We’re in a sideways, stair-stepped structured consolidation and then rally.

Markets bounced on the expectations that a cut is likely with indicators spelling bad omen

Here are 3 indicators you need to know before Powell speak tomorrow👇🧵

Macro Pulse Update 18.05.2024, covering the following topics:

1️⃣ Macro events for the week

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ China Spotligh

1️⃣ Macro events for the week

Last Week

Next Week

2️⃣ Bitcoin Buzz Indicator

Big Firm's Bitcoin Strategy

El Salvador's Bitcoin Venture Yields $57.4 Million Profit

Institutional Investors Fuel Bitcoin ETF Growth

Stock and Memecoin Market Movements

GameStop Stock and Memecoins Surge Dramatically

Pump.fun Faces $2 Million Exploit by Ex-Employee

Cryptocurrency Tokens and Exchanges

Most New Tokens on Binance Underperform

Bybit Faces Regulatory and Operational Challenges

Notcoin Launches with Over $1 Billion Trading Volume

Cryptocurrency Security Concerns

Worldcoin Foundation's Privacy Move Amid Accusations

Sonne Finance and Others Suffer Significant Hacks

NFT Market Trends and Legal Issues

Pudgy Penguins NFT Toys Achieve Major Sales Milestone

95% of 2024 NFT Market Valued as Worthless

Dolce & Gabbana Sued Over NFT Losses

LVMH and BlockBar Launch NFT Edition of Garrus Rosé

Altcoins

Tether attacked Ripple CEO over USDT FUD, calling him an "uninformed CEO".

Runes protocol saw significant decline in activity.

North Korean hackers deployed "Durian" malware targeting crypto firms.

US court seized 279 North Korean crypto accounts as hackers used new malware.

BounceBit mainnet launched amid phishing scam alert.

Antonio Juliano stepped down as CEO of dYdX.

More crypto AI alliances emerged following a $7.5B token merger.

Meme coin HarryPotterObamaSonic10Inu announced its layer-3 blockchain.

Crypto exchange OKX launched a local regulated entity in Australia.

A critical $5 million security flaw was found in the Aptos Wormhole Bridge.

Rain Exchange assured safe customer funds following a $14.8M exploit revelation.

RWA Platform Re debuted a tokenized reinsurance fund on Avalanche with a $15M commitment from Nexus Mutual.

Falcon Labs was fined $1.7M for illegally funneling U.S. users into crypto.

Peter Thiel's Founders Fund and Vitalik Buterin backed a $45M investment in Polymarket.

Zero-knowledge identity project Humanity Protocol hit a $1B valuation after the latest funding round.

Solana-based Cypher developer confessed to gambling away $300K of user funds.

Coinbase director revealed 1 million new tokens were created in April.

Bitget Wallet launched a $10M ecosystem fund alongside Onchain Layer.

Huobi Hong Kong withdrew its license application for the second time.

FLOKI was up 45% on the month and voted on a 15B token burn.

PEPE jumped to an all-time high following Roaring Kitty's return.

Chinese police cracked down on a $1.9B smuggling ring involving USDT.

KuCoin halted Naira-based peer-to-peer trading, citing compliance.

Degen Chain came back online after a 50-hour outage.

Stablecoin issuer Circle eyed a US move, setting the stage for a rumored IPO.

IOTA launched its IOTA 2.0 public testnet.

Robinhood launched Solana staking in Europe plus a new customer rewards program.

Goldman Sachs alumni launched crypto VC Neoclassic Capital.

Intent-centric DeFi protocol Shogun raised a seed round at a $69 million token valuation.

Blast Network unveiled June 26 for the highly anticipated BLAST token airdrop.

ShibaSwap 2.0 launched on Shibarium, boosting SHIB token burn.

Canada’s "Crypto King" and associate were arrested and charged with fraud in an alleged $30M Ponzi scheme.

CME Exchange launched Bitcoin trading for hedge funds and institutions.

Bitpanda expected record-high profit in 2024 as over $100M revenue was reported in Q1.

MakerDAO announced PureDai, a decentralized stablecoin to replace DAI.

Tornado Cash developer appealed a Dutch judge’s jail verdict.

Tether and TON teamed up with a mobile app for USDT-to-fiat transactions.

Arbitrum-based L3 ApeChain integrated Supra's real-time oracle data and randomness protocols.

PancakeSwap offered to pay off interface fees for Uniswap users.

Fantom (FTM) turned "insanely fast" after an upgrade, with its token trading near a monthly peak.

