We are in the Banana Zone.

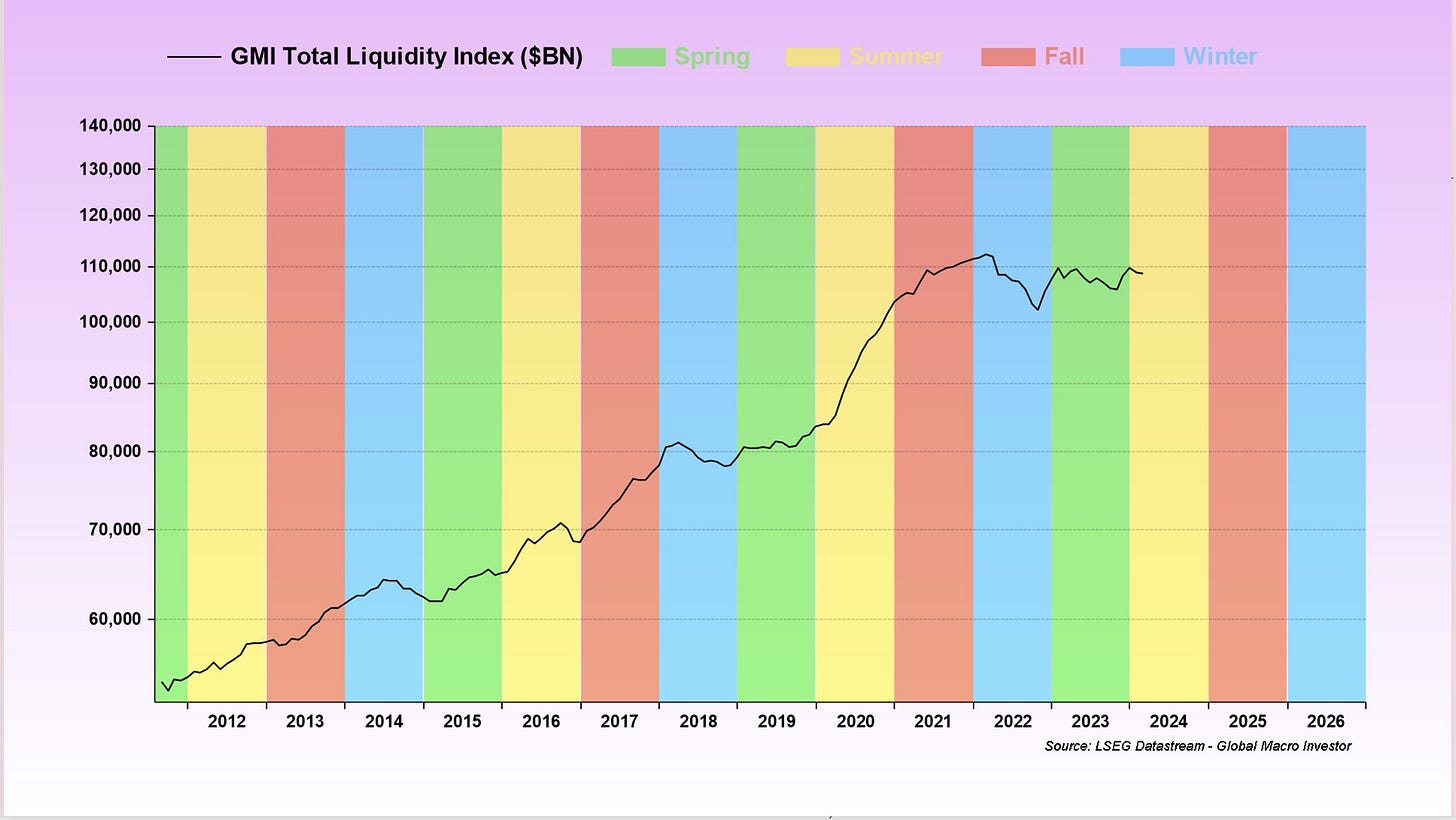

Macro Summer and Fall are driven by the global liquidity cycle that exhibits clear cyclicality since 2008.

