Strong partners’ backing by @Consensys and the @LineaBuild team

IDO on DAOmaker

They are launching with only $421K MC 🧵👇

(Bookmark to obtain IDO WL!)

Public Sale WL

Ticker: $LYNX

Initial Market Cap: $421,500

FDV: $6M

TGE and CEX Listing: 15th of February 👀

Token Unlocks: 20% at TGE, then 20% per month

Public round got the best terms and so I have some WL to give (priority goes to my pad subscribers as usual, will have some spots for the masses too)

Give the thread a Bookmark, RT, Comment and Like

Will pick my loyal followers for the IDO

Public: 20% TGE, 1 months lock, 4 months vesting

Strong Traction During Pre-Launch

Pre-launch started on the 16 Aug and they have already seen imrepssive stats:

40,000 Unique Visitors in 28 days

5,000+ wallets interacted with dApp

500+ wallets signed up to allow-list

$300,000+ daily volume at pre-TGE

10,000+ unique testers on testnet

T1 Exchanges and Partners

About Lynex

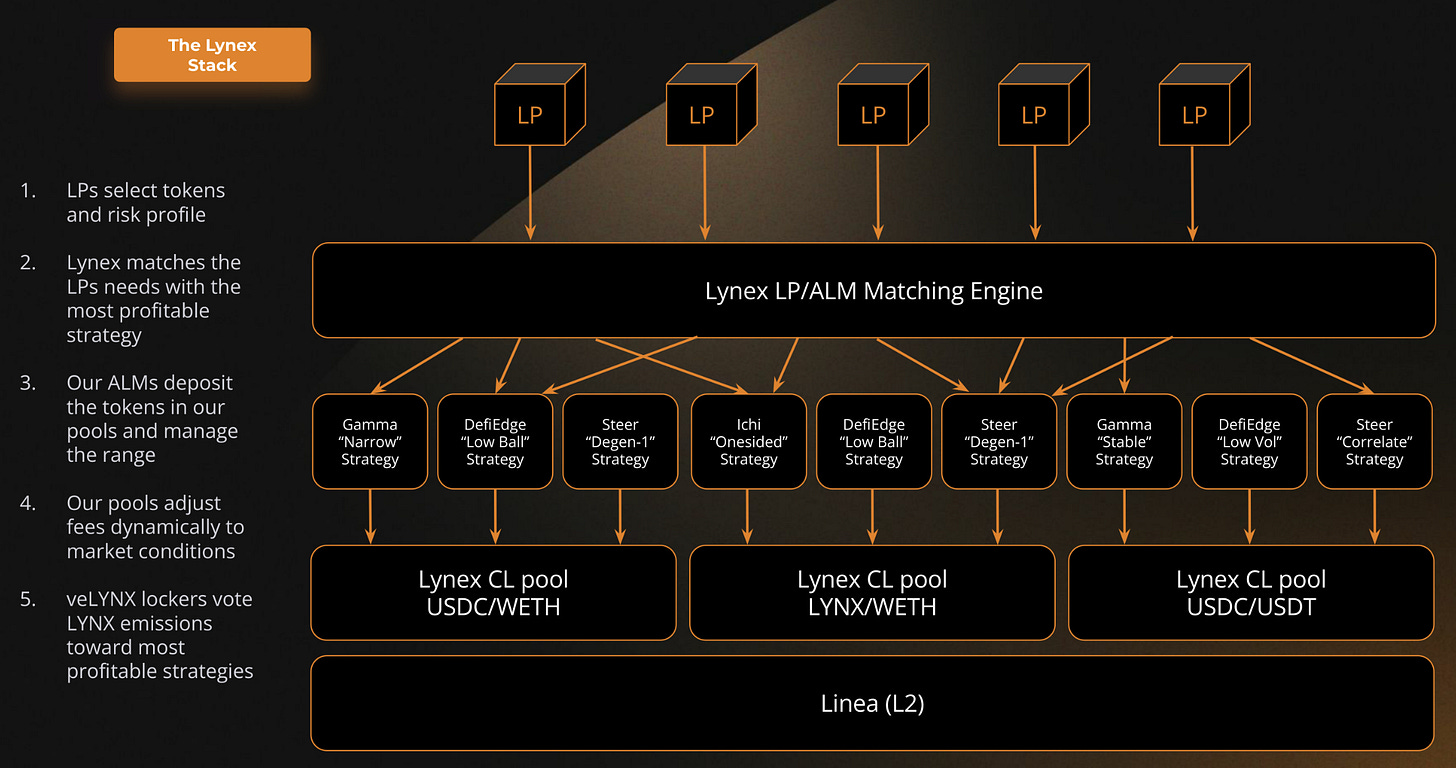

@LynexFi is a ve33 LST-focused liquidity marketplace comprising of the following components:

