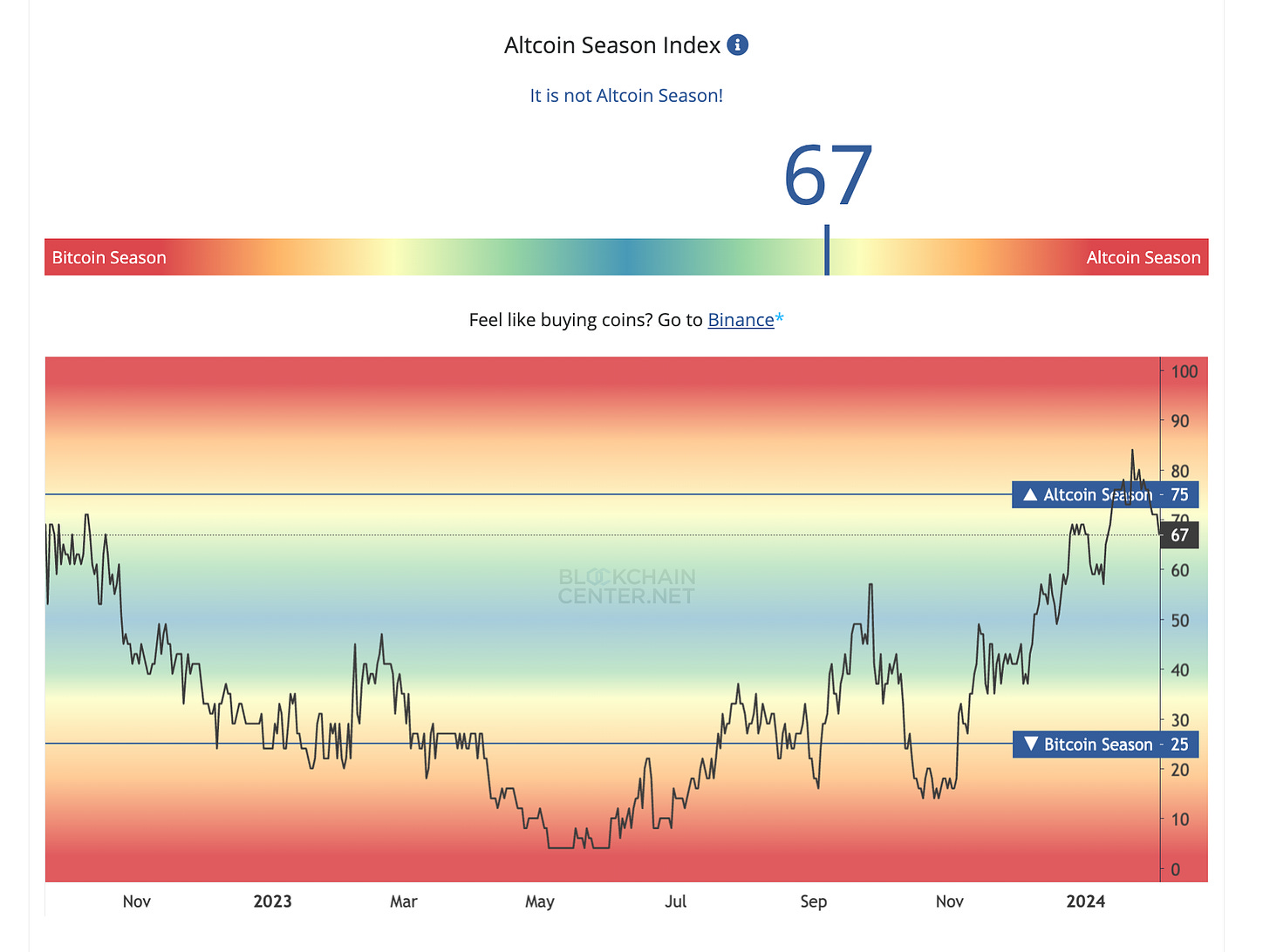

We are 7 points away from ALTCOIN SZN

Crypto bleeds as we decouple from the stock market

China frontruns with money printing

Here are 4 factors that shows economic resilience👇🧵

Macro Pulse Update 03.02.2024, covering the following topics:

1️⃣ Macro events for the week

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ China Spotlight

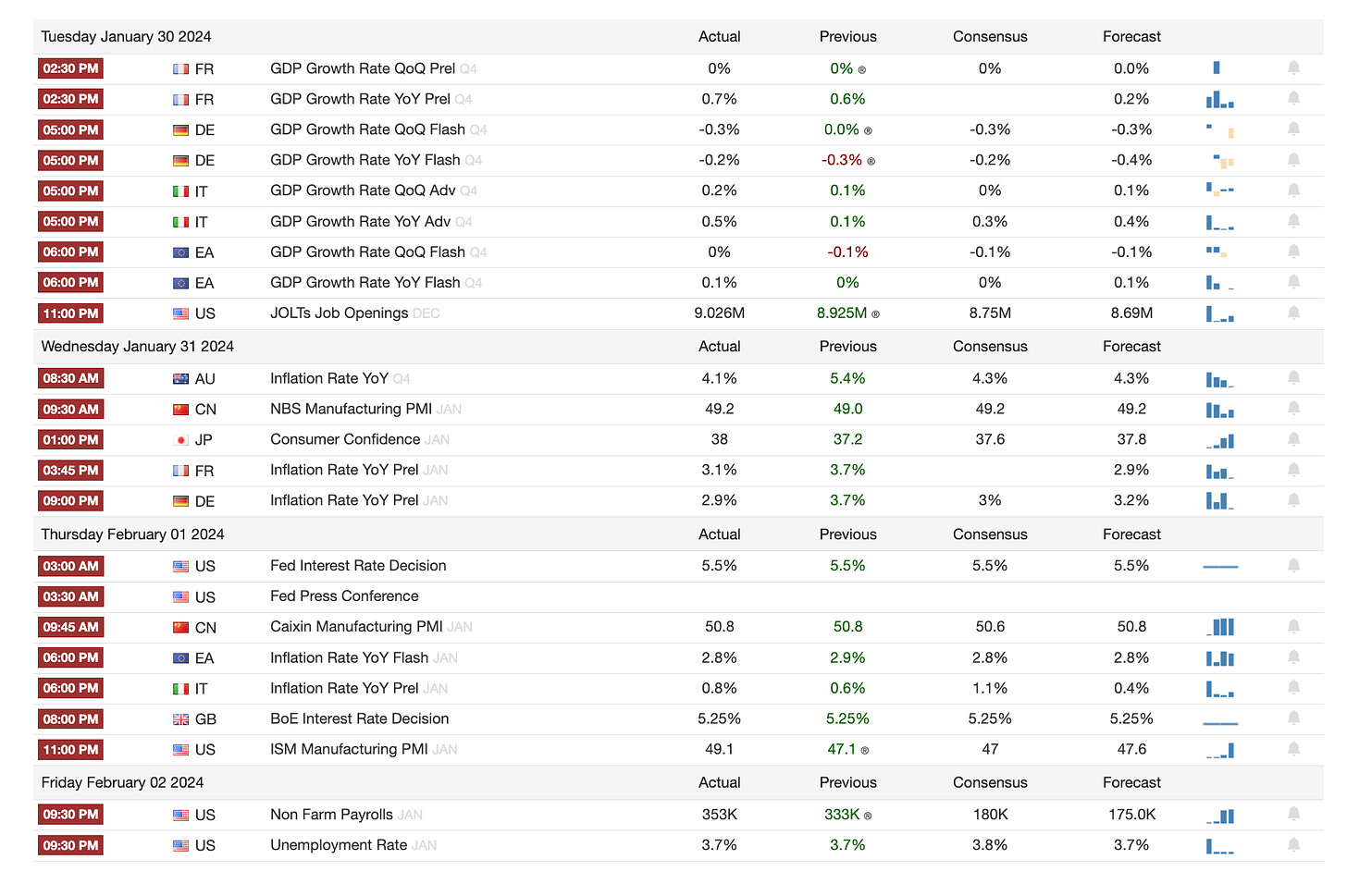

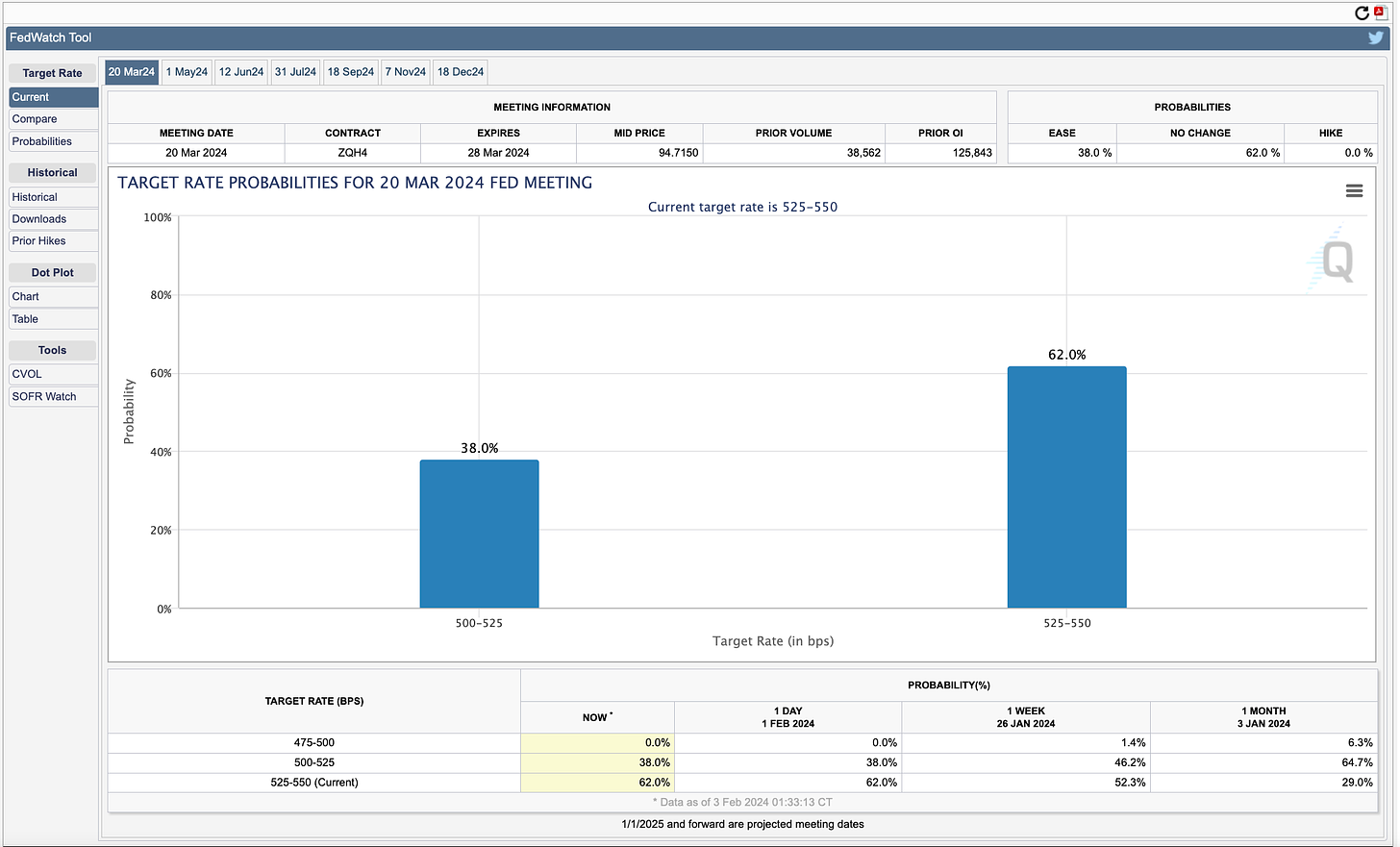

1️⃣ Macro events for the week

Last Week

Next Week

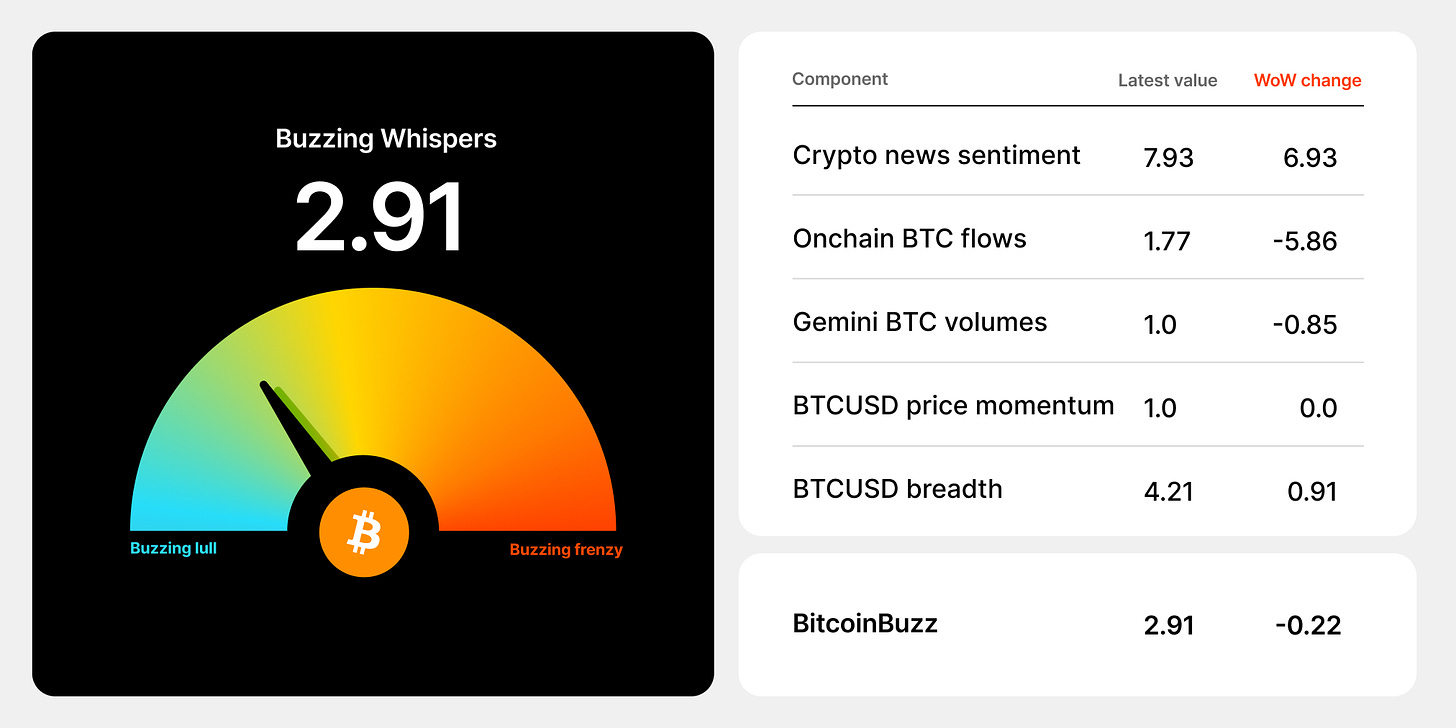

2️⃣ Bitcoin Buzz Indicator

Crypto Market Updates

Ripple Co-Founder's XRP Hack Causes Market Stir

Binance Overcomes Legal Hurdles and Market Dominance

Jupiter's JUP Token: A Volatile Crypto Journey

Hong Kong Tightens Crypto Regulations Amidst Market Changes

Legal and Regulatory Actions

Global Crypto Seizures Spotlight Regulatory Enforcement

FTX Abandons Revival, Faces Legal and Financial Woes

Celsius Network's Bankruptcy Exit and New Ventures

Genesis Settles with SEC Amid Bankruptcy Proceedings