BTC dominance is at the macro golden pocket

Here is what you need to know before BTC moons in the next 30days👇🧵

Macro Pulse Update 19.10.2024, covering the following topics:

1️⃣ Macro events for the week

2️⃣ Bitcoin Buzz Indicator

3️⃣ Market overview

4️⃣ Key Economic Metrics

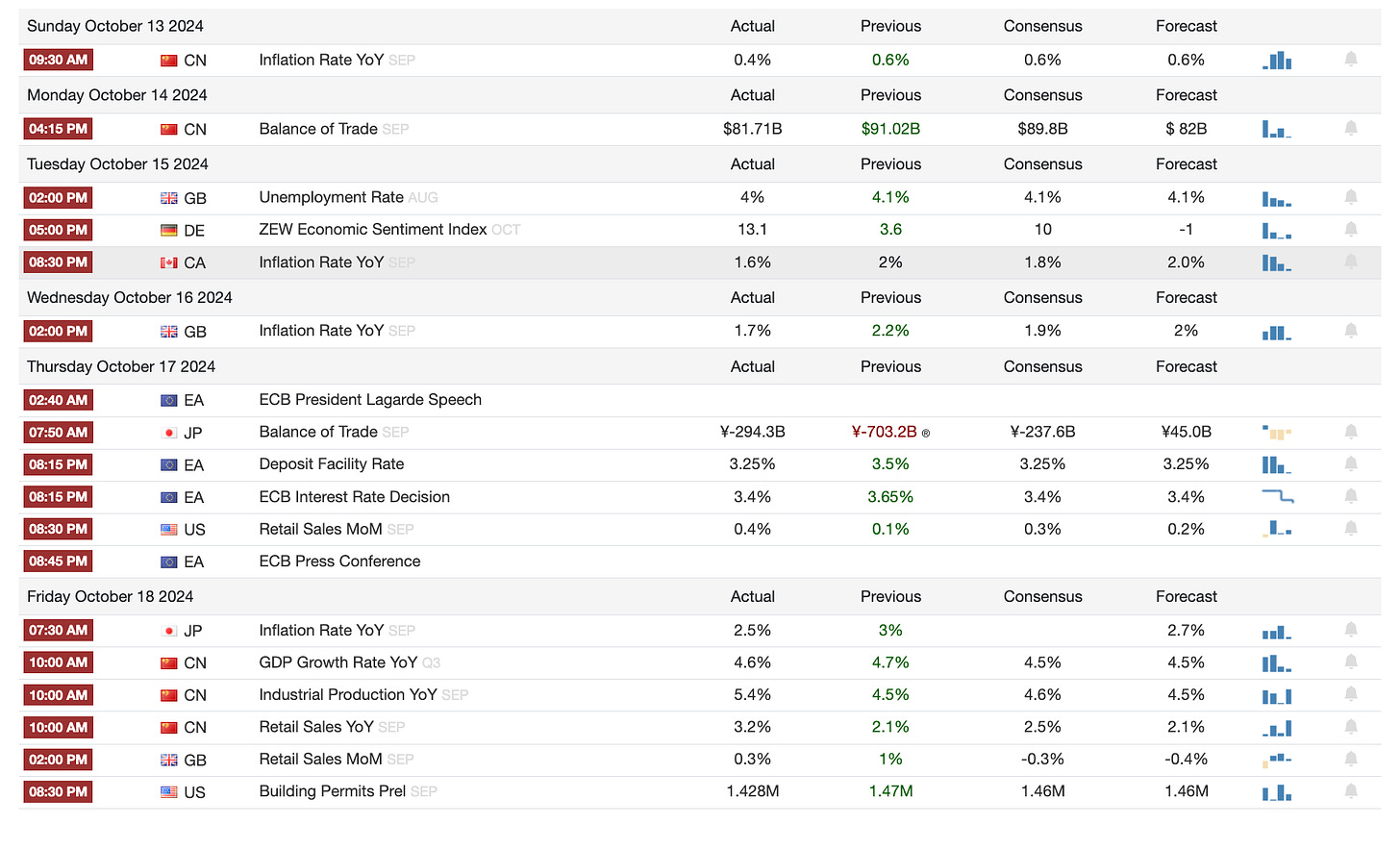

1️⃣ Macro events for the week

Last Week

Next Week

2️⃣ Bitcoin Buzz Indicator

Token Sales & DeFi Developments

WLFI token sale raises just $12 million amid skepticism

SUI's 120% surge sparks insider trading concerns

Radiant Capital suffers $50 million DeFi exploit

Kraken launches wrapped Bitcoin for DeFi integration

Banking & Institutional Adoption

DBS Bank launches blockchain-powered services for institutions

Stripe eyes $1 billion acquisition of Bridge crypto startup

Funding & Bitcoin Expansion

Blockstream secures $210 million in funding for Bitcoin expansion

Hacker Incidents & Cybersecurity

Hacker arrested for SEC Twitter takeover and Bitcoin spike

NFT Market Updates

NFT activity on Telegram surges 400% in Q3

BAYC NFT sold for $1.43 million sparks market discussions

Altcoins

WLFI Token Sale Raises Just $12 Million Amid Skepticism

SUI’s 120% Surge Sparks Insider Trading Concerns

Radiant Capital Suffers $50 Million DeFi Exploit

Kraken Launches Wrapped Bitcoin for DeFi Integration

DBS Bank Launches Blockchain-Powered Services for Institutions

Stripe Eyes $1 Billion Acquisition of Bridge Crypto Startup

Blockstream Secures $210 Million in Funding for Bitcoin Expansion

Hacker Arrested for SEC Twitter Takeover and Bitcoin Spike

3️⃣ Market overview

Crpyto Market Updates

Mt. Gox Delays Bitcoin Repayment: The Mt. Gox bitcoin repayment delay pushes sell pressure to 2025, offering a bullish signal. Bitcoin surged to nearly $67,000, up 10.6% in October. Traders are optimistic that less selling means more price momentum.

US Spot Bitcoin ETFs Surge in Inflows: Spot bitcoin ETFs see a $555 million influx, the largest since June. Fidelity and BlackRock lead the charge, with billions in trading volume. Investors show renewed confidence in bitcoin's potential upside.

Coinbase Fights for SEC Transparency: Coinbase pushes to access SEC documents, seeking clarity on crypto regulation. The case could be a turning point for digital asset compliance in the US. The crypto industry eagerly watches for regulatory answers.

Bitcoin ETF Outflows Amid Mixed Sentiment: After big inflows, spot bitcoin ETFs saw net outflows of $18.66 million on Tuesday. Fidelity’s FBTC led withdrawals, but BlackRock’s IBIT saw inflows. Diverging strategies highlight uncertainty in short-term market moves.

