Market is getting heated

We saw a resurgence of interest for memecoins

Here are 3 factors that points to the Fed that interest rate cuts would happen in the later half of 2024 👇🧵

Macro Pulse Update 09.03.2024, covering the following topics:

1️⃣ Macro events for the week

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ Japan Spotlight

1️⃣ Macro events for the week

Last Week

Next Week

2️⃣ Bitcoin Buzz Indicator

Banking and Regulatory News

SEC Delays Decision on Ethereum ETFs

Binance Faces Regulatory Challenges in Nigeria

Cryptocurrency Market Movements

Memecoins' Surprising Leap Forward

AI Cryptos Outshine Meme Coins

Pantera Capital's Bold Move on Solana

Crypto Exchanges and Platform News

BlockFi and FTX Reach Settlement

Coinbase Grapples with Technical Glitches

Wormhole Embraces Token Airdrop for Decentralization

Country-Specific Developments

Legal Quagmire Deepens for Do Kwon

NFT and Blockchain Innovations

Bitcoin NFTs Outperform Ethereum Collections

Record-Breaking CryptoPunk Sale

NFT Market Dynamics Shift with ETH Surge

Milady NFT Collection Sees Unprecedented Surge

Innovative NFT Integration in Gaming by Sony

Altcoins

Omni Network sealed a $600M deal with Ether.Fi.

Stacks expanded its network with Blockdaemon and NEAR Foundation.

Baanx raised $20M in a funding round as a crypto payments specialist.

Following a $200M exploit, Fantom sought reimbursement from Multichain, alongside a price rise due to Fantom Sonic anticipation.

Deutsche Börse debuted a crypto platform for institutions.

A Lotte subsidiary partnered with Aptos to build a Web3 hub.

Astar Network launched Astar zkEVM on Polygon AggLayer.

EigenLayer flipped Aave with $10.4B in total value locked.

Nexo received license approval in the Middle East.

The SEC accepted a $275,000 settlement from ShapeShift over crypto securities charges.

Io.net's DePIN project raised $30 million on the Solana blockchain in Series A funding.

WOOFi confirmed an $8.75 million exploit on its Arbitrum market.

Revolut partnered with MetaMask for direct crypto buys for millions of users.

TON continued attracting Web3 firms as Telegram Ad Platform went live.

Magic Square unveiled a $66M grant program for its Web3 App Store.

Worldcoin faced a three-month data collection suspension in Spain.

Binance unveiled CRYPTO fragrance to attract more women into blockchain and Web3.

Gala Games launched a $1 million hackathon with Alienware, AWS.

Uniswap's UNI hit a 2-year high as the fee share proposal deadline approached, doubling its user base on Base, Optimism.

Digital Currency Group filed a motion to dismiss a $3B NYAG lawsuit.

Crypto Wallet SafePal ventured into banking with a new USDC Visa Card.

The Greek stock exchange explored the Sui blockchain for an on-chain fundraising tool.

Jupiter saw holders stake $123 million to pick the next Solana token launch.

The Shiba Inu team launched SHIB Name Service with an exclusive discount.

Avalanche unleashed the Durango upgrade, boosting AVAX price with 'Teleporter' debut.

Optimism sold $89M OP tokens in a private transaction.

