s personal expenses.

Hashgraph Association partnered with Taurus to boost global HBAR custody.

Gemini expanded in Europe with a Malta hub to comply with MiCA regulations.

Coinbase app surged in Apple’s U.S. App Store rankings ahead of Trump’s inauguration.

Gate Ventures contributed $20M to the BNB Chain Incubation Alliance.

Linea filtered over 500K Sybil addresses from its upcoming token airdrop.

Immunefi introduced a blockchain arbitration system for bug bounties.

Phantom defended its wallet safety amid alleged vulnerabilities risking user funds.

Avalanche focused on U.S. growth by integrating AI and blockchain innovations.

Circle acquired Hashnote to integrate USYC with USDC.

Uniswap V4 deployments are set to roll out soon.

Crypto.com relaunched its exchange in U.S. markets.

Robinhood Crypto expanded to Spain, adhering to EU regulations.

Base Layer 2 set a record, nearing $3B in DEX volume.

Keplr raised $5M in seed funding at a $50M valuation.

Solana meme coin Fartcoin fell after its AI bot creator sold a large stash.

Ledger co-founder David Balland was kidnapped in France but safely released after police intervention.

BNB Foundation completed its 30th quarterly token burn on BNB Chain.

Frax Finance proposed WLFI investments to enhance its ecosystem presence.

John McAfee reemerged as an AI memecoin and chatbot with a $27M market cap.

Upbit and Bithumb paid $2.4M for crypto outages during South Korean martial law.

OKX received pre-authorization for MiCA compliance via its Malta hub.

ARK Invest’s Cathie Wood rejected Trump Coin, citing a lack of utility.

Justin Sun announced zero-fee stablecoin transactions on TRON.

Davos 2025 emphasized the tokenization of real-world assets as the future of finance.

USDC’s supply surpassed a $50B market cap for the first time since 2022.

Ivanka Trump denounced the fake IVANKA Coin.

Nansen opened its research website to all users as an experiment.

Singapore Court approved the next step in WazirX’s repayment process after a $230M hack.

3️⃣ Market overview

Trump Takes Office & Champions Crypto:

Sworn in as the 47th US president, Trump issued an executive order promoting pro-crypto policies.

Key measures include banning a US CBDC, protecting blockchain developers, and supporting stablecoin growth.

SEC Shakeup:

Gary Gensler stepped down as SEC chair.

Mark Uyeda, a crypto-friendly commissioner, is acting chair, with Hester Peirce leading a new crypto task force.

Trump’s $TRUMP Memecoin:

Trump launched $TRUMP, a memecoin with an initial market cap of $7.3 billion.

The token saw a surge in popularity, followed by the launch of $MELANIA.

Ross Ulbricht Pardoned:

Trump granted a full pardon to the Silk Road founder, celebrated by libertarians and crypto advocates.

MicroStrategy Adds 11,000 BTC:

Michael Saylor’s firm purchased $1.1 billion in Bitcoin, bringing its total holdings to 461,000 BTC.

Utah Proposes Public Crypto Investments:

A bill allowing up to 10% of public funds to be invested in crypto was introduced.

The legislation includes strict eligibility criteria and advanced security protocols.

4️⃣ January 2025 Market Strategy

Inflation Trends

Inflation is stabilizing, but energy price volatility warrants close monitoring

December CPI Update: Headline CPI rose 0.4% month-over-month due to volatile energy prices. Core CPI, more aligned with the Fed’s target, increased 0.2%.

Alternative Measures: The Penn State/ACY Alternative Inflation Index suggests more subdued inflation, with a core year-over-year rate of 1.5%. This highlights limited risk of reflation in 2025.

Fiscal Policy Shifts

Monitor fiscal policy closely as it could become a bearish catalyst for markets.

Deficit Acceleration: The U.S. fiscal deficit reached $655 billion as of mid-January, $237 billion higher than last year. This reversal underscores aggressive government spending, possibly linked to a political transition.

Outlook: If deficits normalize, a fiscal cliff may emerge, reshaping market dynamics.

Monetary Policy Expectations

While rates remain stable, the long-term risks of falling rates cannot be ignored.

