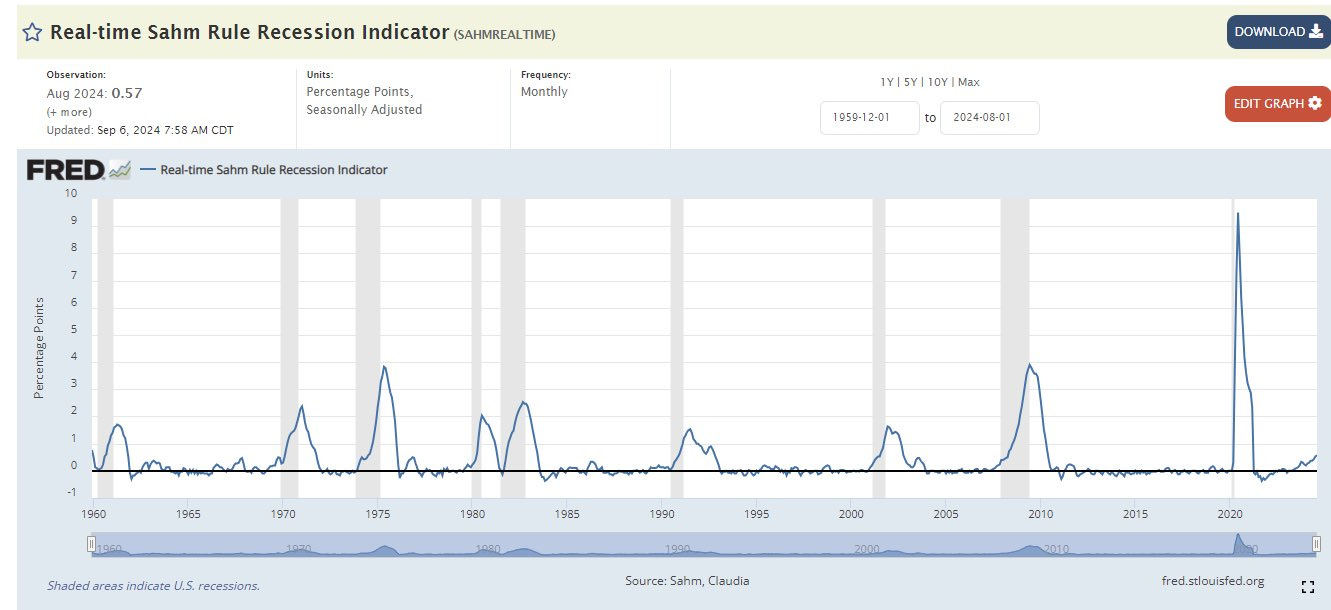

US economy is sliding into a recession

Rate cuts incoming with 50% chance now

Here are 3 indicators that you should know for Rektember👇🧵

Macro Pulse Update 14.09.2024, covering the following topics:

1️⃣ Macro events for the week

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ China, Japan Spotlight

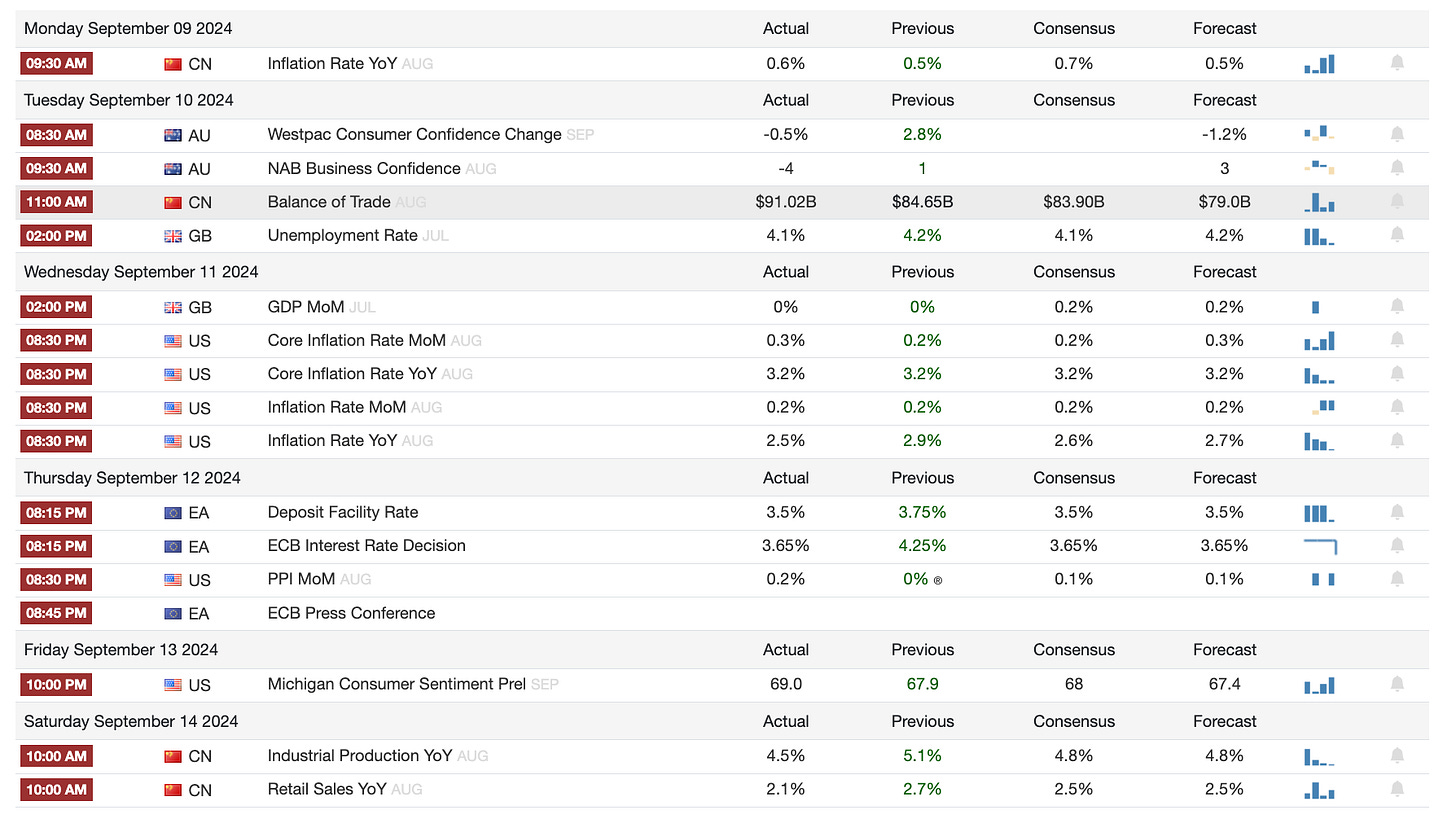

1️⃣ Macro events for the week

Last Week

Next week

2️⃣ Bitcoin Buzz Indicator

Coinbase and Token Updates

Coinbase's cbBTC Nears $100.3M Market Cap

XRP Trust Launch Boosts Ripple's Market Value

Friend.tech Token Drops After Control Transfer

BitGo Expands WBTC to Avalanche and BNB Chain

Exchange Security Breaches

Indodax Faces $22M Hack Amidst Security Concerns

Blockchain and Staking Developments

Binance Lists POL Token Amid Polygon Labs Investment

Solana's Liquid Staking Poised for Major Growth

Starknet Staking Vote Passes with 98.94% Support

Regulatory and Legal News

ParaFi Tokenizes $1.2B Fund Amid RWA Market Surge

eToro Settles with SEC, Limits US Crypto Trading

Tether and Tron Fight USDT-Linked Crimes with New Unit

Digital Chamber Pushes Congress for NFT Regulation Change

NFT and CryptoPunk Market

DeGods NFTs Secure Lifetime Revenue Share Partnership

Trader Acquires $1.5M CryptoPunk for 10 ETH in Buyout

Altcoins

PayPal and Venmo added Ethereum Name Service for smoother transactions.

SunPump introduced a ranking feature as meme coin prices soared.

Tokocrypto, owned by Binance, secured a full Indonesia license for its exchange.

Sonic launched wallet credit scores without KYC, achieving 720ms finality.

BBVA expanded its crypto services by integrating the USDC stablecoin.

