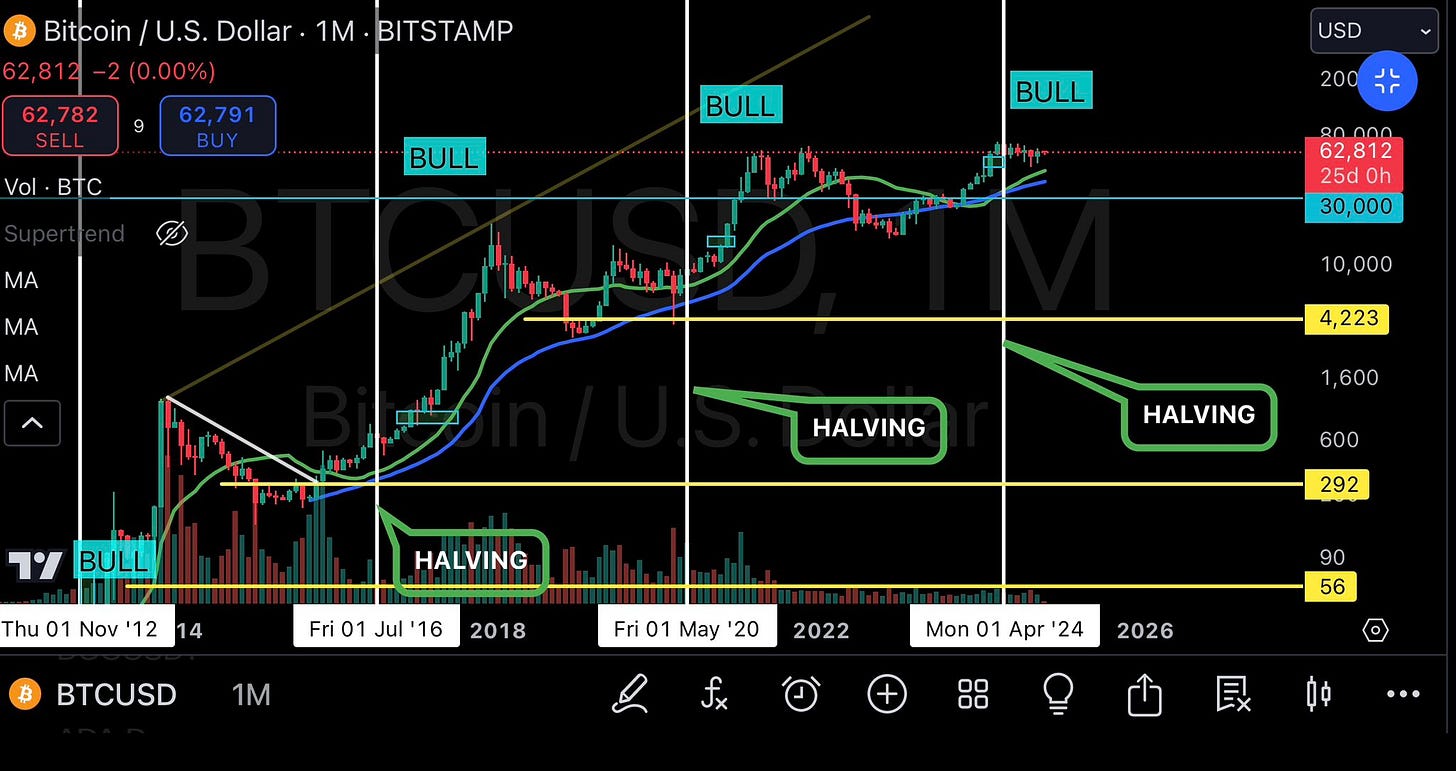

This is it, the 4-year cycle is turning.

We are on the cusp of major moves, elections, rate cuts and new year are usually bullish signals.

