#RWA smashed 2023 fundraising predictions

$LNDX raised over $8mil in funding and is listing on top CEXes @MEXC_Official & @gate_io

A mega thread for $LNDX Tokenomics + Potential🧵👇

If you enjoyed the read, please RESTACK, LIKE and COMMENT on what you like to hear next. It will be super helpful!

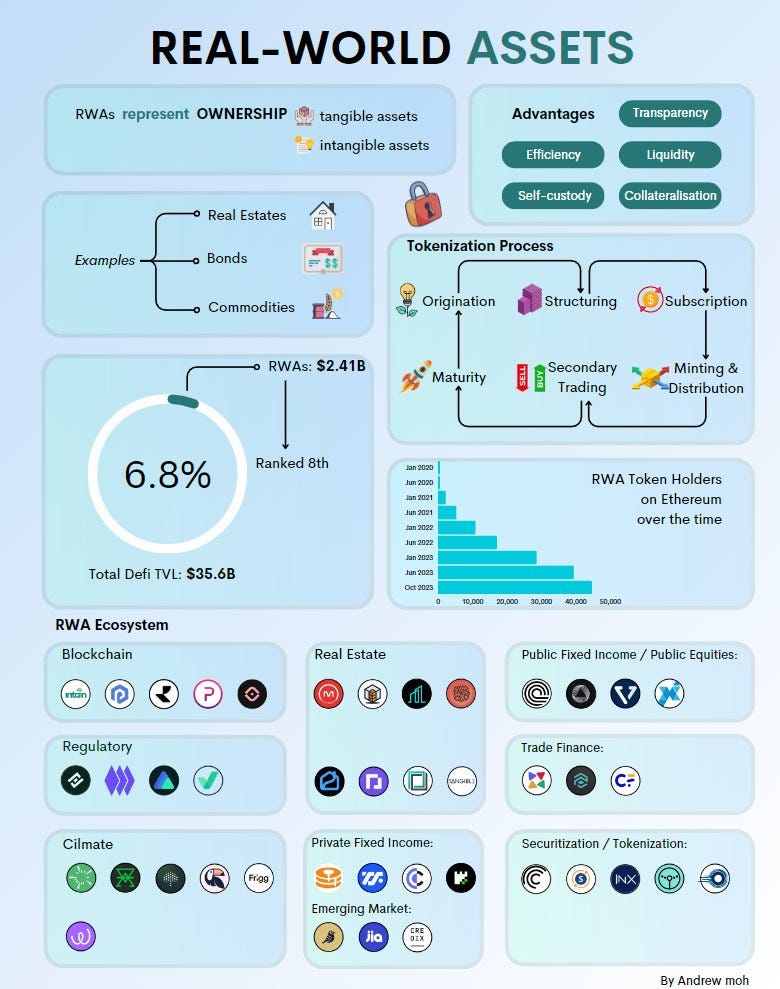

🔷 RWA Narrative 🔷

#RWA is paving the way for widespread adoption. It's the trend to watch in the upcoming market rally.

RWA can be understood as physical world assets (like real estate, bonds, commodities, etc.).

