S&P shows overshelming strength and rising

$SOL memes getting butchered while $TRUMP smashing ATH

History repeats itself and if you remember Q4 2017?

We will see the same as Altcoins explodes once liquidity stabilizes👇🧵

Chart credits to @MacroCharts

Macro Pulse Update 19.01.2025, covering the following topics:

1️⃣ Macro events for the week

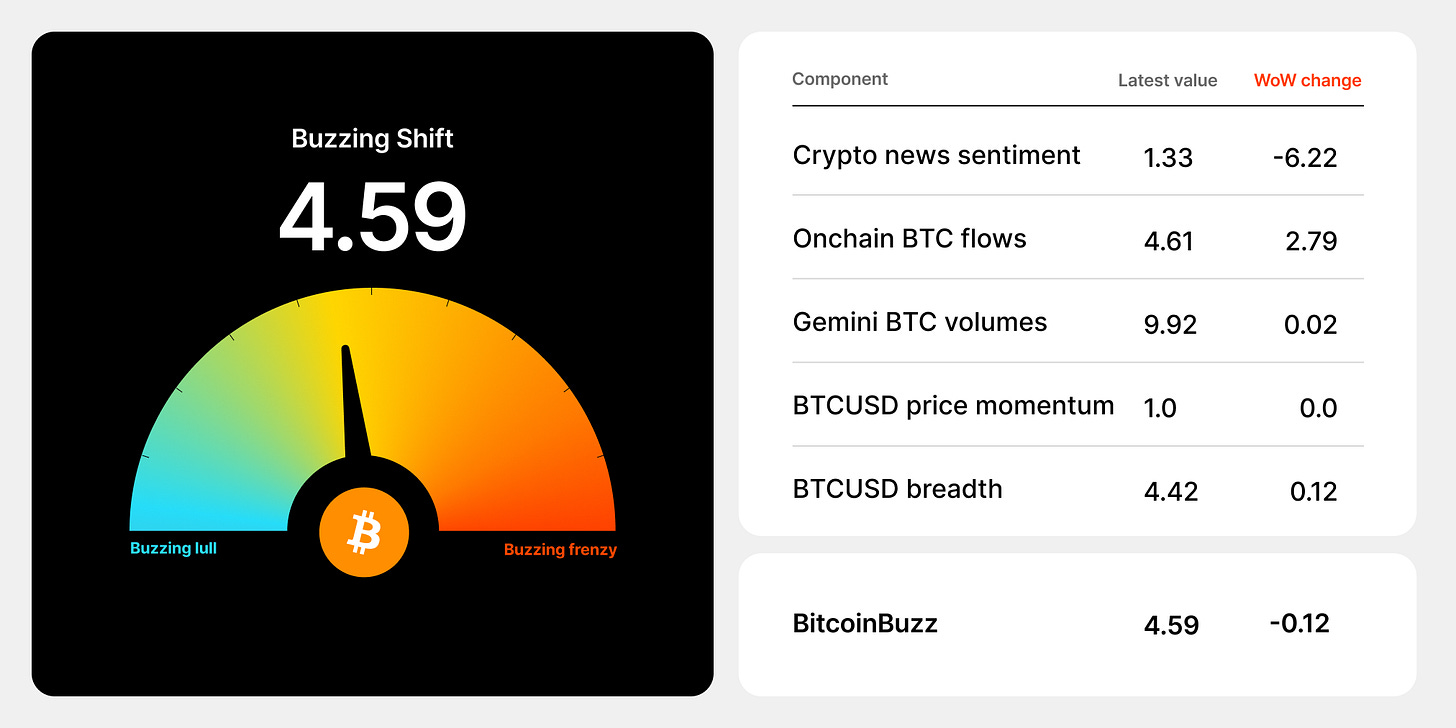

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

5️⃣ China Spotlight

1️⃣ Macro events for the week

Previous Week

Next Week

2️⃣ Bitcoin Buzz Indicator

Crypto Policy and Institutional Strategies

Trump’s Pro-Crypto Policies Shape U.S. Regulation

Corporate Giants Embrace Bitcoin Strategies

Crypto ETFs Gain Momentum Amid SEC Delays

Crypto Sector Sees Major Mergers and Acquisitions

Crypto Regulation Shifts with Court Rulings and Settlements

Cryptocurrency Exchange Updates

FTX to Begin $1.2B Creditor Payouts

New Blockchain Projects and Tokens

Animecoin Launch Targets Web3 Anime Fans

Tether’s USDT0 Debuts on Kraken’s Layer 2

NFT Platforms and Market Trends

Yuga Labs Denies CryptoPunks Copyright Rumors

Indian Railways Issues NFT-Based Train Tickets

MakersPlace Announces Closure Amid Market Challenges

NFT Market Faces Decline Despite Key Success Stories

Altcoins

US government ordered return of 2016 hack funds to Bitfinex.

BlackRock launched the iShares Bitcoin ETF on Cboe Canada.

Coinbase introduced Bitcoin-backed loans through its partnership with Morpho.

Mudrex paused crypto withdrawals for compliance upgrades.

Nodepay announced a 11.5% token supply airdrop.

OpenSea email leaks resurfaced, affecting 7 million users, sparking industry alarm.

Bankless faced criticism for an alleged AICC pump-and-dump on Solana.

The US, Japan, and Korea issued a "strong warning" against DPRK cyber theft.

Celestia's blob sizes surged 10x amid rising transactions and NFT activity.

Crypto laundering hit $1.3 billion in 2024, a 280% increase, according to PeckShield.

