All your favorite alts got rekted in a bloodbath

Many liquidations, stagflation is waiting upon us and so many negative vibes

Here are 3 factors about our economy of stagflation👇🧵

Macro Pulse Update 04.05.2024, covering the following topics:

1️⃣ Macro events for the week

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ China Spotlight

1️⃣ Macro events for the week

Last week

Next week

2️⃣ Bitcoin Buzz Indicator

Crypto Market Updates

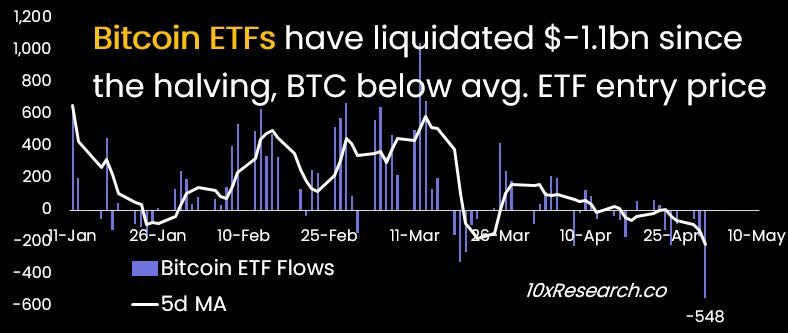

Hong Kong and U.S. Bitcoin ETFs Experience Mixed Fortunes

Australia's ASX Expected to Launch Bitcoin ETFs

EigenLayer Adjusts Token Distribution Strategy

Challenges Plague Friend.tech's Token Launch

Regulatory and Banking Updates

Former Binance CEO Sentenced Following Bank Secrecy Act Violations

ConsenSys Sues SEC Over Ethereum's Security Status

Crypto Exchanges and Platforms

Tokenized Treasury Funds Experience Rapid Growth

Upcoming Token Unlocks Totaling $3.1 Billion in May 2024

Yuga Labs Restructures for Greater Focus on Core Projects

AnimeCoin and Azuki Launch Gacha Grab Game on Ethereum

Altcoins

Thai regulators cracked down on deceptive crypto ads.

Omnity introduced cross-chain transfer functionality for Runes.

Stripe integrated Avalanche C-Chain, enabling direct AVAX purchases through its platform.

Grayscale’s outflows slowed as investor interest in altcoins like Solana, Polkadot rose.

A bankruptcy judge signed off on a $450M FTX-Voyager settlement.

Samourai Wallet developer Keonne Rodriguez was placed under home incarceration after securing $1 million bail.

DTCC announced the exclusion of collateral for crypto ETFs, impacting market dynamics.

Terraform Labs lawyers sought to reduce the penalty to $1M instead of $5.3B.

Tether, USDC, and DAI transaction volume surpassed Visa's 2023 monthly average.

Dune Analytics X account was hijacked to shill an airdrop.

Renzo (REZ) plunged moments after its Binance listing.

Over 80% of Algorand (ALGO), Sandbox (SAND), Arbitrum (ARB) holders were losing money.

April recorded the lowest crypto hack and scam losses since 2021.

Celsius Network burned the entirety of its CEL holdings, eliminating 94% of total supply.

Vitalik Buterin broke down ‘Binius’ as a way to speed up zero-knowledge proofs.

Curve Finance awarded $250K for finding a reentrancy vulnerability.

BONK's market cap surged to $1.40 billion, surpassing Floki Inu.

Pike Finance admitted to an error following a $1.7 million exploit, denying USDC's fault.

A16z’s major OP purchase sent prices skyrocketing.

Robinhood partnered with Uniswap to simplify crypto purchases for US users.

Synethix founder Kain Warwick targeted a mid-May launch for Infinex DEX.

Aave Labs unveiled ambitious plans for Protocol V4.

LayerZero completed its first airdrop snapshot.

Shiba Inu team unveiled a two-phase hard fork strategy for Shibarium.

AltLayer introduced the reALT token in the second phase of its staking program.

Tether netted $4.52B Q1 profit from investments.

Base unveiled its second on-chain summer hackathon.

The Open Network (TON) secured fresh funding from Pantera Capital.

MOONPAY partnered with PayPal for fiat-to-crypto transactions.

Coinbase's $1.6 billion quarterly profits were boosted by stablecoins and rising crypto prices.

The popular Dogecoin (DOGE) Layer-2 solution Dogechain will shut down wallet services next month.

Fantom aimed to attract memecoin traders, reserving $6.5M FTM.

