We’re in a “silver lining” economy

@saylor scooping up all $BTC

I found 4 indicators of a economy at its turning point 👇🧵

Macro Pulse Update 02.12.2023, covering the following topics:

1️⃣ Macro events for the week

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ China Spotlight

1️⃣ Macro events for the week

Last Week

Next Week

2️⃣ Bitcoin Buzz Indicator

Market and Investment Updates

Pando Asset Joins U.S. Bitcoin ETF Race

Crypto VC Funding Hits $1.75 Billion in November

Terra Ecosystem's Remarkable Recovery

Legal and Regulatory Developments

Binance's Legal Woes and Market Presence

Circle Addresses Alleged Ties in Senatorial Letter

Blockchain and Cryptocurrency Innovations

Cosmos Hub Proposes ATOM Inflation Reduction

Polygon's Network Developments and Challenges

Starknet's Potential STRK Token Airdrop

Security and Hacks

KyberSwap's $47 Million Hack Incident

Crypto Hacks Surge to $350 Million in November

NFT and Metaverse Trends

Pudgy Penguins' Rise Amid NFT Market Crash

Kingship Band's New Roblox World

Illuvium and Team Liquid's Blockchain Gaming Venture

Platform and Token Updates

LooksRare's Token Migration and Incentives

Altcoins

Inferno Drainer ceased operations after allegedly stealing $70M in cryptocurrencies.

Circle and SBI Holdings collaborated to increase USDC's presence in Japan.

Hong Kong initiated investigations into a supposed $15.4 million crypto fraud by Hounax.

$750 million in locked crypto tokens were set for release by December.

dYdX Chain finalized its mainnet migration, introducing $20 million in DYDX token rewards.

Some EVM chains witnessed over 1000% increase in transaction counts since mid-November.

MAGIC EDEN debuted its cross-chain wallet for NFTs and crypto.

Chainlink enhanced its staking mechanism, introducing a 45 million LINK pool.

Velodrome and Aerodrome DEXs confirmed fund security post-frontend hack.

Uniswap DAO sanctioned a 10 million UNI delegation to active voters.

Genesis reached a repayment agreement with parent company DCG, concluding a $620M lawsuit.

Zipmex, facing difficulties, proposed repaying creditors at 3.35 cents on the dollar.

The UK planned to impose penalties on crypto users for unpaid taxes.

Iota set up a $100M foundation in Abu Dhabi, aiming for Middle Eastern expansion.

Republic announced plans to list a profit-sharing digital security token on INX.

Wormhole secured $225M funding at a $2.5B valuation.

Rarible’s RARI Foundation chose Arbitrum for its royalty-embedded EVM chain.

Celsius allowed withdrawals for eligible crypto holders.

FTX sought court permission to reduce the IRS's $24B claim to zero, also gaining approval to sell $873M in trust assets.

Brazil announced a 15% tax on crypto transactions with overseas exchanges starting in 2024.

Binance initiated a pilot program for bank-managed collateral to minimize investor risk.

Injective's (INJ) price rose 10% after OKX listing and a $65,000 token burn.

The United Nations partnered with Algorand for Web3 education programs for its staff.

Ripple faced an ongoing legal struggle with the SEC, with rumors of a potential early settlement.

Reddit's r/cryptocurrency subreddit transferred control of the Moons token contract, leading to a surge in MOON.

Bitget ceased registrations in China and hinted at a major upcoming announcement.

3️⃣ Market overview

The economy shows resilience though slowing, geopolitics remains complicated, and markets tread water while eyeing key upcoming inflation figures.

Q3 GDP growth revised up to robust 5.2% due to strong business investment and government spending, signaling economic resilience. However, slower income growth indicates moderate pace of broader recovery.

Positive signs like job market gains and ongoing consumer spending point to slight cooling rather than sharp downturn entering year-end.

Softer PCE inflation data suggests manageable price pressures ahead.

4️⃣ Key Economic Metrics

🟢 U.S. economic data shows continued economic expansion and slowing inflation. Outlook for soft landing better than a year ago but still uncertain. Interest rates weighing on housing and manufacturing outlooks.

Personal spending remains solid, though slowing from Q3 pace.

October PCE deflator confirms ongoing disinflationary trend. Headline and core inflation at lowest rates since early 2021.

Slowing inflation raises prospects for a soft landing, though prices still above Fed 2% target. More evidence needed of sustained moderation.

Housing data shows prices rising at ~4% year-over-year, much slower than 2021/early 2022. Rate hikes slowing market but low inventory and solid jobs market prevent declines.

Manufacturing sector still generally contracting per ISM index. Weakness in employment, production, and new orders components. Index near lowest levels outside recessions in 25 years.

🟢 Economy heading toward slower growth, but with silver linings like easing inflation pressures that support a policy pivot. The Fed looks nearly ready to stop raising rates.

Economic growth is cooling heading into the end of 2022, indicating a slowing pace after a blistering Q3. Slowing activity since early October. This cools previous sentiment of "little to no change."

Slowing consumption, especially on discretionary items, is a main driver. Households seem to be pulling back, particularly middle and low income families who may have run down excess savings. However, demand remains strong for big ticket and luxury items.

Income growth has held up better than expected, though there are signs of incremental labor market weakness. Wage growth remains elevated for high-skilled positions with labor shortages.