Monochrome Launches Australia’s First Spot ETH ETF: Monochrome debuts Australia's first spot ether ETF with cash and in-kind redemptions. The dual-access model appeals to institutional investors, reducing tax risks. Institutional interest is expected to rise, making this ETF a game-changer.

Macro Update

Global Debt Warning: IMF warns global public debt to surpass $100T by end-2023, near 100% of GDP by 2030. Recommends fiscal adjustments to curb rising debt. Bond sell-offs in the UK and France signal market unease.

Lyten Invests in U.S. Battery Factory: Lyten plans $1B investment in Reno for lithium-sulphur battery factory, aiming to reduce U.S. reliance on Chinese materials. Backed by $425M in funding, production begins 2027.

Stock Market Declines Amid Earnings Reports: U.S. stock indexes drop as tech and energy stocks face losses. Nvidia, ASML fall sharply. Oil prices dip, while Bank of America gains after strong earnings. Key macro data includes China’s GDP and U.S. retail sales.

4️⃣ Key Economic Metrics

🟢 US Inflation and Federal Reserve Sentiment:

Inflation Deceleration: US CPI rose 2.4% in September YoY, the lowest since February 2021, driven by falling energy prices. Core inflation ticked up to 3.3%, mainly due to shelter costs.

Fed Sentiment: Fed remains focused on inflation control, expecting a soft landing for the economy. Two 25-basis-point rate cuts are expected by the end of the year.

Labor Market Strength: Despite easing labor market concerns, a strong September jobs report raised concerns about wage growth and inflationary pressures.

🔴 ECB Concerns:

Weak Eurozone Growth: ECB chief economist Philip Lane expresses concern over the slow economic growth in the Eurozone and the need for policy flexibility. Inflation is expected to return to target, but geopolitical risks remain.

🔴 India and EU Climate Policy:

India Criticizes EU’s Carbon Border Tax: India sees the EU’s Carbon Border Adjustment Mechanism as a “trade barrier” that will hurt emerging economies like India, which relies heavily on coal for energy production.

🔴 South Korea’s Pension Crisis:

Pension System Reforms: South Korea is adjusting its pension system to address demographic challenges, proposing to raise contributions to prevent insolvency by 2055.

🟢 Vietnam’s Strong Economic Growth:

Vietnam’s Q3 Growth: Vietnam’s economy grew by 7.4% in Q3 2024, driven by a 15.8% export increase, especially in electronics, cementing its status as a supply chain hub.