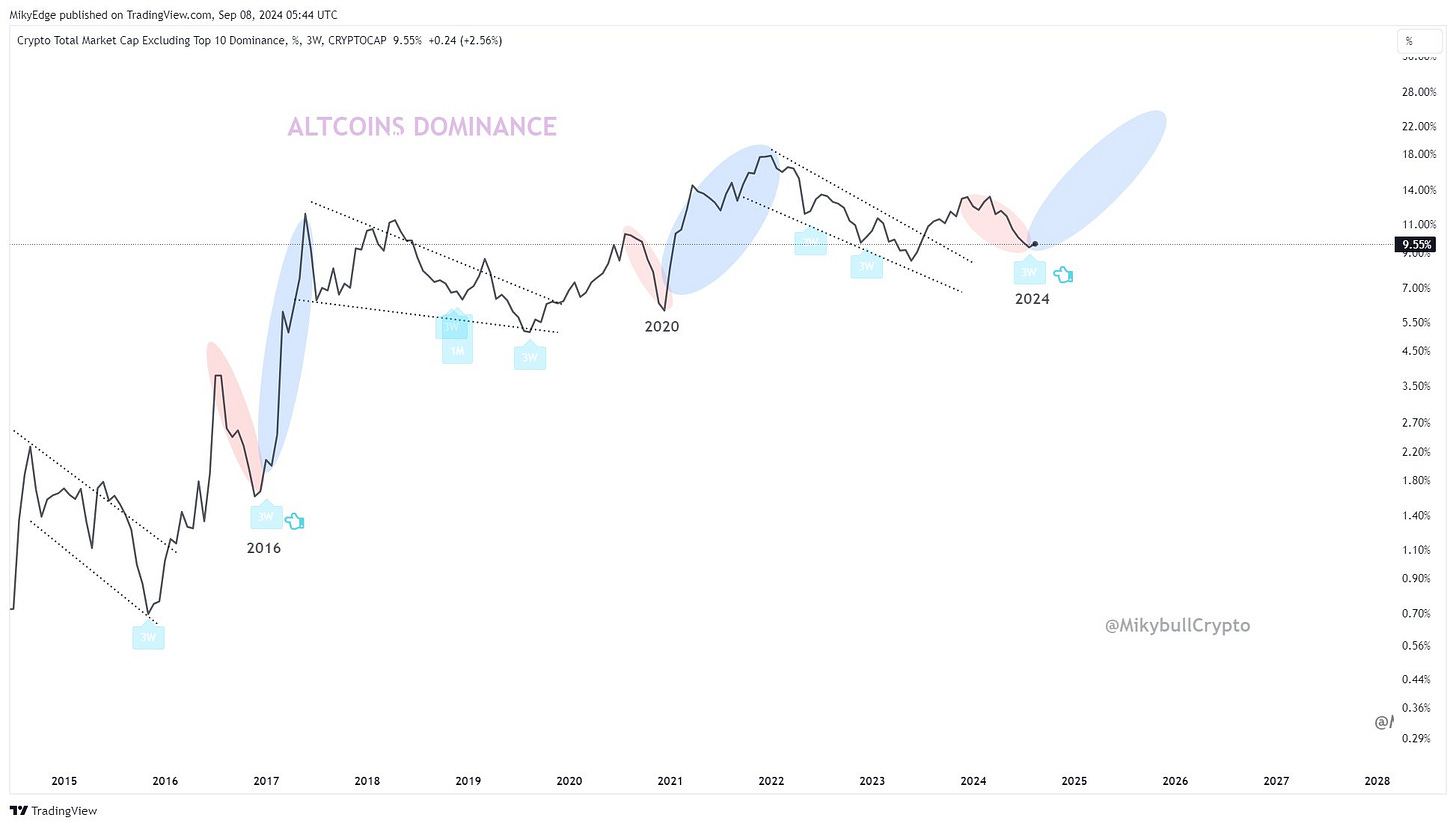

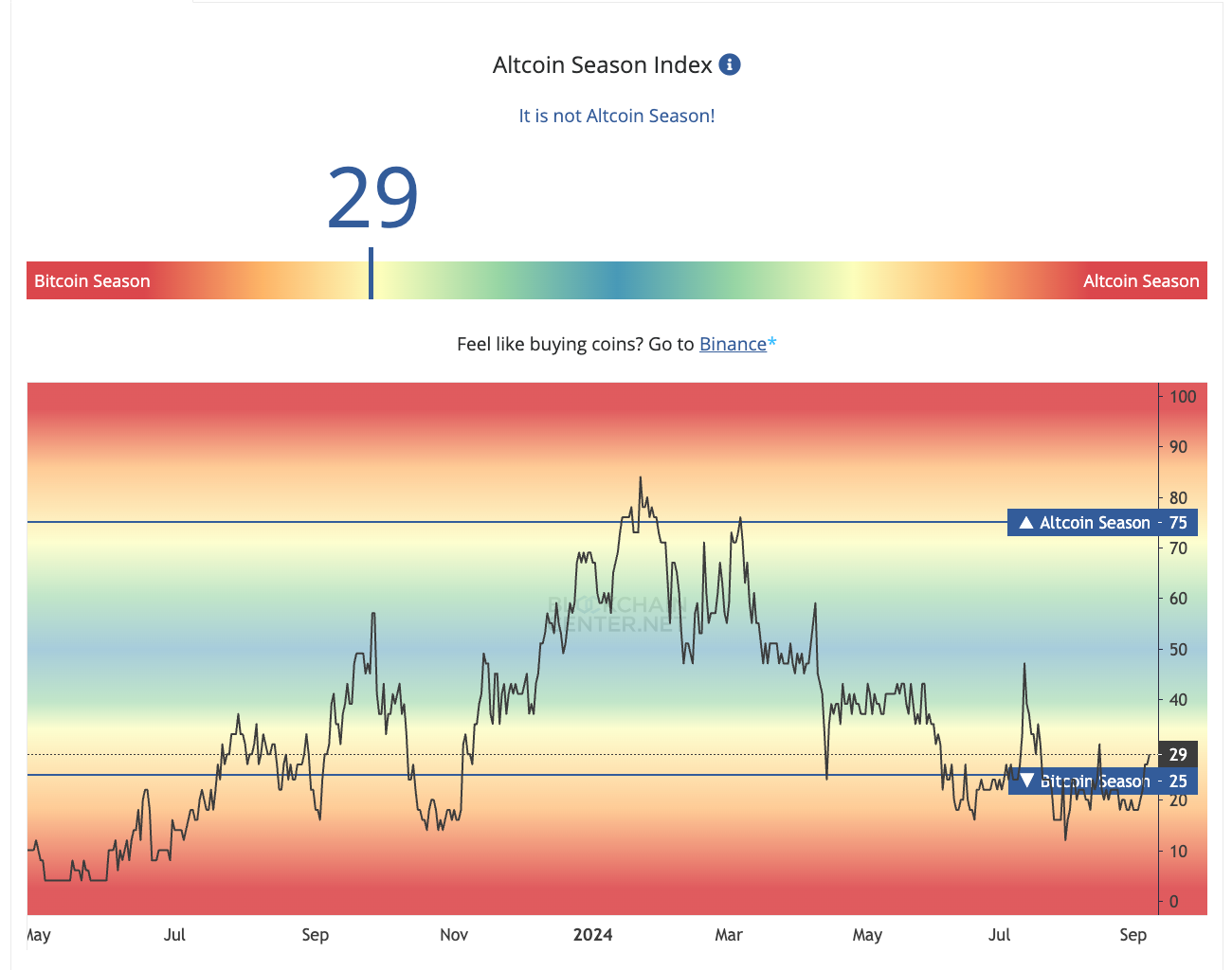

Q4 is showing strong demand for Altcoins.

This is the first time the rare buy signal for altcoins justfor triggered since 2016.