Easing price pressures are another takeaway. Businesses now have less pricing power in light of consumer pushback and sensitivity. Most districts expect the pace of price increases to moderate going forward.

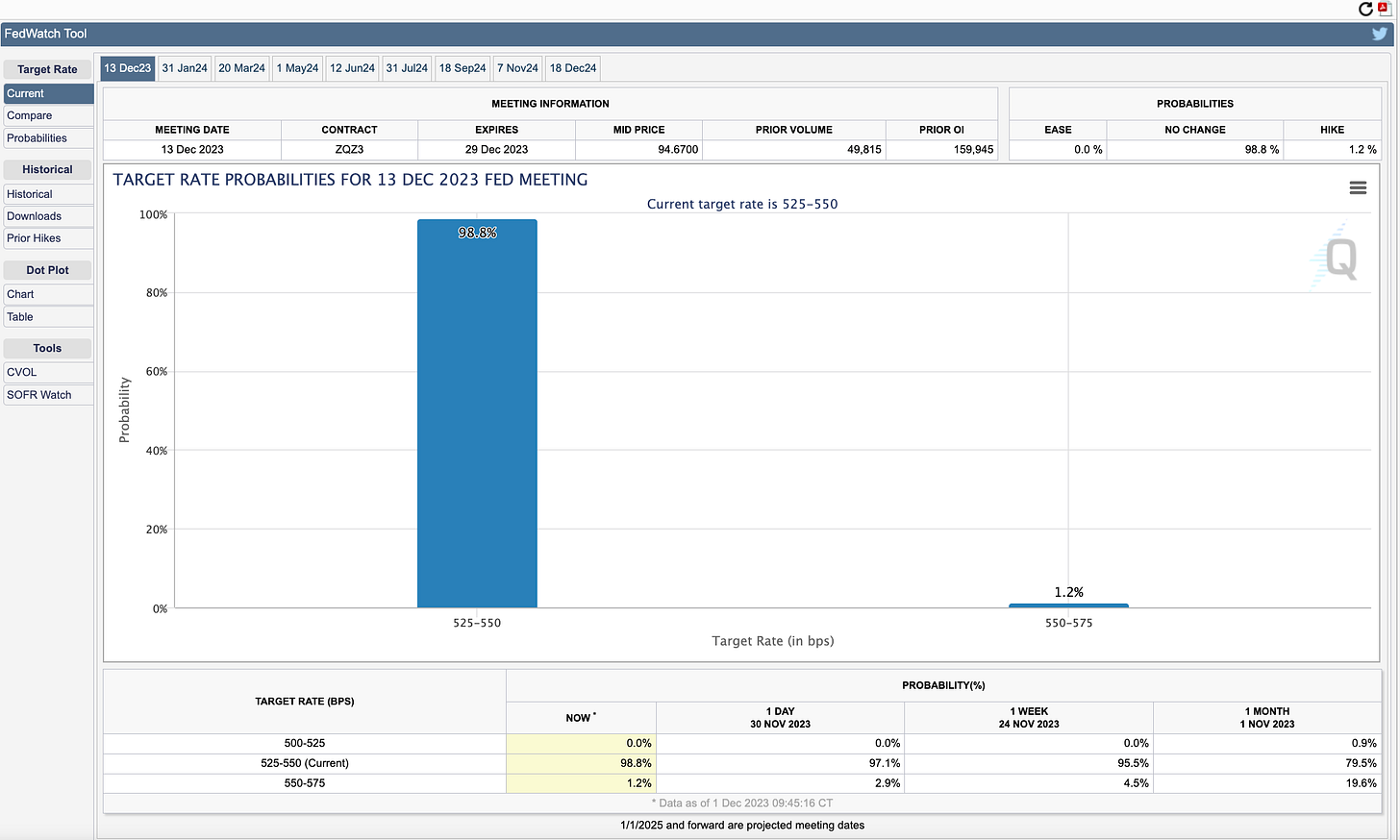

Key themes reinforce the view that the Fed is nearing the end of its rate hike cycle, with moderating consumer spending, cooling labor demand, and subsiding inflation all pointing to potentially lower rates ahead.

🟢 UK shop price inflation dropped to 4.3% in November, the lowest rate in over a year

Driven by heightened retail competition before Christmas and slowing food inflation.

While this easing of price pressures encourages consumer spending, future corporation tax and minimum wage increases could hinder or reverse recent disinflationary trends according to the British Retail Consortium.

5️⃣ China Spotlight🟡

China manufacturing PMI falls for second straight month signaling weakening momentum

Non-manufacturing PMI decline reflects wider economic slowdown

Falls despite promising Q3 GDP growth of 4.9%

Latest PMI data indicates potential economic steam loss entering 2024

May prompt fiscal and monetary support from government to sustain growth

The People's Bank of China has pledged in its latest policy report to use targeted monetary policy tools to support expanding domestic demand.

Despite global and domestic economic challenges, policy aims for precise, powerful interventions to ensure sufficient liquidity with policies introduced to address property sector, local debt, geopolitical tensions

This should enhance financial stability for real economy, plus the banks plan to maintain yuan stability

Targets around 5% GDP growth this year

Signals strategic focus on domestic strength amid global uncertainty

Twitter: https://twitter.com/arndxt_xo/status/1730907968974283122