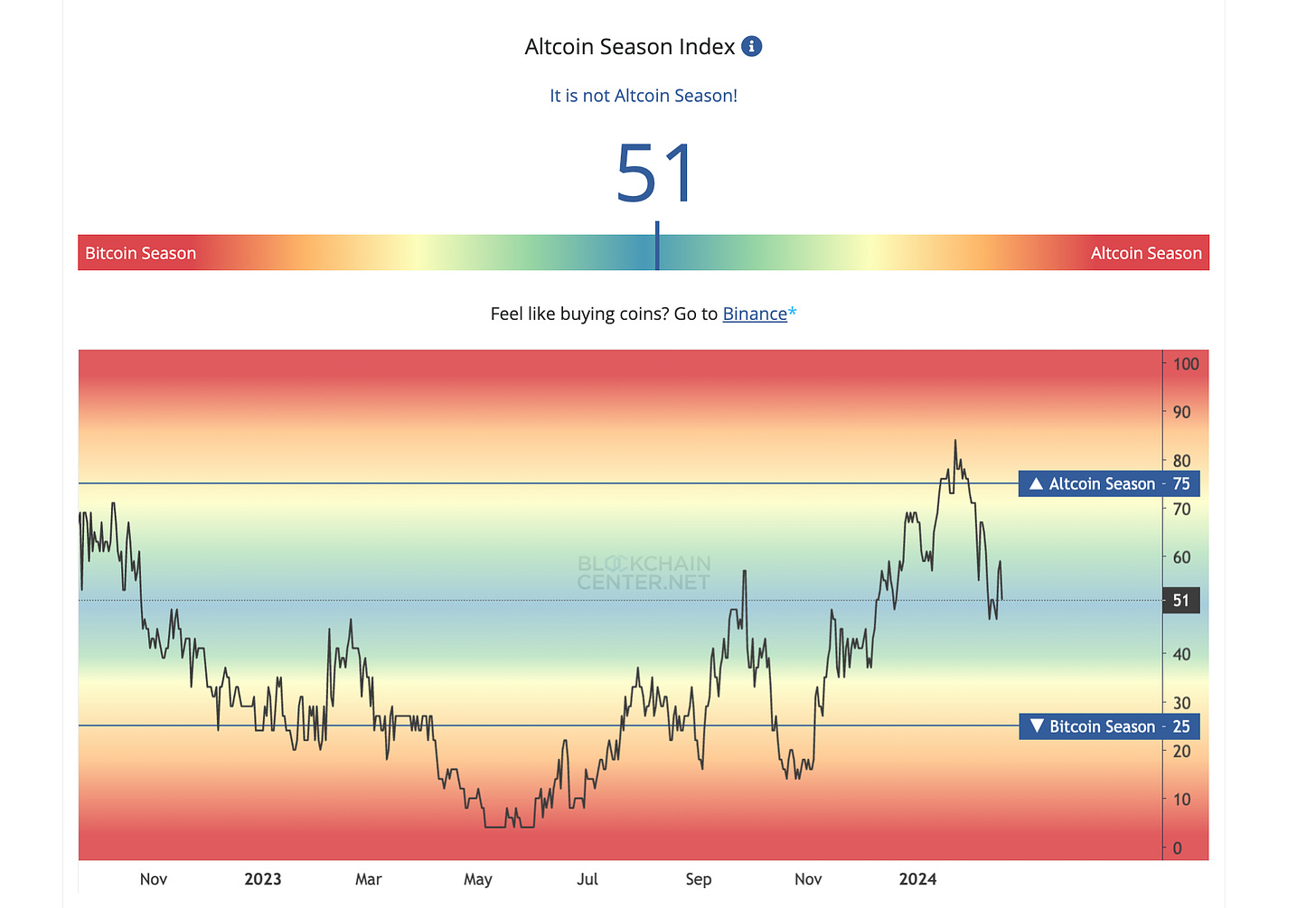

Altcoin season losing steam while $BTC breached $52k

Bezos dumped more than $2B in Amazon shares

Here’s 3 indicators about the current state of economy👇🧵

Macro Pulse Update 17.02.2024, covering the following topics:

