Every FOMC event gets reduced to a binary choice: “cuts = bullish, hikes = bearish.”

Reality is far more nuanced. We need to consider interdependent system with delayed, compounding effects.

The cost of pretending to “outsmart” macro is high. Even if you guess the direction correctly, conviction often collapses under uncertainty. My approach: don’t over-engineer.

My Playbook for FOMC Days

• Liquidity thins: Volumes die ahead of the announcement.

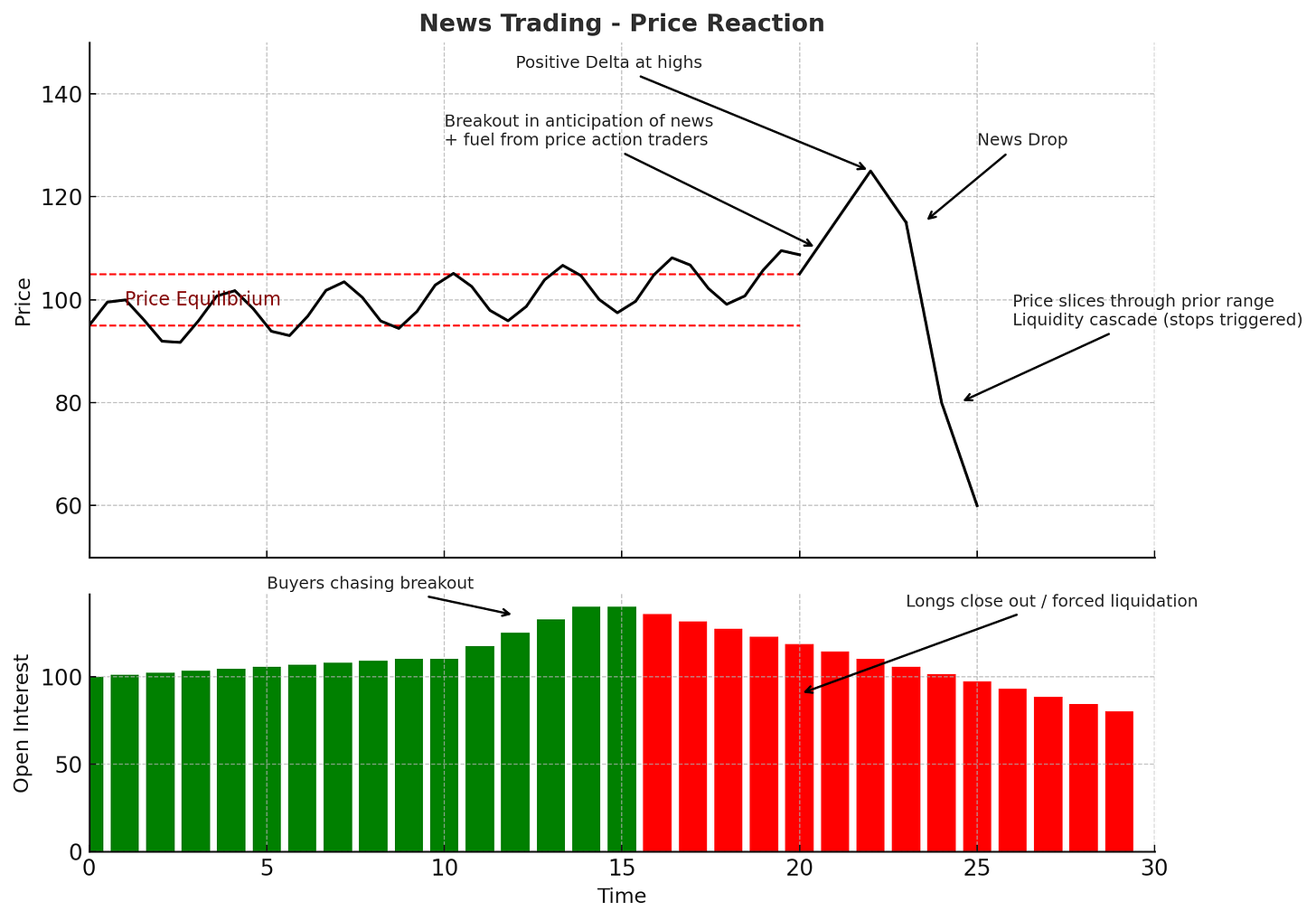

• False signal: Market offers a bait move to one side.

• Reversal: Then whips the other way, liquidating anyone who chased.

Current Odds

• 96% probability of a 25bps cut (base case).

• 4% probability of a 50bps cut.

• 1% probability of a hike (which would signal political capture of the Fed).

Cuts mean cheaper capital. Cheaper capital fuels risk assets, including crypto. Expect volatility, perhaps a sell-the-news pullback before continuation.

Market Structure

• Higher timeframes remain constructive; trend intact until proven otherwise.

• Market structure > macro speculation: delta, price action, open interest provide higher signal-to-noise.

• Avoid unnecessary churn: trying to perfectly sell and rebuy at this stage introduces more risk than reward.

Forward-Looking Narratives

• Fed cuts by 25bps tomorrow.

• U.S. avoids recession until mid-2026 → no structural equity crash before then.

• Rotation: ETH > BTC, SOL > ETH.

• PMF-backed projects ($HYPE, $PUMP) continue scaling; fundamentals drive token strength.

• Liquidity wave begins mid-Oct through early Nov.

• Altseason will not be broad-based. Instead, narratives will drive selective, category-level multiples (AI tokens like $AVNT, $MYX are early case studies).

• Narrative cycles likely extend longer than in past cycles.

For those farming EdgeX, here’s a 10% point boost, link in my bio. https://pro.edgex.exchange/referral/ARNDXT