Interest rates are teetering 🤮

Inflation is persistent. Eurozone in peril 😱

7 must-know economic indicators👇🧵

Macro Pulse Update 16.09.2023, covering the following topics:

1️⃣ Macro events for the week

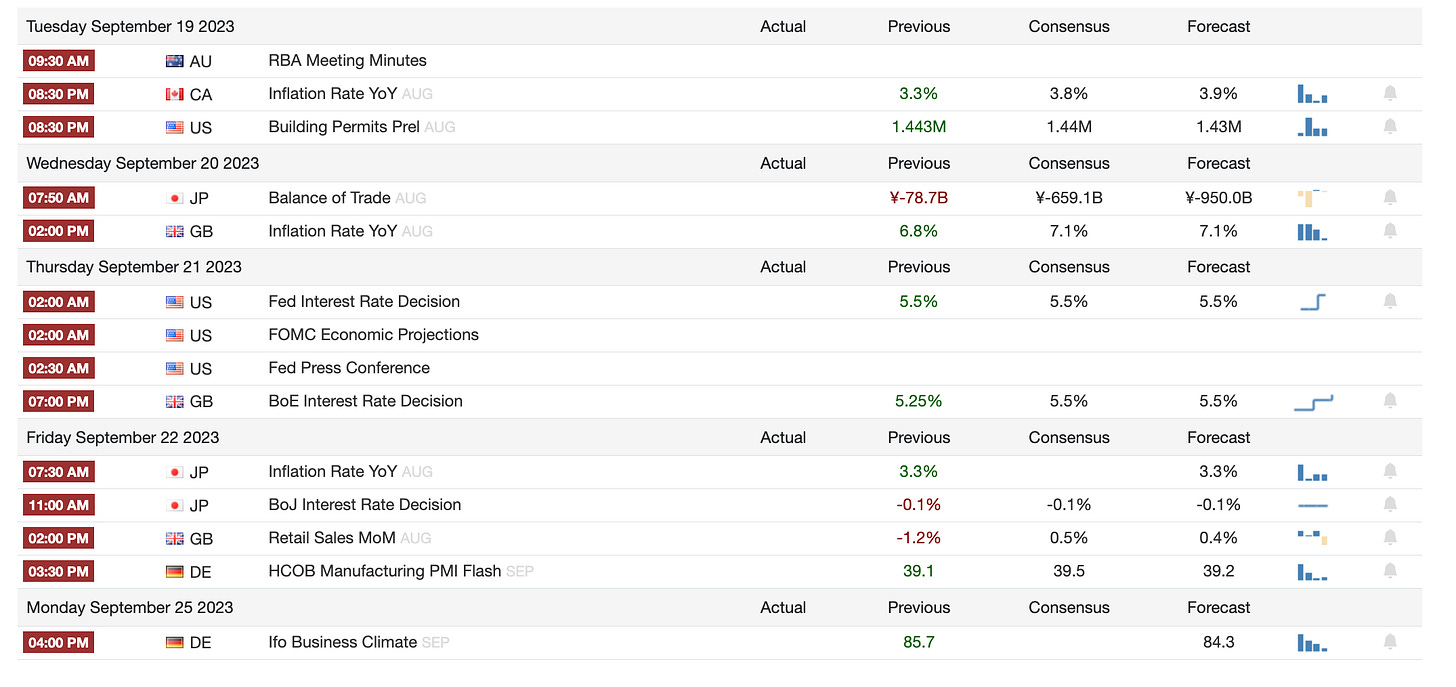

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ China Spotlight

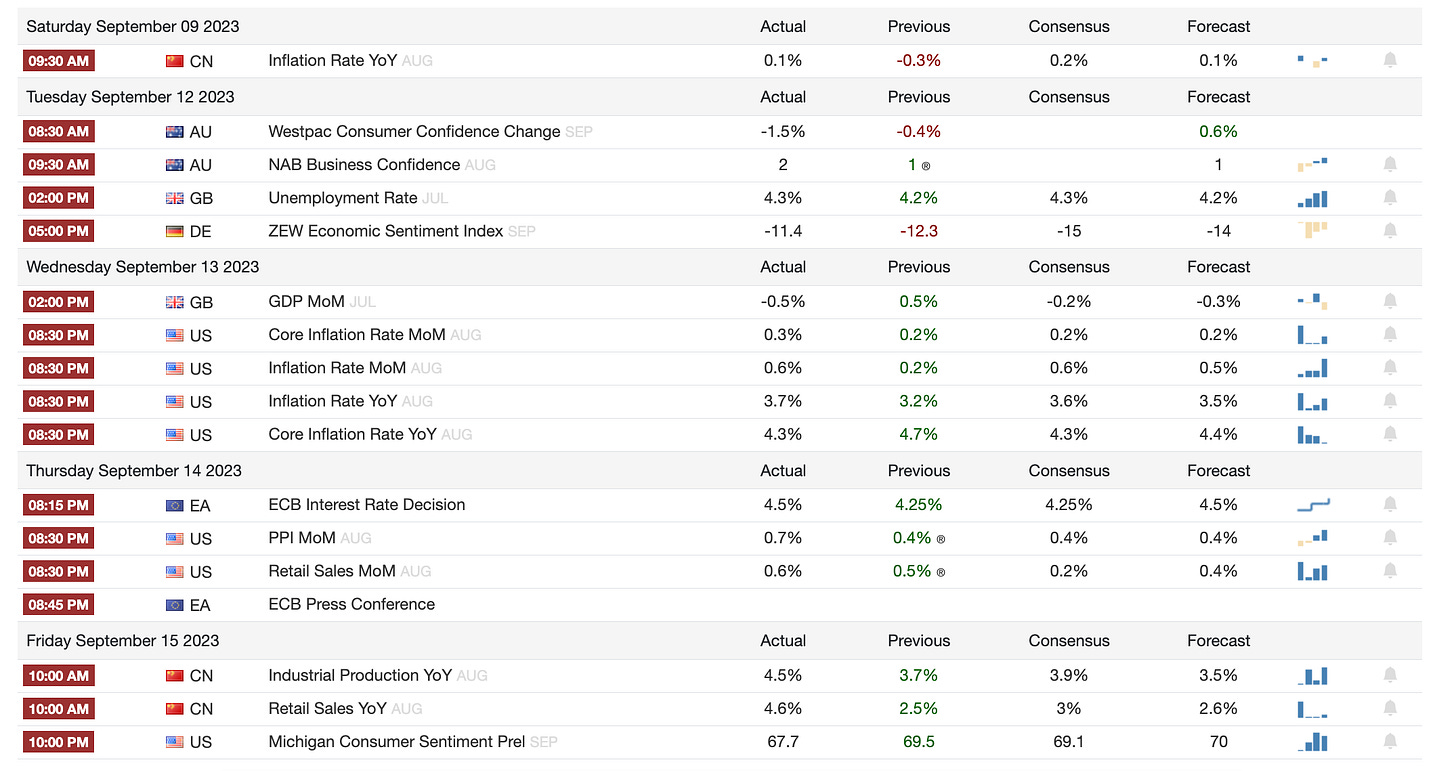

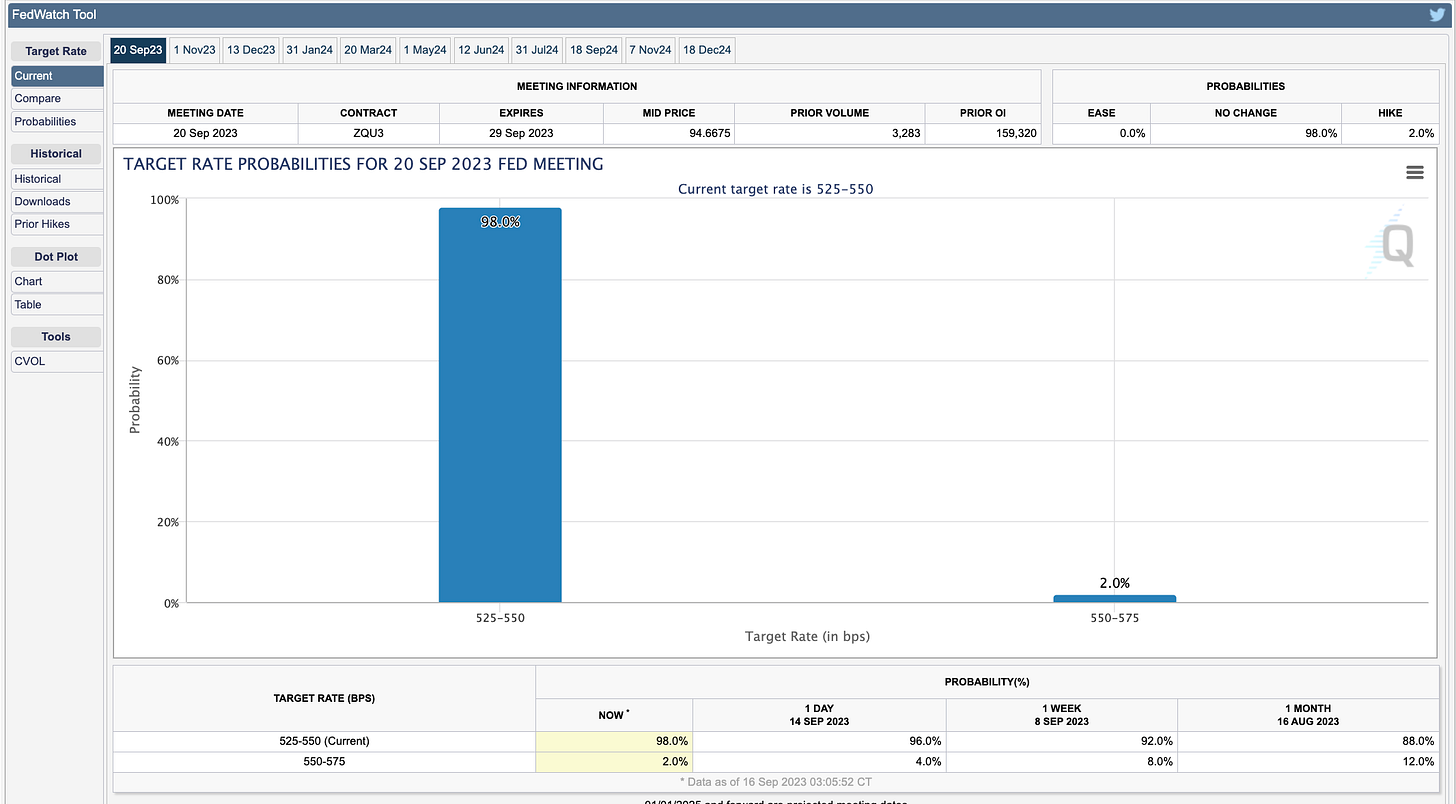

1️⃣ Macro events for the week

Previous week

Next week (Key events: Interest rate decision, FOMC projections)

2️⃣ Bitcoin Buzz Indicator

Crypto Market Introductions

Franklin Templeton Steps into Bitcoin ETFs

FTX Liquidation Causes Market Volatility

Crypto Heists Hit CoinEx and Remitano

Vitalik Buterin's X Account Hacked, NFTs Stolen

Innovations and Adaptations

MetaMask Snaps: A Leap in Wallet Customization

PayPal Enables Crypto for Web3 Merchants

Banking and Institutional Engagement

Deutsche Bank Joins Crypto Custody Trend

Nasdaq Files for Ethereum ETF

Missteps and Recoveries

Bitcoin Miner Returns Excessive Transaction Fee to Paxos

Regulatory Landscape

SEC Investigates Binance US for Transparency Issues

Stoner Cats NFTs Face SEC Penalty

Friend.tech Outperforms NFTs in Trading Volume

Altcoins

Sushi DEX expanded to Aptos Blockchain.

Arbitrum price hit a record low as whales sold off ARB tokens; Optimism overtook its market cap.