1️⃣ Macro events for the week

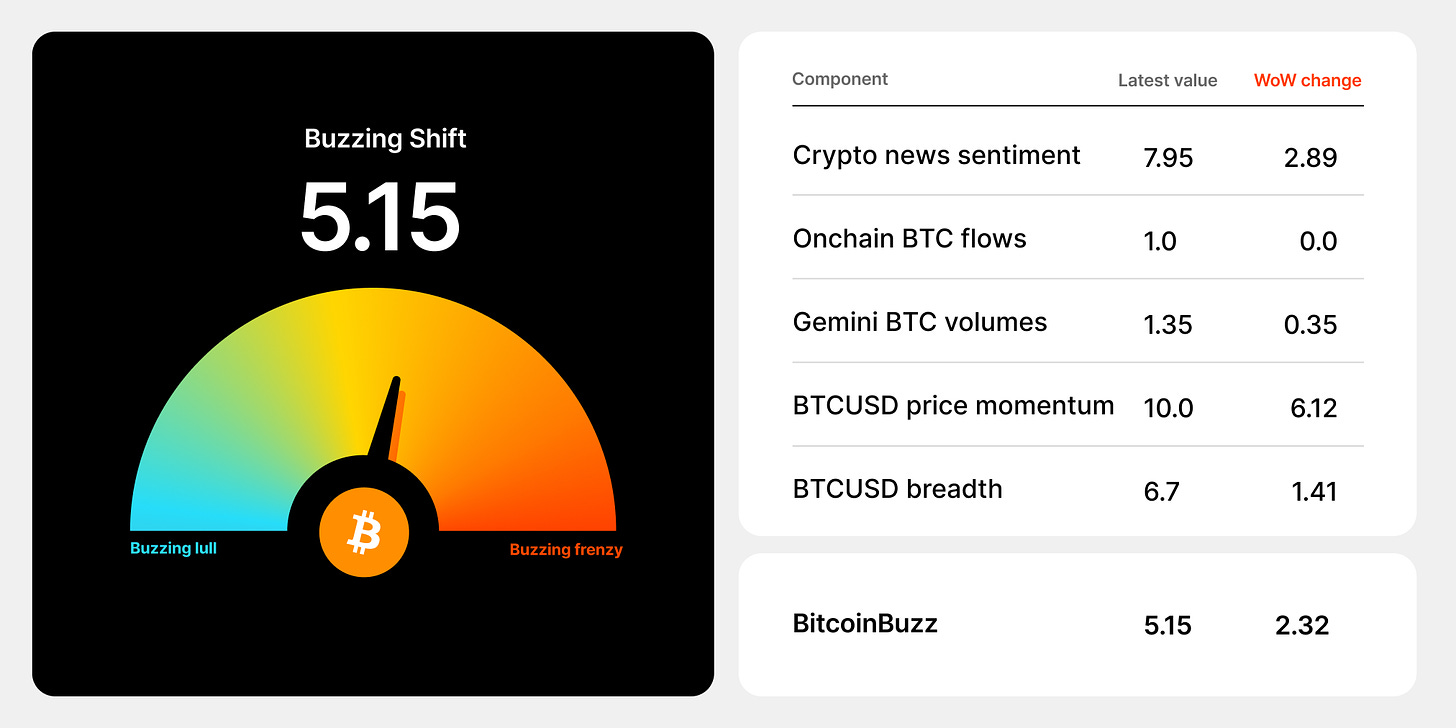

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ China Spotlight

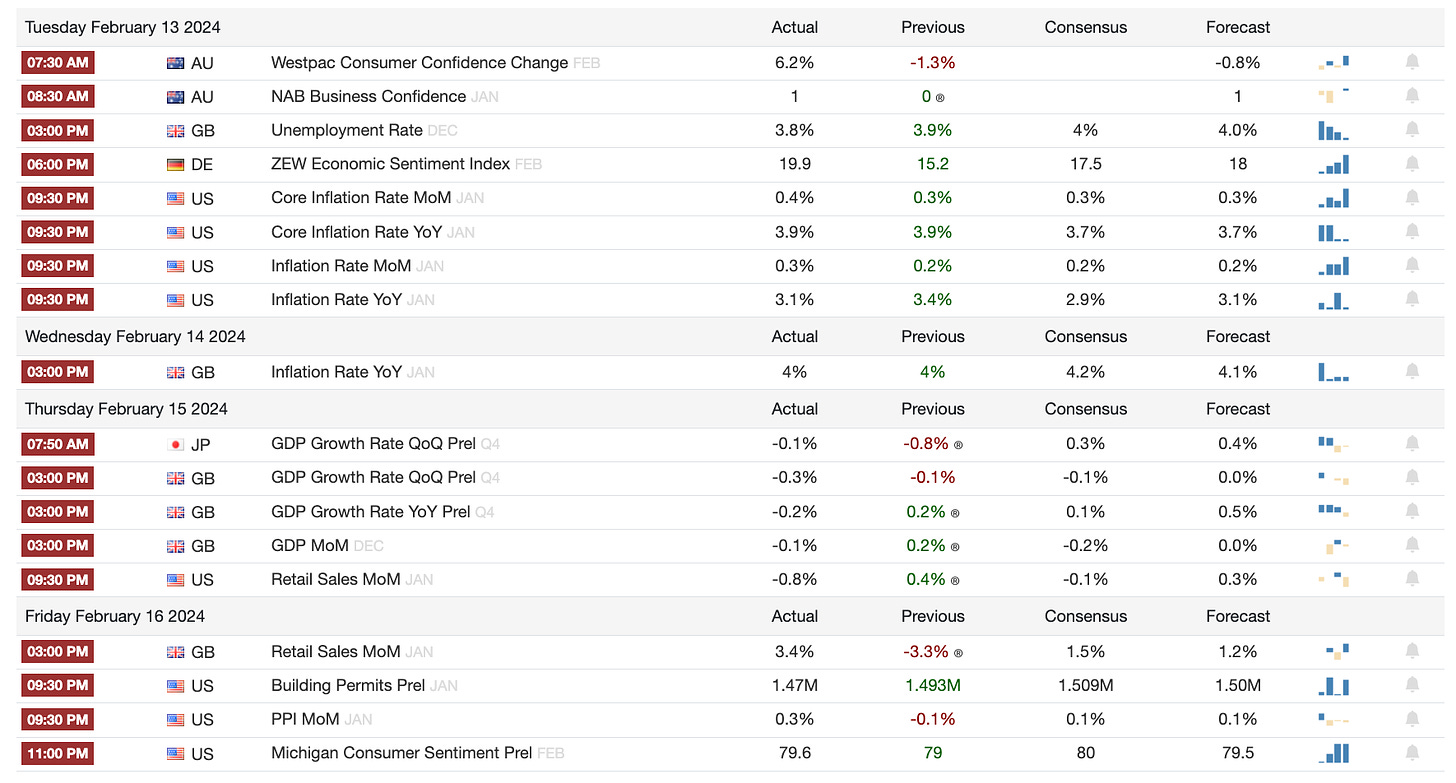

1️⃣ Macro events for the week

Last Week

Next Week

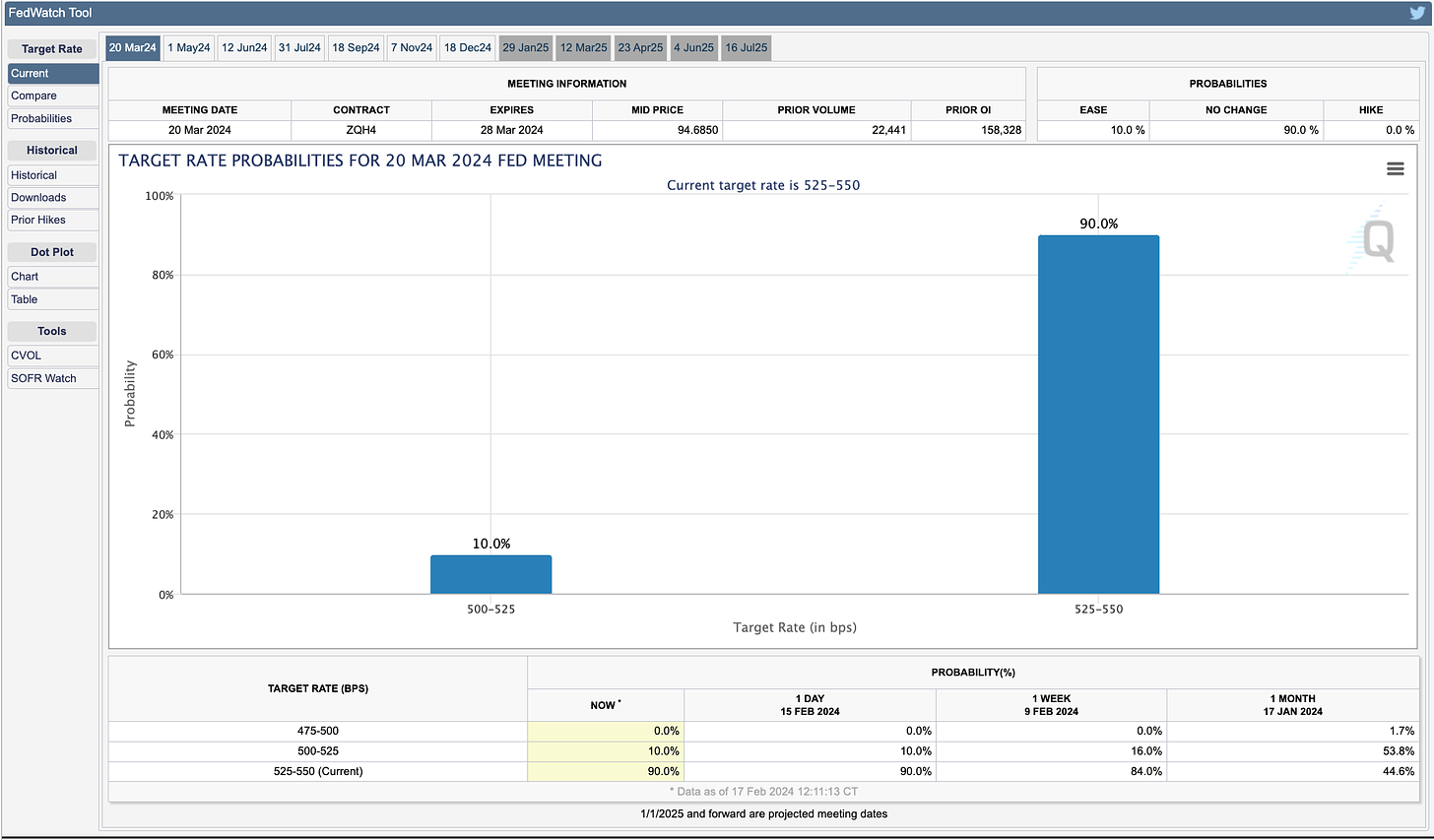

2️⃣ Bitcoin Buzz Indicator

Crypto Market Updates

Investor Frenzy in Bitcoin ETFs Outstrips Mining Supply

ERC-404 and Pandora: Innovating NFT Ownership and Trading

Decentralization at Heart: Starknet's Billion-Token Airdrop

Uniswap V4: Innovating DeFi with Hooks Amid Security Debates

Blockchain and Crypto Innovations

Aptos Labs Leads with Passkey Authentication and Crypto Smartphone

Avalanche Enhances User Experience with Durango Testnet Upgrade