Solana DEX Drift launched a 120 million token airdrop.

HBAR took over Qatar with a $50M digital assets venture studio.

Sei token popped on a V2 roadmap.

OpenAI will mix "authentic" Reddit content into its AI training data.

DTCC and Chainlink completed a pilot project to accelerate fund tokenization.

Binance partnered with Taiwan authorities in a $6.2M money laundering crackdown.

A Binance executive was denied bail in a Nigeria money laundering trial.

Avalanche price soared amid the tokenization of a wine investment fund.

Synthetix's sUSD stablecoin slipped below the dollar peg to $0.96 amid a sell-off.

Lido proposed an alliance promoting an stETH-based restaking ecosystem.

3️⃣ Market overview

The updates cover inflation/rate cut hopes sparking crypto rallies, meme coin volatility, regulatory battles over crypto accounting and money transmission rules, institutional Bitcoin ETF investments, and the new Vanguard CEO's stance on crypto offerings.

US inflation eased in April, with the Consumer Price Index rising 0.3% month-over-month and 3.4% year-over-year. This sparked a rally in crypto markets, with Bitcoin rising over 7% and Ethereum up 5.3% on hopes the Federal Reserve may cut interest rates later in 2023.

The "Roaring Kitty" meme stock leader resurfaced after a 3-year absence, causing a surge and then pullback in the GameStop meme coin (GME) on Solana, which peaked at a 460% gain before settling around $45 million market cap. However, other major meme coins were relatively unmoved.

The U.S. Senate voted to overturn the SEC's accounting bulletin SAB 121 that requires crypto custodians to treat customer assets as liabilities, but President Biden is expected to veto the measure.

The State of Wisconsin Investment Board purchased around $162 million worth of the spot Bitcoin ETFs IBIT and GBTC, making it the first state pension fund to declare ownership of spot Bitcoin ETFs.

U.S. Senators questioned the Department of Justice's stance that non-custodial crypto mixers should register as money transmitters, arguing it contradicts First Amendment protections.

New Vanguard CEO Samil Ramji, formerly of BlackRock, indicated Vanguard is unlikely to launch a spot Bitcoin ETF anytime soon despite his prior experience with crypto ETFs.

4️⃣ Key Economic Metrics

🟢 Evolving economic data is causing investors to continuously re-evaluate their monetary policy expectations, with potential knock-on effects across financial markets and consumer behavior.