ApeCoin sank 42% in a month.

AXS surged 20% last Thursday, likely due to a short squeeze and high trading volumes.

opBNB, a BNB Smart Chain layer 2, went live.

Binance announced the burn of idle BUSD tokens.

Cardano's Midnight sidechain was set for a Devnet launch 'soon.'

Cosmos Hub added liquid staking; Lido Finance partnered with Axelar and Neutron.

France certified 'finfluencers,' including crypto experts.

Ex-Celsius CEO sought FTC suit dismissal.

Google Cloud became LayerZero's default oracle.

Hedera's new Stablecoin Studio and Bithumb listing fueled a 9% HBAR rise.

Sui's zkLogin offered ecosystem access via Google, Facebook, Twitch.

Huobi Global rebranded to HTX for global expansion.

Polygon 2.0 outlined MATIC to POL conversion.

Manta Network launched L2 Manta Pacific for zk adoption.

Metis aided PolyNetwork exploit victims and enhanced its cross-chain structure.

Astar Network launched zkEVM Layer 2, powered by Polygon.

TON Foundation and Telegram partnered for crypto wallet integration.

Google boosted Zilliqa's infrastructure and validation.

Genesis to shut down trading services across all entities.

3️⃣ Market overview

Data indicates persisting inflationary pressures globally, leading central banks to maintain their monetary tightening stances for now. But there are nuances between regions, with the US economy showing more resilience and Europe more vulnerability to an economic downturn. Markets seem hopeful for a soft landing, but risks remain elevated.

Inflation remains persistently high in the US, as evidenced by the larger-than-expected rise in PPI and continued growth in retail sales. This will likely keep the Fed on track for further interest rate hikes to rein in inflation.

There are growing concerns about potential economic stagnation in the eurozone, as the ECB raises rates aggressively but also downgrades growth projections. This illustrates the delicate balancing act central banks face between controlling inflation and supporting growth.

Equity markets continue to hold up well and even rally despite the backdrop of high inflation and central bank tightening. This suggests resilience in risk appetite and optimism that the economy can achieve a soft landing.

The diverging paths of the Fed and ECB, with the former likely to continue raising rates steadily and the latter potentially nearing the end of its hike cycle, are contributing to euro weakness against the dollar. This currency dynamic has broader implications for trade and capital flows.

4️⃣ Key Economic Metrics

Inflation is coming down but remains uncomfortably high. Consumers are feeling some impact, but inflation expectations remain anchored. Spending is set to moderate amid various headwinds.

🔴 Inflation ticked up in August due to higher gasoline prices, but the increase was expected. Energy prices remain volatile and could drive bumps in inflation.

🟢 Core inflation rose at a slower pace, providing evidence that underlying price pressures continue to moderate. This aligns with Fed's outlook and supports case for holding rates steady.

🟢 Retail sales grew more than expected in August, but gain was inflated by higher gas prices. Underlying demand appears more moderate.

🔴 Consumer sentiment declined again in September as current conditions worsened, reflecting growing economic concerns. But inflation expectations fell further.

🔴 Excess savings are depleting, credit conditions are tightening, and growth in incomes is slowing. This points to weaker consumer spending ahead.

