We are at a confluence for an extended macro leg.

The bull case is strengthening:

Macro fears easing

Gaza peace prospects

Summer lull ending

Volume/liquidity flush done

'Cycle over' sentiment common

CZ release imminent

BTC at 60k, chart TradFi-friendly

Big things and new ATHs incoming 🧵👇

Macro Pulse Update 17.08.2024, covering the following topics:

1️⃣ Macro events for the week

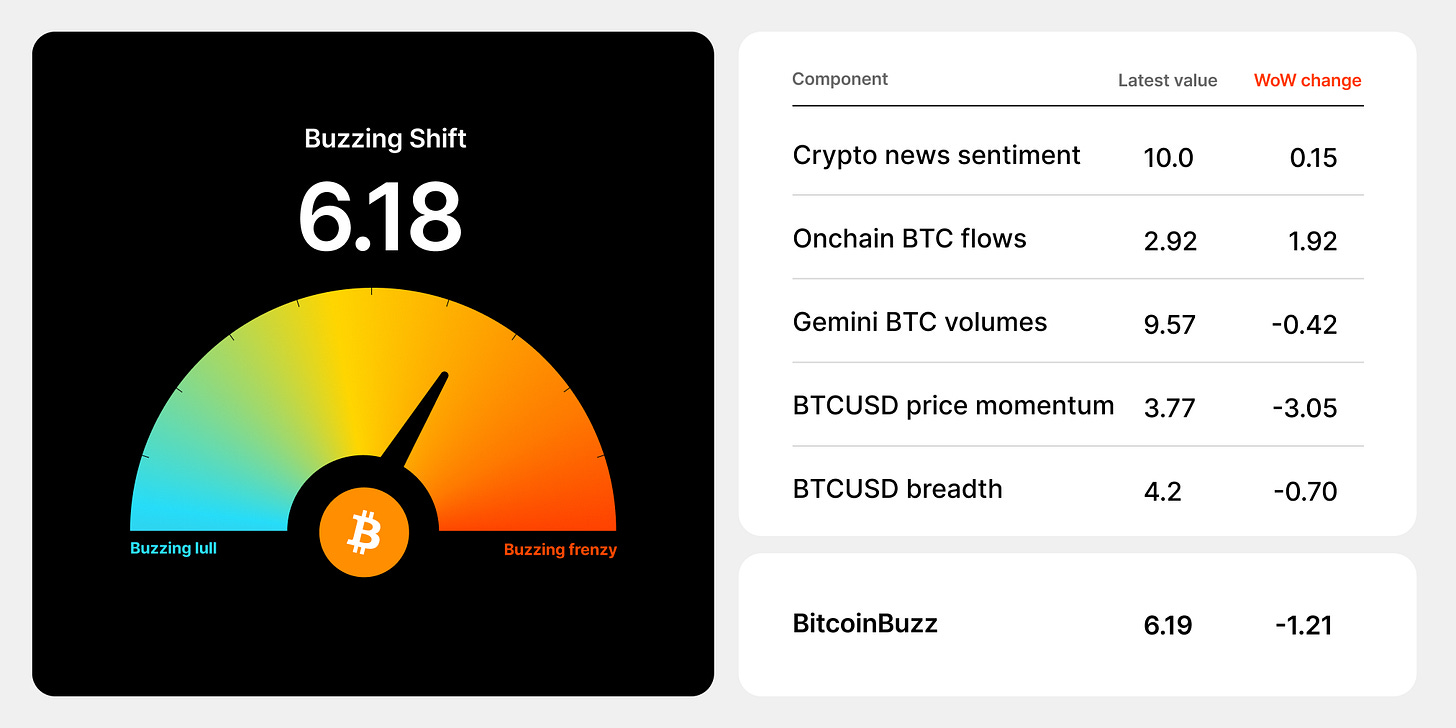

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ China Spotlight

1️⃣ Macro events for the week

Last week

Next Week

2️⃣ Bitcoin Buzz Indicator

BlackRock and Tether Developments

BlackRock Surpasses Grayscale in Crypto ETF Holdings

Tether Faces $3.3 Billion Lawsuit from Celsius

Exchange and Token Updates

Coinbase Introduces cbBTC, Challenging WBTC's Dominance

MetaMask and Mastercard Launch Global Crypto Debit Card

Grayscale Launches Fund Focused on MakerDAO's MKR Token

TON Ventures Raises $40 Million for TON Blockchain Projects

Layer 2 and Protocol Developments

Arbitrum DAO Approves Liquid Staked ARB Token Proposal

Uniswap Labs Surpasses $50 Million in Front-End Fees

Regulatory and Compliance Updates

Binance Settles Compliance Issues and Resumes Global Operations

EigenLayer Faces Controversy Over Airdrop Policy

Country-Specific Crypto Initiatives

Worldcoin Partners with Malaysian Government for Digital ID

Exchange Hack and Recovery

WazirX Nears Completion of Post-Hack Trade Reversals

Political and Financial Disclosures

Trump Discloses $7 Million Earnings from NFTs and Crypto

NFT Market Trends

NFT Trading Resurges on Solana, Ethereum, and Bitcoin

Solana’s DeGods NFT Collection Sees 179% Monthly Surge

Sotheby’s to Auction CryptoPunk and Beeple NFT

Altcoins

NYSE American LLC withdrew its proposal to list and trade options on spot Bitcoin ETFs.

DRW disclosed nearly $200 million in crypto ETF holdings, primarily in ETHE.

El Salvador’s Bitcoin City port transformation secured $1.6 billion in investment.

BlackRock considered launching a native L2 network compatible with Ethereum.

Optimism developed a native interoperability system for Layer 2 chains.

A crypto user mistakenly paid a $90K fee for a $2K ETH transfer.

Crypto startup funding grew to $2.7B in Q2 despite a drop in the number of deals.

SushiSwap reported growing bad debt on the defunct Kashi Lending platform.

The Lido community voted to bring stETH to the BNB Chain.

NetMind.AI entered a strategic partnership with io.net to enhance AI solutions.

Symbiotic launched its devnet, planning a full mainnet in Q3.

deBridge Finance launched an airdrop checker tool.

Bybit and DMCC extended their partnership to strengthen Dubai’s crypto ecosystem.

Euler allocated $4M for security, conducting 29 code audits for v2.

83% of transactions on Jupiter Aggregator failed.