Ether.fi partnered with Scroll for its L2 settlement and announced a crypto credit card.

Pantera and ParaFi bought FTX Metaplex tokens along with other investors.

Kujira formed an alliance to build an app layer on THORChain after merging with Rujira.

FET and TAO surged following the iPhone 16 AI feature announcement.

Fractal launched its Bitcoin sidechain but faced criticism over pre-mining.

Merlin Chain and BitcoinOS unveiled a ZK-powered bridge to connect with Bitcoin.

Paxos expanded to Arbitrum, enhancing the Ethereum Layer 2 ecosystem.

Standard Chartered introduced Bitcoin and Ether custody services in the UAE.

Wintermute repurchased NEIRO on Ethereum, acting as a market maker.

Nansen expanded its staking services across 20+ blockchains after acquiring StakeWithUs.

Sony Bank and Soneium launched Japan’s first yen-linked stablecoin.

A Monero expert debunked Chainalysis' claim that XMR transactions could be traced.

EigenLayer announced the upcoming launch of restaking rewards for ARPA.

DIA revealed ‘Lumina’ to shake up trustless oracle networks.

Atomic Wallet won dismissal of the $100M class-action lawsuit over jurisdiction.

Trump meme coins fell after the debate, while Harris coins gained traction.

Animoca Brands Japan joined Orbs Layer 3 network as a guardian node operator.

Nubank halted trading of its native crypto token following a 97% price plunge.

India and Nigeria led global crypto adoption, with Indonesia as the fastest-growing market.

Osmosis expanded beyond its Cosmos roots by launching the cross-chain token portal Polaris.

Dune users can now access on-chain data for Polkadot’s 50+ parachains.

AI-focused ASI Alliance aimed to onboard Cudos as its fourth member.

Caroline Ellison requested time served due to cooperation with the US government.

Ethervista transactions froze after a record start.

PancakeSwap introduced a Telegram bot for predicting BNB prices.

The UK granted legal clarity to digital assets with a new crypto bill.

Kalshi listed election contracts after defeating the CFTC in court.

Cypherpunk Holdings rebranded to SOL Strategies after going all-in on Solana.

Pump.fun fee account sold another $1.3M of SOL, bringing total revenue to $95.87M.

Stablecoins on Layer 2 networks exceeded $10 billion in total value.

Vega passed a governance vote to shut down its Layer 1 blockchain.

A Consensys and Hashkey-backed accelerator launched with $50M to support CARV’s data layer.

Bitget Wallet introduced a tool to help traders find meme coins with 100x potential.

Worldcoin denied being under investigation in Singapore.

1inch Network published a white paper on cross-chain innovation.

Circle moved its headquarters to New York City.

Uniswap's CEO denied allegations regarding high deployment costs.

WeWork founder's climate firm refunded crypto token holders after a failed launch.

Anchorage Digital Bank and BitGo joined Coinbase to custody 21Shares crypto ETFs.

YieldNest introduced the first liquid-restaking token on the BNB Chain.

Raydium launched a burn-and-earn feature for coin creators to lock liquidity.

Solana apps can prioritize human users with Wormhole’s World ID integration.

Tada ride-hailing app integrated TON crypto payments for rides in Singapore.

Kraken responded to SEC allegations, claiming digital assets are not securities.

ZKSync introduced a governance model on mainnet with token voting and security controls.

Trump's crypto venture World Liberty Financial announced its launch during the election campaign.

The Supreme Court of Montenegro expected to rule on Do Kwon's case this month.

Binance offered a $1M BNB airdrop to users affected by Typhoon Yagi.

The SEC acknowledged regret for confusion regarding some tokens being classified as securities

OKX: BasedBrett (BRETT), Simon’s Cat (CAT), Neiro on ETH (NEIRO), Catizen (CATI)

Binance: Neiro on ETH (NEIRO), Rocket Pool (RPL) Futures, Hamster Kombat (HMSTR) - 58th Launchpool, Catizen (CATI) - 59th Launchpool

Kraken: Popcat (POPCAT)

Upbit: Nervos Network (CKB)

Crypto.com: Neiro on ETH (NEIRO)

DRiP (Solana-based NFT creator platform), Huma Finance (tokenised RWA), Blum (Telegram-integrated DEX), OpenEden (tokenised RWA).