Exchange and Platform Developments

Open Exchange Closes Due to Legal and Market Challenges

OpenSea's Potential Acquisition Amidst Market Shifts

Pixelmon's Decentralized Gaming Evolution Secures Funding

Serum City Launches: Exclusive Gaming for NFT Holders

Quantum Cats NFT Project Faces Technical Setbacks

Altcoins

Ava Labs detailed a scaling solution, Vryx, aiming for Avalanche to achieve 100,000 TPS.

XRP saw its highest single-day whale accumulation since Ripple's partial SEC lawsuit victory.

Orbiter Finance, backed by OKX, launched its own Layer 2 network.

Coinbase's lobby group reported 18 US senators supporting crypto.

Stellar Development Foundation postponed Protocol 20 upgrade due to a bug.

Binance Labs refuted leading a $15M funding round for SkyArk Chronicles.

OKX initiated inscription support for Atomicals, Stamps, Runes, and Doginals.

MakerDAO's co-founder sold $4.5 million in MKR, impacting the token's stability.

TRANSAK teamed up with Visa for global crypto withdrawals in 145 countries.

dYdX Foundation requested a $30M budget and committed to annual spending reports.

Polygon-powered Immutable zkEVM mainnet began early access.

Coinbase implemented fees for USDC to USD conversions exceeding $75 million.

Starknet collaborated with Celestia on Layer 3 data availability.

Abracadabra Finance lost an estimated $6.4 million in a security breach, MIM dumped.

Terraform Labs declared bankruptcy to fund an appeal against the SEC's fraud lawsuit.

Filecoin added Pyth price feeds to enhance its decentralized storage.

Worldcoin, founded by Sam Altman, faced an investigation over privacy breaches in Hong Kong.

Bitfinex Securities commenced operations in El Salvador with plans for US expansion.

DeFiance Capital won a legal dispute against 3AC in Singapore.

Coinbase and Ripple donated $25M and $20M, respectively, to the crypto super-PAC Fairshake.

Bybit submitted a regulatory license application in Hong Kong.

PEPE's value dropped 35.8% in January after a whale sold 1.731T PEPE for $802.5K.

The Biden administration initiated an emergency survey on crypto miners' electricity use in the US.

Polygon Labs cut 19% of its workforce to enhance performance.

Thai regulator instructed Zipmex to halt digital asset trading and brokerage services.