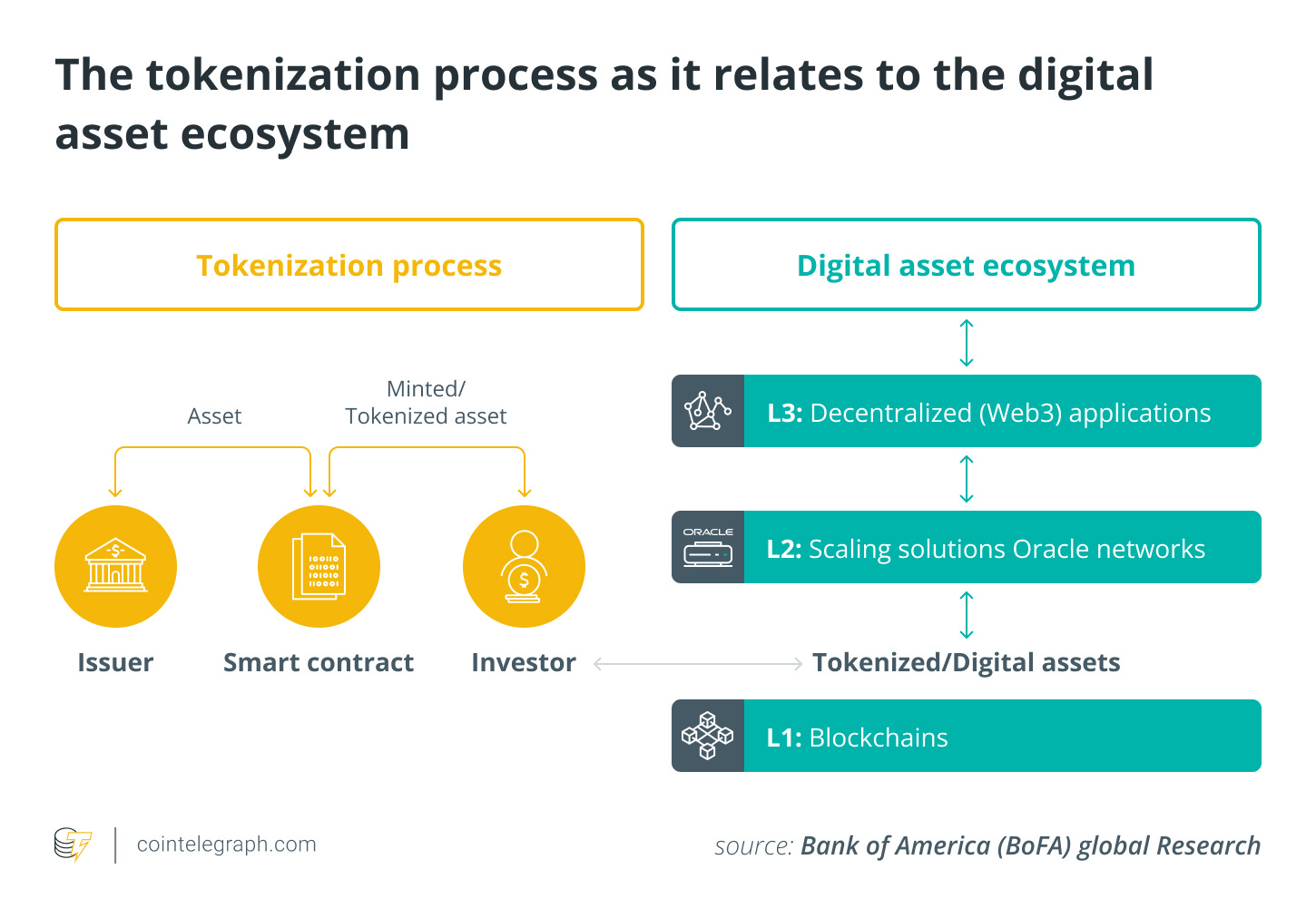

Their tokenization introduces these non-digital assets to the blockchain space…

So DeFi is often viewed as a blockchain-centric investment playground.

Yet, the integration of TradFi and DeFi is key to unlocking tangible economic benefits.

RWA stands as the frontrunner in bridging this divide.

RWA's market value has reached $1.3 billion, with total value locked (TVL) in RWA protocols hitting over $5.77 billion (as reported by Coingecko and DefiLlama), marking an 8x growth since early 2023.

The tokenization process includes:

Origination

Structuring

Subscription

Minting & Distribution

Secondary Trading

Maturity

Tokenization of physical assets boosts their accessibility and liquidity.

In contrast to traditional markets with strict trading restrictions and expensive entry barriers, investors can trade these tokens around the clock, making them more accessible.

🔷 Listing and Opportunity🔷

Mark your calendars as @landxfinance lists on @MEXC_Official & @gate_io on the 14th Dec

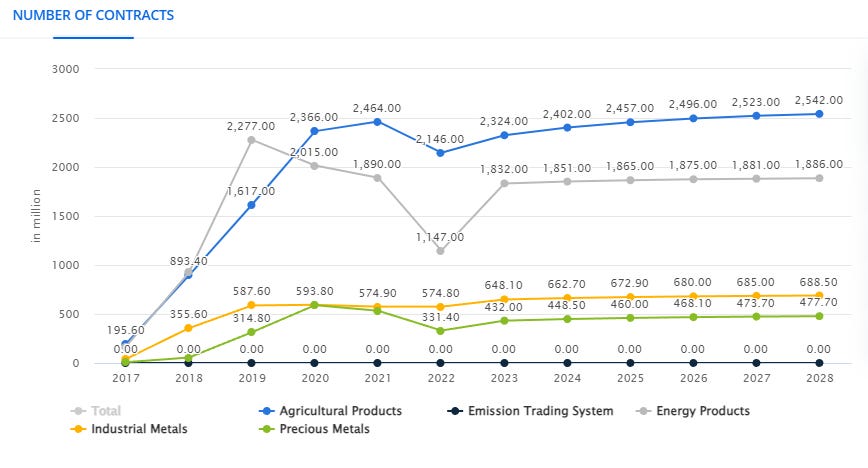

Farmland is a $15T market opportunity and @landxfinance is only just starting out to capture a part of that.

By 2040, the projected market size of RWA on-chain is estimated to be between $16-20T, placing LandX in a position of immense potential as we see more institutions getting interested in in RWA in DeFi.

Only a few understand @landxfinance potential with a MC at $2.7M

🔷 $LNDX Tokenomics 🔷

With a circulating supply of 5.4 million $LNDX tokens and 2.4m held by the treasury, the initial market cap is set at approximately $2.7m.

Based on an initial price of $0.50 per $LNDX.

Considering that they have substantial cash reserves exceeding $6 million, the intrinsic value of LNDX is poised for significant growth.

The token distribution strategy is long term focused.

Seed investor tokens are locked for four years, followed by a four-year vesting period.

As over 40M LNDX will be released starting from year 4, the FDV should be recalculated to reflect this future availability.

Community focused

At launch, 55% of LNDX’s circulating supply is community-held underscoring the widespread adoption and trust in the token.

Utility

LNDX tokens offers utility such as

governance

staking rewards

60% of protocol fees distributed to $LNDX holders via real yield, USDC

🔷 Milestones 🔷

LandX's journey has been marked by over two years of dedicated development, before they launch.

They have a pipeline to onboard over 10,000 hectares of land in 2024, which will keep the team busy with lots of updates. Token holders love to hear all these stuff.

LandX is also strategically positioned for sustained long-term growth

Strong financial backing, with over $6 million in the LandX treasury

Flash public raise, shows strong community support

RWA narrative

ESG driven, which will likely be the next hot narrative

🔷 Conclusion 🔷

The listing of $LNDX on exchanges is a pivotal moment to celebrate in DeFi, RWA might be round the corner for mass adoption.

With a well-thought-out strategy, strong community backing, and a constantly shipping team, the future looks promising for LandX.

It pioneers the integration of a multi-trillion-dollar asset class into the digital finance world.

Twitter: https://twitter.com/arndxt_xo/status/1734533105263030704