Chainlink's Role in Strengthening Telefónica's Transaction Security

Banking and Regulatory Updates

Powell and Waller Weigh In: Stablecoins, DeFi, and Dollar Supremacy

Treasury Tackles Crypto's Role in Illicit Finance Amid Misconceptions

Country-Specific Developments

South Korea Confronts Crypto Scandals with Regulatory Overhaul

Crypto Exchanges and Platforms

SafeMoon Faces Legal Challenges and Financial Instability

Pudgy Penguins Outshine Bored Ape Yacht Club in NFT Arena

Record-Breaking Trading Volume on Mad Lads’ Backpack Exchange

Glenlivet Merges NFTs and AI for Luxury Whiskey Sales

Altcoins

Deutsche Borse's subsidiary Crypto Finance received four crypto licenses.

Fetch.ai Foundation partnered with Deutsche Telekom to advance AI and blockchain synergy.

Nym Technologies secured a grant to enhance ZCash privacy infrastructure.

HectorDAO went silent after a $2.7M hack, shocking investors.

Ledger collaborated with Coinbase for direct crypto purchases via hardware wallets.

Sushi announced the launch of decentralized derivatives exchange Susa on Layer N.

Significant unlocks for several gaming tokens, including SAND, APE, IMX, PRIME, and YGG, occurred in February.

PlayDapp was hit by double exploits, losing $290 million.

EigenLayer became the 4th largest restaking protocol.

Japan urged banks to screen crypto transfers to combat unlawful money transfers.

Cardano's Q4 2023 report showed TVL growth and ADA price surge, outshining competitors.