3️⃣ Market overview

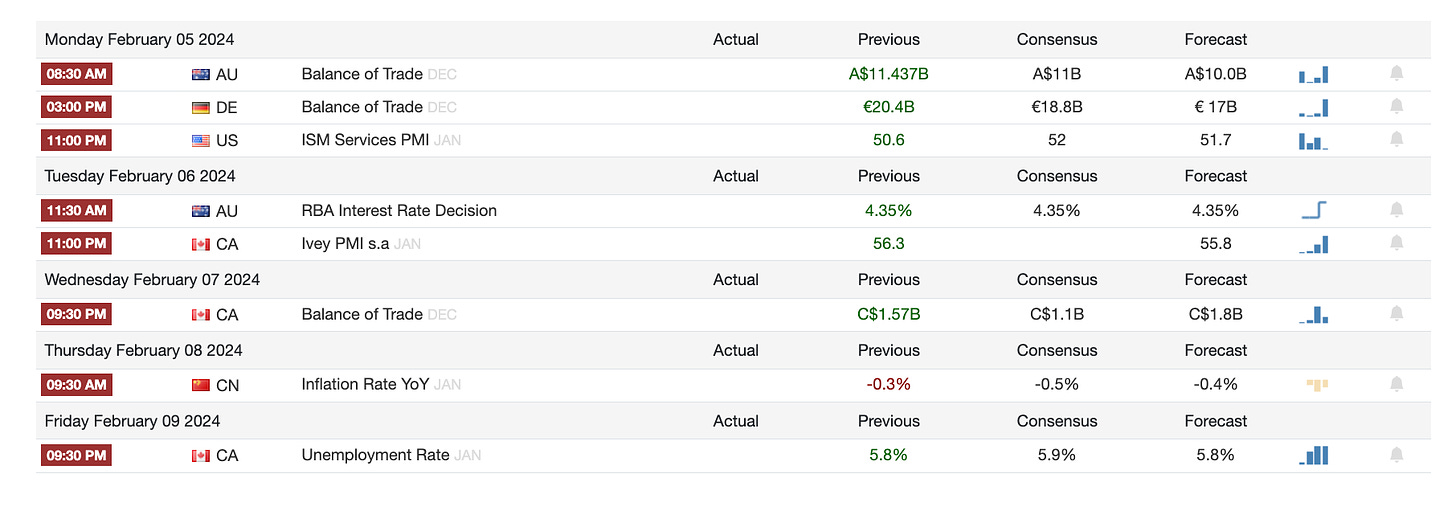

The Fed keeping rates steady indicates its cautious approach to policy in light of economic uncertainties. However, openness to future rate cuts shows willingness to support growth if needed.

Powell emphasizing more data needed before rate cuts suggests the Fed will take a patient approach guided by incoming economic data.

Reducing the balance sheet on schedule shows the Fed remains focused on fighting inflation despite economic risks.

The sharp Nasdaq/S&P decline shows investors growing concerned about earnings and growth outlook amid rising economic uncertainty.

Google's miss on ad revenue highlights worrying signal for digital advertising outlook. Microsoft's strong earnings cushioned by cloud.

Increase in jobless claims to 224,000 suggests a mild cooling of the U.S. labor market, indicating a phase of stabilization following a period of significant job growth. Despite this uptick, layoffs remain historically low, pointing to an underlying robustness in the job market.

4️⃣ Key Economic Metrics

Economy remains on solid footing, though tighter monetary policy will likely slow growth moderately. Key support factors are strong labor market, rising wages, low debt burdens. Inflationary pressures continue easing.

Latest GDP and inflation data suggests the US is on track for a soft landing with continued moderate growth and declining inflation. Consumer spending remains resilient.

🟢 GDP Growth:

Q4 GDP grew a solid 3.3%, slowing from Q3 but showing economic resilience amid rate hikes. Underlying demand steady.

Consumer spending was robust (up 2.8%) on rising wages and low debt burdens. Nonresidential investment also rose despite high rates.

🟢 Inflation Trends:

PCE inflation slowed in December, with core at 2.9% year-over-year - providing room for Fed rate cuts.

Durable goods inflation declined showing normalization of pandemic price spikes. Services inflation remains elevated at 3.9%.

🟢 Incomes/Spending:

Income growth was modest but savings rate declined as spending outpaced incomes. Signals strong consumer demand.

Durable goods spending jumped showing housing/vehicle demand strength. Services spending rose more modestly.

5️⃣ China Spotlight🟢

China's central bank, the PBOC, cut the reserve requirement ratio (RRR) for banks by 50 basis points, unleashing $140 billion into the banking system. This monetary policy easing follows sharp declines in Chinese equities and a troubled property sector.

Equity market capitalization has fallen $6 trillion since 2021, concerning authorities. Easing aims to boost market confidence and valuations.

Property sector is troubled, and PBOC wants to stabilize it. RRR cut will provide more funding for property loans.

PBOC says goal is to create good monetary conditions for the economy. However, easing may be insufficient to stimulate recovery amid a potential liquidity trap.

Fiscal stimulus targeted at households may be more effective to boost domestic demand and reverse deflation.

PBOC reluctant to cut rates aggressively for fear of currency depreciation. But now expects Fed rate cuts to mitigate currency impact.

Further major rate cuts could better boost equities but don't appear imminent.

Twitter: https://twitter.com/arndxt_xo/status/1753739619676696789