Stable Projections: Policy rate expectations remain unchanged, with one rate cut anticipated in 2025. High rates continue to drive capital inflows into U.S. assets.

Potential Shift: A rate cut cycle could disrupt the current growth-fueled virtuous cycle, potentially triggering a market correction.

Investor Behavior and Sentiment

Overconfidence could leave markets vulnerable to unexpected shocks, particularly in growth-sensitive sectors.

Geographic Rotation: Institutional investors reduced U.S. equity exposure in favor of Eurozone assets. However, U.S. equity allocation remains historically high.

"No Landing" Optimism: 38% of investors expect continued economic strength despite high rates—the highest confidence recorded.

Growth vs. Rate Scare

The path of growth remains a critical risk factor—stay prepared for shifting dynamics.

The current consensus fears a disorderly rise in bond yields ("rate scare"), but growth weakness ("growth scare") is a more probable concern. Key drivers include:

Declining productivity of fiscal liquidity.

Potential reversal of capital inflows.

Risk asset rebalancing.

5️⃣ The Liquidity Paradox: Growth without QE

The Setup: 2025 Echoes 2017

We’re in a macro setup reminiscent of 2017, when:

M2 money supply bottomed out and began rising, driving down the DXY.

Inflation was halved before gradually creeping back up as liquidity and markets exploded.

Surprisingly, this all occurred while the Fed raised interest rates.

What enabled this?

Policy normalization after years of near-zero interest rates.

A Fed pause on Quantitative Tightening (QT) in 2014, maintaining a neutral balance sheet until 2017.

By Q4 2017, the Fed strategically resumed QT while markets pushed higher through 2018.

Takeaway: Markets thrived with a balance of liquidity injections, deregulation, and fiscal strategies—all without QE.

The 2025 Playbook

Here’s what we can expect:

Global Money Supply (M2): Higher

Dollar: Lower

Fed Funds Rates: Lower

10Y Treasury Yield: Lower

Fed Balance Sheet: Neutral

Inflation: Neutral

Key tools driving this shift:

Tariffs: Encouraging exports and weakening the dollar.

Deregulation: Boosting economic activity.

Tax Cuts & Reform: Increasing disposable income.

T-Bills: Injecting liquidity into the system.

How to Weaken the Dollar

Tariffs: Trump is already advocating for tariffs to prioritize exports over imports, which puts downward pressure on the dollar.

Revised Jobs Data: Strong jobs numbers that have bolstered the DXY will likely be revised, softening market confidence.

Fed Pauses QT: By declaring ample reserves, the Fed can pause QT without resorting to QE, controlling market momentum while avoiding runaway inflation.

Rate Cuts in Q2: Once the economy appears softened, the Fed can resume rate cuts, further reducing the dollar’s strength.

Why the Fed Cuts Rates Despite Strong Growth

In short: Debt management.

The U.S. government is $36 trillion in debt, with 2025 interest payments projected to exceed $1 trillion—rivaling major budget line items like Social Security and national defense.

To manage this:

The Treasury issues securities (bonds, T-bills) to refinance debt at lower rates.

High rates increase the cost of debt servicing, so cutting rates is a necessity—not an option.

This is the unspoken reason behind rate cuts, even as critics scream “too soon.”

Injecting Liquidity Without QE

Markets don’t need QE to thrive. Here’s why:

Deregulation & Tax Reform: Policies that increase disposable income drive economic activity, which boosts bank lending and liquidity.

Global Liquidity: Central banks like the ECB, BOJ, and PCOB continue low rates or QE, indirectly fueling the U.S. money supply.

T-Bills: Treasury short-term bill issuance reduces Reverse Repo (RRP) usage, freeing liquidity to flow into other assets like equities.

Repo Operations: The Fed can conduct standard repo agreements to temporarily inject cash into the banking system.

Together, these tools increase money supply, lending, and investment without risking the inflationary chaos of QE.

The Bottom Line

Quantitative Easing is off the table in 2025, but liquidity will flow through other means. Strategic fiscal and monetary tools will:

Weaken the dollar.

Support markets.

Maintain manageable inflation levels.

The playbook is clear, and history is on our side. The markets are primed to go higher—even without QE.