DEX

Liquidity vaults

Automated Liquidity Management (ALM) aggregator

Key Features

Concentrated Liquidity Infrastructure - Powered by Algebra

Automatic Liquidity Manager Aggregator - Marketplace for ALM with a set and forget approach by maxmizing APY and protection against IL

Elastic Liquidity Pools - Dynamic fee structure and a concentrated liquidity model. Balancing the incentivization of LP.

ve(3,3) Voting Mechanism - Promote on-chain liquidity and governance participation

zkLynex - First adopter of ZK-SNARKs technology on the Linea introducing a dark pool concept, improving privacy and prevent MEV attack.

Options Liquidity Mining - Liquidity providers earns Options LYNX (oLYNX) tokens where LP enjoy flexibility.

Narratives

Positioning and Growth Timing

Capitalize on Linea's growth, as they achieved a $700M funding and backing by Consensys.

First and only ALM aggregator on Linea.

The only DEX with zk Dark pool technology on Linea.

Market Cap Potential

Launching with inital MC $421k

Drawing parallels with the success of Thena of seeing 15x

Trading Strategy Insight

Lock LYNX into veLYNX to earn epoch rewards and bribe mechanisms

Flywheel cycle by provinding LP to earn oLYNX, convert to veLYNX, and vote in weekly gauges to collect trading fees and bribes, reducing LYNX selling pressure.

Roadmap

2023 Q3:

Partnership with Thena, Algebra

First ALM integration with Gamma Strategies

Limit orders and stop-loss .

Integrate single-sided deposits with ICHI

2024 Q1:

Initial Liquidity Incentives and Bribes Program

Auto Bribing Module $LYNX can be supplied and borrowed

Launch Options token as a service.

2024 Q2:

zkLynex: Zero-Knowledge MEV Protected Swaps.

Fiat On/Off Ramp

Strategy insights, impermanent loss analysis, and yield projections.

2024 Q3:

Integrate Liquidity Bins

Introduce Cross-Chain Swaps

Community-Driven Ecosystem Fund

Integrate Yield Insurance

2024 Q4:

AI-Driven ALM Solutions

Account abstraction

Release Lynex SDK for Developers

And Beyond:

Launch Lynex Derivative Products: Futures and options trading.

Empower community involvement in significant protocol upgrades through voting.

Organize Lynex Hackathons

Expand into Institutional Services

More cross-chain interactions.

Lynex (LYNX) revenue streams

Lynex generates revenue from trading fees.

More volume more fees, more LYNX locked to compete over these revenues and decreasing LYNX circulating supply.

Lynex has a list of partners that will supply yield-bearing assets as liquidity on Lynex (QiDAO, Davos, Ledgity, Overnight). These assets will accrue value, part of which will also be added to our DEX revenue in the form of locking and voting incentives.

Swap Fees - Treasury holds veLYNX tokens to optimize liquidity and collect swap fees. These fees are used for various operational activities, such as LYNX token buybacks and burns, bribing core pools, and funding development efforts.

Emissions and Treasury Allocation - 4% portion of the emissions is allocated to the treasury.