We are at the turning point of the market 👇🧵

Macro Pulse Update 12.10.2024, covering the following topics:

1️⃣ Macro events for the week

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ China Spotlight

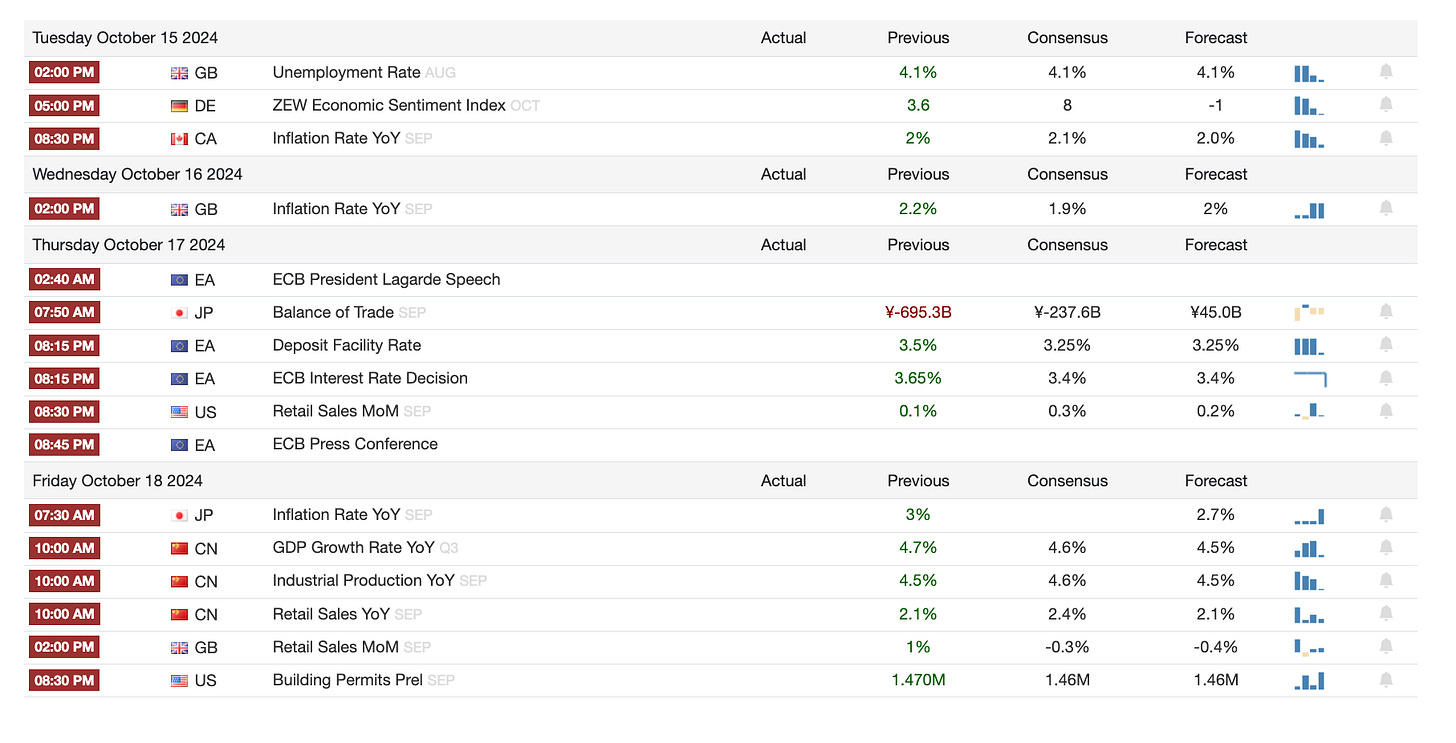

1️⃣ Macro events for the week

Last Week

Next week

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

Crypo Market

HBO Documentary Hints Peter Todd is Satoshi Nakamoto: HBO’s “Money Electric” suggests early Bitcoin developer Peter Todd could be Satoshi Nakamoto, though Todd denies the claim. The film highlights his cryptography expertise and ties to Bitcoin’s origins.