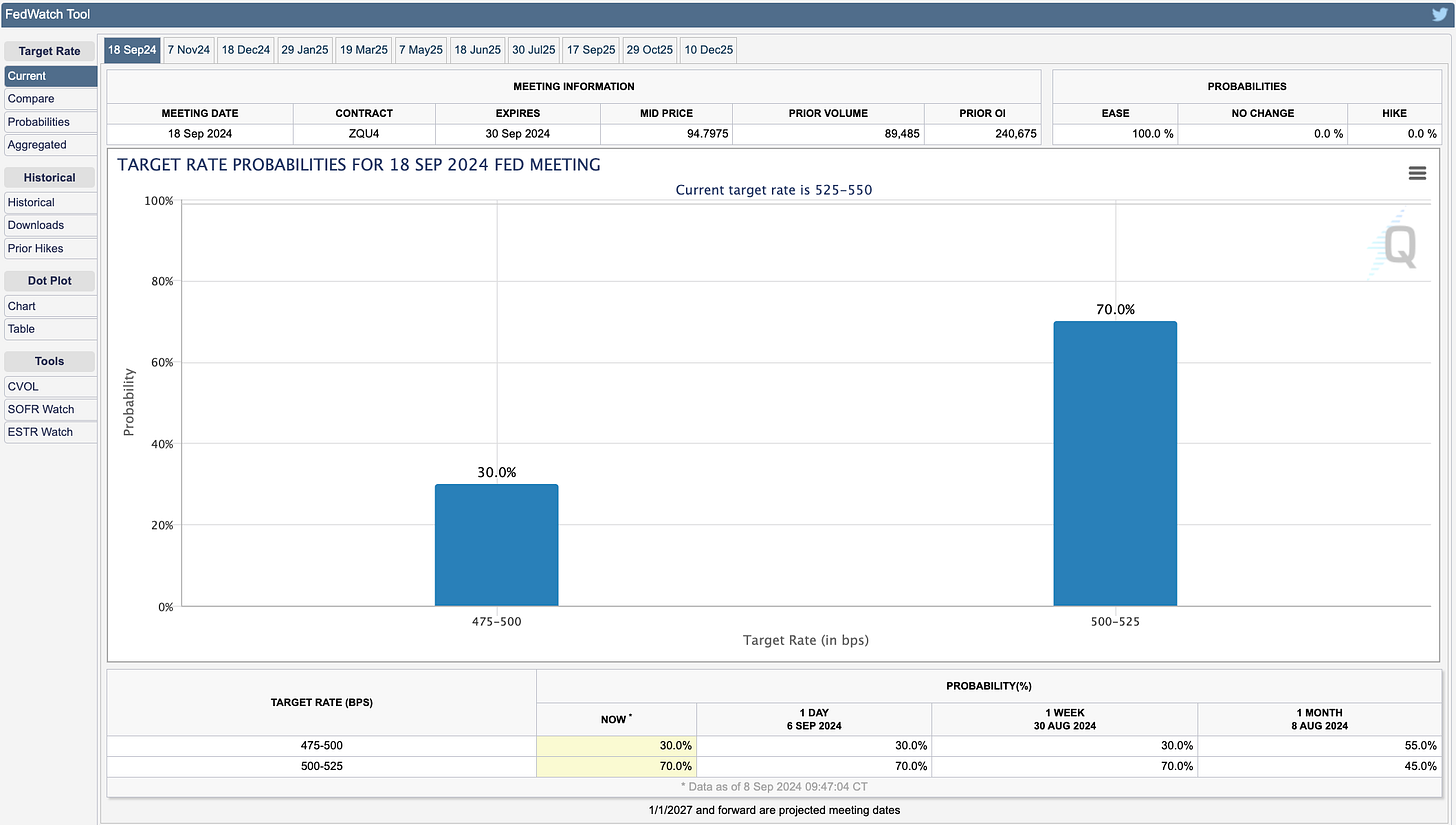

With a looming recession, rate cuts are incoming👇🧵

Macro Pulse Update 08.09.2024, covering the following topics:

