The conclusion is the macro top is likely much higher than here.

We are in the HODL-ing wave with massive accumulation the past week

The macro story leading up to a possible rate cute in Sep 👇🧵

Macro Pulse Update 10.08.2024, covering the following topics:

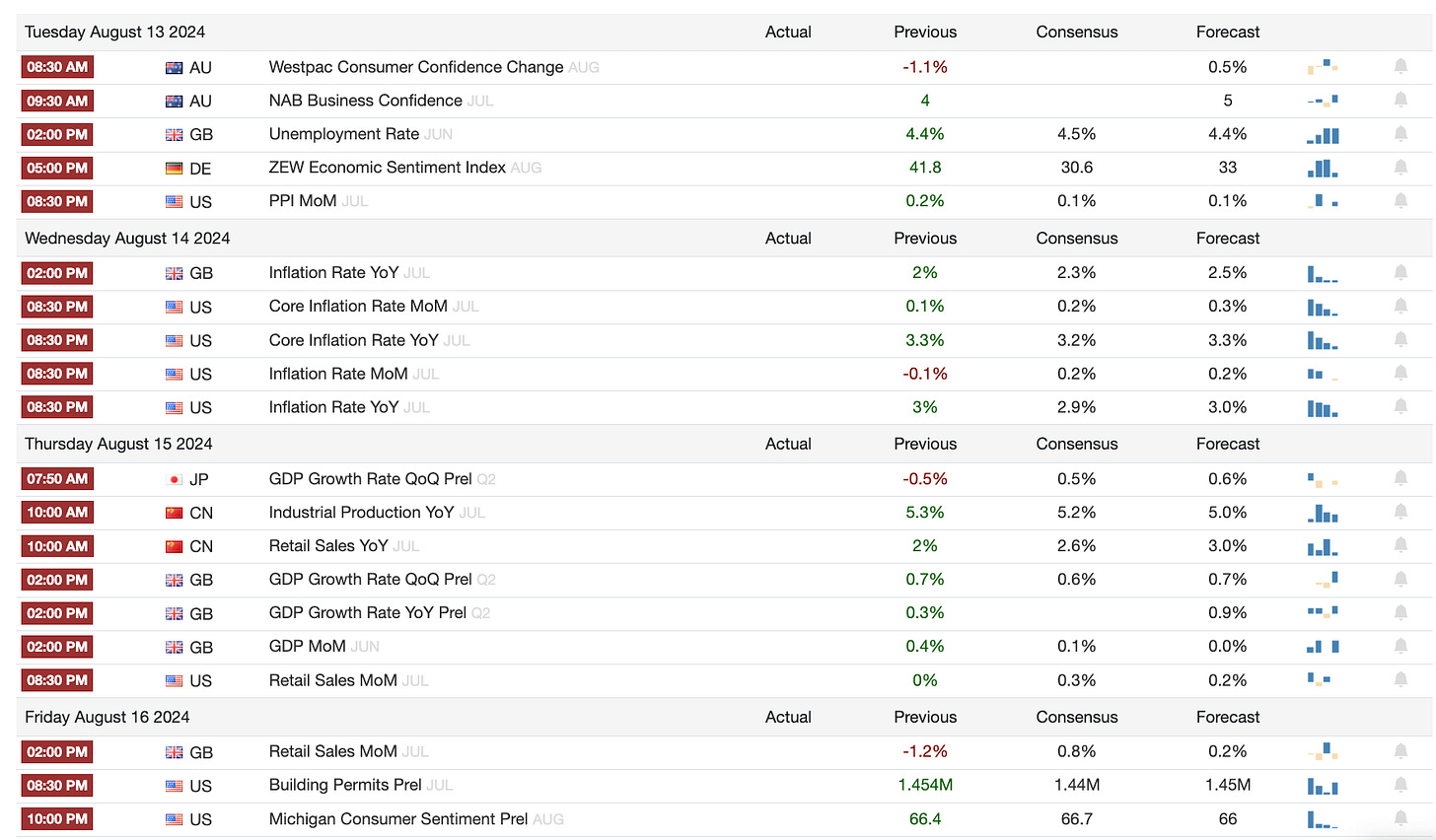

1️⃣ Macro events for the week

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ China Spotlight

1️⃣ Macro events for the week

Last week

Next week

2️⃣ Bitcoin Buzz Indicator

Crypto Market Updates

Bitcoin price surges past $62,000 amid market caution

Ethereum faces critical support levels as whale activity rises

Bitcoin ETFs see record inflows; Ether ETFs face outflows

Cboe re-files spot Bitcoin ETF application amid SEC engagement

Stablecoins and Market Trends

Tether mints $1.3 billion USDT as Bitcoin rebounds

Regulatory and Legal Developments

Crypto leaders confront White House over banking challenges

OKX enforces sanctions compliance with account deactivations

Thailand SEC launches Digital Asset Regulatory Sandbox

Debates and Market Analysis

Bitcoin power law debate sparks intense controversy

Security and Technology

Solana developers address critical security threat proactively

Celestia's Lemongrass upgrade brings key improvements

Crypto Exchanges and Platforms

Coinbase to list Zetachain and Across Protocol

Partnerships and Collaborations

Illuvium partners with Samsung for Web3 gaming integration

Lamborghini partners with Animoca for digital engagement

Market Movements and Transactions

Worldcoin price rises despite Alameda token transfer

Innovative Platforms and Blockchain Development

Pump.fun incentivizes memecoin creators with Solana rewards

SuiNS transitions to decentralized governance with NS token

Nostra expands to Monad blockchain for DeFi enhancement

Country-Specific Crypto Developments

Montenegro court delays Do Kwon's extradition to South Korea

Turkey's new crypto regulations spur surge in license applications

Legal Battles and Challenges

Avraham Eisenberg seeks acquittal in Mango Markets case

Cryptocurrency Scandals and Issues

Trump-themed cryptocurrency crashes 95% after Eric Trump denial

Kanpai Pandas NFTs drop amid Trump token controversy

3️⃣ Market overview

Key Insights

Bitcoin’s Rollercoaster Week: Bitcoin dipped below $50,000 earlier this week, hitting its lowest point since mid-February. However, it quickly rebounded, nearing $60,000 by Thursday as market sentiment improved despite ongoing recession fears.

Spot Bitcoin ETFs Experience Significant Outflows: Amidst global market volatility, US spot Bitcoin ETFs saw $168.4 million in net outflows on Monday. Grayscale’s GBTC led these withdrawals, with broader macroeconomic issues and crypto-specific challenges driving the selloff.

Crypto Industry Calls for Regulatory Clarity: Over 50 crypto firms, united under the Crypto Market Integrity Coalition, have urged the Biden administration to establish clearer regulations for digital assets, highlighting the need for a more secure and innovation-friendly environment.

Ethereum Activity Declines as Solana Gains Traction: The launch of spot ether ETFs coincided with a sharp drop in new Ethereum wallet addresses, hitting their lowest level this year. In contrast, Solana saw growth in new addresses, driven by its expanding DEX ecosystem and increased interest in memecoins