Crypto.com Sues SEC for Overreach: Crypto.com is suing the SEC, challenging the agency’s attempt to classify most cryptocurrencies as securities. This adds to the growing crypto industry’s legal pushback against SEC regulations.

Bitcoin Falls Amid Inflation Worries: Bitcoin dipped below $60K after US inflation data for September showed a 2.4% rise, sparking negative market sentiment despite earlier gains from positive jobs reports.

US Bitcoin ETFs See $19M in Outflows: US spot Bitcoin ETFs reported $18.66M in outflows, led by Fidelity’s FBTC. Only BlackRock’s IBIT saw inflows, showing investor caution amid market volatility.

Hong Kong to Approve More Crypto Exchanges: Hong Kong’s SFC plans to approve more crypto exchanges by the end of 2024, aiming to expand the digital asset sector despite criticism over its strict licensing rules.

Overall Macro Market

US Inflation Rises in September: Core CPI increased by 0.3%, driven by food and housing, signaling persistent inflation. Fed is expected to maintain a cautious approach on rate cuts despite the strong jobs report.

Bank of Korea Cuts Rates: South Korea’s central bank reduced its benchmark rate to 3.25% after inflation fell to 1.6%. More cuts are likely amid favorable inflation trends and weakening housing demand.

US Stocks Dip Amid Mixed Data: S&P 500 fell 0.2%, with inflation data and jobless claims raising uncertainty over Fed rate cuts. First Solar dropped 9.3%, while CrowdStrike and Micron saw gains. Oil and gold rose, Bitcoin fell below $60K.

4️⃣ Key Economic Metrics

🟢 The US economy is showing resilience, with strong job growth in September adding 254,000 new jobs and unemployment falling to 4.1%. Inflation remains elevated but is gradually easing, prompting the Federal Reserve to take a cautious approach to rate cuts. Consumer spending and disposable income saw modest gains, signaling steady economic activity. Overall, the economy is trending toward a soft landing, but inflationary pressures and interest rate decisions remain key challenges.

US Inflation Slows but Remains Bumpy: Consumer prices remain sticky, with slight variation in data. The Fed plans to recalibrate rate hikes more gradually, reflecting ongoing inflationary risks.

Mixed Global Economic Data: Japan shows encouraging wage growth, while the U.K.’s GDP recovery continues. New Zealand cuts rates, signaling potential for further central bank easing. China’s stimulus lags expectations, while inflation cools in Mexico but rises in Brazil.

Consumer Credit Growth Slows: Consumer credit growth moderated in August, with credit card balances declining as interest expenses increased.

Hurricanes to Impact Economic Data: Hurricanes Helene and Milton are expected to distort upcoming economic data, especially in the Southeastern US, but full damage assessments are still pending.

🟡 Globally, economic trends are mixed. The Eurozone saw inflation drop to 1.8%, but services inflation remains high, leading to slow rate cuts by the ECB. Japan is cautious with monetary tightening due to weak growth, while South Korea cut rates as inflation fell to 1.6%. Meanwhile, China’s stimulus measures have underwhelmed, and global manufacturing activity is slowing, with India standing out as a strong performer.

Eurozone Inflation Eases: Eurozone inflation dropped to 1.8%, the lowest in three years. While services inflation remains high, the ECB is expected to continue cutting rates slowly.

Bank of Korea Cuts Rates: The Bank of Korea reduced rates by 25 basis points as inflation falls to 1.6%, signaling further rate cuts in the face of weak housing demand.

Global Manufacturing Weakens: Global manufacturing PMI fell to 48.8 in September, with major economies like the US, eurozone, Japan, and China showing declining activity. India remained the top performer.

BIS Warns of More Volatile Inflation: BIS warns that geopolitical and climate factors could cause more frequent price spikes, requiring central banks to raise interest rates more often.

Japan’s Monetary Caution: The Bank of Japan faces pressure to tighten monetary policy but remains cautious due to weak economic growth and concerns about export competitiveness.