1️⃣ Macro events for the week

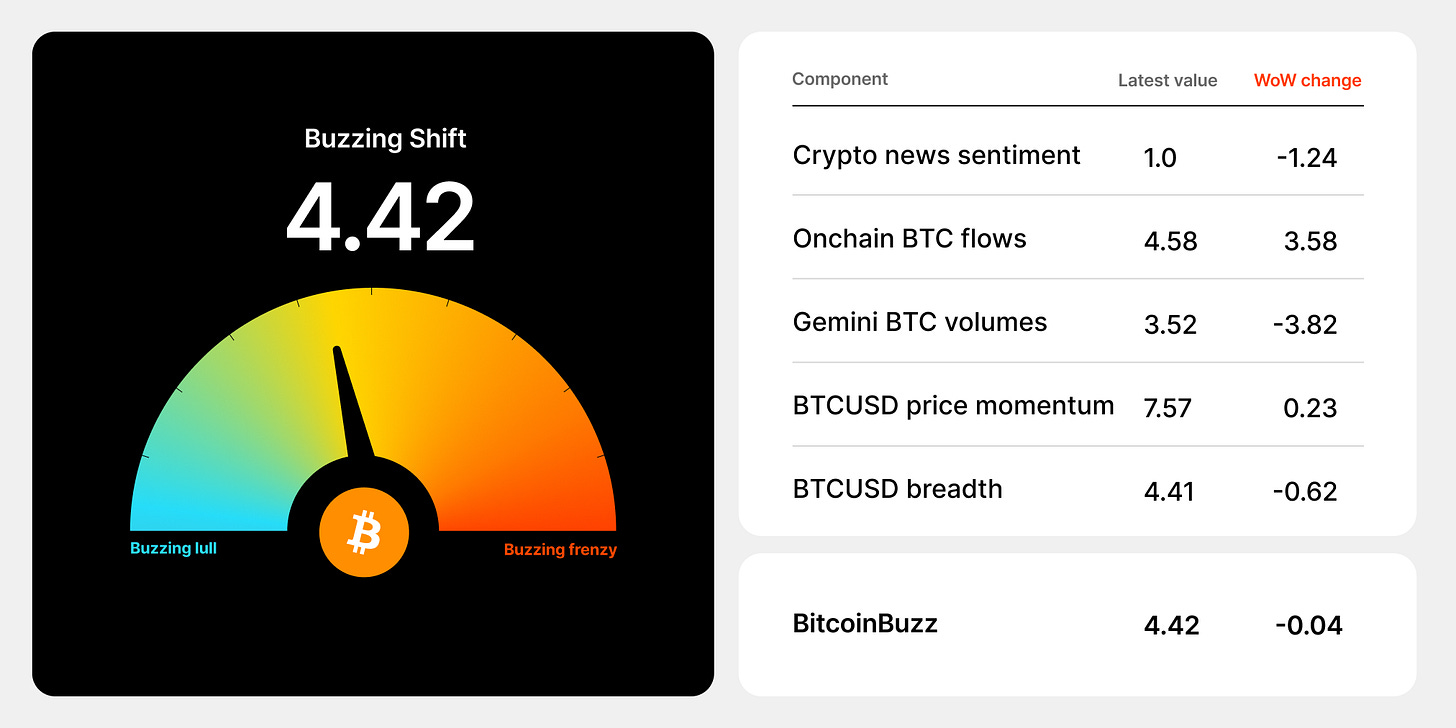

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ China Spotlight

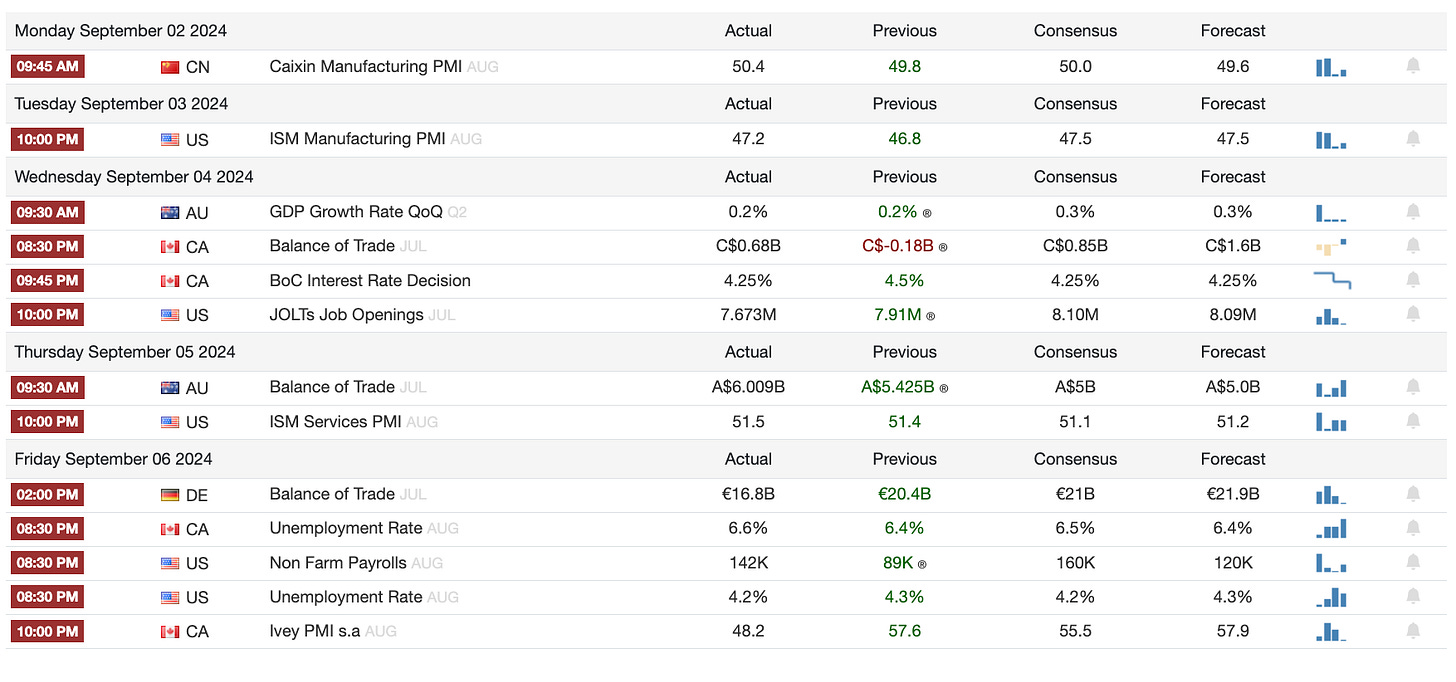

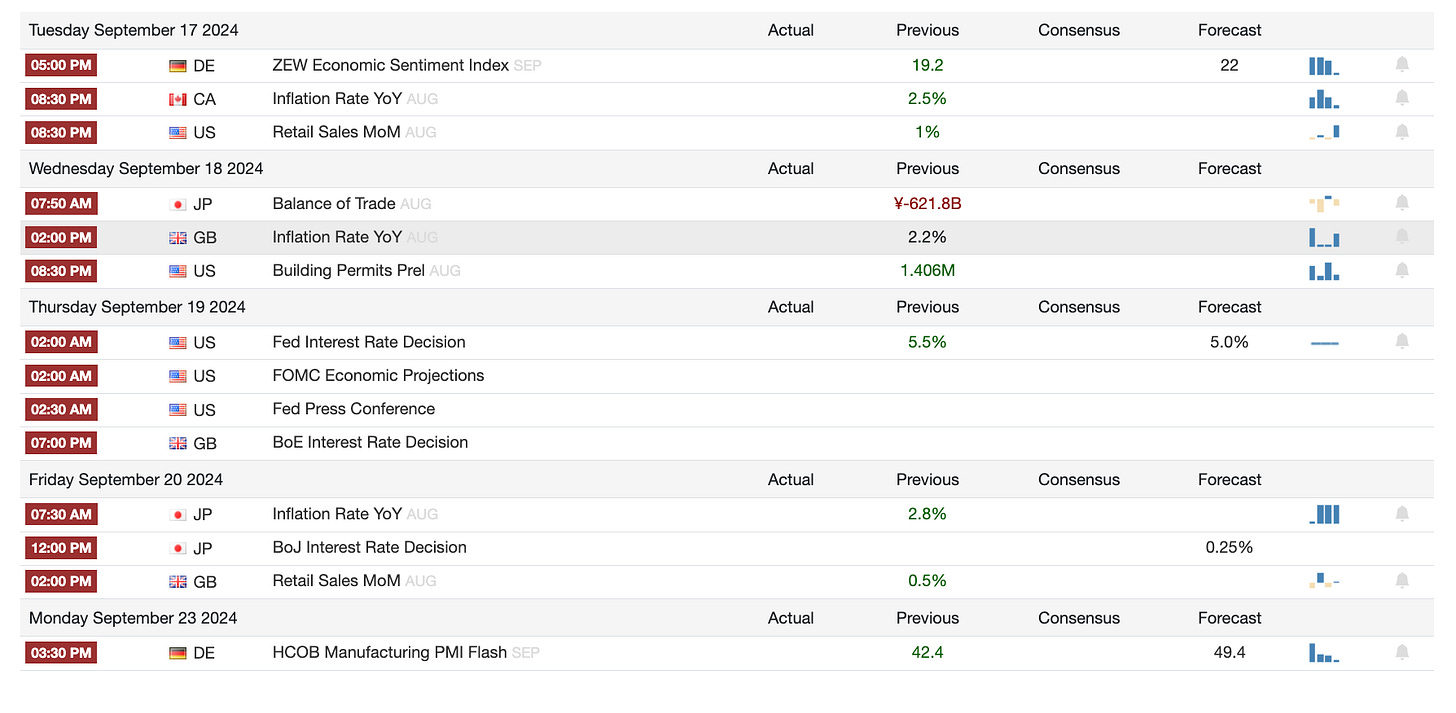

1️⃣ Macro events for the week

Last Week

Next Week

2️⃣ Bitcoin Buzz Indicator

Regulatory Updates

CFTC fines Uniswap $175K over regulatory breach

SEC fines Galois Capital $225K post-FTX collapse

Ripple delays $125M SEC payment, launches stablecoin

Platform and Executive News

Telegram updates moderation after CEO's arrest in France

CZ barred from managing Binance but retains influence

DeFi Hacks and Security

Penpie hacked, losing $27M due to DeFi vulnerability

Crypto Project Developments

Polygon's MATIC upgrades to POL

Trump-backed WLF stablecoin project faces scrutiny