3️⃣ Market overview

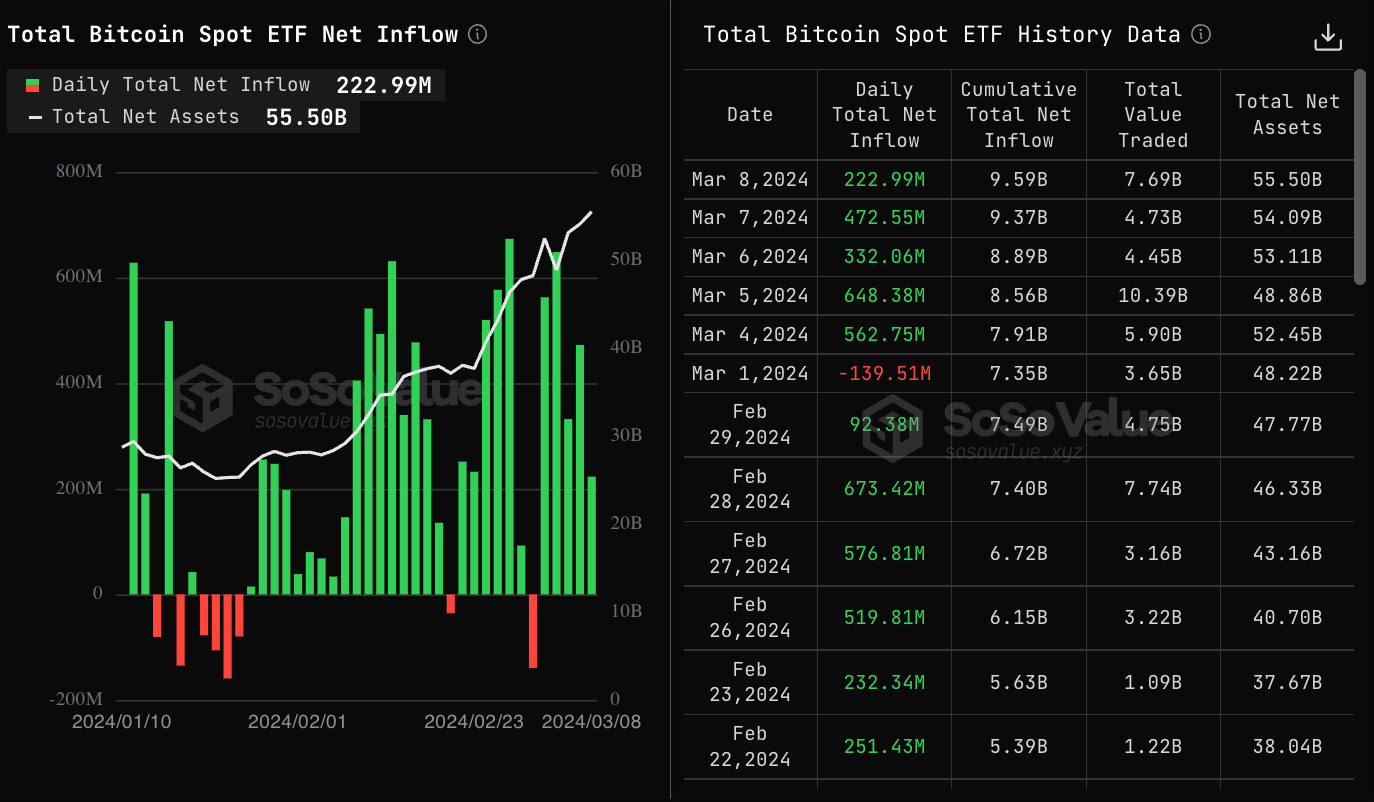

The crypto market continues to exhibit volatility, with significant price movements followed by rapid recoveries. This behavior underscores the market's resilience and the changing dynamics around BTC halving events.

Institutional and Retail Investment: The actions of large institutions like MicroStrategy and the resurgence of memecoin mania highlight continued interest from both institutional and retail investors in the cryptocurrency space.

Regulatory: Developments such as the Dencun upgrade for ETH and the awaited decisions on ETH ETFs demonstrate the market's sensitivity to regulatory actions and technological advancements, which can significantly influence price movements and investor sentiment.

Monetary Policy: Remarks from the Federal Reserve regarding potential interest rate cuts in 2024 have implications beyond traditional financial markets, affecting investor outlook and market dynamics in the cryptocurrency space as well.

Resurgence of Memecoin Interest: Memecoins have seen a dramatic increase in market participation, with six memecoins entering the top 100 by market cap and the sector's market cap reaching around $55 billion, indicating a potential return of retail investors to the crypto market.

4️⃣ Key Economic Metrics

🟡 Federal Reserve may extend its tight monetary policy to manage wage pressures and inflation, delaying anticipated interest rate cuts to the latter half of the year.

Reduction in Consumer Spending: The decline aligns with earlier retail sales data, indicating a broader trend of reduced consumer expenditure.

Inflation Dynamics: Monthly inflation accelerated, particularly for services, reflecting the tight labor market's impact on sustaining high service inflation.

Services Inflation Remains High: This trend is driven by increased labor costs and rising demand for services such as hotels, personal care, and financial services.

Implications for Federal Reserve Policy: The persistence of service inflation suggests the Federal Reserve may maintain a tight monetary policy longer than initially expected to address wage pressures and ease inflation towards the 2% target. This has led to a shift in expectations for interest rate cuts, now anticipated to start in the latter half of the year, rather than the early months.

🟢 Eurozone core inflation, excluding food and energy, is on a declining trend but remains above the European Central Bank's (ECB) target of 2%.

Persistent Services Inflation Amid Tight Labor Markets: Wages are increasing faster than prices, contributing to sustained inflation in the services sector. The inflation for services, which are labor-intensive, continues to be a significant issue. This high rate is attributed to the tight labor market conditions in the Eurozone, with unemployment at a record low of 6.4% and real wages rising quickly as of the third quarter of 2023.

Stable Yet Stubborn Headline Inflation: The Eurozone's annual headline inflation has been relatively stable but stubborn, fluctuating between 2.4% and 2.9% over the past five months.

Varied Inflation Rates Across Member States: Inflation rates differ significantly across Eurozone countries, with February figures ranging from 0.9% in Italy to 3.6% in Belgium.

Likely Delay in Interest Rate Cuts by ECB: Given the ongoing issues with services inflation and the robust labor market, it is probable that the ECB will postpone any cuts in interest rates to monitor further developments and ensure inflation targets are sustainably met.

5️⃣ Japan Spotlight🔴

Japan's inflation is decreasing, reducing pressure on the BOJ to alter its easy monetary policy despite a significant drop in industrial output and two quarters of declining real GDP. The country faces acute demographic challenges with record low births and marriages, prompting the government to take unprecedented steps to address this "gravest crisis," potentially impacting Japan's long-term economic growth and societal structure.

Inflation and Policy: Japan's inflation cooled to 2.2% in January, easing the Bank of Japan's pressure to tighten policy amid decreasing core-core inflation.

Economic Downturn: Weak domestic demand and a continuous decline in real wages by 2.1% in January highlight Japan's economic challenges.

Monetary Policy: The BOJ persists with easy monetary policy, diverging from global central banks, attributing inflation to temporary factors.

Industrial Slump: A notable drop in industrial output, especially in autos, threatens further GDP decline, reflecting broader economic weaknesses.

Demographic Crisis: Record low births and marriages in 2023 signal deep demographic issues, prompting government action towards reversing the trend.

Policy Response: The government deems the declining birthrate its gravest crisis, with drastic steps planned to mitigate a potential 30% population decline by 2070.

Twitter: https://twitter.com/arndxt_xo/status/1766493119909081297