Macro Rebound, BTC’s Ranging, ETH in Accumulation Setup, Altseason

Macro Pulse Update 10.02.2025

Everyone calling macro tops, but the weekly & monthly charts say otherwise. 🤔

$BTC stuck in a range (90k-110k) = no real macro shift.

$ETH holding $2k = accumulation before an inevitable breakout to $10k?

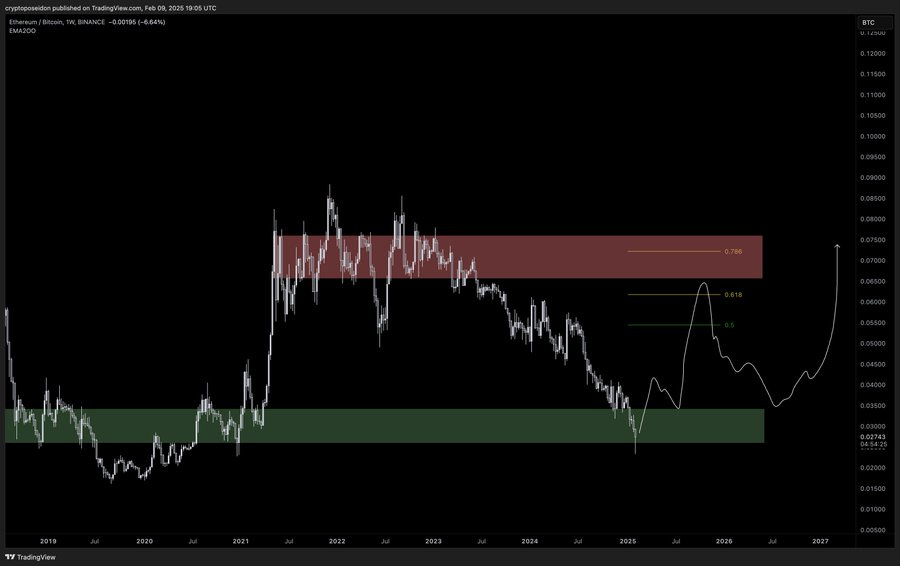

$ETHBTC down 70% in 2 years = a historic support zone & potential alt season trigger.

My analysis 🧵👇

Macro Pulse Update 10.02.2025, covering the following topics:

1️⃣ Macro events for the week

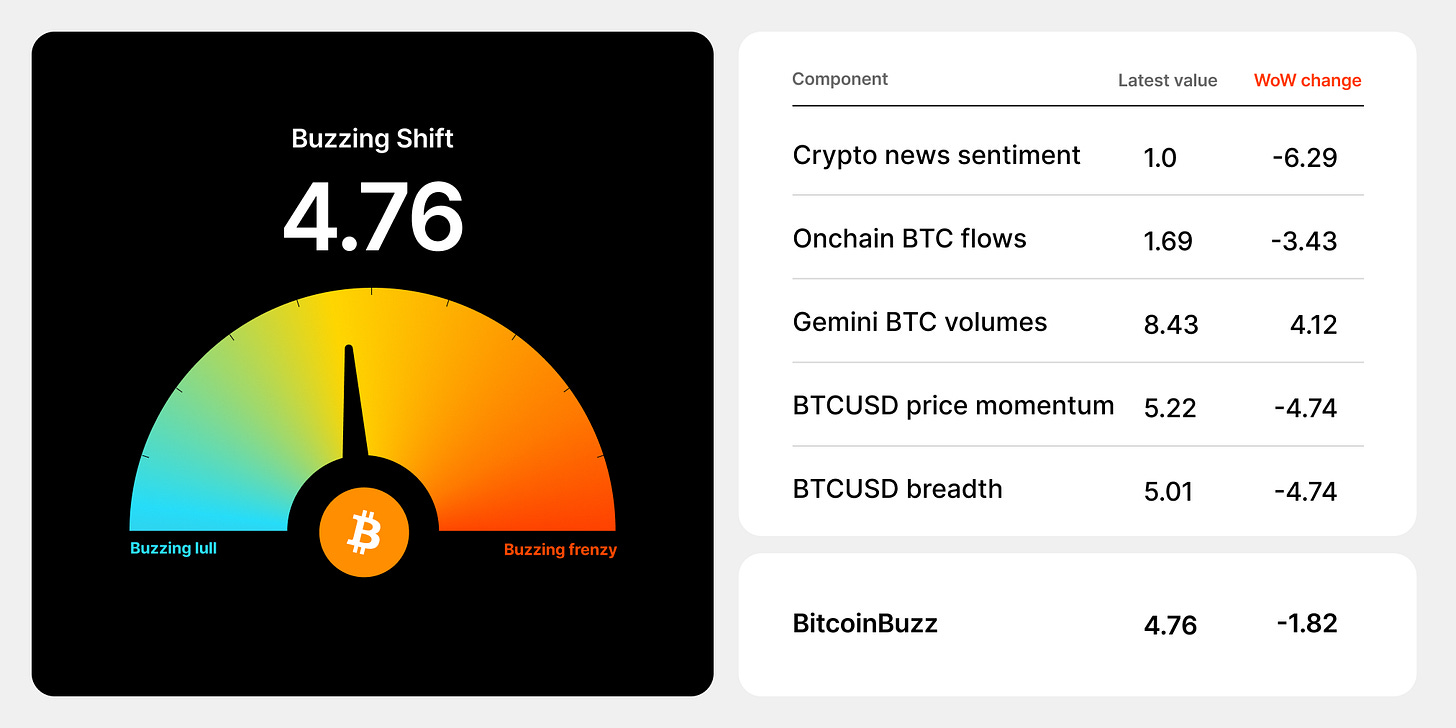

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ EU Spotlight

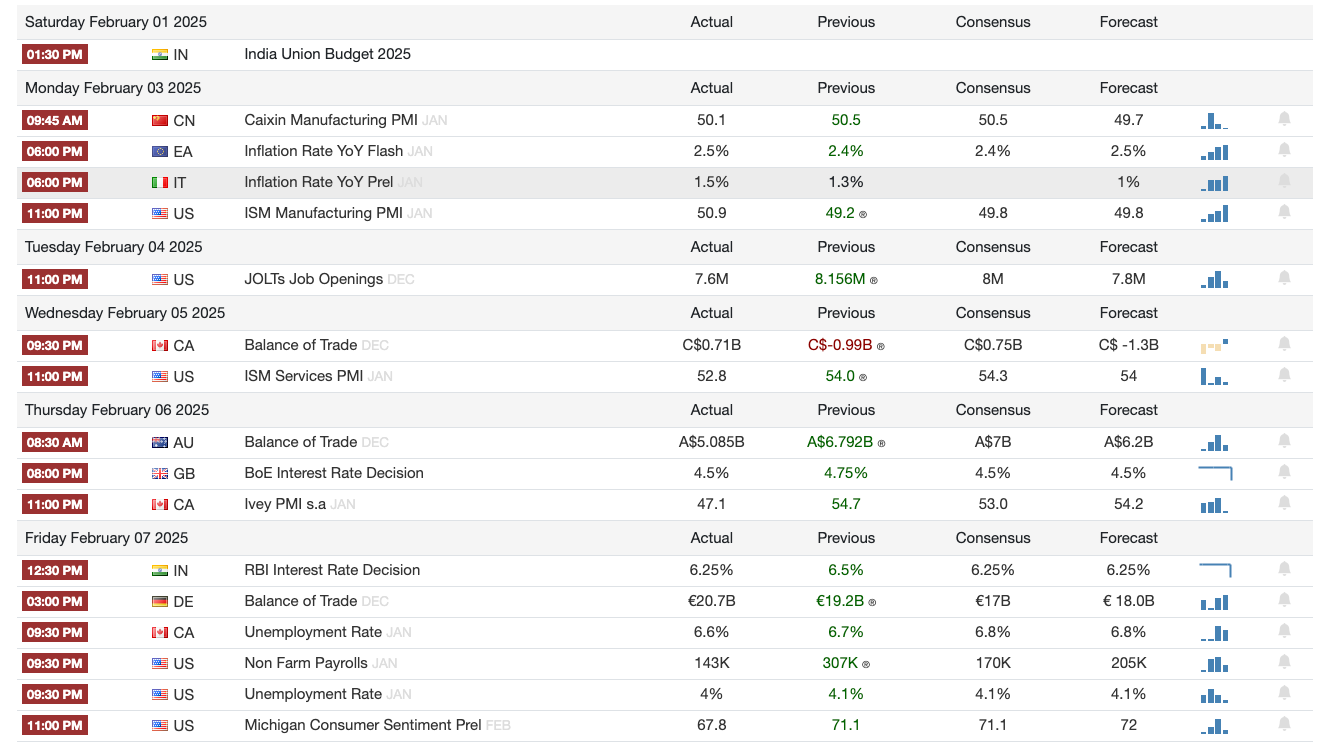

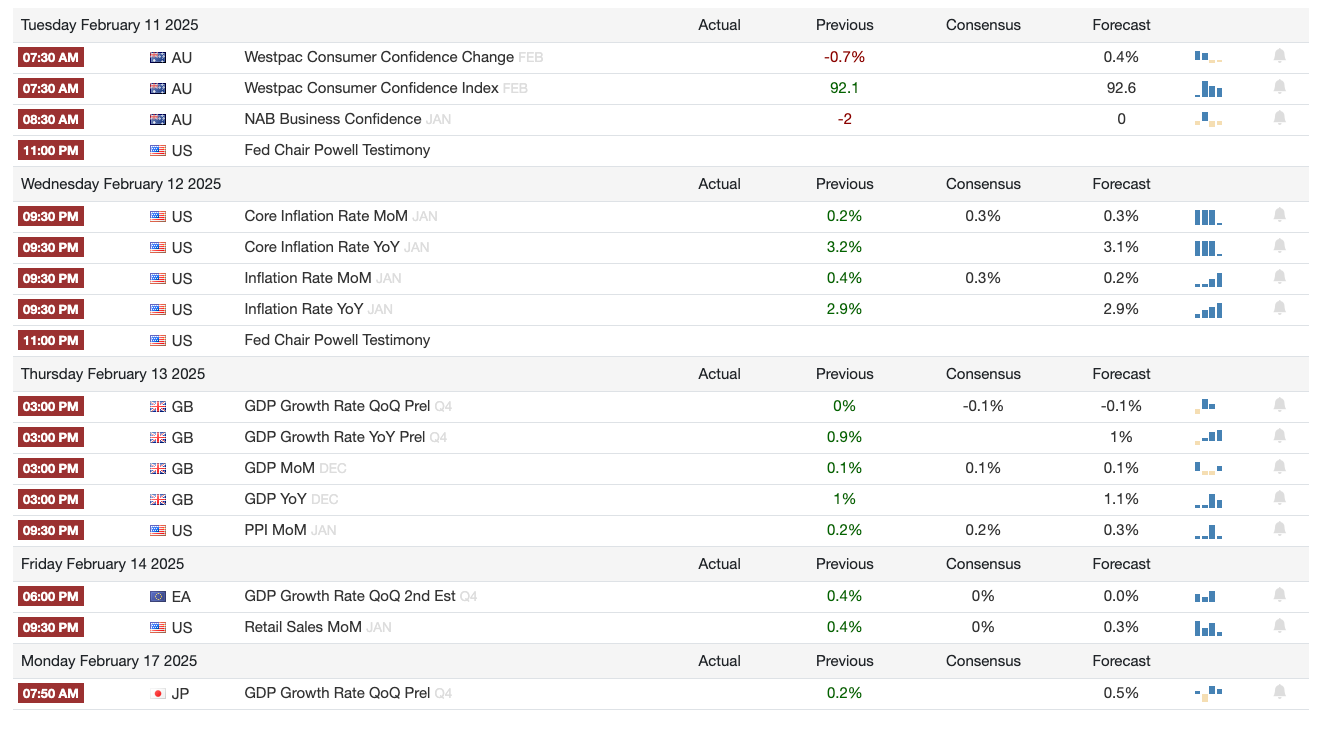

1️⃣ Macro events for the week

Previous week

Next week

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

US Spot Bitcoin ETFs See Record Inflows – Spot bitcoin ETFs in the US recorded $5.25 billion in net inflows in January, surpassing December’s total. BlackRock (IBIT) and Fidelity (FBTC) led the surge, reflecting strong investor interest. Analysts predict 2025 will be another major year for crypto ETFs, with potential approvals for XRP and Solana ETFs.

US Crypto Czar Predicts ‘Golden Age’ for Crypto – David Sacks and key legislators reaffirmed their commitment to pro-crypto policies, with stablecoin legislation as the first priority. The administration is also exploring a strategic US crypto reserve following Trump’s executive order.

Monochrome Group Launches First Australian Bitcoin & Ethereum ETFs in Singapore – These ETFs, approved under Monetary Authority of Singapore (MAS) regulations, cater to institutional investors. The move signals growing global adoption of spot crypto ETFs and Southeast Asia’s role as a regulatory hub.

