Over $900M tokens unlocked in August 2024.

ETH ETFs had a net inflow of $33,700,000.

BlackRock bought $118,000,000 $ETH.

Here is what you need to need know for the next leg up👇🧵

Macro Pulse Update 03.08.2024, covering the following topics:

1️⃣ Macro events for the week

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ China Spotlight

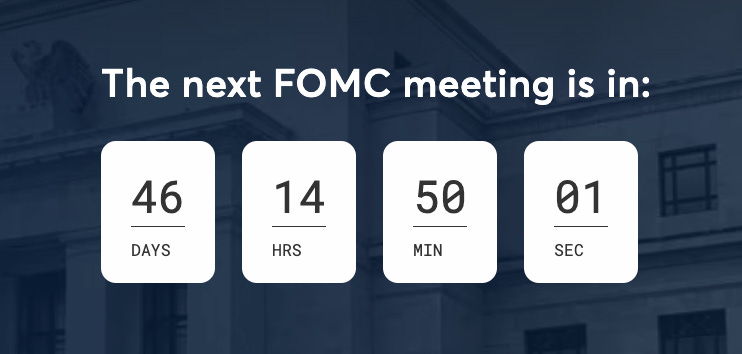

1️⃣ Macro events for the week

Last Week

Next Week

2️⃣ Bitcoin Buzz Indicator

Crypto Market Updates

SEC Adjusts Crypto Strategy, Charges BitClout Founder

Compound Finance Faces Governance Attack, Proposal Canceled

Raydium Meme Coin Launch Causes Market Turbulence

Terra Blockchain Exploit Halts Operations, Resumes with Fix

Company Performance and Financial Reports

Tether Reports $1.3 Billion Q2 Profit, Pauses Bitcoin Purchases

Coinbase Reports $1.4 Billion Q2 Revenue Amid Allegations

Governance and Security

Kujira's Token Drops 40%, Team Discusses Bailout

Neiro Memecoin Surges 4,400% Despite Insider Trading Concerns

Games and NFT Developments

"Hamster Kombat" Game Whitepaper Reveals Token Plans

Donald Trump's Bitcoin NFT Sneakers Sell Out

Artists Sue SEC Over NFT Classification

NFT Market Sales Decline by 36.6% in July

Altcoins

Layer3 distributed tokens starting July 30.

OKX listed ONDO, causing a 7% surge.

WazirX faced backlash over recovery plan and sought Binance's help.

21Shares integrated Chainlink for Ethereum ETF transparency.

Ava Labs planned to provide 42M digital car titles via app by 2025.

StarkNet ZKX ceased operations due to low user participation.

Renzo lost 55% of TVL in 6 weeks.

Aave launched V3.1 to enhance protocol.

Women in crypto earned 15% more, per Pantera survey.

Worldcoin launched ID verification in Austria.

LayerZero powered Animoca Brands’ Web3 gaming interoperability.

USDY stablecoin launched on Aptos.

Wemix.fi suspended lending services after $7M legal victory.

Nansen CEO's memecoin hit $6M market cap in a day.

Mantle TVL dropped after reaching all-time high.

Ethena Labs launched USDe collateral on Bybit.

Elixir launched deUSD with $1B liquidity support.

Over $900M tokens unlocked in August 2024.

Casper Network resumed operations after security breach.

Ripple partnered with OpenEden to access tokenized treasury market.

Manchester United and Tezos launched Web3 fantasy football game.

DWF Labs debuted synthetic stablecoin amid sector growth.

Galaxy Digital posted $177M net loss in Q2.

Bitlayer overtook Merlin in the scaling battle.

Convergence's code removal led to a $212K hack.

Jupiter proposed a major reduction in JUP supply.

HashKey OTC secured a major license from Singapore's MAS.

Sandbox partnered with LayerZero to expand SAND.

BlackRock's BUIDL paid $2.1M in July dividends.

Pixelverse opened NFT mint, celebrating 38M players.

Fantom rebranded as Sonic Labs, launched new token.

Bybit withdrew from France due to regulations.

Court upheld Do Kwon's extradition to South Korea.

Eclipse launched mainnet powered by Solana.

Binance Labs invested in aPriori.

Binance Labs invested in Particle Network.

Morpho raised $50M in a round led by Rabbit Capital.

Bitcoin Layer-2s attracted VC funding amid rising interest.

Coinbase, Google veterans raised $5M for 'blockchain's LinkedIn'.

A16z Crypto led $9M round for DePIN project Daylight.

DuelNow received $11M for Web3 betting.

3️⃣ Market overview

Fed Signals Possible Rate Cuts, but Middle East Tensions Impact Crypto: Fed officials hinted at a potential rate cut in September during their July meeting, but crypto prices dropped after Iran vowed retaliation against Israel for assassinating Hamas leader Ismail Haniyeh.

Trump’s Pro-Crypto Stance: At the Bitcoin Conference, Trump pledged to establish a strategic bitcoin reserve, halt US bitcoin sales, and fire SEC Chair Gary Gensler if re-elected, though Trump-themed tokens saw a decline.

Cantor Fitzgerald’s $2 Billion Bitcoin Financing Business: CEO Howard Lutnick announced plans to launch a Bitcoin financing business with an initial $2 billion investment to provide leverage to Bitcoin investors and support the cryptocurrency ecosystem.

US Spot ETH ETFs Experience Outflows: The nine US spot Ethereum ETFs had $98.29 million in outflows on Monday, extending their negative flow streak, with Grayscale Ethereum Trust facing the largest outflows.

SEC to Amend Binance Complaint: The SEC seeks to amend its complaint against Binance, focusing on “Third Party Crypto Asset Securities,” which could delay the court’s decision on whether certain tokens are securities.

4️⃣ Key Economic Metrics

🔴 Economic Resilience with Signs of Weakening:

Despite recent indications of economic weakening, such as slower employment growth, higher unemployment, and high borrowing costs affecting consumers, the US economy showed resilience in the second quarter with a 2.8% annualized growth rate.

Investors expect the Fed to cut rates, which could lower bond yields and mortgage interest rates, potentially boosting the housing market and consumer spending on durable household products

Consumer spending grew by 2.3%, with significant increases in durable goods (4.7%), non-durable goods (1.4%), and services (2.2%).

Foreign trade had a net negative impact on GDP, with exports up 2% and imports up 6.9%. Government purchases increased by 3.1%, led by a 5.2% rise in defense spending.

Favorable inflation data and easing labor market tightness suggest the Fed may cut interest rates in September, with a 90% chance of a 25-basis-point cut.

Real consumer spending grew faster than real disposable income in June, leading to a reduced savings rate and increased debt.

The personal consumption expenditure (PCE) deflator was up 2.5% in June year-over-year, with core prices rising 2.6%. Durable goods prices fell by 2.9%, while service prices increased by 3.9%, reflecting rising wages.

5️⃣ China Spotlight🔴

China’s central bank, the People’s Bank of China (PBOC), has cut the one-year loan rate by 10 basis points, continuing a trend of cautious monetary policy. Since late 2021, the one-year loan rate has been cut by a total of 50 basis points, reflecting a cautious approach amid economic challenges.

The Chinese economy is experiencing slower growth, with second-quarter GDP growth significantly lower than the first quarter.

Retail sales also grew slowly in June, highlighting weak domestic demand and contributing to deflationary pressures.

While monetary easing aims to boost credit creation, structural issues like the property crisis and external challenges have hindered economic revitalization.

Analysts are advocating for greater emphasis on fiscal and regulatory policies to stimulate domestic demand.

Excessive rate cuts could weaken the RMB, complicating foreign debt servicing and potentially inviting protectionist measures from trading partners. Maintaining a steady currency value may require tighter capital controls or central bank intervention, offsetting the benefits of rate cuts.

Surprise Rate Cut and Loans:

The PBOC cut a key interest rate by 20 basis points and announced $27.5 billion in new loans at the new rate, indicating a shift towards more aggressive monetary easing.

Anticipation of potential rate cuts by the US Federal Reserve may have eased concerns about downward pressure on the renminbi.

Fiscal Stimulus:

The Chinese government plans to provide $41.5 billion in subsidies for households to purchase automobiles and consumer electronics, funded by special purpose bonds.

This fiscal stimulus aims to invigorate consumption and address excess capacity and deflationary pressures in the market.

Twitter:

Great summary! Appreciate your work :)