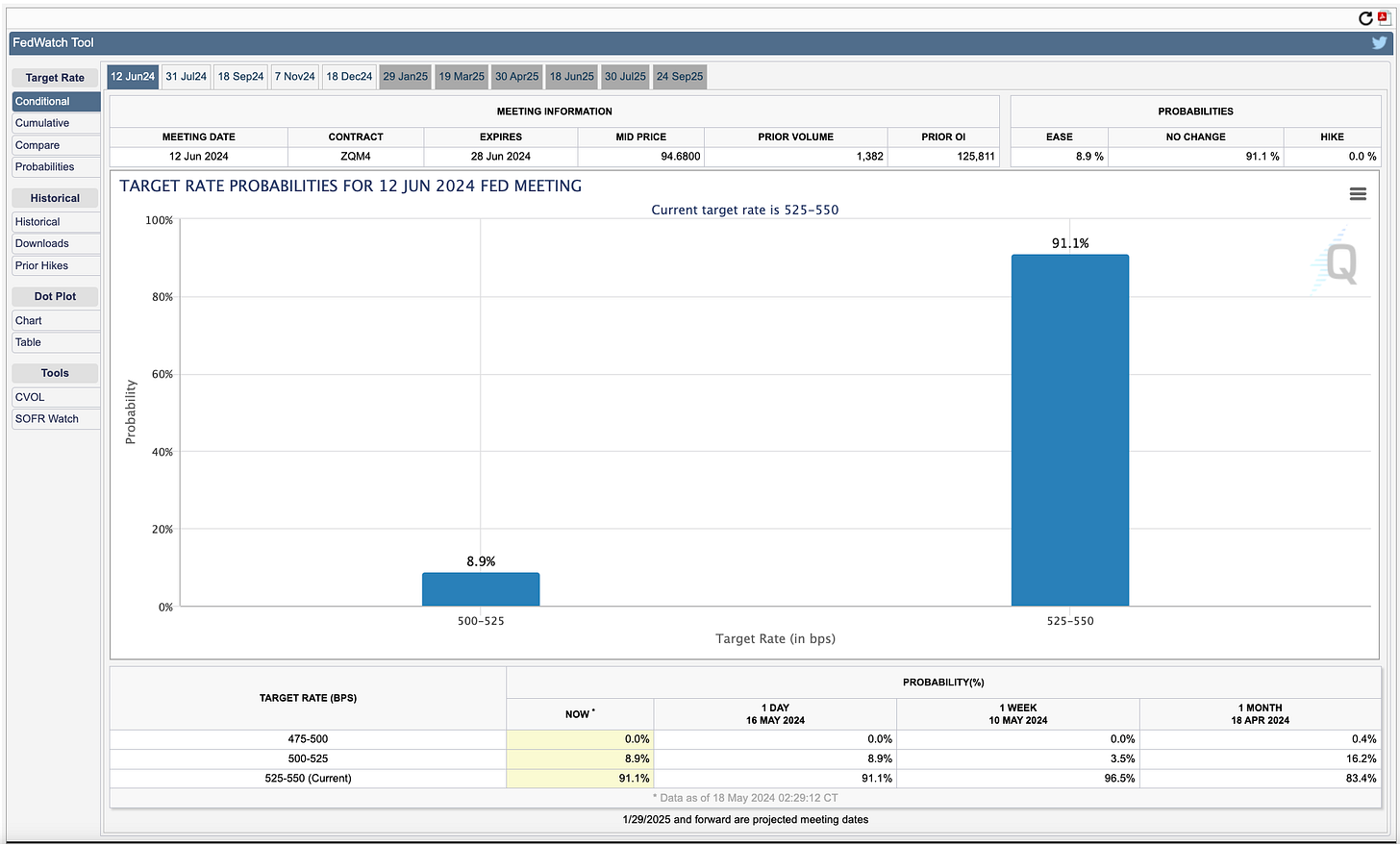

Investors have revised their expectations over the past two weeks, now anticipating the Fed may loosen/cut interest rates faster than previously expected.

This shift was driven by data showing slower job growth, a decline in job openings, and weaker Q1 GDP growth, suggesting the Fed's tight policy may finally be impacting the economy.

Slower growth raises expectations that inflationary pressures could ease, allowing the Fed to cut rates sooner than anticipated.

The changing expectations help explain the recent drop in 10-year Treasury yields after an earlier rise when investors thought the Fed would keep rates higher for longer.

It also explains modest gains in U.S. equity prices recently and the appreciation of the Japanese yen.

However, a sharp $36 billion decline in U.S. bank lending in Q1, mainly from reduced credit card lending, could signal consumers are feeling financial stress despite low unemployment.

Credit card delinquencies are at a 13-year high, though still below the 2008 crisis peak, as high interest rates burden some households.

The pullback in credit card borrowing could foreshadow an easing in consumer spending growth if it persists.

🟢 So while the quarterly bounce was relatively strong, the UK still faces challenges in sustaining robust growth momentum amid lingering economic headwinds. But the Q1 data marks an encouraging start to the expected recovery in 2023.

UK real GDP grew by 0.6% quarter-on-quarter in Q1, the fastest pace since Q4 2021. This follows two previous quarters of negative growth, indicating the economy has exited recession.

On the demand side, consumer spending grew a modest 0.2%, while business investment (+0.9%) and government spending (+0.3%) provided support.

Net trade was a positive contributor as imports fell more than exports.

The 0.6% QoQ growth exceeded the pace in the Eurozone and United States over the same period.

5️⃣ China Spotlight🔴

An aging migrant workforce shifting to services, along with more educated urbanites, is causing a manufacturing labor shortage and rising costs in China. This is contributing to supply chains moving out while China boosts imports of tech for AI development.

Labor Shortage in Manufacturing:

China's rapid growth was fueled by rural-to-urban migration and resulting productivity gains, but this migration has slowed/reversed recently.

The pool of migrant workers is aging rapidly - 31% over 50 years old now vs. only 10% in 2008. Many are shifting to services or retiring.

The share of migrants working in manufacturing fell from 38% in 2008 to 28% currently.

More urbanites are getting university degrees and preferring white-collar service jobs over manufacturing.

This labor shortage is causing manufacturing labor costs to rise sharply in China compared to places like Thailand.

Trade Patterns:

Chinese exports rebounded modestly in April after falling sharply in March.

Exports to neighbors like Taiwan and Southeast Asia are rising, while exports to US, EU, Japan are declining.

Imports surged 8.4% in April, driven by demand for AI-related equipment like computers/components.

Imports from US, SE Asia rose but declined from EU, Japan, reflecting efforts to boost AI capabilities.