Cardano Voltaire era begins with governance overhaul

Magic Eden criticized for US-exclusive domain and token launch

NFT Market Insights

96% of NFTs "dead" as market faces major downturn

Rare CryptoPunk sold for $1.5M amid market slump

Altcoins

Metaplanet partnered with Japan’s SBI to improve Bitcoin custody and trading in the region.

21Shares introduced 21BTC to advance Bitcoin wrapping with better security and stability.

Monochrome applied to launch an Ethereum ETF in Australia.

Toncoin fell to $5 as South Korean police investigated Telegram.

Frax Finance introduced Frax Name Service for decentralized identity management.

OKX received full licensing in Singapore and appointed a former MAS official as CEO.

Tokenization firm Libre, backed by Brevan Howard, launched on NEAR Blockchain.

DeFi fees dropped 24% in August due to declining yield strategies.

LayerZero launched its community program, allocating 5M ZRO tokens.

BNB Chain added yBTC, and Core launched LstBTC amid rising Bitcoin staking.

Zest Protocol introduced Bitcoin liquid staking with BTCz on Stacks.

ZkSync’s active users dropped 80% as Matter Labs reduced its workforce by 16%.

A Binance executive detained in Nigeria requested bail due to worsening health.

Vega Protocol proposed shutting down its network and launching a new token.

SK Telecom and Hana Financial acquired a stake in BitGo’s Korean branch.

Justin Sun initiated a 100% on-chain buyback for SunPump.

Aave and Sky partnered to enhance the DeFi ecosystem.

Sonic Labs integrated Chainlink CCIP and Data Feeds to boost network capabilities.

Toncoin dropped 94% due to a glitch, causing panic in the community.

A Terraform wallet moved $62M in BTC while Do Kwon remained in legal limbo.

Arbitrum Stylus mainnet launched, enabling Web3 development for traditional coders.

Siemens and Samsung ramped up Web3 efforts with digital bonds and startup investments.

Mysten Labs plans to release a Web3 gaming device in the first half of 2025.

A major Solana whale quietly sold over $99 million worth of SOL this year.

The SEC extended its deadline for deciding on 7RCC’s spot Bitcoin and carbon credit ETF.

WazirX accelerated INR withdrawals after a hack but suspended crypto trading for six months.

Euler v2 went live, introducing modular design and improved lending capabilities.

AI tokens saw daily losses surpass the market average following DOJ’s Nvidia subpoena.

Japan’s financial regulator considered taxing crypto as a financial asset.

Conflux Network partnered with Alibaba Cloud.

Bitfarms responded to Riot’s claims as their rivalry intensified.

Robinhood settled a $3.9 million penalty for issues with crypto withdrawals.

ApeCoin teased plans to boost Bored Ape development ahead of ApeChain launch.

Binance planned to launch Solana staking in September.

EigenLayer allocated 86 million tokens for stakeholders in season 2’s ‘stakedrop.’

Grass airdrop faced backlash over concerns about token distribution.

Synthetix built its own blockchain on Optimism’s Superchain.

Worldcoin aimed for global reach comparable to Facebook’s scale.

ASI Alliance pushed for decentralized cloud infrastructure in AI development.

Aave’s founder sold $6.67 million worth of AAVE tokens.

Travala integrated with Skyscanner, offering access to 2.2M hotels.

Vitalik Buterin initiated a suspicious 2.1 million STRK unlock.

Mercuryo launched Spend, a virtual Mastercard for non-custodial crypto payments.

Bybit introduced a liquid staking token to strengthen the Solana ecosystem.

Cardano's IOHK and Hedera joined the Decentralized Recovery Alliance with Ripple and Algorand.

Jupiter DEX added a market depth metric for high-risk meme tokens.

Injective allowed traders to bet on BlackRock's BUIDL Fund growth.

Kamala Harris-linked Super PAC started accepting crypto donations.

Binance announced fixed-rate loans in USDC and FSUSD stablecoins.

Kraken enabled WIF and PEPE trading in Canada.

Liquity integrated NFTs in its V2 stablecoin upgrade.

Celestia unveiled a roadmap to implement 1-gigabyte blocks.

An MEV bot took out a $12M loan but only profited $20.

The Dogecoin Foundation shared an important update on its Trailmap progress.

FCA reported that 87% of crypto registration applications in the UK failed to meet standards.

South Africa used AI to track down tax-evading crypto traders.

Sonic SVM planned to sell $12.8M worth of HyperGrid nodes on Solana.

3️⃣ Market overview

Crypto Markets

Market Decline & Liquidations: The crypto market faced a broad decline, with over $162M in liquidations, primarily from long positions. US bitcoin ETFs saw $276M in net outflows, and bitcoin’s price dropped to around $56,000.

FTX Bankruptcy Plan Under SEC Scrutiny: The SEC raised concerns over FTX’s proposal to repay creditors in stablecoins, potentially delaying the plan. The SEC’s stance on the legality of crypto distributions could impact creditor payouts.

Cardano's Decentralized Governance: Cardano’s "Chang" upgrade introduced decentralized governance, empowering ADA holders to vote on network changes and elect representatives, while adding utility to ADA.

Binance Executive Detained: Binance's compliance head, Tigran Gambaryan, has been denied medical bail in Nigeria despite serious health concerns, sparking legal battles over his treatment.

Centralized Exchange Volume Growth: Trading volumes on centralized exchanges rose by 6.6% in August, reaching $1.2T, with North American exchanges experiencing over 21% growth. This trend may signal bullish sentiment ahead.

