Grayscale optimistic on Bitcoin ETF approval

We’re midway to a full-blown altcoin season

5 indicators that tell us if 2024 is in bull or bear 🧵👇

Macro Pulse Update 16.12.2023, covering the following topics:

1️⃣ Macro events for the week

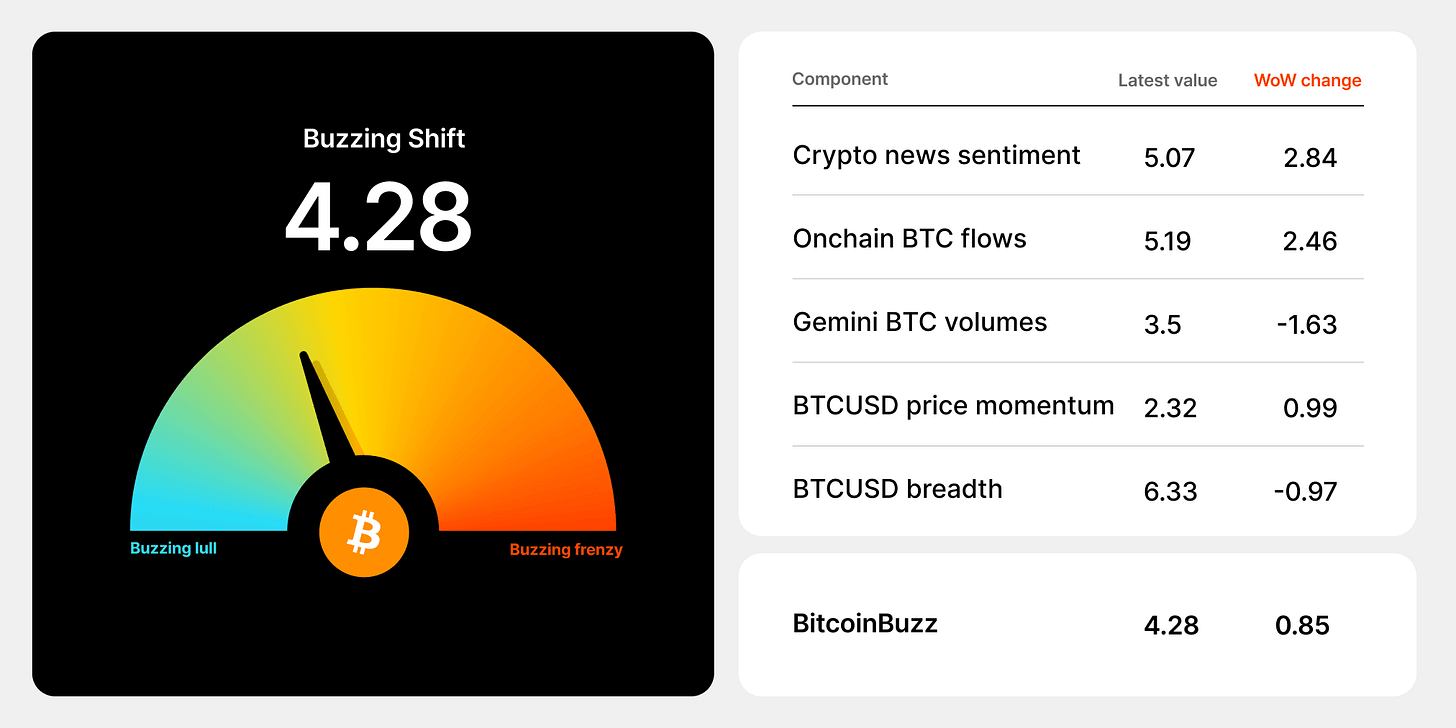

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ China Spotlight

1️⃣ Macro events for the week

Previous week

Next Week

2️⃣ Bitcoin Buzz Indicator

Cryptocurrency Market Updates

2024: A Pivotal Year for Bitcoin's Mainstream Journey

Bonk Inu's Meteoric Rise in the Crypto Elite

KuCoin Exits New York, Facing $22 Million Fine

Ledger Breach: A Call for Enhanced DeFi Security

Regulatory and Legal Developments

FTX vs. IRS: A $24 Billion Tax Showdown

Binance's Legal Woes and Market Share Decline

Tether's Wallet-Freezing Policy: Aligning with US Regulations

Bankruptcy and Legal Cases

SafeMoon Files for Bankruptcy Amid SEC Fraud Charges

First Conviction in Solana DeFi App Fraud Case

Country-Specific Crypto Initiatives

El Salvador's Crypto-Centric Economic Strategy

NFT Market Trends and Innovations

Sotheby's NFT Auction: A Bitcoin Blockchain Milestone

Casio Dives into Ethereum NFTs with Virtual G-Shocks

Trump's NFT Collection Impact on Market Value

FIFA's NFT Endeavor on Algorand and Polygon Networks

Web3 and Digital Ecosystems

LINE NEXT Secures Funding for Web3 Ecosystem Expansion

Altcoins

Compound DAO's vote on a major bug fix fell short by 15,000 votes.

Gods Unchained, rated 'Adults Only' for play-to-earn elements, was removed from Epic Games Store.

Litecoin's active addresses reached a record high four months post-LTC halving.

Synthetix announced the end of SNX token inflation, focusing on buybacks and burns; SNX price soared then dropped.

Nym, Protocol Labs, Oasis, and Aztec formed the 'Universal Privacy Alliance' for web3.

StarkWare distributed $3.5M in fees to developers through its 'Devonomics' program.

Polygon introduced Celestia as a data solution for new Layer-2 developers.

Aptos (APT) Token soared to June-level highs, defying recent token unlock.

3AC's Su Zhu faced Singapore court proceedings after being released, Bloomberg reported.

OKX DEX experienced a $2.7 million exploit due to a suspected private key leak.

Sam Altman planned to introduce Worldcoin's eye-scanning orb to Reddit and Microsoft.

Yearn Finance's faulty script caused a $1.4 million treasury loss, leading to a reimbursement request.

Coinbase's international branch started spot trading for non-US institutions.