Bakkt was approved for a $150M securities sale to address its cash bleed.

The Klaytn and Finschia merger was greenlit, forming Asia's largest web3 ecosystem.

Over 1 million Telegram users signed up on NEAR Protocol's self-custodial wallet in 10 days.

BitTorrent's BTT surged as Tron completed a TRX burn, and unveiled a Bitcoin Layer 2 solution.

Stardust teamed up with Mysten Labs to streamline game deployment on Sui.

Crypto money laundering dropped 30% last year, with Lazarus switching to YoMix after sanctions against Sinbad mixer, according to Chainalysis.

ApeCoin DAO chose Arbitrum for ApeChain amid governance controversy and community reactions.

Solana's BONK rose 35% at one point as Revolut ignited listing speculations.

Smart money investors invested $2 million into PEPE, leading to a 30% increase after a significant dump.

Binance Trust Wallet's iOS app vulnerability was listed on NIST, CEO contested misinformation.

Jupiter's crypto investment was scrapped by the compliance team, reports FT.

GoFundMe shut down the Tornado Cash legal defense crowdfunding campaign.

VeChain's native token VET surged amid the launch of an account abstraction feature.

Ronin's price popped after the Ethereum gaming network revealed RON rewards halving.

Robinhood reported a 10% revenue increase amid crypto market expansion.

CoinShares reported $108M in revenue in its 2023 earnings report.

Coinbase saw $3.1 billion of revenue in 2023, with a third of that total in Q4.

Analog closed $16M funding for cross-chain communication tools.

Lava Network raised $15 million in seed funding, introducing Magma.

3️⃣ Market overview

Stronger U.S. inflation data lowered chances of a Fed rate cut in May, signaling persistent price pressures. China firmly opposed EU's proposed trade curbs on Chinese firms over Russia ties. Major U.S. indices fell as Tesla slid on Musk's 2024 sales warning and Bezos offloaded $4 billion in Amazon shares. Investors await U.S. Retail Sales data amid this backdrop of inflation challenges, trade tensions, and corporate dynamics.

U.S. inflation data for January came in higher than expected at 3.1% year-over-year, compared to the forecasted 2.9%.

Core inflation remained steady at 3.9% year-over-year, indicating persistent price pressures.

This led to a decrease in the probability of a Federal Reserve interest rate cut in May, from 50% to 30%, and almost eliminated expectations for a March cut.

The inflation data challenges the Fed's strategy of rate cuts and suggests a more cautious approach to monetary policy adjustments.

4️⃣ Key Economic Metrics

🟢 US Trade Tariffs

The 25% tariffs imposed by the Trump administration on Chinese imports led to a moderate decline in US-China trade, but also led to a diversion of trade, with Chinese firms exporting inputs to Southeast Asia for final assembly and export to the US.

Despite the decline in US imports directly from China, the Chinese share of value-added in goods consumed in the US has actually increased.

Chinese exporters have taken advantage of a loophole that allows packages valued under $800 to enter the US tariff-free, leading to a surge in such shipments from China.

While the 25% tariffs have had a limited impact due to excess production capacity in China and trade diversion, a proposed 60% tariff could significantly raise prices and pressure producers to shift production elsewhere.

Higher tariffs could create a stronger incentive for boosting shipments of inputs to Southeast Asia for final assembly and export to the US, further evading tariffs while maintaining supply chains.

🔴 Market Reactions:

U.S. stock markets saw notable declines following the inflation data release, with the S&P 500 dropping 1.37%, the Dow Jones 1.35%, and the Nasdaq 1.80%.

Tesla plummeted 12.13% post-earnings, due to CEO Elon Musk's warning of potential sales deceleration in 2024.

Amazon founder Jeff Bezos liquidated more than $2 billion, as revealed in filings..

5️⃣ China Spotlight🔴

Trade Tensions:

China has strongly opposed the European Union's proposed trade restrictions on three Chinese firms for allegedly supporting Russia's military actions in Ukraine.

Beijing has labeled these potential sanctions as "illegal" and underscores its commitment to protecting the interests of Chinese companies.

The EU's restrictions mark a potential first in targeting businesses from China and India over the Ukraine conflict.

These trade tensions highlight the growing rift in international trade relations amid geopolitical conflicts.

Twitter: https://twitter.com/arndxt_xo/status/1758810784296280122