Coinbase added PNUT support on Solana and included TOSHI in its listing roadmap.

TikTok dismissed Elon Musk acquisition rumors ahead of a potential US ban.

Sony launched its L2 blockchain, Sonieum.

Bubblemaps announced a token launch on Solana.

Solana's stablecoin supply reached $5.89 billion, its highest in two years.

Crypto AI agents' market cap rose 220% in Q4 2024, reaching $15.4 billion.

Huione Group launched a censorship-resistant stablecoin despite concerns about its subsidiary.

The SEC sued Elon Musk for disclosure failures regarding Twitter stock.

AI tokens surged after Franklin Templeton claimed they would "revolutionize" social media.

LayerZero released a high-performance blockchain-optimized database.

Coinbase revealed 90% of reviewed crypto assets failed to meet listing standards.

Aethir expanded its GPU network with EigenLayer, offering new staking opportunities.

Arweave uploaded data onto a lunar lander, designed to last for thousands of years.

WLFI clarified a $60 million ETH movement amid sell-off rumors linked to Trump.

The SEC sued Elon Musk over untimely disclosure of his Twitter ownership.

Justin Sun launched USDD 2.0 with a 20% APY, citing abundant reserves.

The SEC filed an appeal claiming a district court's Ripple ruling was flawed.

Burwick Law targeted Pump.fun for legal action.

The UAE Tax Authority announced VAT on crypto mining services.

Bitget's report revealed 20% of Gen Z and Alpha view crypto as a retirement alternative.

eToro filed for a US IPO targeting a $5 billion valuation.

Telegram malware scams spiked 2000% in two months, Scam Sniffer reported.

Pyth Network introduced Lazer, an oracle for latency-sensitive crypto applications.

Orbiter Finance disclosed OBT token details, planning an airdrop on Inauguration Day.

A Multicoin proposal sought to reduce SOL inflation and move to market-driven emissions.

DWF Labs partnered with NEAR Protocol to develop AI agents.

Yat Siu-backed Open Campus launched the EDU Chain, a layer-3 solution, on Arbitrum.

Coinbase’s Base targeted $100 billion valuation and 25 million users by 2025.

Crypto.com pledged $1 million for Los Angeles wildfire relief.

SoSoValue announced a 49-million-token airdrop for its first season.

AI agents are coming to Bitcoin through Merlin Chain and ElizaOS integration.

AAVE planned Bitcoin mining to stabilize GHO.

3️⃣ Market overview

CPI Sparks Crypto Rally: Core CPI rose 3.2% YoY in December, below forecasts. Bitcoin surpassed $100K, Ethereum up 5%, amid optimism about pro-crypto policies under President-elect Trump.

XRP Soars: XRP surged 46% this week, driven by regulatory optimism, Ripple’s stablecoin launch, and anticipated ETF approval.

BlackRock Expands ETFs: iShares Spot Bitcoin ETF launched in Canada, solidifying BlackRock’s dominance in the crypto ETF market.

Court Challenges SEC: A US court ordered the SEC to explain its rejection of Coinbase's petition for crypto-specific regulations, citing due process concerns.

Ripple Case Appeal: SEC appeals ruling on XRP’s non-security status as leadership transitions to pro-crypto Paul Atkins.

4️⃣ Key Economic Metrics

🔴 US Job Market Remains Robust

December Jobs Report: 256K jobs added, strongest since March 2024; unemployment dipped to 4.1%.

2024 Trends: Monthly job growth averaged 186K, exceeding pre-pandemic levels.

Industry Highlights: Gains in retail, professional services, healthcare, and hospitality; declines in manufacturing.

Market Impact: Bond yields rose, US dollar strengthened, and equities fell on inflation fears.

🔴 Job Openings Signal Tight Labor Market

JOLTS Report: Job openings rate increased to 4.8% in November, matching pre-pandemic highs.

Sector Highlights: Highest openings in professional services (7.6%), lowest in wholesale trade (2.5%).

Market Reaction: Bond yields surged as investors anticipate cautious Fed policies amid inflation risks.

🔴 Fed Signals Gradual Rate Cuts

Policy Shift: December minutes revealed a 25 bps rate cut and a cautious approach to easing monetary policy.

Inflation Concerns: Fed cited risks from trade and immigration policies, with inflation potentially more persistent.

Market Outlook: Futures imply only one interest rate cut in 2025.

5️⃣ Tariffs vs Currencies 🔴

US Dollar Fluctuations Amid Tariff Speculation

Policy Expectations: Reports suggest the incoming Trump administration may pursue limited, targeted tariffs instead of across-the-board measures. Focus areas include defense-related materials (steel, aluminum) and essential goods (medical supplies, clean energy).

Market Reaction: The US dollar fell against major currencies on expectations of fewer inflationary pressures. However, later reports of a potential national emergency to expedite tariffs caused the dollar to surge.

Trade Imbalances and Tariff Impact

Tariffs may reduce imports temporarily but won’t fix the trade deficit, which stems from low savings and high investment. A stronger dollar typically accompanies tariffs, boosting imports and widening the trade deficit over time.

Inflation and Interest Rates

Inflation Outlook: Fewer tariffs imply lower inflation risk, giving the Federal Reserve room for more aggressive rate cuts.

Bond Yields: Expectations of fewer tariffs initially lowered bond yields, but news of potential aggressive tariffs could reverse this trend.

Oil Prices Drop with Dollar Surge

The rising dollar, fueled by tariff-related uncertainty, led to a sharp drop in crude oil prices, as oil becomes more expensive in other currencies.

Twitter: