$BTC at 35k ATH for 2023

The economy shows underlying strength

3 factors showing that we are feeling bullish 👇🧵

Macro Pulse Update 04.11.2023, covering the following topics:

1️⃣ Macro events for the week

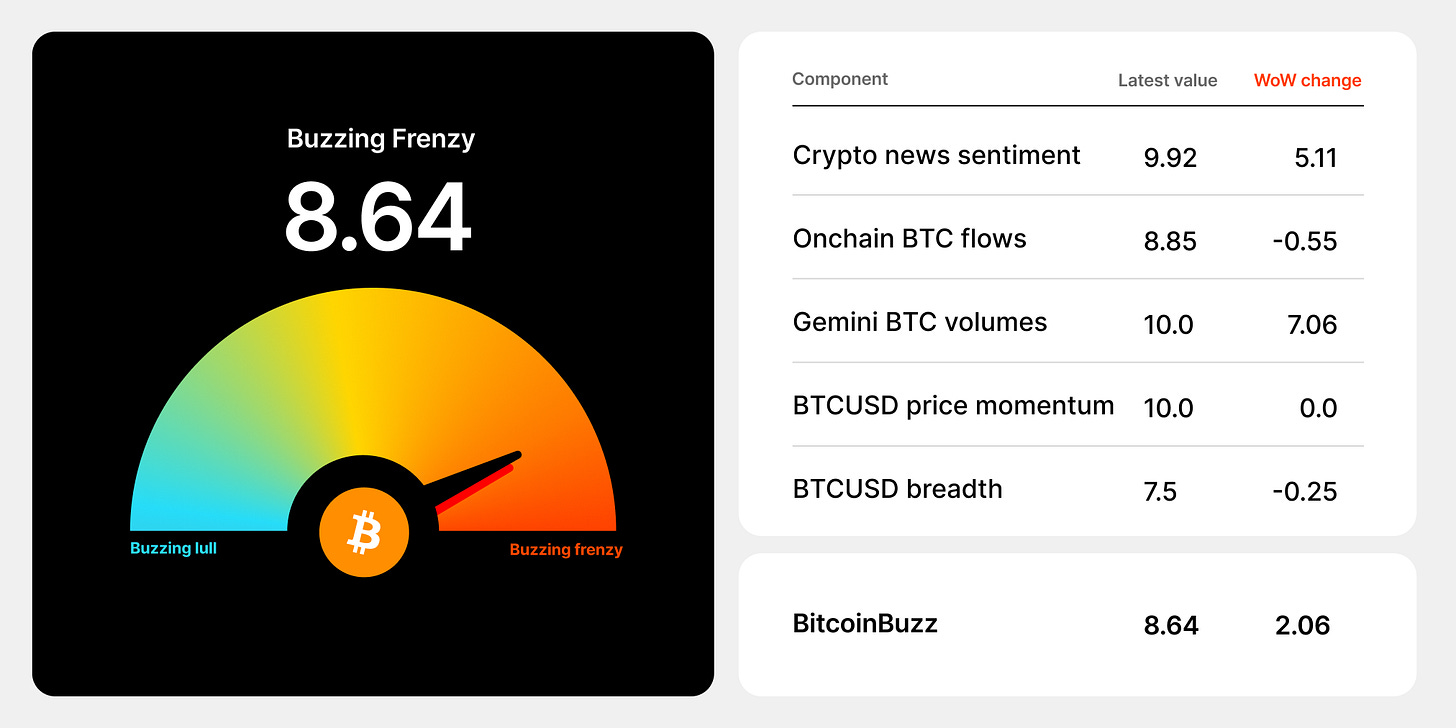

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ Politics and Migration

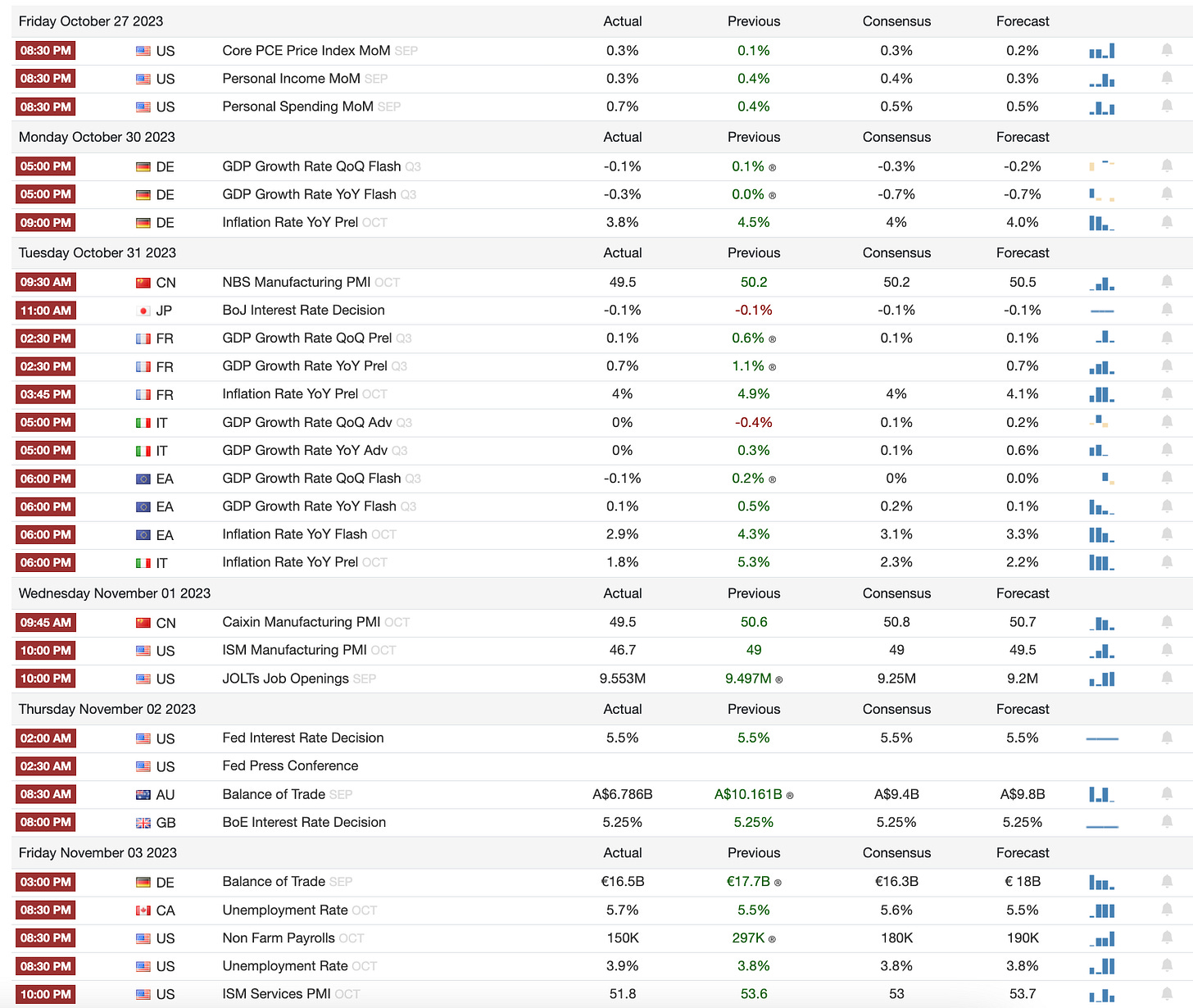

1️⃣ Macro events for the week

Last week

Next Week

2️⃣ Bitcoin Buzz Indicator

Crypto Market and Regulatory Updates

Bitcoin ETFs Signal Market Optimism

Solana's Meteoric Rise Amid Challenges

PayPal's Crypto Moves Under Scrutiny

Unibot Exploit Shakes Trust in Crypto Bots

Legal and Financial Crypto Updates

FTX Founder's Conviction Sends Warning

U.S. Seizes Millions in Crypto from Drug Trafficker

Coinbase and Block's Financial Performance

SEC's Firm Stance on Terraform Labs

Blockchain and Platform Developments

Celestia's Mainnet Beta Launch Challenges

Aragon Association's Decentralized Shift

SafeMoon's Legal Troubles Escalate

Musk's Critique Highlights Bitcoin Ordinals

Dapp Industry Shows Signs of Recovery

Rarible Launches NFT Marketplace Service

OpenSea Pro Expands with Polygon Integration

Altcoins

Zodia Custody, backed by Standard Chartered, expanded its operations into Hong Kong.

The FLR token from Flare saw an increase as the company launched its public staking feature.

Advocates for bridging protocols called for open tech standards and criticized LayerZero.

Steve Aoki released digital sneakers for the move-to-earn game 'Stepn.'

Snowtrace, the AVAX blockchain explorer, announced its shutdown amid controversy over Etherscan fees.

Starknet launched a reward program offering 50M STRK for early contributors.

Injective Protocol completed its integration with Google Cloud's CloudHub data exchange.

Tether reported a surplus of $3.2 billion in reserves but faced delays in reducing secured loans.

Argent, a crypto wallet developer, halted development on zkSync Era to focus on Starknet.

The UK's financial regulator listed Bitfinex as an unauthorized firm.

Ava Labs suggested the Astra upgrade to improve the subnet architecture on Avalanche.

Circle ended stablecoin minting support for consumer accounts.

Bitget and Floki accused each other of manipulation following a token listing.

Aave proposed a new strategy to restore the GHO token's peg.

MakerDAO transferred $250 million from Coinbase to rebuild DAI's collateral.

WalletConnect limited its services in Russia, adhering to OFAC guidelines.

The founder of Oyster Protocol received a four-year sentence for evading $5.5 million in taxes.

Frax Finance resolved its domain name hijacking issue.

Taiwanese police disrupted a $324.2 million USDT laundering scheme.

Aptos and Avalanche led the $450 million token unlocks in November.

An attacker stole $2.1 million from Onyx in a recent DeFi security breach.

Nym introduced mixnet privacy to the NEAR ecosystem and ventured into decentralized VPNs.

Hashflow activated a 'Fee Switch,' redistributing 50% of revenue to its stakers.

Pyth Network announced a token airdrop for over 75,000 wallets.

Qredo cut half its staff, with only six months of operational funds remaining.

Visa partnered with HSBC and Hang Seng Bank to test tokenized deposits for Hong Kong's CBDC.

Axie Infinity's developer is adapting Japanese Web2 games for the Ronin blockchain.

The Dubai Financial Services Authority greenlit Ripple for use in the Dubai International Financial Center, as XRP Ledger growth surged in Q3 according to Messari.

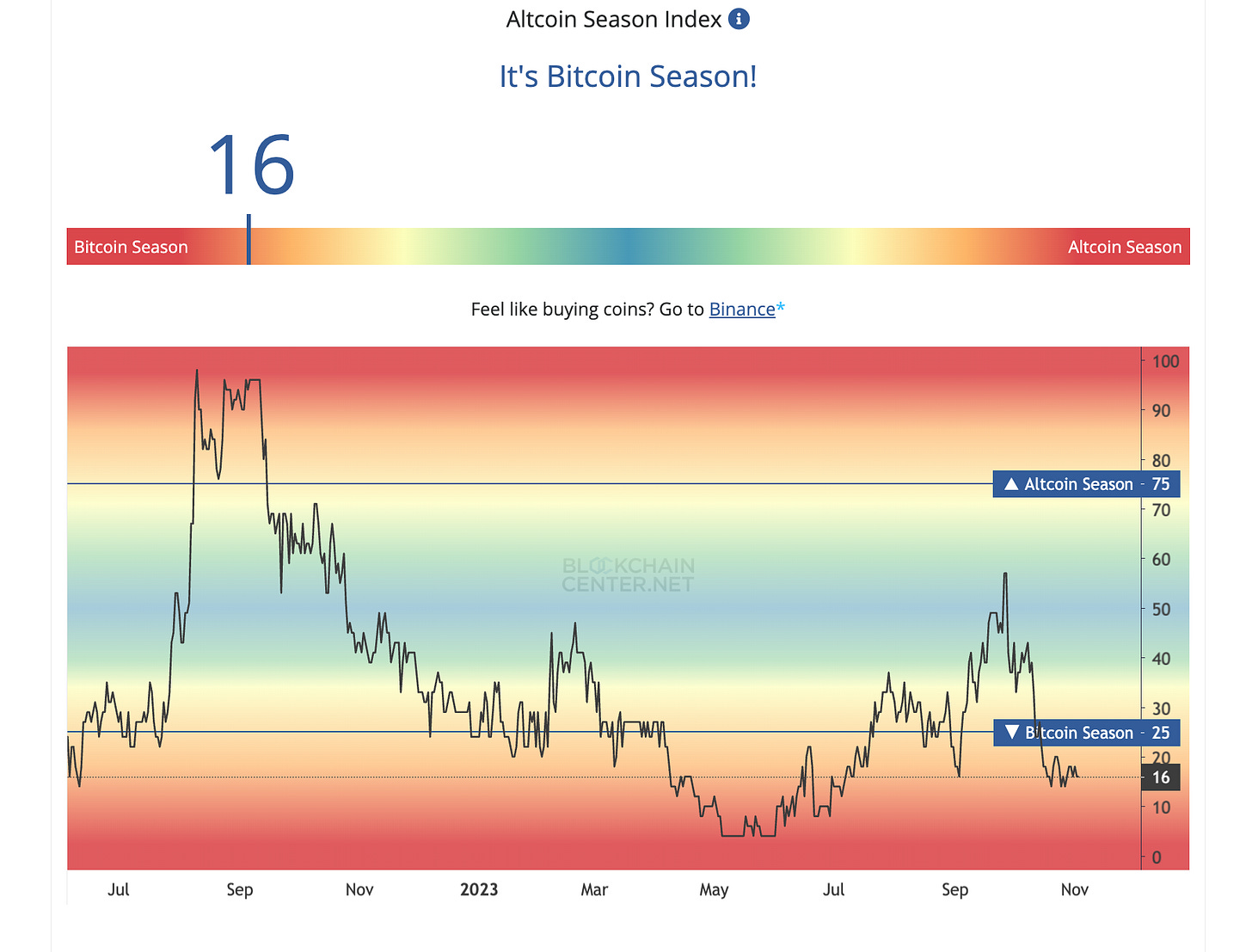

3️⃣ Market overview

Key data to watch: China PMI and economic indicators, US jobs reports, earnings reports, inflation and consumer spending metrics, for signals on economic trajectory and central bank policy outlook.

China's economic data for October shows signs of weakness, with manufacturing PMI dropping to 49.5 and services PMI falling to 50.6. This raises expectations of potential policy easing by the PBOC via interest rate cuts or banking rule changes.

Elon Musk's Twitter, now rebranded as X, has seen its valuation plummet to $19B amidst a 60% revenue decline and $13B debt burden since Musk's takeover. Despite ambitions to become an "everything app", paid subscriptions remain minimal.

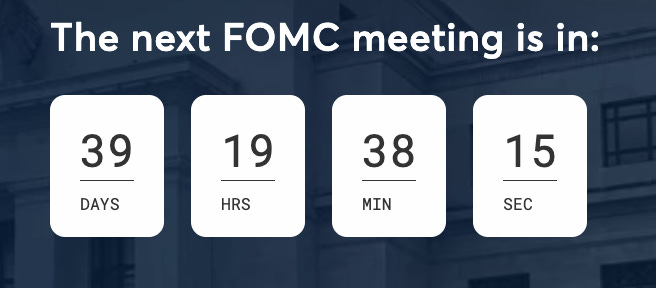

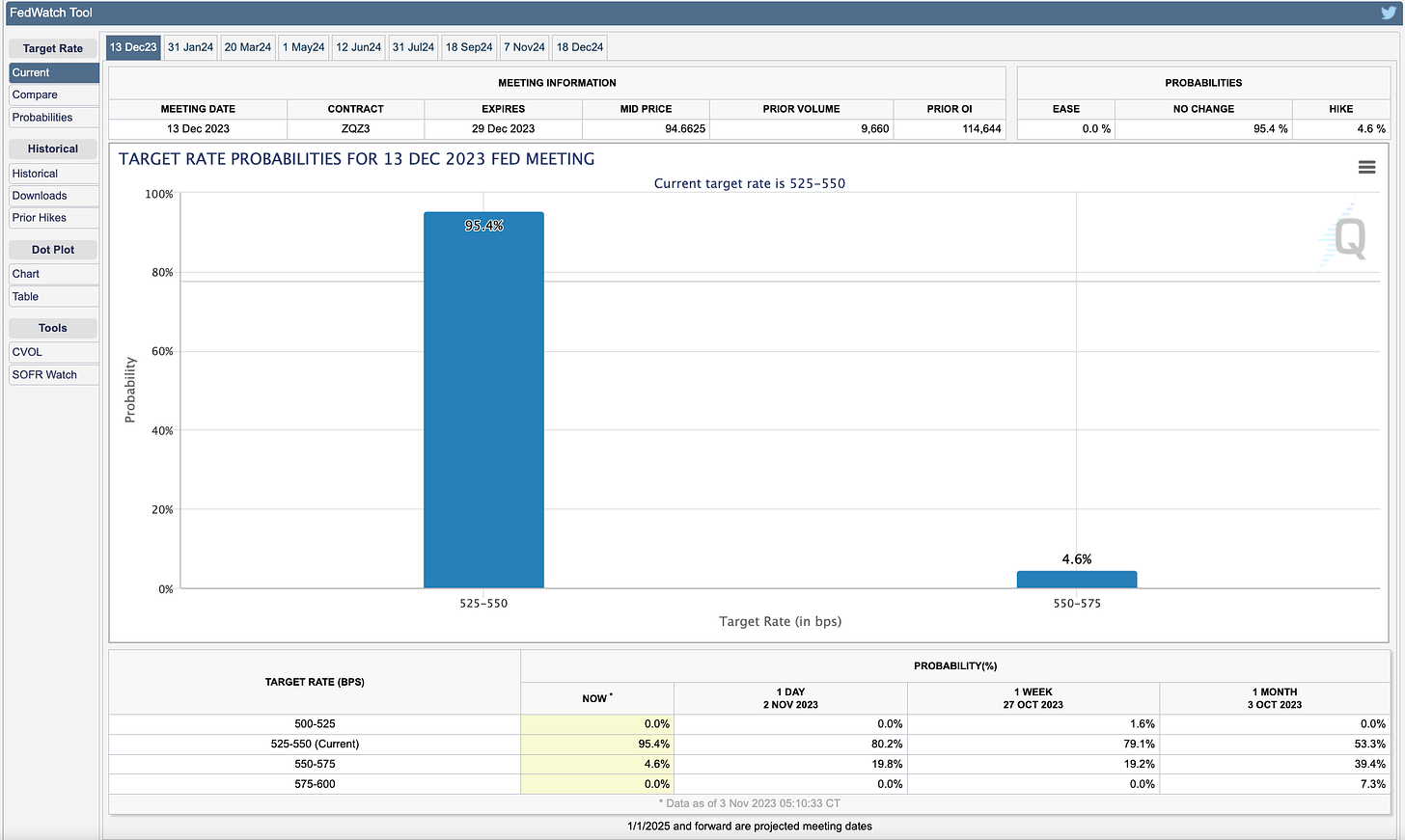

The Federal Reserve is expected to keep interest rates unchanged at its upcoming meeting, holding steady at 5.25-5.50% as it assesses the impact of past hikes. This follows a series of aggressive rate increases over 2022.

Fed is likely to strike a cautious tone, signaling that future rate decisions will depend on incoming data. The Fed appears to be nearing the end of its tightening cycle.

Attention is on the U.S. Treasury's upcoming borrowing plans amid a substantial budget deficit. There is speculation of a shift toward short-term bill issuance, which could push 10-year yields above 5% and stir volatility.

4️⃣ Key Economic Metrics

🟢 The pace of growth is expected to moderate but there are still signs of underlying economic strength. Sustaining this amid tightening policy will be the key challenge.

The US economy grew at a rapid 4.9% annual rate in Q3 2022, the fastest pace since Q4 2021, driven by strong consumer spending and inventory accumulation.

However, real disposable income fell in Q3, suggesting high consumer spending is unsustainable. Also, weak business investment indicates monetary tightening is having an effect.

Growth is expected to slow sharply in Q4 as high spending dips into savings and tightening weighs on business activity. However, October PMIs suggest a positive start to Q4.

The GDP report is not expected to impact upcoming Fed policy, as rapid growth amid tightening is seen as unusual. Bond yields remain high.

Other positive signals include low unemployment claims signaling a strong labor market, and a surge in new home sales in September to the highest since February.

🟡 Income and spending data indicate continued economic momentum but also potential headwinds if incomes stagnate. Moderating core inflation adds nuance to the Fed's policy outlook.

Real US consumer income fell for the 3rd straight month in September while spending rose, fueled by a declining savings rate. This suggests spending growth could slow if incomes don't rebound.

Inflation-adjusted durable goods spending rebounded strongly in September, now 5.5% higher than a year ago. Service spending lagged at just 2.4% above last year.

Headline PCE inflation was steady at 3.4% year-over-year in September, but core PCE inflation declined to 3.7%, its lowest since May 2021.

Falling core inflation will likely impact the Fed's upcoming policy meeting and support the case for a smaller rate hike.

5️⃣ Politics and Migration 🟡

Balancing economic needs and political tensions will be key for migration policy and its impact on advanced economies.

Permanent migration to advanced economies surged 26% in 2022, hitting a record high, driven by labor shortages and demographic needs.

Migration is helping address labor shortages and wage inflation pressures that central banks are trying to ease but also causes political backlash in some countries.

Migration policy will play a big role in determining growth as it affects workforce expansion and the ratio of workers to retirees.

The US and Europe saw large increases in permanent migrants and asylum seekers, especially from Ukraine.

Europe faces acute demographic pressures and may need 50 million migrants by 2047 just to maintain its welfare state.

However, anti-immigration sentiment in parts of Europe complicates increased immigration.

Twitter: https://twitter.com/arndxt_xo/status/1720775158569611753

Nice overview! What's the website you're using for Macro events for the week?

Thx