We’re 2 points away from an alt season

Money is rotating to ETH in anticipation of a ETH ETF

Here’s 4 indicators as we brace for an alt season👇🧵

Macro Pulse Update 13.01.2024, covering the following topics:

1️⃣ Macro events for the week

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ China Spotlight

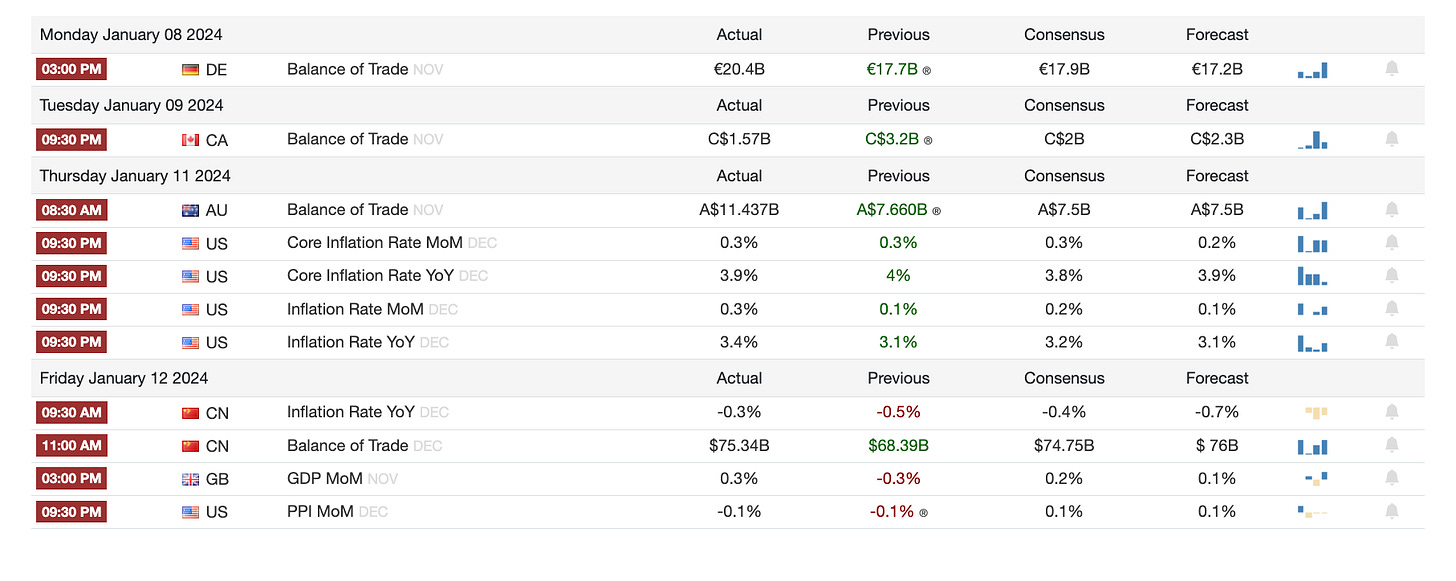

1️⃣ Macro events for the week

Last week

Next week

2️⃣ Bitcoin Buzz Indicator

Banking and Regulatory Updates

Spot Bitcoin ETFs: A Tipping Point in Crypto Adoption

Bitcoin ETF False Tweet: Market Surge and SEC's Cybersecurity Flaw

SEC Nods to 11 Bitcoin ETFs: A New Era for Cryptocurrency

Ethereum ETF Anticipation: Rising Market and SEC Scrutiny

Country-Specific Developments

DCG Settles Debts Amidst Genesis and Regulatory Challenges

Grayscale Adds XRP: A Glimpse into Future ETF Prospects

Circle's Public Offering Plan: Stepping into the Spotlight

Do Kwon's Legal Battle: A Tangled Web of Extradition and Delays

Information about Crypto Exchanges and Platforms

Polygon's Growth: Media and Finance Embrace Blockchain Tech

Solana's Ecosystem Surge: Prices, Meme Coins, and Developer Growth

X Drops NFT Profile Feature: A Shift in Crypto Strategy

SEC's Fake Tweet Fallout: Bitcoin ETF Approval and Security Lessons

NFT Market Shift: Polygon Edges Out Solana in Sales

Altcoins:

CoinsPaid suffered a $7 million hack, as reported by Cyvers.

Bit24 denied claims of a KYC data breach.