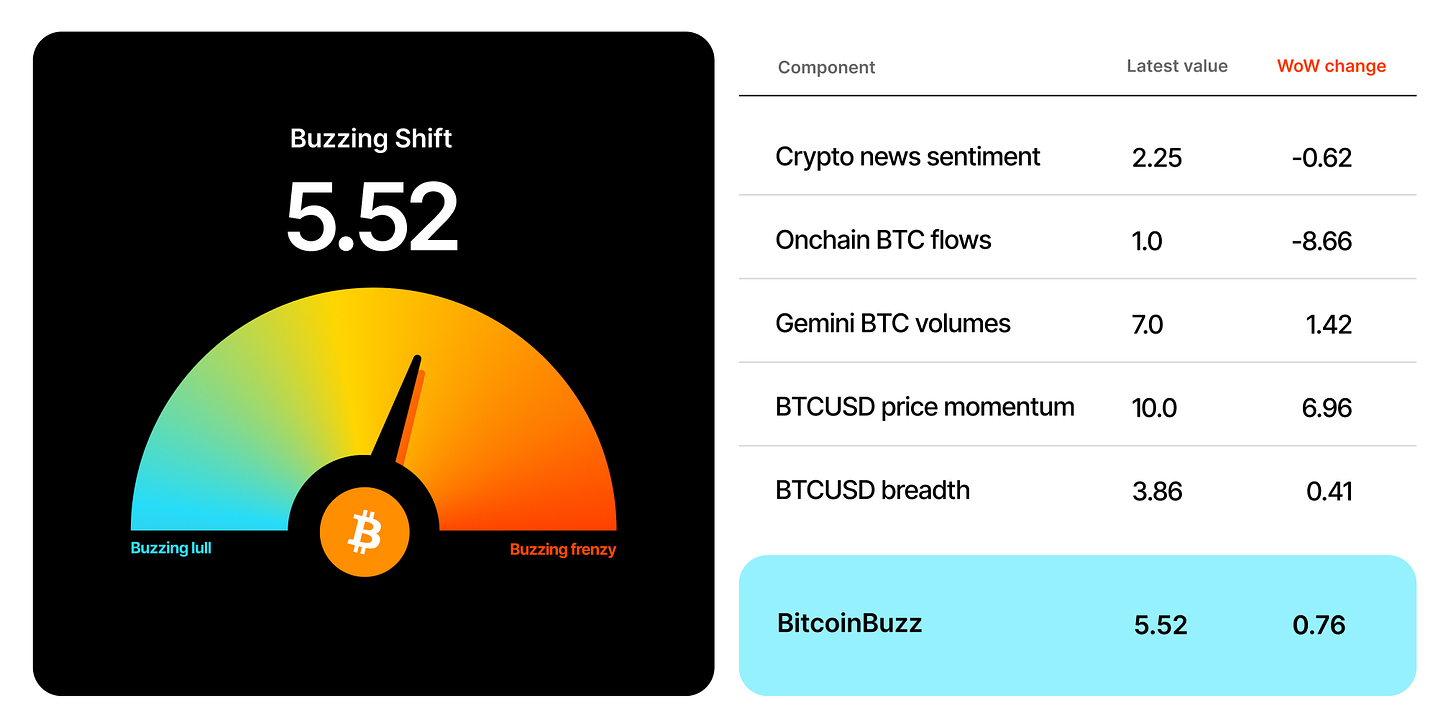

🟡 Interest rate forecast

The overall outlook is still uncertain. There is a possibility for an actual rate cut anytime soon.

Expect no change to current target fed funds rate range of 5.25-5.50% at the September 20-21 meeting.

Recent data suggests policy tightening over last 18 months is starting to have intended effect of cooling demand and easing inflation.

But inflation still high and labor market adjusting gradually, so FOMC likely to maintain hawkish bias.

Dot plot may show slightly lower median year-end 2023 projection, signaling increased confidence in disinflation.

But 2024-25 projections expected to hold steady, underscoring rates to stay restrictive for foreseeable future.

FOMC walking fine line between acknowledging inflation progress and keeping expectations aligned on further tightening if needed.

5️⃣ China Spotlight🔴

August data is encouraging but does not indicate clear turning point given continued property sector concerns. PBoC steering towards currency stability going forward.

August activity data beat expectations, suggesting some stabilization, but property sector woes persist and will continue weighing on growth.

Real estate downturn is a major risk as the sector accounts for ~30% of GDP. Fiscal stimulus remains limited and ineffective.

Forecasts still point to slower growth this year with risks tilted to the downside. Bottoming out not guaranteed despite better data.

Yuan has weakened this year as economy slowed and PBoC eased policy. But recent PBoC actions aim to stabilize currency.

Peak depreciation has likely pass, even though the yuan may stay defensive in the near-term given economic uncertainty.

Twitter: https://twitter.com/arndxt_xo/status/1703012772005716331

love your macro overviews bro! well done!