AI-related tokens surged amidst market caution before the Fed's rate decision.

Gemini Earn users might recover only 60% of their crypto funds.

Cronos Labs launched a public zkEVM chain testnet to boost mainstream adoption.

LayerZero unveiled a testnet for its V2 iteration.

IMMUTABLE hinted at gas-free web3 gaming with ZKEVM.

The Interchain Foundation allocated $26.4M for the Cosmos ecosystem's expansion.

Arbitrum experienced a 'Partial Outage' due to a traffic surge.

3️⃣ Market overview

Crypto market is impacted by broader economic resilience, major regulatory developments involving leading firms, and heightened oversight from authorities enforcing adherence to existing regulations. These dynamics are influencing market activity and investor confidence.

The global economy is showing resilience in the face of challenges like inflation and supply chain issues. This brighter outlook has positively impacted the crypto market, with renewed investor interest in major cryptocurrencies.

Regulatory advancements like the potential approval of Bitcoin ETFs are buoying the crypto market. Grayscale remains optimistic its Bitcoin Trust will be approved as an ETF by January 2024.

Binance agreed to a $4.3 billion settlement to resolve allegations over sanctions violations and inadequate AML practices. This signals stronger enforcement against crypto platforms failing to adhere to regulations.

The SEC continues scrutinizing crypto exchanges, suing Kraken over allegedly operating as an unregistered broker and dealer. The industry faces evolving regulatory landscapes that significantly impact market dynamics.

Key industry players like Binance are acknowledging the need for greater transparency and adherence to regulatory standards in light of enforcement actions. Leadership changes and settlements with authorities reflect this shift.

4️⃣ Key Economic Metrics

🔴 While high US deficits bear monitoring, there are not yet clear signs they are unmanageable or triggering a crisis. Addressing future deficits requires difficult political choices, especially on entitlement reforms.

The US budget deficit is expected to be 5.8% of GDP in 2023. While high, this is amid economic growth and low unemployment. The deficit is forecasted to gradually decline before rising again in coming years.

Rising deficits reflect higher costs to service debt and increased entitlement spending, especially on Medicare as the population ages. Debt-to-GDP ratios will likely rise above 115%.