Macro Markets

U.S. Export Controls on Tech: The Biden administration introduced new export controls on quantum computing and semiconductor technologies to curb China's advancements, aligning with allies like Japan and the Netherlands to limit adversaries' access to cutting-edge military technologies.

China Brokerage Merger: China is merging two state-backed brokerages, Guotai Junan Securities and Haitong Securities, into a $230 billion entity. This move aims to strengthen its financial sector, making it more competitive with global firms by consolidating the fragmented securities industry.

U.S. Markets: The S&P 500 and Dow Jones dropped 0.30% and 0.54%, respectively, while the Nasdaq rose 0.25%, boosted by Tesla’s surge. Trading volume was slightly below average, with anticipation for U.S. nonfarm payroll data expected to influence future Federal Reserve rate decisions.

Binance CEO's Lifetime Ban: Richard Teng confirmed that Binance founder CZ faces a lifetime ban from managing Binance as part of his plea deal with U.S. prosecutors. CZ is expected to be released from prison on September 29, but his involvement with Binance is limited to consultation.

EigenLayer’s Second Airdrop: EigenLayer announced a second airdrop of 86 million EIGEN tokens, benefiting stakers, node operators, and community members. The platform’s TVL has dropped from $20.1 billion to $11.5 billion amid market challenges.

4️⃣ Key Economic Metrics

🔴 Central bankers expressed optimism about a soft landing for the global economy, with reduced concerns over recession or difficult trade-offs between inflation and employment. The overall tone was one of confidence in managing inflation and economic growth.

Fed's Rate-Cut Signals: Powell of the US Federal Reserve hinted that rate cuts are appropriate, citing a decline in inflation driven by pandemic-related supply issues and a balanced labor market. Powell emphasized that future rate decisions will depend on incoming data, though the Fed is prepared to respond to risks.

ECB's Cautious Stance: The European Central Bank (ECB) remains hesitant on immediate rate cuts, with Chief Economist Philip Lane warning that inflation targets are not yet secure. However, the ECB is also wary of maintaining rates too high for too long, which could hurt economic output and employment.

BOE's Optimism on Inflation: The Bank of England (BOE) Governor Andrew Bailey expressed cautious optimism regarding inflation, signaling that further rate cuts may be on the horizon. The UK has made progress on inflation, but Bailey stressed that it's too early to declare victory.

Monetary Policy Lag Warning: Federal Reserve Bank of Chicago President Austan Goolsbee raised concerns about the delayed impact of monetary policy changes, warning that negative effects from recent tightening may not have fully materialized yet, and it remains unclear if easing measures could offset them quickly.

Global Economic Coordination: Central bankers from major economies showed a coordinated approach to managing inflation and growth, with careful consideration of the timing and impact of rate cuts to prevent unintended economic consequences.

🟢 While real interest rates have risen, some argue the Fed’s policy isn’t tight, citing favorable financial conditions and economic resilience.

Fed’s Rate Cut Signals: The Fed is likely to cut rates in September, driven by easing inflation and a weakening labor market.

Consumer Spending vs. Income: Consumer spending outpaced modest income growth in July, supported by a declining savings rate.

Stable Inflation: The Fed’s preferred inflation measure (PCE-deflator) remained at 2.5%, slightly above the target, with core inflation decelerating to 2.6%.

Rate Cut Expected: Data supports a likely September rate cut, as markets have reacted with little movement in equities and bond yields.

5️⃣ China Spotlight🔴

The renminbi's share in China’s bilateral trade has grown to 53%, up from 40% in three years, driven by China’s goal to reduce reliance on the US dollar.

Impact of Russia Trade: Increased renminbi-based transactions are partly due to China's trade with Russia, as sanctions restrict Russia’s access to US dollars.

Currency Swap Agreements: China's currency swap agreements with countries like Saudi Arabia, Argentina, and Brazil have contributed to the rise in renminbi transactions, particularly in oil trade with Saudi Arabia.

Currency Stability: China's efforts to stabilize the renminbi-dollar exchange rate encourage more renminbi transactions, though capital controls remain a barrier to further adoption.

Global Renminbi Share: Despite the rise, the renminbi still accounts for less than 5% of global transactions.