Tether Reports Record $13 Billion Profit in 2024 – Driven by strategic investments in Bitcoin, gold, and US Treasuries, Tether’s profits highlight the growing dominance of stablecoins in global markets. USDT’s market cap now stands at $134 billion, far ahead of USDC.

4️⃣ Key Economic Metrics

🔴 Global Trade Shifts as US Tariff Decisions Loom

As the world anticipates new US trade policies, global economic relations are rapidly evolving.

US Share of Global Trade Declining – Since 2017, the US share of global trade has shrunk, even as its economy and stock market have grown. Meanwhile, non-US trade has expanded, with major economies forging new trade agreements.

Trade Liberalization Accelerates – The EU and China have aggressively pursued free trade agreements (FTAs) to reduce reliance on the US, signing multiple deals across Latin America, Asia, and the Pacific.

Financial Markets React to Tariff Risks – The US dollar has strengthened, while bond yields have risen. Emerging markets face currency depreciation, potentially leading to inflationary pressures and tighter monetary policies.

US Still a Key Trade Player – Despite the shifting landscape, the US remains the largest global importer, keeping it attractive to international businesses. Some governments are seeking new trade deals to avoid tariff escalation.

Service Trade Remains Open – While US tariffs focus on goods, services trade remains unrestricted, benefiting industries like IT, finance, digital trade, and professional services.

🟢 US Economy Maintains Strength Amid Shifting Trends

The latest US economic data confirms solid growth, despite minor slowdowns in certain sectors.

GDP Growth Remains Robust – Real GDP grew 2.8% in 2024, only slightly below 2023’s 2.9%. Many had predicted a recession, but strong job growth and rising productivity kept the economy on track.

Consumer Spending Driving Growth – Household spending rose 4.2% in Q4, fueled by 12.1% growth in durable goods, especially vehicles and recreational goods. However, spending outpaced income growth, signaling potential constraints ahead.

Mixed Business Investment Trends – Nonresidential fixed investment declined by 2.2%, with sharp drops in equipment purchases (-7.8%). However, investment in intellectual property rose 2.6%, indicating continued demand for software and R&D.

Trade and Inventory Effects – A decline in goods trade and inventory reductions subtracted from GDP growth. However, rising demand could boost production and imports in the coming months.

Inflation Remains Contained – The PCE-deflator rose 2.3%, signaling mild inflation, though core inflation increased slightly to 2.5%, still near the Federal Reserve’s 2% target.

Outlook: Strength with Some Risks – The US economy is expected to remain strong but face headwinds, including higher credit card delinquencies and potential tariff-induced price increases. However, business-friendly policies like tax cuts and deregulation could provide an offsetting boost.