Some worry large deficits will make government debt hard to sell or require Fed monetization, risking high inflation. However, US Treasuries remain the world's safest asset.

Large deficits have not yet alarmed bond traders or caused a spike in borrowing costs. Japan also suggests there may be room for more US debt before a crisis.

Reducing future deficits is more a political than economic issue. It likely requires some mix of higher taxes, reduced spending, later retirement age, and more immigration.

Entitlements are the biggest component of spending and expected to grow with an aging population, making them key to address in deficit reduction efforts.

Recent dysfunction in Congress and the narrow political debate on taxes and discretionary spending does not bode well for making progress on long-term deficits.

🟢 The latest data indicates the job market remains strong for now rather than showing weakness typical of recessions, supporting hopes for a soft landing. Key metrics like job gains, low unemployment, and wage growth remain healthy.

Job growth accelerated in November from October, adding 199,000 jobs, indicating continued strength in the labor market

Hiring still remains faster than the long-term ability of the economy to generate jobs, even if slower than early 2022

The job market has not yet shown signs of an economic downturn as widely expected

Manufacturing, motion pictures, healthcare, leisure/hospitality posted job gains, offset by declines in retail likely due to seasonal adjustment issues

Wage inflation eased slightly but remains far above the Fed’s 2% target at 4% year-over-year

Other labor market indicators like unemployment falling to 3.7%, expanded labor force participation, and reduced youth unemployment also signal strength

Overall the report suggests continued modest economic growth, rather than an overheating or contracting economy

🟢 Investors see interest rate cuts by 2024 while Fed tightening shows impact on the labor market already. However job openings still suggest a historically tight labor economy amid continued inflation risks.

Investors expect the Fed to cut interest rates in 2024, with 125 basis points of cuts to put rates between 4-4.25%. This diverges from the Fed's own projections.

Investor expectations are shifting due to faster-than-expected inflation decline and economic deceleration. Markets also see cuts as likely if recession risks rise.

Regardless of Fed intent, its past tightening is already impacting the labor market. Evidence points to the job market weakening.

The job openings rate fell to 5.3% in October, the lowest since Feb 2021, indicating less labor shortage after hitting a record high in March 2022.

Even with the decline, job openings remain historically high, signaling need for further Fed tightening to reduce wage pressures and meet 2% inflation target.

The professional services sector still shows labor market strength with a 7.1% openings rate. Accommodation, food services, healthcare and transportation also remain high at about 6-7%.

🟢 Bond markets naturally incorporate expectations of economic and policy shifts, moving yields lower amid weakening output and prices. This market mechanism helps moderate downturns before they worsen, serving a stabilizing function for the broader economy.

Economic weakening leads investors to expect lower credit demand and thus lower borrowing costs. This helps stabilize activity as lower rates boost demand.

Declining bond yields in the US and Europe partly reflect expectations of weaker economic demand and resulting lower inflation.

Lower oil prices also signal weaker demand and contribute to declining inflation expectations. This implies earlier monetary policy easing by central banks.

Falling US 10-year bond yields have been driven about one-third by dropping inflation expectations. Expectations directly impact real yields.

Weaker growth leading to lower rates exemplifies self-correction, averting sharper downturns and laying groundwork for recovery.

5️⃣ EU Spotlight 🟢

Investors foresee interest rate declines in Europe happening faster than central bank guidance suggests, reacting to economic weakness and disinflation. This contrasts with less dramatic US expectations. The potential coordinated central bank rate cuts could aid global growth by 2025.

Investors expect the ECB to cut rates sooner than ECB leadership has indicated, betting on cuts beginning by March 2024 and 150 basis points of cuts by end of 2024.

Expectations are driven by rapidly declining inflation in Europe, now lower than the US, plus weakening economic indicators.

Investors expect more aggressive ECB rate cuts compared to the Fed, possibly reflecting higher European recession risks.

Steady ECB and Fed rate cuts by mid-2024 could boost business investment and transactions, supporting a 2025 recovery.

However, current investor expectations outpace what ECB and Fed leaders themselves have actually signaled regarding future rate moves.

Twitter: https://twitter.com/arndxt_xo/status/1735980880869630065