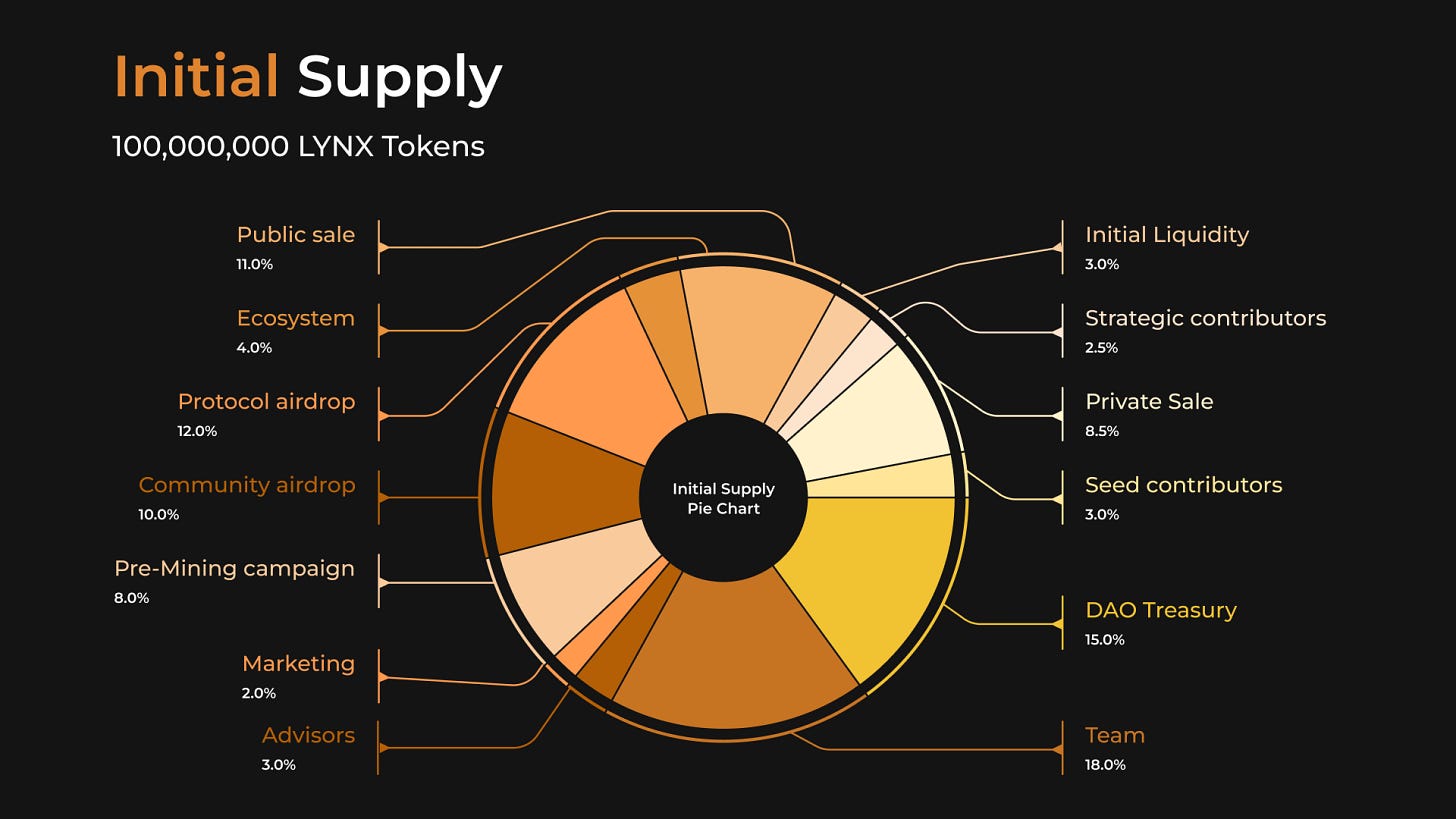

Tokenomics

$LYNX have a range of utilities:

Better discounts on Options LYNX: Holding $veLYNX will give liquidity miners enhanced discounts on their $oLYNX claims.

Governance Participation: Lock $LYNX holders to obtain $veLYNX for governance

Voting Rewards: $veLYNX voting entitles voters to fee distribution and bribes.

Emissions directions: $veLYNX voters get to vote on weekly protocol emissions and rewards

Liquidity Mining: Users can acquire $LYNX and pair it with other assets to earn $oLYNX

Collaterals: $LYNX tokens can be used as collateral

Here are some important sale terms you need to know:

Public: 20% TGE, 1 months lock, 4 months vesting

Strategic/KOL: 15% TGE, 6 months lock, 0 months vesting

Private: 10%, TGE, 6 months lock, 24 months vesting

Seed: 10%, TGE, 6 months lock, 24 months vesting

Lynex Team

Apeguru - CEO & Founder, Co-founder of ApeSwap

Krugo - Head of BD, Austrian economist turned crypto degen since 2016

Bronnie - Head of marketing, with 6 years of experience in Digital marketing

Apetastic - Solidity dev and head of security

Partners

Advisors:

Simon Yi - Founder of Myosin - Previous: Growth Hacker at Consensys

Mauvis Ledford - Head Advisor at BitNinja Web3 Advisory - Previous: CTO at Coinmarketcap

Zeb - Senior Analyst at Cyber Capital - Mentor at Outlier Ventures - Previous: Grant Lead at Balancer

Elliot Meijer - CEO at Decubate

Partners:

StakeStoke - Omnichain LST

Overnight - Omnichain CDP

QiDAO - Omnichain CDP

Davos - Omnichain LST Stablecoin

Orbs - DeFi utilities layer 3

Apebond (Ex ApeSwap) - Multichain bonding protocol

Twitter: https://twitter.com/arndxt_xo/status/1755979897082941777