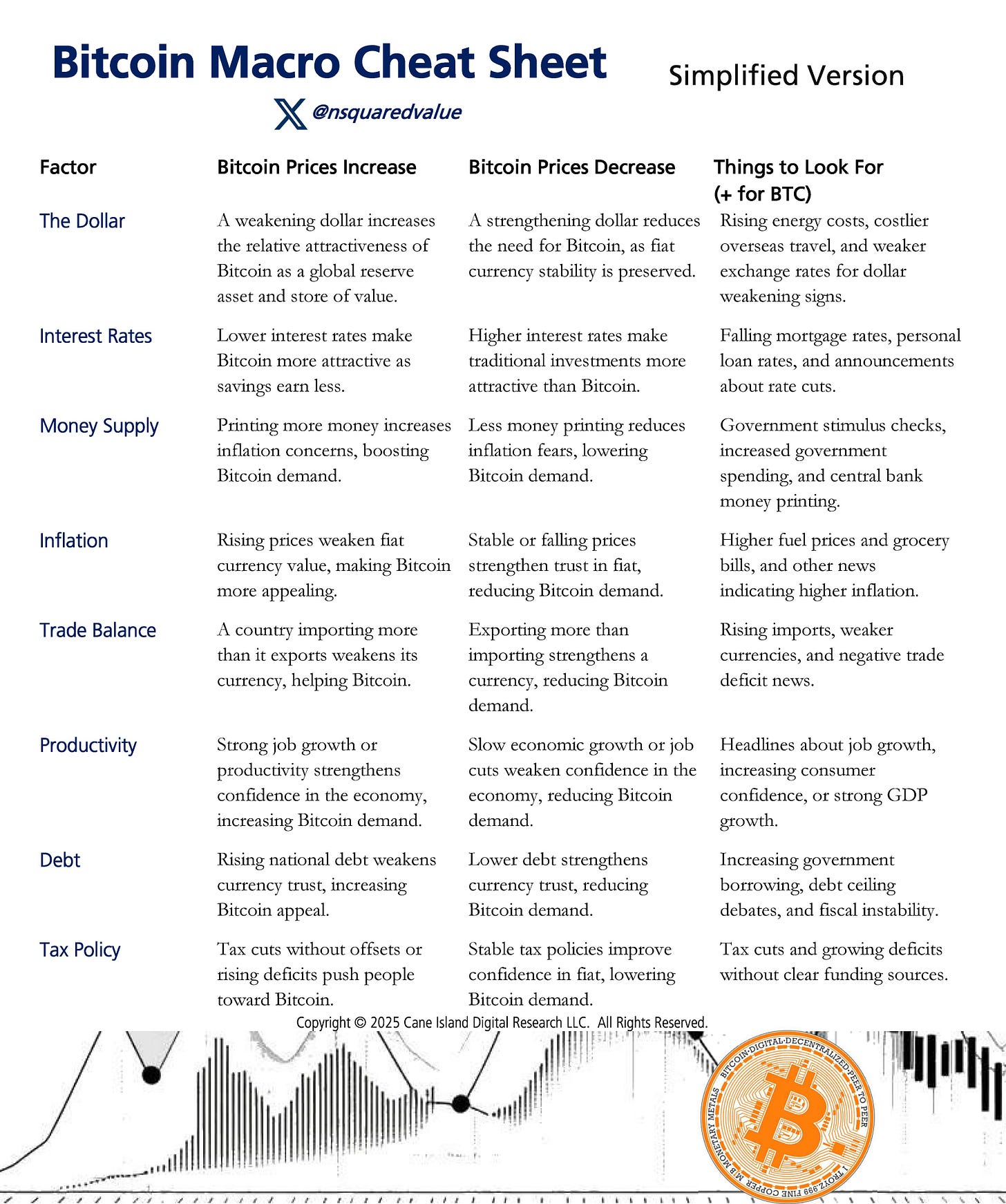

The only macro cheat sheet that you need to frontrun everyone in 2025

2018 & 2022 endured brutal 12-month bear markets with ~80% losses.

Last 3 runs lasted for 9, 9, & 11 months.

History signals this surge could ignite until Sept 2025.👇🧵

(Credits to @nsquaredvalue)

Macro Pulse Update 04.01.2025, covering the following topics:

1️⃣ Macro events for the week

2️⃣ Bitcoin Metric Overview to Start 2025

3️⃣ Market overview

4️⃣ 2024 Crypto Year in Review

1️⃣ Macro events for the week

Last week

Next week

2️⃣ Bitcoin Buzz Indicator

Market Movements and Trends

MicroStrategy Leads New Bitcoin Acquisitions

Global Crypto Regulation Trends in Early 2025

Ethereum ETFs Outperform Bitcoin Counterparts in 2024

Do Kwon Faces Major Legal Challenges

Token and Blockchain Developments

Grayscale Adds Tokens, Focuses on AI and Solana

Uniswap v4 Launch Scheduled for 2025

Legal and Financial Disputes

Celsius Appeals Dismissed $444M Claim Against FTX

NFT Market Insights

NFT Market Recovers in Q4 2024

Crypto Platform Innovations

Telegram Updates Integrate NFTs and Verification

Altcoins

XRP overtook USDT to become the 3rd-largest crypto by market cap.

Coinbase expanded in Europe by acquiring BUX Cyprus subsidiary.

Solana’s co-founder was sued by ex-wife over millions in staked SOL.

Decentralized exchange volume reached a record $462B in December.

Malaysia’s securities regulator ordered Bybit to cease operations.

A16z Crypto backed legal action challenging IRS DeFi rules.

HYPE token staking launched on the HyperLiquid mainnet.

TON Foundation partnered with Jupiter to incubate a DEX aggregator.

Ai16z aimed to enhance AI agents with strategic tokenomics reforms.

Sky Protocol reported $22M December revenue amid DeFi recovery.

NYDIG explored Bitcoin-backed loans using insurance float.

Avalanche unveiled AvalancheAI to integrate AI into the AVAX ecosystem.

MIRA DadSiqi Chen launched ZERO token, citing a rug pull mistake.

MoonPay obtained a MiCA license for crypto payments in the Netherlands.

Binance Labs planned a 2025 rebrand with increased involvement from CZ.

Tron network revenue hit $329.57M in 30 days, surging 115.73% YoY to $2.12B.

Vitalik Buterin donated $170K to Tornado Cash developers’ legal fund.

CFTC vs. Gemini trial was postponed to January 21.

Binance Labs invested in THENA.

Floki DAO approved liquidity allocation for Floki ETP creation.

Sonic S tokens prepared to launch on 13 exchanges in January 2025.

Kekius Maximus memecoin crashed after Elon Musk reverted X profile name.

Binance secured its 21st global crypto license in Brazil.

Pump.fun began 2025 with $14M in daily revenue, Kraken deposits reached $300 million.

BlackRock’s crypto fund BUIDL paid $17M+ in dividends since launch.

Odds of a 2025 US Solana ETF listing reached 77%, per VanEck research.

KuCoin introduced a crypto payment system for seamless transactions.

BlackRock’s BUIDL token was approved to back Frax Finance’s frxUSD.

Crypto.com launched zero-commission stock and ETF trading in the US.

Bio Protocol revealed a roadmap with multichain expansion for Jan-Feb.

Virtuals Protocol fixed a critical bug and rewarded a security researcher.

Ethena announced its 2025 roadmap, planning iUSDe launch next month.

3️⃣ Bitcoin Metric Overview to Start 2025

• Hash Rate at All-Time High: Bitcoin’s decentralized computing power surpasses 1% of global cloud providers combined, showcasing network strength.

• Rising On-Chain Wallets: Addresses holding at least $100 or $1,000 in BTC near record levels, signaling growing retail adoption.

• Institutional Growth: Bitcoin held by U.S.-traded ETFs surged from 650,000 to 1.25M in 2024, reflecting institutional interest.

• Supply on Exchanges Declining: Bitcoin on exchanges dropped below 2.79M, the lowest since 2019, as holders move assets off-platform.

• Bull Market Outlook: MVRV Z-Score indicates room for further price growth despite over 86% of BTC being “in profit.”

• Transaction Decline: December saw lower transaction volumes, potentially indicating increased long-term holding.

4️⃣ 2024 Crypto Year in Review

January 2024

Ethereum's Dencun upgrade improved Layer 2 transaction costs and scalability.

Google’s Willow quantum chip showcased advanced computational power.

Cardano integrated smart contracts to compete with Ethereum dApps.

February 2024

Ethereum's "Veritas" update enhanced privacy and scalability.

SEC approved the first Bitcoin ETF, boosting institutional adoption.

NFT trades surged, with major art and music releases on OpenSea.

March 2024

Polygon launched zkEVM for better Ethereum app privacy and scalability.

Meta announced deeper Web3 integration with NFTs and VR.

April 2024

Solana's major network upgrade boosted DeFi and NFT capabilities.

Ripple settled with the SEC, paving the way for relisting on exchanges.

May 2024

Tezos introduced more validators for decentralization and security.

U.S. officials targeted Binance with potential AML fines.

June 2024

Ethereum's PoS transition made significant energy and scalability gains.

Discussions on NFT ownership and regulation gained momentum.

July 2024

Aave’s V3 protocol added flash loans and risk management tools.

WazirX hack resulted in a $234.9M loss, impacting investor trust.

August 2024

Binance Smart Chain enabled advanced cross-chain protocols.

SushiSwap implemented decentralized governance tools.

September 2024

Ethereum's Shanghai update allowed staked ETH withdrawals.

DeFi platforms like Uniswap tested governance independence.

October 2024

ConsenSys laid off 20% of its workforce amid economic pressures.

Bitcoin reached yearly highs after the SEC approved the Bitcoin ETF.

November 2024

Polygon partnered with WSPN to integrate stablecoins into DeFi.

Decentralized Identity (DID) projects gained momentum for data control.

December 2024

Bitcoin hit an ATH of $103,000 before closing the year at $94,500.

Crypto breaches increased by 40%, with $2.3B lost.

India Blockchain Week spotlighted India’s rising role in global Web3.