4️⃣ Key Economic Metrics

Market overiew

Inflation Eases, Setting the Stage for Rate Cuts: The Consumer Price Index (CPI) rose 2.5% in August, down from July's 2.9%. This lower inflation rate increases the likelihood that the Federal Reserve will cut interest rates by 25 basis points at its next meeting, a positive signal for the crypto market, which tends to benefit from lower interest rates.

FTX Settles Robinhood Shares Dispute: FTX reached a $14 million settlement with Emergent Technologies over the contested 55 million Robinhood shares. This resolution helps expedite Emergent's bankruptcy proceedings and avoids costly legal battles, bringing more clarity to FTX’s efforts to recover value for its creditors.

Bitcoin ETFs Face Significant Outflows: Spot Bitcoin ETFs saw $1.2 billion in outflows over eight days, marking their longest streak of net withdrawals amid market volatility. Despite the sell-off, analysts predict a potential bitcoin surge in Q4 2024 if markets stabilize.

🟢 The U.S. job market is showing signs of softening, with job openings falling to pre-pandemic levels and wage growth decelerating, indicating an easing of labor market tightness.

While job growth in August was concentrated in a few sectors, such as construction and health care, manufacturing and retail saw declines.

Unemployment fell to 4.2%, and initial claims for unemployment insurance remain low.

This normalization of the job market suggests the economy is stabilizing, reducing inflationary pressures and providing the Federal Reserve with confidence to consider rate cuts in the near term.

🟢 The U.S. yield curve, which has been inverted for 26 months, is no longer inverted between the 10-year and two-year bonds, a historical precursor to recessions. However, the gap between the 10-year and three-month yields remains inverted. While an inverted yield curve has traditionally predicted recessions, it is not a direct cause but reflects underlying factors like monetary tightening. As the Federal Reserve prepares to ease policy following months of high interest rates, the economy may face a slowdown or potential recession.

Despite resilience due to fiscal stimulus and strong balance sheets, the economy is showing signs of deceleration, which could prompt the Fed to cut rates.

End of Yield Curve Inversion: The gap between the 10-year and two-year bonds is no longer negative, historically signaling potential recession, though the 10-year and three-month gap remains inverted.

Monetary Tightening Effects: The inversion often reflects monetary tightening, where higher short-term rates are used to control inflation, and the end of inversion suggests expectations of Fed rate cuts.

Lagging Impact of Tightening: Economic effects from monetary tightening typically lag, meaning the negative impacts may only now begin to surface, despite potential Fed easing.

Resilience of the Economy: The economy has shown resilience due to factors like pandemic-related savings, ongoing fiscal stimulus, and strong household and business balance sheets, but those buffers are diminishing.

5️⃣ China, Japan Spotlight🔴

Former central bank leaders from China and Japan have expressed concern over China’s deflationary pressure, drawing parallels to Japan's struggles in the 1990s and 2000s. China faces issues such as weak domestic demand, excess capacity, and a troubled property market. The former head of the People’s Bank of China (PBOC) recommends increased fiscal stimulus, more aggressive monetary easing, and addressing property market imbalances. Meanwhile, the former head of the Bank of Japan (BOJ) highlighted similarities to Japan’s past economic challenges, noting that while China's situation isn't as severe yet, prompt action is necessary.

Deflationary Pressure in China: China is grappling with deflation while other major economies struggle with inflation, indicating a unique economic challenge.

Yi Gang’s Recommendations: The former PBOC chief suggests more fiscal stimulus, easing monetary policy, addressing the property market, and dealing with local government debt to combat deflation.

Kuroda’s Warnings: The former BOJ head warns that China’s situation mirrors Japan’s deflationary period from 1998 to 2012, though China's current problem is not as severe.

Excess Capacity and Local Governments: Excess capacity is worsened by local governments’ reluctance to close unprofitable companies, reminiscent of Japan’s “zombie” companies that persisted due to banks rolling over bad loans.

Urgency for Action: Both former central bankers stress the importance of prompt measures to prevent a prolonged deflationary period in China.