The community was split on an ENS petition against Unstoppable Domains patent.

ZKasino scam suspect was arrested, and $12.2M seized by Dutch authorities.

ZkSNACKs decided to sunset its coinjoin anonymizing service amid a US coin mixer crackdown.

Hybrid L2 Build on Bitcoin launched its mainnet, facing geo-blocking for US users.

Polkadot experienced increased user activity in Q1, but revenue dropped 91% due to lower transaction fees,

3️⃣ Market overview

Macro concerns impacting crypto prices, major regulatory actions against crypto leaders, uncertainties around Ether's security status, the rise of tokenized Treasury products, and upcoming token unlocks that could increase market selling.

Crypto markets slid amid concerns about potential stagflation in the U.S. economy, with sticky inflation and slowing GDP growth. However, the Fed Chair downplayed fears of stagflation.

Binance founder Changpeng Zhao was sentenced to 4 months in prison and fined $50M for failing to implement proper anti-money laundering measures, though the sentence was lighter than prosecutors sought due to his cooperation.

Ether's price fell after a lawsuit revealed the SEC has considered ETH a security since March 2023, contradicting previous statements suggesting it may not be a security due to being decentralized.

BlackRock's new tokenized Treasury fund BUIDL has rapidly grown to dominate the tokenized Treasury market, holding nearly 30% market share after just 6 weeks.

About $4 billion worth of tokens from 21 crypto projects, including major ones like Ripple's XRP, are set to be unlocked, potentially leading to increased selling pressure.

The macro backdrop of high interest rates, inflation concerns, and growth slowdown pose challenges, though the Fed remains optimistic and dismisses stagflation fears for now.

The Federal Reserve left interest rates unchanged at 5.25-5.5% amid persistent inflation, signaling rates may stay elevated for longer. However, the Fed plans to scale back quantitative tightening in June.

The Japanese yen surged over 3% against the U.S. dollar in late trading, sparking speculation of possible currency intervention by Japanese authorities, though officials remained ambiguous.

4️⃣ Key Economic Metrics

🔴 The data suggests the Fed will likely remain patient and keep rates elevated for longer to combat persistent inflation, despite some emerging signs of economic cooling. Progress on lowering inflation appears to have stalled, giving the Fed little incentive yet to start cutting rates.

April data showed continued solid job growth of 175,000 payrolls added, though at a slightly slower pace, with the unemployment rate ticking up to 3.9%. Signs of some cooling in the labor market.

However, underlying inflation pressures remain stubborn, with the Employment Cost Index and unit labor costs coming in higher than expected in Q1.

The ISM manufacturing and services surveys showed contraction territory and rising price pressures, indicating goods and services inflation is not cooling as quickly as hoped.

Higher interest rates are weighing on construction activity, with declines in residential and private non-residential construction spending in March. Public infrastructure was a bright spot.

🟡 Recent data has pushed the Fed away from imminent rate cuts, adopting more of a wait-and-see approach for greater disinflation progress

As expected, the FOMC unanimously kept the federal funds rate unchanged at 5.25-5.50%.. The post-meeting statement noted the lack of further progress in getting inflation down to the 2% target, despite earlier easing.

Core PCE inflation has remained elevated at 4.4% annualized over the past 3 months, after falling from over 5% in 2022 to 2.8% in March.

This confidence is unlikely until at least the September FOMC meeting, based on Powell's commentary walking back earlier timing references.

However, Powell also stated it's "unlikely" the Fed will need to hike rates further from current restrictive levels.

5️⃣ China Spotlight🔴

Anticipated the yen recovering against the USD, aided by a worsening U.S. economic outlook, Fed easing, lower U.S. yields, and one more BoJ rate hike by year-end. The key driver of yen weakness this year has been the Fed's higher-for-longer rates policy. Fed cuts and BoJ tightening could reverse the yen's 8% year-to-date decline around late 2024.

The yen fell to a 34-year low near 160 per USD on Monday, prompting suspected currency intervention by Japan's Ministry of Finance and Bank of Japan to support the yen.

Though not officially confirmed, money market data from the BoJ signaled liquidity reductions worth tens of billions of dollars on Monday and Wednesday, suggesting FX intervention.

This would be Japan's first yen-buying intervention since late 2022 when it spent around $59 billion to prop up the currency after it breached 145 per USD.

In the short-term, the intervention is seen as a temporary Band-Aid, with a sustained yen rebound requiring monetary policy shifts from the Fed and BoJ.

Twitter:https://twitter.com/arndxt_xo/status/1786785217975664844