Ripple Expands Its Stablecoin Ambitions: Ripple is moving forward with its stablecoin strategy by preparing to launch Ripple USD (RLUSD) on the XRP Ledger and Ethereum. This move is expected to bolster Ripple’s efforts in enhancing cross-border transaction innovation.

4️⃣ Key Economic Metrics

🟡 Investors are questioning whether the Federal Reserve delayed cutting interest rates, following a weak jobs report and significant market volatility, including a sharp drop in the 10-year bond yield and declines in equities.

Market Reactions: The S&P 500 fell 2.3%, tech stocks saw sharp declines, the dollar weakened against major currencies, and Brent crude prices dropped 3.4%, reflecting concerns over the economic outlook.

Jobs Report: The July employment report showed a modest gain of 114,000 jobs, with unemployment rising to 4.3%. Wage growth slowed to 3.6%, signaling potential economic weakness.

Recession Concerns: The word “recession” gained traction as indicators like rising credit card delinquencies, weak manufacturing orders, and a slowing job market raised concerns, despite strong consumer spending and business investment.

Fed’s Dual Mandate: The Fed is shifting focus from solely inflation to also considering employment, with expectations of a rate cut in September as the Fed acknowledges rising unemployment and financial stress among households.

US productivity Growth: Strong productivity growth in the US during the second quarter has alleviated some inflationary pressures, suggesting that rising wages may not translate into higher prices, which could prompt the Federal Reserve to ease monetary policy sooner.

Tight US Labor Market Shows Signs of Easing: Despite rising productivity, initial unemployment claims have increased, indicating potential easing in the tight labor market, which could reduce wage pressures and further support lower inflation.

🟢 The Eurozone economy is recovering modestly, with Spain showing robust growth due to strong consumer spending and exports, while Germany lags due to weak investment and high energy costs.

ECB Faces Dilemma on Rate Cuts Amid Mixed Inflation Data: Eurozone inflation remains stuck at elevated levels, particularly in services, complicating the European Central Bank’s decision on whether to continue cutting interest rates, as it balances between controlling inflation and supporting economic recovery.

Eurozone Inflation Varied by Country: Inflation trends in the Eurozone are mixed, with some countries like Italy and Spain showing signs of easing, while others, such as Belgium, still face higher inflation, adding complexity to the ECB’s policy decisions.

5️⃣ China Spotlight🟢

The renminbi’s internationalization has seen significant growth, with a 22.9% increase in its global usage index in 2023, but it remains far behind the US dollar and euro, indicating limited global influence.

Government Efforts to Boost Renminbi Usage: China is actively promoting the renminbi through cross-border financial settlement platforms and currency-swap arrangements, aiming to enhance its role in global trade and finance.

Capital Controls Hinder Renminbi’s Potential: China’s continued use of capital controls, which allows the government to manage currency value and maintain low interest rates, is a major barrier to the renminbi challenging the dominance of the US dollar in the near future.