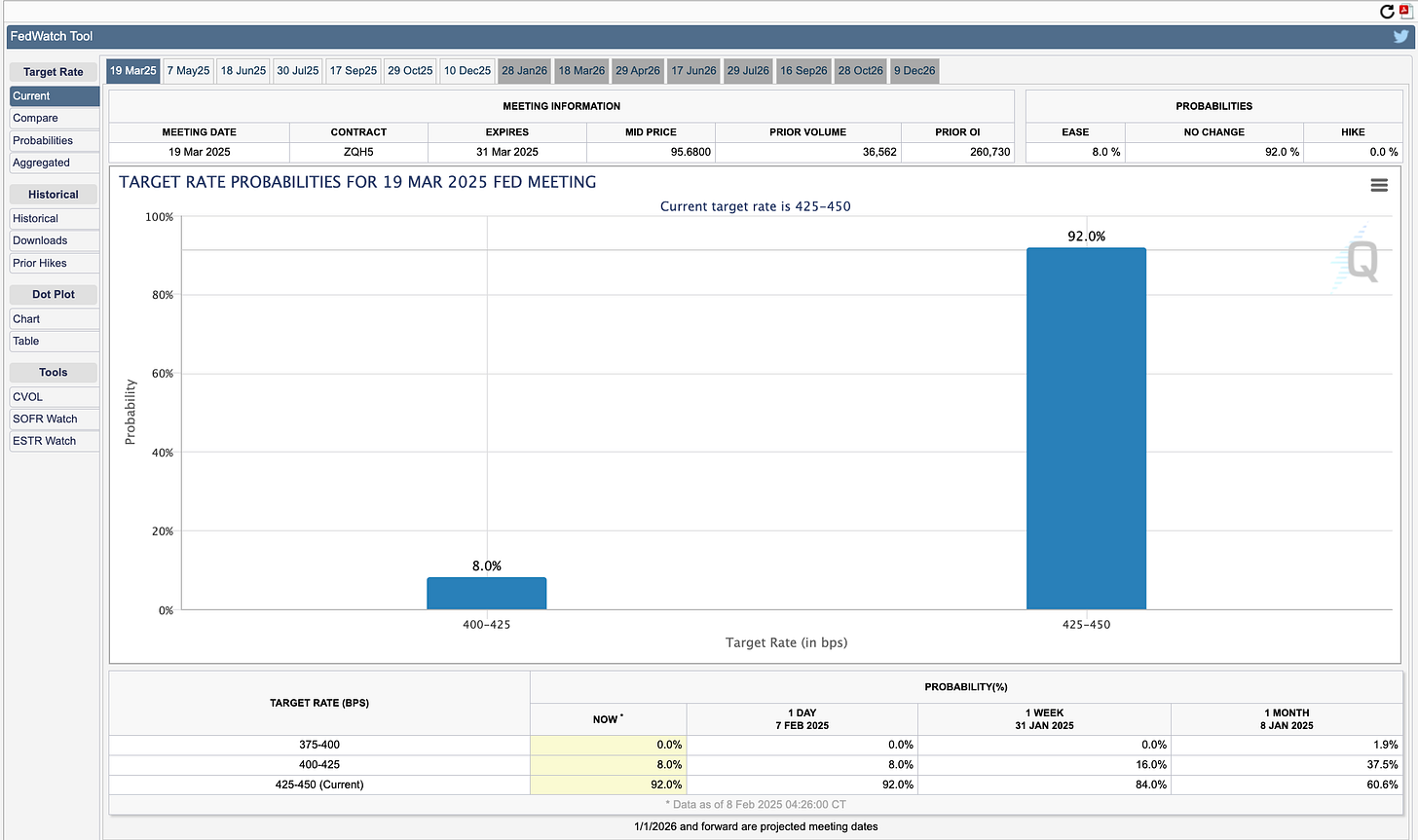

🟡 US Federal Reserve Holds Rates Steady Amid Economic Uncertainty

The Federal Reserve kept its benchmark interest rate unchanged on Jan. 29, 2025, as expected. The decision reflects a cautious approach amid economic strength and inflation concerns.

Labor Market Cooling but Still Strong – Fed Chair Jerome Powell noted that job growth is no longer driving inflation, but the labor market remains solid.

Inflation Progress, But Policy Still Tight – While inflation has eased, it remains above target, prompting the Fed to maintain a restrictive stance. Powell confirmed that interest rates are still above “neutral”.

Market Reaction Mixed – Stocks declined, and bond yields rose, signaling that investors viewed the Fed’s stance as slightly hawkish. Markets were already under pressure following AI-related concerns from China.

Uncertainty Over Future Policy – The Fed emphasized a data-driven approach, awaiting clarity on fiscal policies from the Trump administration, including taxes, trade, and regulation, before making adjustments.

5️⃣ EU Spotlight🔴

Eurozone Economy Stagnates as ECB Begins Rate Cuts

The Eurozone economy stalled in Q4 2024, prompting the European Central Bank (ECB) to cut interest rates amid growing concerns over weak growth.

GDP Growth Slows Sharply – Eurozone GDP was flat in Q4, while the broader EU economy grew just 0.1%. For 2024, GDP increased only 0.7% in the Eurozone and 0.8% in the EU, marking a year of sluggish expansion.

Diverging Regional Growth – Germany (-0.2%) and France (-0.1%) contracted, while Spain (+0.8%) and Portugal (+1.5%) surged, driven by tourism and immigration.

ECB Responds with Rate Cuts – The ECB cut rates by 25bps, bringing the deposit facility rate down to 2.75% as inflation trends toward the 2% target.

Lagarde’s Warning on Trade Risks – ECB President Christine Lagarde highlighted weak consumer confidence, fragile manufacturing, and global trade frictions as key downside risks, with US tariffs posing further uncertainty.

Rate Cuts Expected to Continue – Markets anticipate faster ECB rate cuts than the US Fed, which could weaken the euro but boost export competitiveness.