Helium partnered with major U.S. carriers to offload traffic.

Bithumb allowed customers to open bank accounts via its app.

The SEC accused NovaTech of orchestrating a $650 million crypto fraud.

Three Arrows Capital liquidators sued Terraform Labs for $1.3B.

Singapore’s DBS bank rolled out a blockchain-powered ‘treasury tokens’ pilot.

Theta Labs received a U.S. patent for off-chain verification of distributed computing tasks.

Binance.US faced a renewed lawsuit over alleged HEX price manipulation.

Hamster Kombat skipped VC fund offers and criticized 'exit liquidity' practices.

Kelp DAO launched ‘Gain Vault’ to maximize L2 airdrop rewards.

Pump.fun achieved a record monthly high of $28.73M in agreement income.

Hedera partnered with Copper to enhance institutional access to HBAR tokens.

Curve Finance marked its 4th anniversary by reducing CRV emissions.

ezBtc's founder misappropriated $9.5M in crypto funds.

Tether invested $3 million in Kem app to boost Middle East financial inclusion.

Coinbase re-entered Hawaii following state regulatory changes.

Exodus expanded wallet capabilities with Blockchain.com integration.

ASX faced a lawsuit over statements about its abandoned blockchain project.

Crypto.com became an official UEFA Champions League partner.

Nigeria’s $37M USDT freeze linked to MEXC and KuCoin hot wallets.

dYdX enabled permissionless listing with a new update.

Solana Meme Coin Gigachad rose after a meme model endorsement.

Neon EVM introduced a new loyalty points program.

Renzo entered Solana liquid restaking, launching ezSOL on Jito.

User activity on Near dropped to a multi-month low.

Six Malaysians were charged with kidnapping, demanding $1M in Tether as ransom.

Tokenized RWA reached $3B without including stablecoins.

A man was sentenced to prison after spending most of $6.9M mistakenly sent by a major crypto exchange.

Users claimed ZKasino still hasn’t returned ETH months after claims opened.

Cronos zkEVM debuted on Alpha Mainnet on ZKsync.

Circle planned to enable NFC contactless payments for USDC on iPhones.

A memecoin mastermind likely made $3M from ‘Celeb meta’—ZachXBT reported.

Bitfinex partnered with Ledger-backed Komainu to enhance crypto trading and custody.

MANTRA and Novus Aviation Capital led the way in tokenizing aviation assets.

ZynCoin launched ‘Comfy,’ a physical collectible that earns tokens as rewards.

Vitalik Buterin donated over $500K in animal-themed coins to charity.

Base completed Chainlink rollout with data streams and VRF.

Aave's token price retook $110 as weekly borrowers hit an all-time high.

Phantom wallet fixed a balance display bug after user concerns.

Aavegotchi Studio revealed a 'Members Only' Ethereum Layer-3 gaming chain.

Raise partnered with WalletConnect to offer crypto payment options.