Upbit achieved full licensing in Singapore.

Bitfinex will restrict services in the UK.

Starknet's vote approved STRK token for fees.

Controversy arose around Thai digital money giveaway.

ImToken wallet requested removal from Singapore's blacklist.

XAI airdrop put $70 million into gamers' wallets on Arbitrum.

Celsius creditors asked to return funds withdrawn before bankruptcy.

Apple India blocked several crypto exchanges following an FIU notice.

Richard Heart hired high-profile lawyers, leading to a surge in HEX tokens.

Kava Chain transitioned to a fixed supply, introducing Tokenomics 2.0.

Cosmos Hub proposed setting minimum ATOM inflation to zero.

Aave community voted to integrate PayPal’s stablecoin.

Near Foundation plans a 40% staff cut, yet maintains a strong treasury.

Hedera and Algorand collaborated to form the DeRec Alliance for asset recovery.

Injective rolled out the Volan upgrade focused on real-world assets and Cosmos chains connectivity.

Telcoin restored user balances after an exploit, leading to a 400% increase in deposits.

1inch DAO voted to hire legal support from Storm Partners for decentralized legal challenges.

3️⃣ Market overview

US inflation rose higher than expected to 3.4% annually in December, exceeding forecasts of 3.2%. This has cast doubt on expectations of Fed interest rate cuts as early as March.

Core inflation also surpassed forecasts, affirming the Fed's hesitation to reduce rates from 23-year highs.

Following the inflation data, US stocks saw a slight decline and the bond market showed volatility. But 2023 inflation pressures significantly decreased from 2022 peak.

US equity markets fluctuated yesterday following higher inflation data. Nasdaq rose 0.17%, S&P 500 fell 0.07%, Dow Jones rose 0.04%.

Average US junk bond yields remain around 8%, down from 9.4% in early November.

Upcoming Taiwanese elections present crucial geopolitical implications for US-China relations and global markets. Markets likely to respond gradually, contingent on outcomes and reactions from Beijing and Washington. Safe haven assets like USD, JPY, gold and developed market sovereign bonds could protect against escalating risks.

Investors awaiting China inflation data today for further economic insights influencing markets.

4️⃣ Key Economic Metrics

🟢 The job market and certain data continues highlighting labor market strength, but emerging signs of economic weakness could shift Fed policy. Key gauges sending mixed signals. Wage pressures remain persistent concern for inflation outlook.

US job market remains strong despite Fed tightening, consistently adding more jobs than expected.

Job openings rate edged down but remains far above pre-pandemic levels, indicating persistent labor shortage despite some loosening since 2022 peak.

Industries with most job openings include healthcare, professional services, accommodation and food. Lower rates in retail, education, manufacturing.

🟡 Latest eurozone inflation data sends mixed signals on the outlook. An inflation rebound poses challenges for ECB policy easing, but the slowdown in core inflation and large excess savings buffer provide potential economic fuel if deployed.

🟢 Cuts expected sometime this year.

Minutes indicate Fed intends to keep interest rates high "for some time" despite market pricing in cuts.

But Fed acknowledges progress on bringing demand/supply into alignment and significantly lower recent inflation figures.

Potential concern is impact of tight policy on credit markets - rising delinquencies signaled risk.

Members expect GDP growth to cool in 2024 and inflation to moderate further.

Surveys show sharp increase in US consumer confidence and optimism in Dec after prior pessimism.

More positive views on business conditions, jobs, inflation outlook for 2024 (expected at 3.1%).

5️⃣ China Spotlight🔴

The reversal of the long-standing migration flows from rural to urban areas poses a demographic challenge for China, especially if it persists. It risks depriving cities of an important source of labor that previously bolstered growth and productivity. Managing this trend and its impacts will be a key policy consideration going forward.

Mass internal migration of rural workers to cities was a key driver of China's economic growth over past 2 decades by boosting productivity.

In 2022, number and share of workers in agriculture rose for first time in 20 years, reversing long-term trend that began in 1999.

Potential factors include pandemic restrictions leading some urban workers to return to rural areas, and weak economy reducing job opportunities in manufacturing and services.

This reversal could continue depending on health of urban economy. It risks exacerbating China's declining workforce if fewer rural workers migrate to cities.

An urban labor shortage resulting from reduced migration would hinder economic growth at a time when China's economy already faces headwinds.

Twitter: https://twitter.com/arndxt_xo/status/1746149137517781129