Justin Sun bet on memecoins with a Tron-based token generator.

DOGS airdrop date was confirmed with 400 billion tokens.

The world’s third-largest pension fund invested $80M in MicroStrategy and Coinbase.

The IMF proposed an 85% power tax hike on crypto and AI data centers.

The Shiba Inu team announced the official launch date for Shibarium Liquid Staking.

Synapse's price soared as Binance unveiled futures listing.

DePin token Aethir surged following South Korean exchange listings.

Telegram's coin PAAL AI slumped amid crypto whales’ sell-offs.

BANANA token hit a weekly high after an $8.68M burn and 50x leverage futures launch.

Sahara Labs raised $37 million in strategic funding.

Chaos Labs raised $55M as demand grew for on-chain risk management.

Ion Protocol raised $4.8 million to unlock native yield on rollups and appchains.

Sling Money raised $15 million in Series A for its stablecoin-based global payment app.

ParaFi Capital led a $10M Series A into Parfin, a permissioned Ethereum Layer 2 developer.

Ethereum L2 Essential raised $11 million in Series A funding.

3️⃣ Market overview

Inflation cools again: Consumer prices in the US increased by just 2.9% in July compared to the previous year, marking the slowest rise in three years, according to the US Department of Labor. This continued cooling strengthens the case for the Federal Reserve to consider rate cuts in September.

Kamala Harris overtakes Donald Trump in election odds on Polymarket: Vice President Kamala Harris has surpassed Donald Trump in odds to win the US presidential election on Polymarket. Although Harris’s campaign has reached out to the crypto industry, her stance on digital assets remains unclear, adding uncertainty to her position.

Three Arrows Capital’s liquidators sue Terraform Labs for $1.3 billion: The lawsuit against Terraform Labs, stemming from the 2022 Terra network collapse, alleges market manipulation by Terraform that led to 3AC’s significant losses. This legal battle adds another layer of complexity to the ongoing fallout from Terra’s implosion.

Tether disputes Celsius’s $2.4 billion lawsuit: Tether has dismissed Celsius Network’s lawsuit as unfounded, asserting that it acted within the terms of their agreement when liquidating bitcoin assets to offset Celsius’s debt. The outcome of this dispute could set a precedent for future asset liquidation cases in crypto.

US spot ETH ETFs see $4.9 million in inflows: After three days of outflows, US spot ethereum ETFs recorded $4.9 million in net inflows on Monday, with Fidelity’s FETH leading the pack. This development may signal renewed investor interest in ethereum, though the market is still cautious.

Grayscale launches new fund focused on MakerDAO’s governance token: Grayscale has introduced a new fund centered on MakerDAO’s MKR token, which saw a price surge following the announcement. This move further solidifies Grayscale’s position as a leader in crypto asset management, highlighting its commitment to expanding investment options.

4️⃣ Key Economic Metrics

🔴 Market Events

Market Turmoil Began on August 2: Triggered by a worse-than-expected US employment report, leading to fears of delayed Fed rate cuts and a potential recession.

Investor Panic and Tech Selloff: August 5 saw a sharp market selloff, exacerbated by the unwinding of the Japanese carry trade and declines in tech stocks.

🟢 Economic Indicators

Mixed Economic Signals: Slowing job growth and rising PMI suggest uncertainty; Sahm Rule triggered, but not necessarily indicative of a recession.

Fed Rate Cut Expectations: Markets expect aggressive Fed action, potentially leading to a rebound in asset prices and increased M&A activity.

🔴 Market Reactions

Market Rebound: US and Japanese equities stabilized by week’s end, with fears of a recession appearing overblown.

BOJ Caution: Japan’s central bank signals cautious approach to rate hikes, calming markets but leaving future policy uncertain.

5️⃣ China Spotlight🟢

Weaker-than-Expected Chinese Exports: Chinese exports in July increased by 7% year-over-year, below expectations and slower than June’s 8.6% growth, attributed to a decline in export prices despite strong volume growth.

Potential for Temporary Export Surge: US companies may be frontloading orders, possibly leading to a temporary surge in Chinese exports in the coming months, which could create a misleading impression of strength.

Sector-Specific Export Trends: Strong export growth was observed in machinery, electronics, and automobiles, while exports of discretionary products like apparel, furniture, and luxury goods were weak.

Stronger Import Growth: Imports surged by 7.2% in July, a significant rebound from the 2.3% decline in June, driven by increased imports of inputs for export production, frontloading ahead of trade restrictions, and fiscal stimulus boosting demand for construction products.

Regional Import Growth: Imports from the US rose 24% (likely due to frontloading), with increases of 11% from Southeast Asia and 7% from the European Union.